Tennessee Health Insurance Plans

Health insurance is a vital aspect of modern life, ensuring individuals have access to quality healthcare services without incurring excessive financial burdens. In the state of Tennessee, residents have a range of options when it comes to securing health coverage. This article aims to provide an in-depth analysis of Tennessee health insurance plans, exploring the different types available, their key features, and how they cater to the diverse needs of Tennesseans.

Understanding Tennessee’s Health Insurance Landscape

Tennessee offers a comprehensive range of health insurance options, designed to cater to various demographics and lifestyles. From comprehensive plans offering extensive coverage to more affordable, basic options, the state’s insurance market aims to provide accessible healthcare for all.

Types of Health Insurance Plans in Tennessee

Tennessee’s health insurance market can be broadly categorized into several types, each with its own unique features and benefits. These include:

- Individual and Family Plans: Tailored for individuals and families, these plans offer customizable coverage options, allowing policyholders to choose the level of protection that suits their specific healthcare needs.

- Group Health Insurance: Many employers in Tennessee offer group health insurance plans as part of their employee benefits packages. These plans often provide comprehensive coverage at a discounted rate, as the risk is spread across a larger group.

- Medicaid and TennCare: Tennessee’s Medicaid program, known as TennCare, provides health coverage for low-income individuals and families who meet certain eligibility criteria. It offers a range of benefits, including doctor visits, hospital stays, and prescription medications.

- Medicare Advantage Plans: For Tennesseans aged 65 and over, or those under 65 with certain disabilities, Medicare Advantage plans offer an alternative to original Medicare. These plans are offered by private insurance companies and typically include additional benefits beyond traditional Medicare coverage.

- Short-Term Health Insurance: Short-term plans provide temporary coverage for individuals between jobs, transitioning to a new plan, or those who prefer a more flexible and affordable option. These plans typically have lower premiums but also offer more limited coverage and benefits.

Key Considerations for Choosing a Health Insurance Plan

When selecting a health insurance plan in Tennessee, several factors should be carefully considered to ensure the chosen plan aligns with an individual’s or family’s unique healthcare needs and financial situation. These considerations include:

- Coverage and Benefits: Evaluate the scope of coverage offered by the plan, including doctor visits, hospital stays, prescription drugs, and specialty care. Ensure that the plan covers the specific healthcare services you or your family members are likely to require.

- Network of Providers: Determine whether your preferred healthcare providers are in-network with the plan. In-network providers typically offer more cost-effective services, as the plan has negotiated rates with them. Out-of-network care can be significantly more expensive.

- Premiums and Out-of-Pocket Costs: Consider the monthly premium for the plan, as well as any deductibles, copayments, and coinsurance. While lower premiums may be appealing, it’s essential to also consider the potential out-of-pocket costs, especially if you anticipate frequent use of healthcare services.

- Prescription Drug Coverage: If you or your family members rely on prescription medications, ensure that the plan provides adequate coverage for the specific drugs you require. Some plans may have preferred drug lists or require prior authorization for certain medications.

- Flexibility and Customization: Assess whether the plan allows for customization to suit your specific needs. For instance, if you have a chronic condition, look for plans that offer specialized programs or additional benefits to support your ongoing healthcare requirements.

| Plan Type | Premium (Monthly) | Deductible | Provider Network |

|---|---|---|---|

| Comprehensive Individual Plan | $450 | $2,000 | Large network, including most major hospitals and specialists |

| Family Plan with Maternity Benefits | $800 | $1,500 | In-state network with access to pediatricians and obstetricians |

| Group Insurance (Small Business) | Varies by employer | Typically lower than individual plans | Negotiated network with local healthcare providers |

| Medicaid (TennCare) | No cost for eligible individuals | Varies based on income and program | Statewide network, including community health centers and rural clinics |

| Medicare Advantage (HMO) | Varies by plan, often lower than original Medicare | May include copayments for doctor visits and prescriptions | Restricted network, but includes access to Medicare-approved providers |

Tennessee’s Health Insurance Market: A Snapshot

Tennessee’s health insurance market is a dynamic landscape, influenced by various factors such as federal and state policies, healthcare provider networks, and the diverse needs of its residents. Here’s a closer look at some key aspects of the market:

Affordability and Access

Tennessee has made significant strides in improving access to affordable health insurance, particularly through the implementation of the Affordable Care Act (ACA) and the expansion of Medicaid under the TennCare program. As a result, the state has seen a notable decrease in its uninsured rate, with more residents now able to access essential healthcare services.

Market Competition and Choice

Tennessee’s health insurance market boasts a healthy level of competition, with multiple insurers offering a diverse range of plans. This competition benefits consumers, as it drives insurers to provide competitive pricing, innovative benefits, and improved customer service. As a result, Tennesseans have a wealth of options to choose from, ensuring they can find a plan that best suits their individual needs.

Specialty Coverage Options

Tennessee’s health insurance market also caters to individuals with specific healthcare needs. For instance, plans offering comprehensive maternity and pediatric benefits are readily available, providing essential coverage for families. Additionally, the state’s insurers often provide specialized plans for individuals with pre-existing conditions or chronic illnesses, ensuring these populations have access to the care they require.

The Impact of Telehealth

The rise of telehealth services has had a significant impact on Tennessee’s health insurance landscape. Many insurers now offer plans that incorporate telehealth benefits, allowing policyholders to access healthcare services remotely. This has proven particularly beneficial during the COVID-19 pandemic, ensuring residents can continue to receive essential medical care while minimizing the risk of exposure.

Future Outlook

Looking ahead, Tennessee’s health insurance market is expected to continue evolving to meet the changing needs of its residents. With ongoing advancements in medical technology and an increasingly diverse population, insurers will likely continue to innovate and adapt their offerings. This may include the development of more specialized plans, increased focus on preventive care, and further integration of digital health solutions.

Conclusion

Tennessee’s health insurance market offers a wide array of options, ensuring residents can access the healthcare services they need without financial hardship. By understanding the different types of plans available and carefully considering their specific healthcare requirements, Tennesseans can make informed decisions to secure the best possible coverage. As the market continues to evolve, it is poised to provide even greater accessibility and innovation in the years to come.

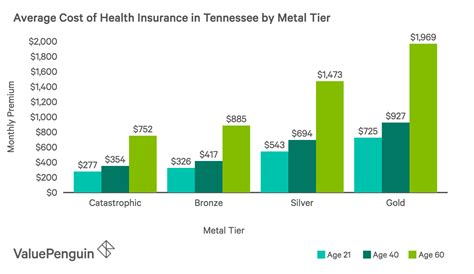

What is the average cost of health insurance in Tennessee?

+

The average cost of health insurance in Tennessee can vary widely depending on the type of plan, coverage level, and individual factors such as age and health status. According to recent data, the average monthly premium for an individual plan in Tennessee is around 400 to 500, while family plans can range from 800 to 1,200 or more. However, these averages can be significantly influenced by various factors, and it’s essential to obtain personalized quotes to determine the actual cost for your specific situation.

How can I find out if I’m eligible for Medicaid in Tennessee?

+

Eligibility for Medicaid in Tennessee, known as TennCare, is determined based on income and certain other factors. Generally, individuals and families with incomes up to 138% of the federal poverty level may qualify. To find out if you’re eligible, you can visit the official TennCare website or contact your local Department of Human Services office. They can provide guidance on the application process and help determine if you meet the eligibility criteria.

Are there any discounts or subsidies available for health insurance in Tennessee?

+

Yes, Tennessee residents may be eligible for discounts or subsidies to help offset the cost of health insurance. Through the Affordable Care Act (ACA), individuals and families with moderate incomes may qualify for premium tax credits, which can significantly reduce the cost of their monthly premiums. Additionally, some insurers may offer discounts or incentives for certain groups, such as seniors or those who maintain a healthy lifestyle. It’s advisable to explore these options when comparing health insurance plans.