Supplemental Insurance For Medicare

Medicare is a federal health insurance program in the United States that provides coverage for millions of individuals aged 65 and older, as well as those with certain disabilities. While Medicare offers comprehensive benefits, there are gaps and limitations in its coverage, which is where supplemental insurance, often referred to as Medigap, comes into play. Supplemental insurance for Medicare fills these gaps, ensuring that individuals have more comprehensive and tailored coverage to meet their specific healthcare needs.

In this comprehensive guide, we will delve into the world of supplemental insurance for Medicare, exploring its purpose, benefits, and how it can enhance the overall healthcare experience for beneficiaries. By understanding the intricacies of Medigap, we can make informed decisions to secure the best possible healthcare coverage during our golden years.

Understanding Medicare and Its Coverage Gaps

Medicare is divided into different parts, each covering specific aspects of healthcare. Part A covers inpatient hospital stays, skilled nursing facility care, and some home healthcare services. Part B covers outpatient medical services, including doctor visits, laboratory tests, and durable medical equipment. Part D, on the other hand, provides prescription drug coverage. While these parts offer a wide range of benefits, there are certain gaps in coverage that can result in significant out-of-pocket expenses for beneficiaries.

One of the primary coverage gaps in Medicare is the lack of coverage for certain services, such as dental, vision, and hearing care. These services are essential for maintaining overall health and quality of life, especially as we age. Additionally, Medicare may not cover the full cost of certain procedures or treatments, leaving beneficiaries responsible for coinsurance or copayments.

Another gap in Medicare coverage is the absence of comprehensive foreign travel protection. For individuals who enjoy traveling abroad, this can be a significant concern. Medicare generally does not provide coverage for healthcare services received outside the United States, leaving beneficiaries to bear the full cost of any medical expenses incurred during their travels.

The Role of Supplemental Insurance

Supplemental insurance, or Medigap, is designed to fill these coverage gaps and provide additional financial protection for Medicare beneficiaries. By purchasing a Medigap plan, individuals can gain access to a range of benefits that enhance their overall healthcare coverage.

One of the key advantages of supplemental insurance is the potential for reduced out-of-pocket expenses. Medigap plans can cover a portion or even the entire cost of coinsurance, copayments, and deductibles associated with Medicare-covered services. This means that beneficiaries can have more predictable and manageable healthcare expenses, which is especially beneficial for those with chronic conditions or frequent healthcare needs.

Additionally, supplemental insurance often includes coverage for services not covered by Medicare, such as dental, vision, and hearing care. These plans can provide comprehensive coverage for routine exams, treatments, and even prescription medications related to these specialties. By including these benefits, Medigap plans ensure that beneficiaries have access to a wide range of healthcare services without facing financial barriers.

Medigap Plan Options

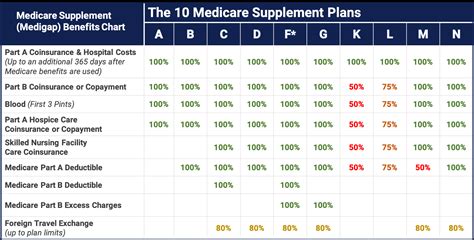

There are various Medigap plan options available, each offering different levels of coverage and benefits. It is essential to understand the specific needs and preferences of the beneficiary to choose the most suitable plan.

Plan A

Plan A is the most basic Medigap plan, offering coverage for Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. It also covers the first three pints of blood each year and provides foreign travel emergency coverage for up to 60 days.

Plan B

Plan B is similar to Plan A but includes additional coverage for Medicare Part B deductibles and coinsurance. This plan provides more comprehensive protection, ensuring that beneficiaries have reduced out-of-pocket expenses for a wider range of Medicare-covered services.

Plan C and Plan F

Plans C and F are the most comprehensive Medigap plans, offering the highest level of coverage. In addition to the benefits provided by Plan B, these plans cover the Medicare Part B deductible and cover excess charges that Medicare may not pay. These plans provide the most financial protection and are ideal for individuals who want to minimize their out-of-pocket expenses.

It is important to note that as of 2020, new Medigap policies cannot include coverage for the Medicare Part B deductible. However, existing beneficiaries who already have Plan C or Plan F policies are not affected by this change.

Selecting the Right Supplemental Insurance Plan

Choosing the right supplemental insurance plan involves careful consideration of various factors. Here are some key aspects to keep in mind:

- Health Status: Assess your current and anticipated future health needs. If you have chronic conditions or require frequent medical care, a more comprehensive plan may be beneficial.

- Budget: Evaluate your financial situation and determine how much you are willing and able to spend on supplemental insurance. Plans with higher coverage levels typically come with higher premiums.

- Prescription Drug Needs: Consider whether you have ongoing prescription medication needs. Some Medigap plans offer prescription drug coverage, which can be a valuable addition to your overall healthcare coverage.

- Travel Plans: If you frequently travel outside the United States, it is essential to choose a plan that includes foreign travel emergency coverage. This ensures that you have financial protection in case of unexpected medical emergencies while abroad.

- Insurance Company Reputation: Research the reputation and financial stability of the insurance company offering the Medigap plan. Choose a reputable company with a track record of reliable service and prompt claim processing.

Enrolling in Supplemental Insurance

The enrollment process for supplemental insurance varies depending on the state and the insurance company. However, there are a few key steps that are generally involved:

- Research and Compare Plans: Take the time to research and compare different Medigap plans offered by various insurance companies. Consider factors such as coverage, premiums, and customer reviews to find the plan that best suits your needs.

- Contact Insurance Companies: Reach out to the insurance companies offering the plans you are interested in. Discuss your specific needs and ask any questions you may have about the coverage, premiums, and enrollment process.

- Apply for the Chosen Plan: Once you have selected the plan that aligns with your needs, submit an application to the insurance company. The application process typically involves providing personal information, medical history, and sometimes undergoing a medical underwriting process.

- Wait for Approval: After submitting your application, the insurance company will review it and make a decision. If approved, you will receive a policy outlining the coverage and terms of your supplemental insurance plan.

- Pay Premiums: Supplemental insurance plans typically require monthly or annual premiums. Ensure that you pay your premiums on time to maintain your coverage.

The Importance of Timing for Enrollment

Timing is crucial when it comes to enrolling in supplemental insurance for Medicare. There are specific enrollment periods that offer benefits and protections to beneficiaries.

The Medicare Initial Enrollment Period is a critical window for enrolling in both Medicare and supplemental insurance. This period begins three months before the month of your 65th birthday and extends for seven months after that. During this time, you can enroll in Medicare Part A and Part B, as well as choose a Medigap plan without any medical underwriting. This means that insurance companies cannot deny you coverage or charge you higher premiums based on your health status.

Additionally, there is the Medicare Open Enrollment Period, which occurs annually from October 15 to December 7. During this time, beneficiaries can make changes to their Medicare coverage, including switching Medigap plans or adding supplemental insurance. This period provides an opportunity to assess your current coverage and make adjustments to better suit your needs.

It is essential to be aware of these enrollment periods and plan your supplemental insurance enrollment accordingly. Missing these periods may result in higher premiums, limited plan options, or even the need for medical underwriting, which can be a challenging and time-consuming process.

Potential Challenges and Considerations

While supplemental insurance for Medicare offers numerous benefits, there are some challenges and considerations to keep in mind.

One of the main challenges is the cost of premiums. Medigap plans can be expensive, especially for those with higher coverage levels. It is crucial to carefully assess your budget and determine whether the benefits provided by the plan outweigh the cost of the premiums.

Another consideration is the potential for plan changes or discontinuation. Insurance companies may make changes to their Medigap plans over time, which could impact your coverage. It is important to stay informed about any changes and assess whether your plan still meets your needs.

Additionally, some Medigap plans may have restrictions or limitations on certain services. For example, some plans may only cover a limited number of days for skilled nursing facility care or may have specific requirements for prescription drug coverage. It is essential to thoroughly review the plan details and understand any restrictions before enrolling.

Maximizing the Benefits of Supplemental Insurance

To make the most of your supplemental insurance plan, consider the following strategies:

- Review Your Coverage Regularly: Stay informed about your plan's coverage and benefits. Periodically review your policy to ensure that it continues to meet your needs and that you are maximizing the available benefits.

- Utilize Network Providers: Many Medigap plans have networks of preferred providers. By utilizing these in-network providers, you may be eligible for additional benefits or discounted rates.

- Understand Claim Procedures: Familiarize yourself with the claim submission process for your plan. Knowing how to properly submit claims can ensure prompt reimbursement and avoid any delays or denials.

- Seek Support: If you have any questions or concerns about your supplemental insurance plan, don't hesitate to reach out to your insurance company's customer support. They can provide guidance and assistance to ensure you are making the most of your coverage.

Future Trends and Developments

The world of supplemental insurance for Medicare is constantly evolving, and there are several trends and developments to watch out for.

One emerging trend is the integration of technology into Medigap plans. Some insurance companies are exploring the use of digital tools and platforms to enhance the beneficiary experience. This may include mobile apps for policy management, online claim submission, and virtual assistance for healthcare-related inquiries.

Additionally, there is a growing focus on preventive care and wellness programs within supplemental insurance plans. Insurance companies are recognizing the importance of proactive healthcare and are incorporating incentives and rewards for beneficiaries who engage in healthy behaviors and regular preventive screenings.

Furthermore, there is an increasing emphasis on personalized healthcare plans. Insurance companies are utilizing data analytics and predictive modeling to develop tailored Medigap plans that address the unique needs of individual beneficiaries. This approach ensures that coverage is optimized to provide the most relevant and beneficial services.

Conclusion

Supplemental insurance for Medicare plays a vital role in enhancing the healthcare coverage and financial protection of beneficiaries. By understanding the coverage gaps in Medicare and the benefits offered by Medigap plans, individuals can make informed decisions to secure the best possible healthcare experience during their retirement years.

From reduced out-of-pocket expenses to comprehensive coverage for essential services, supplemental insurance provides peace of mind and ensures that beneficiaries have access to the healthcare they need without facing significant financial burdens. With careful consideration and a well-informed approach, individuals can navigate the world of Medigap and find the perfect plan to meet their specific needs.

What is the difference between Medigap and Medicare Advantage plans?

+Medigap, or supplemental insurance, works alongside Original Medicare (Parts A and B) to fill coverage gaps. On the other hand, Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and typically include additional benefits such as prescription drug coverage and dental, vision, and hearing services. It is important to assess your specific needs and preferences to determine which option is best for you.

Can I have both a Medigap plan and a Medicare Advantage plan at the same time?

+No, you cannot have both a Medigap plan and a Medicare Advantage plan simultaneously. These plans serve different purposes and are designed to be mutually exclusive. If you have a Medicare Advantage plan, you will not be eligible for a Medigap plan, and vice versa. It is essential to choose the type of coverage that aligns with your needs and preferences.

Are there any age restrictions for enrolling in Medigap plans?

+Age restrictions for Medigap plans vary depending on the state and the insurance company. In most cases, there are no age restrictions during the Medicare Initial Enrollment Period, which allows individuals to enroll in Medigap plans without medical underwriting. However, outside of this period, some insurance companies may have age restrictions or charge higher premiums for older individuals. It is best to check with the specific insurance company and your state’s regulations to understand any potential age-related considerations.