State Farm Whole Life Insurance Calculator

In the ever-evolving landscape of financial planning and insurance, understanding the intricacies of life insurance policies is crucial. This article delves into the world of State Farm's Whole Life Insurance, offering a comprehensive guide to help individuals make informed decisions about their financial future. By examining the features, benefits, and practical applications of this insurance product, we aim to provide a valuable resource for those seeking to protect their loved ones and secure their legacy.

Unveiling State Farm’s Whole Life Insurance

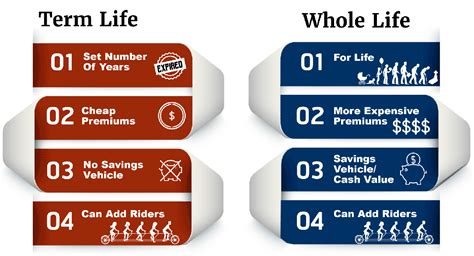

State Farm, a renowned name in the insurance industry, offers a range of comprehensive policies designed to meet various needs. Among their offerings, Whole Life Insurance stands out as a reliable and enduring solution for long-term financial protection. This policy is crafted to provide coverage throughout an individual’s lifetime, offering a blend of death benefit protection and cash value accumulation.

Key Features and Benefits

Whole Life Insurance from State Farm boasts a multitude of features that set it apart:

- Lifetime Coverage: As the name suggests, this policy offers coverage that remains in force for the insured’s entire life. This guarantees peace of mind, knowing that financial protection is secured regardless of life’s uncertainties.

- Guaranteed Cash Value: One of the unique aspects is the policy’s ability to build cash value over time. This accumulated value can be borrowed against or withdrawn, providing flexibility in financial planning.

- Flexible Premiums: State Farm’s Whole Life Insurance allows for customizable premium payments, offering policyholders the option to adjust their payment schedule to align with their financial goals and life stages.

- Policy Loans: Policyholders can access the cash value through loans, which can be a valuable resource for major life events or unforeseen expenses.

- Tax Benefits: The policy’s cash value growth is typically tax-deferred, offering a significant advantage in long-term financial planning.

These features make State Farm's Whole Life Insurance an attractive option for individuals seeking comprehensive and flexible financial protection.

Understanding the Calculator

The State Farm Whole Life Insurance Calculator is a powerful tool designed to assist individuals in determining the appropriate coverage and premium amounts for their specific needs. This calculator takes into account various factors, including age, health status, lifestyle, and financial goals, to provide accurate estimates.

| Calculator Feature | Description |

|---|---|

| Premium Estimation | Provides an estimated premium based on the coverage amount and policyholder's details. |

| Coverage Analysis | Assesses the adequacy of the chosen coverage amount in relation to the policyholder's financial responsibilities. |

| Cash Value Projection | Offers insights into the potential growth of the policy's cash value over time, considering various investment scenarios. |

By utilizing this calculator, individuals can gain a comprehensive understanding of the financial implications of Whole Life Insurance and make informed decisions.

The Application Process

Applying for State Farm’s Whole Life Insurance is a straightforward process:

- Contact State Farm: Reach out to a State Farm agent or representative to initiate the application process.

- Provide Details: Share relevant personal and financial information to obtain an accurate quote.

- Review and Customize: Review the policy terms and conditions, and customize the coverage and premium payments to align with your needs.

- Medical Examination: In most cases, a medical examination may be required to assess health status and determine eligibility.

- Policy Issuance: Once approved, the policy is issued, and coverage begins.

Considerations for Applicants

When applying for Whole Life Insurance, it’s essential to consider the following:

- Health Status: Pre-existing health conditions may impact eligibility and premium rates. It’s crucial to disclose all relevant health information.

- Financial Goals: Assess your short-term and long-term financial goals to determine the appropriate coverage amount and premium structure.

- Policy Riders: State Farm offers optional riders, such as waiver of premium or accelerated death benefit, which can enhance the policy’s benefits. Discuss these options with your agent.

Real-World Applications

State Farm’s Whole Life Insurance finds application in various life scenarios:

Financial Protection for Families

Whole Life Insurance is an ideal solution for families seeking to protect their loved ones financially. In the event of an untimely demise, the policy’s death benefit can provide financial stability and cover expenses such as:

- Funeral and burial costs

- Outstanding debts and loans

- Living expenses for surviving family members

- Education funds for children

Estate Planning

The policy’s cash value accumulation can be a valuable asset in estate planning. It can be used to:

- Pay for estate taxes and administrative costs

- Provide an inheritance for beneficiaries

- Fund charitable donations

Business Owners

Whole Life Insurance is often utilized by business owners to:

- Protect business interests in the event of a key person’s death

- Fund buy-sell agreements

- Provide capital for business expansion

Performance Analysis

The performance of State Farm’s Whole Life Insurance is marked by its reliability and long-term value. The policy’s ability to offer guaranteed death benefit protection and cash value accumulation makes it a stable investment option. Over time, the policy’s cash value can grow significantly, providing a valuable financial asset.

| Performance Metrics | Description |

|---|---|

| Death Benefit Payouts | The policy's death benefit provides a lump-sum payment to beneficiaries, ensuring financial security. |

| Cash Value Growth | Over time, the policy's cash value can accumulate, offering a valuable financial resource. |

| Policy Loan Options | Policyholders can access the cash value through loans, providing flexibility in financial planning. |

Expert Insights and Tips

Here are some expert insights to enhance your understanding of State Farm’s Whole Life Insurance:

- Customizable Premiums: Take advantage of the flexible premium structure to align payments with your financial capabilities and goals.

- Long-Term Planning: Whole Life Insurance is an enduring solution, so consider its benefits in the context of your long-term financial strategy.

- Policy Riders: Explore optional riders to enhance the policy’s benefits and tailor it to your specific needs.

- Professional Advice: Consult with a State Farm agent or financial advisor to ensure you fully understand the policy’s features and make informed decisions.

Future Implications

State Farm’s Whole Life Insurance is poised to remain a cornerstone of financial protection and planning. As individuals seek stable and long-term solutions, this policy’s ability to offer guaranteed coverage and cash value growth makes it an attractive option. With the evolving landscape of financial products, Whole Life Insurance stands as a reliable and trusted companion for individuals and families looking to secure their financial future.

Frequently Asked Questions

Can I change my coverage amount after purchasing the policy?

+Yes, State Farm allows policyholders to increase their coverage amount through a process called a “rider.” However, this may require additional underwriting and could impact your premium.

Are there any age restrictions for Whole Life Insurance?

+State Farm offers Whole Life Insurance to individuals within a specific age range, typically from 18 to 80 years old. However, eligibility may vary based on individual health and underwriting guidelines.

Can I cancel my policy and receive a refund?

+Whole Life Insurance policies are designed to provide coverage for life, and canceling may result in a surrender charge. However, you can access the policy’s cash value through a policy loan or withdrawal, which can be beneficial in certain circumstances.