State Farm Quote Home Insurance

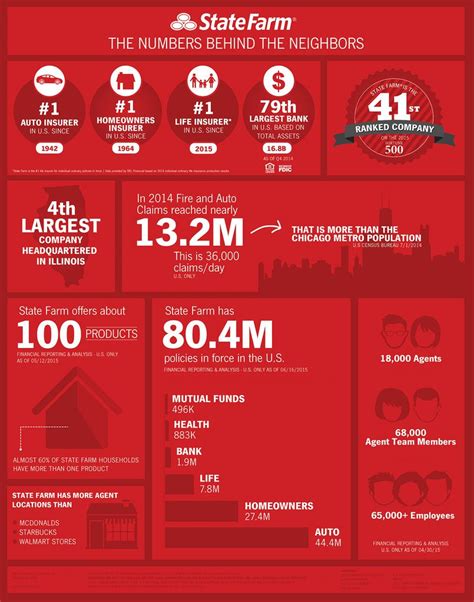

When it comes to protecting your home and assets, having the right insurance coverage is crucial. State Farm, one of the leading insurance providers in the United States, offers a range of insurance products, including home insurance. Obtaining a State Farm quote for home insurance is a straightforward process that allows homeowners to assess their coverage needs and make informed decisions. In this comprehensive guide, we will delve into the world of State Farm home insurance, exploring its coverage options, the quote process, and the factors that influence policy costs.

Understanding State Farm Home Insurance Coverage

State Farm’s home insurance policies are designed to provide comprehensive protection for homeowners. The coverage options available vary based on the specific needs and preferences of the policyholder. Here’s an overview of the key components of State Farm home insurance:

Dwelling Coverage

Dwelling coverage is the cornerstone of any home insurance policy. It provides financial protection for the physical structure of your home, including the walls, roof, and permanent fixtures. This coverage ensures that in the event of a covered loss, such as a fire or storm damage, State Farm will help cover the costs to repair or rebuild your home.

State Farm offers customizable dwelling coverage limits, allowing homeowners to select an amount that aligns with the replacement cost of their home. It's essential to accurately assess the value of your home to ensure adequate coverage.

Personal Property Coverage

Personal property coverage protects the contents of your home, including furniture, electronics, clothing, and other valuables. In the unfortunate event of a loss, this coverage helps replace or repair your personal belongings. State Farm offers different coverage options for personal property, such as actual cash value or replacement cost, depending on the policy chosen.

Additionally, State Farm provides coverage enhancements for high-value items like jewelry, art, or collectibles. These endorsements ensure that valuable possessions are adequately insured and covered in the event of a loss.

Liability Coverage

Liability coverage is an essential aspect of home insurance, as it provides protection against legal claims and lawsuits arising from accidents or injuries that occur on your property. State Farm’s liability coverage helps cover the costs associated with medical expenses, legal fees, and settlements resulting from such incidents.

Homeowners can choose liability coverage limits based on their specific needs and the level of protection they desire. It's important to note that liability coverage not only safeguards against financial losses but also provides peace of mind in case of unforeseen circumstances.

Additional Living Expenses Coverage

In the event that your home becomes uninhabitable due to a covered loss, State Farm’s additional living expenses coverage comes into play. This coverage reimburses you for the extra costs incurred while you temporarily reside elsewhere, such as hotel stays, restaurant meals, and other necessary expenses until your home is repaired or rebuilt.

By having additional living expenses coverage, homeowners can ensure that their daily lives are minimally disrupted during the restoration process.

Other Coverage Options

State Farm offers a range of additional coverage options to cater to unique circumstances. These may include coverage for identity restoration, service line protection, and optional endorsements for specific risks, such as water backup or sewer line damage.

It's recommended to discuss these coverage options with a State Farm agent to determine which ones are relevant to your situation and provide the necessary protection.

The State Farm Quote Process

Obtaining a State Farm quote for home insurance is a simple and efficient process. Here’s a step-by-step guide to help you navigate through the quote journey:

Step 1: Gather Information

Before initiating the quote process, it’s beneficial to gather the necessary information about your home and its contents. This includes details such as the year your home was built, its square footage, the type of construction, and the value of your personal belongings.

Additionally, having a basic understanding of your coverage needs and preferences will streamline the quote process. Consider the level of coverage you require for your dwelling, personal property, and liability.

Step 2: Visit the State Farm Website

To obtain a State Farm quote, visit the official State Farm website at www.statefarm.com. The website provides a user-friendly interface that guides you through the quote process.

Navigate to the home insurance section and click on the "Get a Quote" button. This will initiate the online quote process, allowing you to input the necessary details about your home and coverage preferences.

Step 3: Provide Home Details

On the quote form, you’ll be prompted to provide information about your home. This includes the address, the year it was built, the type of construction, and the number of floors. Accurate information ensures that the quote is tailored to your specific home.

You may also be asked to provide details about any recent renovations or additions to your home, as these factors can influence the cost of your policy.

Step 4: Select Coverage Options

The next step involves selecting the coverage options that best suit your needs. State Farm provides a range of coverage choices, including dwelling, personal property, liability, and additional living expenses coverage. Choose the coverage limits and endorsements that align with your preferences.

Keep in mind that selecting higher coverage limits or adding optional endorsements may impact the overall cost of your policy.

Step 5: Provide Personal Information

To complete the quote process, you’ll need to provide personal information, such as your name, contact details, and date of birth. This information is essential for State Farm to process your quote accurately.

You may also be asked to provide details about your current insurance status, such as whether you have existing home insurance or if you're looking to switch providers.

Step 6: Review and Submit

Once you’ve provided all the necessary information, review the quote carefully. Ensure that the coverage options, limits, and personal details are accurate and reflect your preferences.

If everything is in order, click the "Submit" button to finalize your quote request. State Farm will then process your information and provide you with a personalized home insurance quote.

Factors Influencing State Farm Home Insurance Costs

The cost of State Farm home insurance policies can vary based on several factors. Understanding these factors can help homeowners make informed decisions when selecting their coverage and managing their insurance costs.

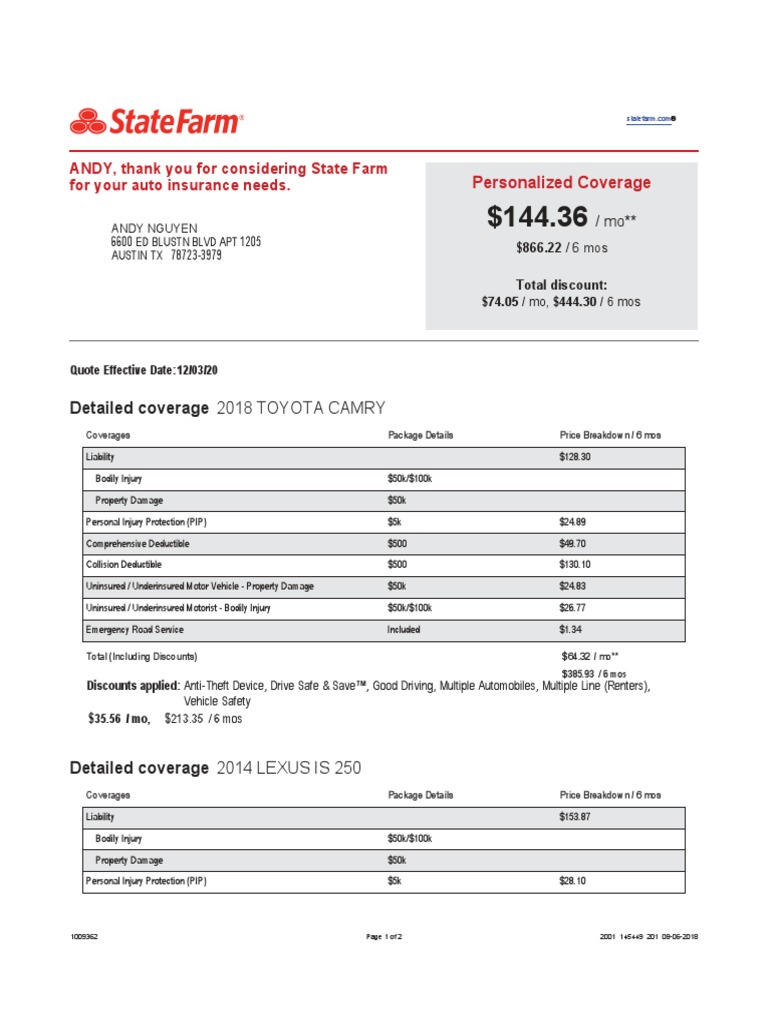

Coverage Limits and Options

The coverage limits and options chosen by homeowners significantly impact the cost of their home insurance policy. Higher coverage limits, especially for dwelling and personal property, can result in increased premiums. Similarly, adding optional endorsements or enhancing coverage for specific risks may also affect the overall cost.

It's essential to strike a balance between adequate coverage and affordable premiums. Working with a State Farm agent can help homeowners find the right coverage limits and options that align with their needs and budget.

Home Location and Construction

The location of your home plays a crucial role in determining insurance costs. Homes located in areas prone to natural disasters, such as hurricanes, earthquakes, or floods, may incur higher premiums due to the increased risk of damage.

Additionally, the construction materials and design of your home can also influence insurance costs. Homes built with fire-resistant materials or equipped with security systems may be eligible for discounts or lower premiums.

Claims History

State Farm, like other insurance providers, takes into account an individual’s claims history when determining insurance costs. Homeowners with a history of frequent or costly claims may experience higher premiums. It’s important to carefully assess your coverage needs and only file claims for legitimate losses to maintain a positive claims history.

Discounts and Bundling

State Farm offers a range of discounts to help homeowners save on their insurance premiums. These discounts may include multi-policy discounts for bundling home and auto insurance, loyalty discounts for long-term customers, and safety discounts for homes equipped with certain security features.

Additionally, State Farm encourages policyholders to maintain a good credit score, as credit-based insurance scores can impact insurance costs. Homeowners with a good credit history may be eligible for lower premiums.

Deductibles and Payment Plans

The deductible, or the amount you pay out of pocket before your insurance coverage kicks in, is another factor that affects policy costs. Choosing a higher deductible can result in lower premiums, as it reduces the financial burden on the insurance provider. However, it’s important to select a deductible that aligns with your financial capabilities.

State Farm also offers flexible payment plans, allowing homeowners to pay their premiums monthly, quarterly, or annually. The chosen payment plan may impact the overall cost of the policy.

Conclusion: Empowering Homeowners with State Farm

State Farm’s home insurance policies provide comprehensive protection for homeowners, offering peace of mind and financial security in the face of unforeseen circumstances. By understanding the coverage options, navigating the quote process, and being aware of the factors influencing policy costs, homeowners can make informed decisions when selecting their home insurance coverage.

Obtaining a State Farm quote for home insurance is a straightforward and convenient process, empowering homeowners to assess their coverage needs and tailor their policies accordingly. With State Farm's expertise and personalized approach, homeowners can feel confident in their insurance choices and protect their homes and assets effectively.

Frequently Asked Questions

How often should I review my State Farm home insurance policy?

+

It’s recommended to review your home insurance policy annually or whenever significant changes occur in your life or home. This ensures that your coverage remains up-to-date and aligns with your evolving needs.

Can I customize my State Farm home insurance policy?

+

Absolutely! State Farm offers customizable coverage options, allowing homeowners to tailor their policies to their specific needs. Whether it’s adjusting coverage limits, adding endorsements, or selecting additional coverage, State Farm provides the flexibility to create a policy that suits your unique circumstances.

What should I do if I need to file a claim with State Farm?

+

In the event of a covered loss, contact State Farm immediately to initiate the claims process. They will guide you through the necessary steps, provide support, and help you navigate the process efficiently. It’s important to have all the relevant documentation and details ready when filing a claim.

Can I bundle my home and auto insurance with State Farm to save money?

+

Yes, bundling your home and auto insurance policies with State Farm is an excellent way to save money. By combining these policies, you may be eligible for multi-policy discounts, resulting in lower overall premiums. It’s a convenient and cost-effective way to manage your insurance needs.

How does State Farm determine the replacement cost of my home?

+

State Farm utilizes various factors to determine the replacement cost of your home, including the cost of construction materials, labor, and local building codes. They may also consider the size of your home, its unique features, and any recent renovations. Accurate replacement cost assessments ensure that you have adequate coverage in the event of a covered loss.