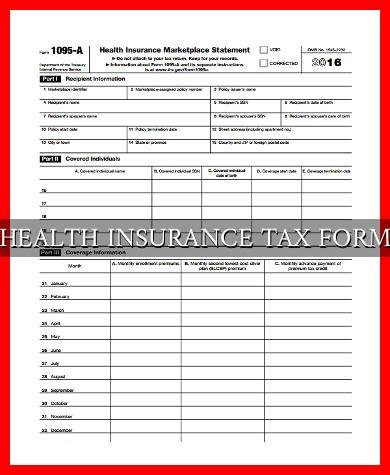

Tax Form For Health Insurance

The world of taxes and health insurance can be a complex maze, but understanding the tax forms related to your health coverage is crucial. This comprehensive guide aims to demystify the process, providing you with a clear roadmap to navigate the intricate relationship between your health insurance and tax obligations.

Understanding the Basics: Health Insurance and Taxes

Health insurance is an essential component of modern life, offering financial protection and peace of mind in the event of unexpected medical expenses. When it comes to taxes, the Internal Revenue Service (IRS) provides guidelines and forms to ensure individuals and businesses comply with tax laws regarding health insurance coverage.

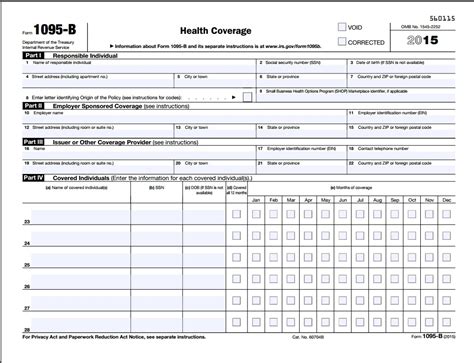

One of the key forms associated with health insurance and taxes is the Form 1095-B, often referred to as the Health Insurance Provider Statement. This form plays a vital role in reporting health coverage to the IRS, ensuring individuals and businesses meet the requirements of the Affordable Care Act (ACA) and any applicable state regulations.

The ACA, also known as Obamacare, introduced several significant changes to the health insurance landscape, including the individual mandate, which required most individuals to have qualifying health coverage or face a penalty. While the individual mandate has been eliminated for tax years 2019 and beyond, understanding your tax obligations related to health insurance remains crucial.

Navigating the Form 1095-B

The Form 1095-B is a critical document for both individuals and businesses. It provides a detailed report of your health coverage during the previous tax year, including the months you were covered, the type of coverage, and the provider’s information. Here’s a breakdown of the key sections of the form:

Part I: Personal Information

This section includes your name, Social Security Number (SSN), and the coverage period, detailing the months you had health insurance coverage.

| Field | Description |

|---|---|

| Name | Your legal name as it appears on your government-issued ID. |

| SSN | Your unique nine-digit identification number for tax purposes. |

| Coverage Period | The 12-month period for which the health coverage information is reported. |

Part II: Coverage Information

This section provides a detailed breakdown of your health coverage, including the type of coverage, the coverage provider’s information, and the months you were covered.

| Field | Description |

|---|---|

| Coverage Type | Indicates whether you had major medical, prescription drug, or other types of coverage. |

| Provider's Name and Address | Details the name and contact information of your health insurance provider. |

| Coverage Months | Specifies the months you were covered by the health insurance plan. |

Part III: Qualifying Events

This section is relevant for individuals who experienced life events that may have affected their health coverage, such as marriage, divorce, birth, or adoption. It provides information on these qualifying events and their impact on coverage.

| Field | Description |

|---|---|

| Qualifying Event | Lists the specific life event that may have impacted your health coverage. |

| Event Date | The date the qualifying event occurred. |

| Coverage Start and End Dates | Details the start and end dates of the coverage period affected by the qualifying event. |

Reporting Health Coverage on Your Tax Return

When it comes to filing your tax return, the information from your Form 1095-B plays a crucial role. Here’s a step-by-step guide on how to incorporate this information into your tax filing process:

Step 1: Obtain Your Form 1095-B

Ensure you have received the Form 1095-B from your health insurance provider. If you haven’t received it by January 31st, contact your provider to request a copy.

Step 2: Review the Form

Carefully review the form to ensure the information is accurate and complete. Pay close attention to your personal details, coverage period, and coverage type.

Step 3: Filing Your Tax Return

When filing your tax return, you will need to report your health coverage information. This is typically done by attaching a copy of your Form 1095-B to your tax return or by entering the relevant information into the appropriate fields of your tax software or tax preparation forms.

If you had qualifying health coverage for the entire tax year, you will generally not face a penalty. However, if you had a coverage gap, you may be subject to a Shared Responsibility Payment, also known as the individual mandate penalty.

Step 4: Shared Responsibility Payment

If you had a coverage gap, you may need to calculate and report the Shared Responsibility Payment on your tax return. This penalty is designed to encourage individuals to maintain qualifying health coverage. The IRS provides guidelines and calculators to help you determine the amount of the penalty.

Step 5: Filing Status and Coverage

Your filing status and the number of individuals covered by your health insurance plan can impact your tax obligations. For example, if you are married filing jointly and one spouse has health insurance through their employer, while the other spouse has a marketplace plan, you may need to consider the Premium Tax Credit when filing your taxes.

Special Considerations: Marketplace Plans and Premium Tax Credit

If you obtained your health insurance coverage through the Health Insurance Marketplace, there are additional considerations when it comes to taxes. The Premium Tax Credit, also known as the Advanced Premium Tax Credit (APTC), is a credit designed to help individuals and families with low to moderate incomes afford their health insurance premiums.

When you apply for health insurance through the Marketplace, you can choose to receive the Premium Tax Credit in advance, which is applied directly to your monthly premiums. This advance payment reduces your out-of-pocket premium costs. At tax time, you will need to reconcile the Premium Tax Credit you received with the amount you're actually eligible for based on your income and family size.

Reconciliation Process

When you file your tax return, you will need to complete Form 8962, Premium Tax Credit, to reconcile the advance payments you received with the actual amount you’re eligible for. If you received more advance payments than you’re eligible for, you may need to repay some or all of the excess amount. On the other hand, if you’re eligible for more than you received, you can claim the difference as a refundable credit on your tax return.

Conclusion: Navigating Tax Obligations with Confidence

Understanding the relationship between your health insurance and tax obligations is crucial for ensuring compliance and maximizing your tax benefits. By familiarizing yourself with forms like the Form 1095-B and staying informed about tax laws related to health insurance, you can navigate the tax landscape with confidence and ease.

Remember, while this guide provides a comprehensive overview, it's always advisable to consult with a tax professional or a qualified health insurance advisor to ensure you're making the right decisions for your unique situation.

What happens if I don’t receive my Form 1095-B by January 31st?

+If you don’t receive your Form 1095-B by January 31st, contact your health insurance provider to request a copy. They are required to provide you with this form, and it’s important to have it for your tax filing purposes.

Do I need to report my health coverage if I’m not required to file a tax return?

+Even if you’re not required to file a tax return, you may still need to report your health coverage to the IRS. This is particularly important if you had a coverage gap and may be subject to the Shared Responsibility Payment. Consult the IRS guidelines for more information.

Can I claim the Premium Tax Credit if I didn’t receive advance payments through the Marketplace?

+Yes, you can still claim the Premium Tax Credit on your tax return even if you didn’t receive advance payments through the Marketplace. This is known as the Reconciliation of Premium Tax Credit and can result in a refundable credit on your tax return.