State Insurance Pa

The state of Pennsylvania, often referred to as the Keystone State, boasts a rich history and a diverse landscape, from its bustling cities to its picturesque countryside. One aspect that plays a crucial role in the lives of its residents is insurance, which provides financial protection and peace of mind in various aspects of life. This article aims to delve into the world of State Insurance in Pennsylvania, exploring its significance, the different types available, and how it impacts the lives of Pennsylvanians.

Understanding State Insurance in Pennsylvania

In Pennsylvania, state insurance serves as a vital safeguard for individuals, families, and businesses, offering protection against a range of unforeseen events and financial risks. From auto accidents to health emergencies and natural disasters, insurance policies provide a crucial safety net. The state’s insurance sector is governed by the Pennsylvania Insurance Department, which ensures that insurance companies operate ethically and fairly, protecting the interests of policyholders.

The Pennsylvania Insurance Department plays a pivotal role in regulating and overseeing the insurance market, enforcing strict standards to ensure consumer protection. They review and approve insurance policies, ensuring they meet the state's requirements for coverage and clarity. Additionally, the department investigates consumer complaints, ensuring fair treatment and timely resolution of issues. By enforcing strict regulations and providing consumer protection, the department fosters a robust and trustworthy insurance market in the state.

Key Statistics and Trends

As of the latest data, Pennsylvania boasts a robust insurance market, with over 500 authorized insurance companies offering a wide range of policies. The state’s insurance sector contributes significantly to the economy, generating billions in annual premiums. A recent study revealed that the average Pennsylvanian holds multiple insurance policies, with auto and health insurance being the most prevalent.

| Insurance Type | Average Premiums (2022) |

|---|---|

| Auto Insurance | $750 per year |

| Health Insurance | $5,000 per year |

| Homeowners Insurance | $800 per year |

| Life Insurance | $500 per year |

These statistics highlight the importance of insurance in Pennsylvania, with residents understanding the value of financial protection. The state's insurance market is dynamic, with ongoing trends such as the rise of digital insurance platforms and the increasing demand for personalized coverage.

Types of State Insurance in Pennsylvania

Pennsylvania offers a comprehensive range of insurance types to cater to the diverse needs of its residents. Let’s explore some of the key categories:

Auto Insurance

Auto insurance is a legal requirement for all drivers in Pennsylvania. It provides financial protection in the event of an accident, covering expenses such as vehicle repairs, medical bills, and legal fees. The state’s minimum liability coverage requirements are as follows:

- Bodily Injury Liability: $15,000 per person / $30,000 per accident

- Property Damage Liability: $5,000 per accident

However, many Pennsylvanians opt for more comprehensive coverage, including collision, comprehensive, and uninsured/underinsured motorist coverage. These additional policies provide broader protection, covering a wider range of scenarios and potential costs.

Health Insurance

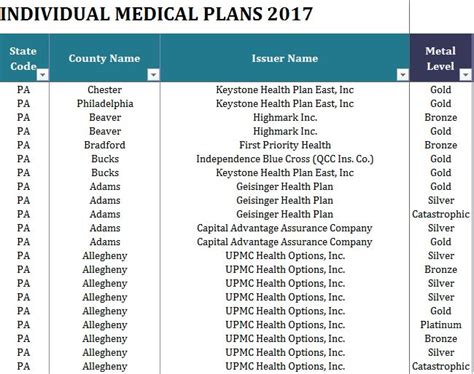

Health insurance is another critical aspect of state insurance in Pennsylvania. The state offers a variety of health insurance plans, including individual, family, and employer-sponsored policies. With the implementation of the Affordable Care Act (ACA), Pennsylvanians have access to more affordable and comprehensive health coverage options.

Key features of health insurance in Pennsylvania include:

- Essential Health Benefits: All plans must cover a set of essential health benefits, including hospitalization, prescription drugs, and mental health services.

- Pre-Existing Condition Coverage: Thanks to the ACA, insurance companies cannot deny coverage or charge higher premiums based on pre-existing conditions.

- Subsidies and Tax Credits: Low- and middle-income Pennsylvanians may qualify for financial assistance to help cover the cost of health insurance premiums.

Homeowners Insurance

Homeowners insurance is essential for protecting one’s residence and personal belongings. In Pennsylvania, this type of insurance typically covers:

- Dwelling Coverage: Protects the physical structure of the home.

- Personal Property Coverage: Covers the cost of replacing personal belongings damaged or destroyed by a covered event.

- Liability Protection: Provides coverage in case a visitor is injured on the property.

- Additional Living Expenses: Covers temporary living expenses if the home becomes uninhabitable due to a covered incident.

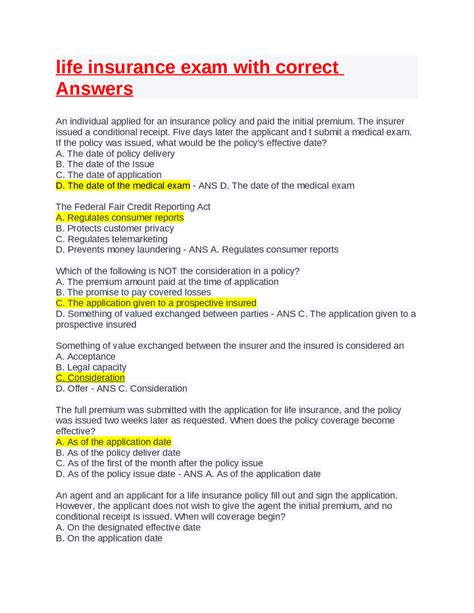

Life Insurance

Life insurance is a crucial component of financial planning, providing financial security for loved ones in the event of the policyholder’s death. Pennsylvania offers a range of life insurance options, including term life and whole life policies. These policies can help cover funeral expenses, pay off debts, and provide ongoing income for dependents.

Other Insurance Types

In addition to the above, Pennsylvania residents can access a wide array of other insurance types, such as:

- Renter's Insurance: Covers personal belongings and provides liability protection for renters.

- Business Insurance: Protects businesses from various risks, including property damage, liability claims, and loss of income.

- Travel Insurance: Provides coverage for trip cancellations, medical emergencies, and lost luggage while traveling.

- Pet Insurance: Covers veterinary costs and other pet-related expenses.

The Impact of State Insurance on Pennsylvanians

State insurance plays a pivotal role in the lives of Pennsylvanians, offering protection and peace of mind in various aspects of daily life. Let’s explore some key ways in which insurance impacts the state’s residents:

Financial Security and Peace of Mind

One of the most significant benefits of state insurance is the financial security and peace of mind it provides. Insurance policies act as a safety net, ensuring that individuals and families can recover from unexpected events without facing catastrophic financial consequences. Whether it’s an auto accident, a health emergency, or a natural disaster, insurance helps Pennsylvanians navigate these challenges with greater ease.

Healthcare Access and Affordability

Health insurance is a critical component of state insurance, and it plays a vital role in ensuring Pennsylvanians have access to quality healthcare. With the implementation of the Affordable Care Act, more residents have been able to obtain affordable health coverage, leading to improved overall health outcomes. Additionally, insurance companies in Pennsylvania offer a wide range of health plans, allowing individuals and families to choose options that best suit their needs and budgets.

Protection for Businesses and Entrepreneurs

State insurance also extends its benefits to the business community in Pennsylvania. Business insurance policies provide protection against various risks, such as property damage, liability claims, and loss of income. This coverage is essential for entrepreneurs, as it helps them navigate the challenges of running a business and ensures they can continue operating in the face of unforeseen events. By providing this crucial protection, insurance enables businesses to thrive and contribute to the state’s economy.

Community Resilience and Recovery

Pennsylvania is no stranger to natural disasters, from hurricanes and floods to severe winter storms. In such challenging times, state insurance plays a crucial role in community resilience and recovery. Insurance policies help residents and businesses rebuild and recover, providing financial support to repair damaged properties and replace lost belongings. This support is essential for communities to bounce back and continue thriving.

Economic Stability and Growth

The insurance industry in Pennsylvania contributes significantly to the state’s economy, generating billions in annual premiums and providing employment opportunities. The robust insurance market fosters economic stability and growth, benefiting not only insurance companies but also various supporting industries and professionals. This economic impact underscores the importance of state insurance and its role in Pennsylvania’s overall prosperity.

Conclusion

In conclusion, state insurance in Pennsylvania is a multifaceted system that provides crucial protection and peace of mind to its residents. From auto and health insurance to homeowners and life insurance, Pennsylvanians have access to a diverse range of policies to meet their unique needs. The impact of state insurance extends far beyond financial protection, playing a vital role in healthcare access, business resilience, community recovery, and overall economic stability.

As Pennsylvania continues to evolve and face new challenges, the state's insurance sector will remain a cornerstone of its prosperity and well-being. With ongoing innovation and a commitment to consumer protection, Pennsylvania's insurance market will continue to thrive, ensuring that residents can navigate life's uncertainties with confidence and security.

FAQ

What is the minimum auto insurance coverage required in Pennsylvania?

+The minimum auto insurance coverage required in Pennsylvania is 15,000 bodily injury liability per person and 30,000 per accident, as well as $5,000 property damage liability.

How can I find affordable health insurance in Pennsylvania?

+You can explore health insurance options through the Affordable Care Act’s marketplace, where you may qualify for subsidies or tax credits based on your income. Additionally, comparing quotes from different insurers can help you find the most affordable plan that meets your needs.

What should I consider when choosing homeowners insurance in Pennsylvania?

+When choosing homeowners insurance, consider factors such as the coverage limits, deductibles, and any additional coverage options like flood insurance. It’s essential to assess your specific needs and the potential risks in your area to ensure adequate protection.

Are there any discounts available for life insurance policies in Pennsylvania?

+Yes, there are often discounts available for life insurance policies in Pennsylvania. Common discounts include non-smoker rates, multiple policy discounts (e.g., bundling life insurance with other policies), and loyalty discounts for long-term customers.