Supplemental Medicare Insurance

Medicare Supplemental Insurance, commonly known as Medigap, is an essential topic for individuals approaching Medicare eligibility or currently enrolled in Medicare Part A and/or Part B. This comprehensive guide will delve into the intricacies of Medigap, providing an expert analysis to help readers make informed decisions about their healthcare coverage.

Understanding Medicare Supplemental Insurance (Medigap)

Medicare Supplemental Insurance, or Medigap, is a type of health insurance designed to fill the gaps in original Medicare coverage. It is offered by private insurance companies and is specifically tailored to complement Medicare Parts A and B, the core components of the federal Medicare program.

Medicare Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some home healthcare services. Meanwhile, Medicare Part B covers medical services and supplies, including doctor visits, outpatient care, preventive services, and durable medical equipment. While these two parts of Medicare provide a robust foundation for healthcare coverage, there are still potential gaps in coverage that Medigap aims to address.

The Role of Medigap

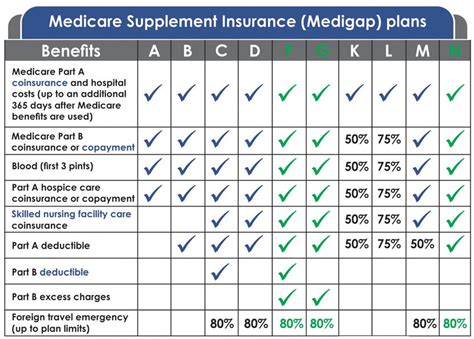

Medigap policies, or Medigap plans, are standardized by the Centers for Medicare and Medicaid Services (CMS). This standardization ensures that each Medigap plan, labeled A through N, offers a specific set of benefits. These plans cover expenses that original Medicare may not, such as copayments, coinsurance, and deductibles.

Additionally, Medigap plans can offer coverage for services like emergency healthcare while traveling outside the United States, which is not typically covered by original Medicare. By filling these gaps, Medigap ensures that individuals have more comprehensive and predictable healthcare coverage.

| Medigap Plan | Benefits Covered |

|---|---|

| Plan A | Basic coverage including Part A coinsurance and hospital costs, Part B coinsurance or copayment, blood (first 3 pints), and Part A hospice care coinsurance. |

| Plan F | Comprehensive coverage including all benefits in Plan A, plus Part B excess charges, skilled nursing facility care coinsurance, and foreign travel emergency coverage. |

| Plan G | Similar to Plan F but with the exception of the Part B deductible. |

| Plan N | Cost-sharing coverage including all benefits in Plan A, with additional coverage for Part B coinsurance or copayment and some blood costs. |

Eligibility and Enrollment for Medigap

Eligibility for Medigap is tied to enrollment in Medicare Part A and/or Part B. To be eligible for Medigap, you must have original Medicare coverage. This means you are either 65 years or older and enrolled in Medicare Part A and Part B, or you are under 65 with a disability and enrolled in Medicare Part A and Part B.

The best time to enroll in Medigap is during your Medicare Open Enrollment Period, which is the 6-month period starting the month you turn 65 and are enrolled in Medicare Part B. During this period, insurance companies can't deny you a Medigap policy or charge you more due to health conditions. This is a crucial window to ensure you get the coverage you need without the worry of additional health-related costs.

Late Enrollment Penalties

If you miss your Medicare Open Enrollment Period, you may still be able to enroll in Medigap, but there are potential consequences. If you have a Medicare Advantage Plan (Part C) and decide to switch back to original Medicare (Part A and/or Part B), you'll have a new Medigap Open Enrollment Period lasting 6 months from the date you disenroll from your Medicare Advantage Plan.

However, if you don't enroll in a Medigap plan when you're first eligible, or during a new Medigap Open Enrollment Period, you may face a late enrollment penalty. This penalty is typically added to your monthly Medigap premium and can be avoided by enrolling during your initial Open Enrollment Period.

Choosing the Right Medigap Plan

Selecting the appropriate Medigap plan is a critical decision that requires careful consideration of your healthcare needs and financial situation. The different Medigap plans offer varying levels of coverage, and understanding these differences is essential.

Factors to Consider

When choosing a Medigap plan, here are some key factors to keep in mind:

- Coverage Needs: Evaluate your current and potential future healthcare needs. Consider any pre-existing conditions, the likelihood of needing specialized care, and your general health status. This will help you determine the level of coverage you require.

- Premium Costs: Medigap plans have different premium costs, which can vary based on the plan's coverage, the insurance company, and your location. Assess your budget and financial stability to determine what you can comfortably afford.

- Provider Network: Some Medigap plans may have a network of preferred providers, while others may offer more flexibility. Consider whether you prefer the convenience of in-network providers or the freedom to choose any Medicare-approved provider.

- Plan Availability: The specific Medigap plans available to you can depend on where you live. Research the plans offered in your area and compare their benefits and costs.

- Company Reputation: Look into the reputation and financial stability of the insurance companies offering Medigap plans. You want to ensure your chosen company is reliable and will be able to provide coverage over the long term.

Comparative Analysis

To illustrate the differences between Medigap plans, let's compare Plan A and Plan F. Plan A is a basic Medigap plan that covers the fundamentals, including Part A coinsurance and hospital costs, Part B coinsurance or copayment, blood (first 3 pints), and Part A hospice care coinsurance. On the other hand, Plan F is a comprehensive plan that covers all the benefits in Plan A, plus Part B excess charges, skilled nursing facility care coinsurance, and foreign travel emergency coverage.

While Plan F offers more extensive coverage, it may not be suitable for everyone. For instance, if you rarely travel outside the country and have a limited need for skilled nursing facility care, Plan A could be more cost-effective. However, if you anticipate needing more extensive coverage, especially for unexpected medical emergencies, Plan F might provide the peace of mind you're seeking.

The Future of Medigap

As healthcare landscapes evolve, it's essential to consider the potential future implications for Medigap. The healthcare industry is constantly changing, and staying informed about these changes can help individuals make proactive decisions about their healthcare coverage.

Potential Trends and Developments

Here are some potential trends and developments that could impact Medigap in the future:

- Rising Healthcare Costs: As healthcare costs continue to rise, the premiums for Medigap plans may also increase. Staying informed about these cost trends can help individuals budget effectively and anticipate future expenses.

- Policy Changes: The federal government and insurance companies can make changes to Medigap policies. Keeping an eye on policy updates ensures individuals are aware of any changes in coverage, costs, or enrollment periods.

- Advancements in Healthcare Technology: Innovations in healthcare technology, such as telemedicine and remote patient monitoring, could impact Medigap coverage. These advancements may lead to new benefits or cost savings, influencing the overall value of Medigap plans.

- Demographic Shifts: Changes in the population, such as an aging demographic or shifts in disease prevalence, can impact the demand for and nature of Medigap coverage. Staying aware of these demographic trends can help individuals anticipate potential changes in their healthcare needs.

Adapting to Change

The key to effectively navigating potential changes in Medigap is staying informed and proactive. Regularly reviewing and updating your Medigap coverage based on your changing healthcare needs and the evolving healthcare landscape can ensure you maintain comprehensive and cost-effective coverage.

FAQs

Can I have both Medigap and a Medicare Advantage Plan (Part C)?

+

No, you cannot have both Medigap and a Medicare Advantage Plan. Medigap is designed to work with original Medicare (Part A and Part B), not with Medicare Advantage Plans. If you have a Medicare Advantage Plan, you should enroll in a Medicare Supplement plan when you switch back to original Medicare.

Do Medigap plans cover prescription drugs?

+

No, Medigap plans do not cover prescription drugs. Original Medicare Part D or a Medicare Advantage Plan that includes drug coverage is needed for prescription drug coverage.

Can I change my Medigap plan once I’ve enrolled?

+

Yes, you can change your Medigap plan during certain times of the year, such as during your Medigap Open Enrollment Period or if you qualify for a Special Enrollment Period. However, it’s important to note that you may have to undergo medical underwriting, which means the insurance company can use your health status to determine whether to accept you and how much to charge.