Term Insurance Plan

In the realm of financial planning, term insurance plans stand as a crucial pillar, offering a cost-effective and comprehensive solution for securing the future of loved ones. This article delves into the intricacies of term insurance, exploring its benefits, features, and why it's an essential consideration for individuals and families alike. Through a detailed analysis, we aim to provide an insightful guide, empowering readers to make informed decisions about their financial protection.

Understanding Term Insurance Plans

Term insurance, often referred to as pure protection insurance, is a type of life insurance policy designed to provide financial coverage for a specified period, known as the term. Unlike traditional life insurance, which combines protection with an investment component, term insurance focuses solely on offering high coverage amounts at affordable premiums. It serves as a vital tool for individuals to ensure their family’s financial well-being, especially during challenging times.

Key Features of Term Insurance

Term insurance plans offer a range of features that make them an attractive choice for financial planning:

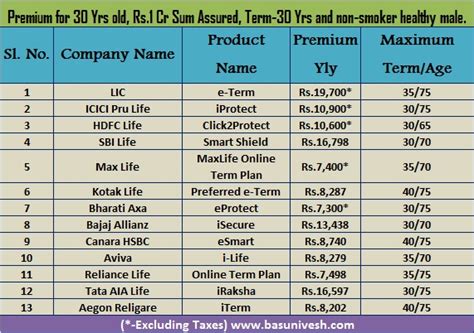

- Affordable Premiums: The primary advantage of term insurance is its cost-effectiveness. Premiums are typically lower compared to other life insurance types, making it accessible to a wider range of individuals.

- High Coverage: Despite the affordable premiums, term insurance provides substantial coverage amounts. This ensures that beneficiaries receive a significant sum in the event of the policyholder’s untimely demise.

- Flexibility: Policyholders have the flexibility to choose the term duration, ranging from 10 to 30 years, depending on their needs and life stage. This allows for personalized financial protection.

- Rider Options: Many term insurance plans offer additional rider benefits, such as accidental death benefit, critical illness cover, or waiver of premium. These riders enhance the policy’s overall value and cater to specific needs.

- Tax Benefits: Term insurance premiums are eligible for tax deductions under Section 80C of the Income Tax Act, providing an additional financial advantage.

| Term Insurance Feature | Description |

|---|---|

| Renewability | Most policies offer the option to renew at the end of the term, providing continuous coverage. |

| Conversion Privilege | Some policies allow conversion to a permanent life insurance plan, ensuring long-term protection. |

| Level Premium | Premiums remain constant throughout the policy term, making financial planning easier. |

How Term Insurance Works

Term insurance operates on a straightforward principle. The policyholder pays a premium, either annually, semi-annually, quarterly, or monthly, depending on the chosen payment frequency. In return, the insurance company guarantees a death benefit to the nominated beneficiaries if the policyholder passes away during the policy term.

The Role of Riders

Riders are optional add-ons that can be attached to a term insurance plan, enhancing its coverage and tailoring it to specific needs. Some common riders include:

- Accidental Death Benefit: Provides an additional sum assured in case of death due to an accident.

- Waiver of Premium: If the policyholder becomes disabled or critically ill, this rider waives future premium payments.

- Critical Illness Cover: Offers a lump-sum payout upon diagnosis of a specified critical illness, providing financial support for treatment.

- Income Benefit: This rider provides a regular income to the beneficiaries for a defined period, ensuring financial stability.

Choosing the Right Term Length

Determining the term length is a crucial aspect of term insurance planning. It’s essential to consider life stage, financial goals, and the age of financial dependents. Here’s a simplified guide:

- Young Adults: Opt for a longer term, typically 25-30 years, to ensure coverage until children are independent and mortgages are paid off.

- Middle-Aged Individuals: A term of 15-20 years can provide coverage until retirement, ensuring financial security during the transition.

- Retirees: Term insurance may be less relevant, but it can still offer coverage for a few years to cover final expenses and ensure a dignified send-off.

Benefits of Term Insurance

Term insurance offers a myriad of advantages, making it a popular choice for financial protection:

- Financial Security: The primary benefit is the peace of mind that comes with knowing that loved ones are financially secure, even in the event of an untimely death.

- Affordability: With its cost-effective nature, term insurance allows individuals from various income brackets to access substantial coverage.

- Flexibility: Policyholders can customize their plan, choosing the term length, sum assured, and optional riders to meet their specific needs.

- Tax Benefits: As mentioned earlier, term insurance premiums are tax-deductible, providing an additional financial incentive.

- Renewability: The ability to renew the policy at the end of the term ensures continuous coverage, even as life circumstances change.

Case Study: John’s Term Insurance Journey

Consider John, a 30-year-old software engineer with a young family. He purchases a term insurance plan with a sum assured of $1 million and a term of 25 years. John chooses to include an accidental death benefit rider and a waiver of premium rider. With his policy in place, he ensures that if anything were to happen to him, his wife and children would receive the necessary financial support to maintain their current lifestyle, pay off their mortgage, and cover educational expenses.

Comparing Term Insurance to Other Life Insurance Types

While term insurance is a popular choice, it’s essential to understand how it differs from other life insurance types:

| Insurance Type | Term Insurance | Whole Life Insurance | Endowment Policy |

|---|---|---|---|

| Coverage Period | Fixed term (10-30 years) | Lifetime | Fixed term (usually 10-20 years) |

| Premium Costs | Affordable | Higher | Moderate |

| Investment Component | None | Builds cash value | Builds cash value |

| Flexibility | High (riders, term length) | Limited | Limited |

| Suitability | Young families, breadwinners | Long-term financial goals | Saving for specific goals |

The Role of Term Insurance in Estate Planning

Term insurance plays a crucial role in estate planning, especially for high-net-worth individuals. It can be used to cover estate taxes, ensuring that heirs receive their inheritance without significant financial burdens. Additionally, term insurance can provide liquidity to the estate, covering immediate expenses and ensuring a smooth transition.

Selecting the Right Term Insurance Provider

When choosing a term insurance provider, it’s essential to consider the following factors:

- Financial Stability: Ensure the insurance company has a strong financial rating and a history of stability.

- Reputation: Research the company’s reputation and customer satisfaction ratings.

- Policy Features: Compare policies to find the one that best aligns with your needs and offers the desired riders.

- Claims Process: Understand the claims process and ensure it is straightforward and efficient.

- Customer Service: Opt for a company with responsive and knowledgeable customer service.

The Future of Term Insurance

As the insurance industry evolves, term insurance plans are likely to become even more flexible and customizable. We can expect to see innovative features, such as dynamic sum assured adjustments and more comprehensive rider options. Additionally, with the rise of digital insurance platforms, purchasing and managing term insurance policies will become more accessible and convenient.

Conclusion

Term insurance plans offer a vital layer of financial protection, ensuring that loved ones are cared for in the face of uncertainty. With its affordability, flexibility, and comprehensive coverage, term insurance is an essential consideration for anyone looking to secure their family’s future. By understanding the features, benefits, and choosing the right provider, individuals can make informed decisions and navigate the complex world of financial planning with confidence.

How much term insurance coverage do I need?

+The coverage amount depends on your financial goals and the needs of your dependents. A general rule is to have 10-15 times your annual income as the sum assured. However, it’s best to consult a financial advisor for a personalized assessment.

Can I switch my term insurance policy to a permanent plan later on?

+Yes, many term insurance policies offer a conversion privilege, allowing you to convert your term plan to a permanent life insurance policy without undergoing another medical exam.

What happens if I outlive my term insurance policy?

+If you outlive the policy term, you won’t receive any payout. However, you can renew the policy or consider other types of insurance to meet your changing needs.

Are there any exclusions or limitations in term insurance policies?

+Yes, term insurance policies typically exclude coverage for death due to suicide, war, or certain high-risk activities. It’s important to read the policy document carefully to understand any exclusions or limitations.