Term Life Insurance Premiums

Term life insurance is a fundamental component of financial planning, offering a cost-effective way to secure the financial well-being of your loved ones. Understanding the factors influencing term life insurance premiums is crucial for making informed decisions. In this comprehensive guide, we delve into the intricacies of term life insurance, shedding light on the key aspects that determine the cost of your policy.

Unraveling the Factors that Impact Term Life Insurance Premiums

The cost of term life insurance premiums is influenced by a multitude of factors, each playing a unique role in shaping the overall policy price. From your age and health status to lifestyle choices and the coverage amount, every detail contributes to the final premium calculation. In this section, we'll explore these factors in depth, providing a comprehensive understanding of how they collectively impact your term life insurance premiums.

The Role of Age and Health Status

Age and health are two of the most significant determinants of term life insurance premiums. Insurance providers carefully assess these factors to evaluate the level of risk associated with insuring an individual. The younger and healthier you are, the lower your premiums are likely to be. This is because younger individuals generally have a longer life expectancy and are at a reduced risk of developing health conditions that could impact their longevity.

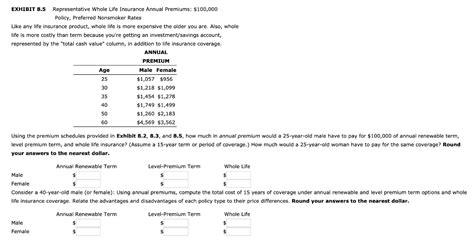

Consider the following table illustrating the impact of age on term life insurance premiums for a non-smoker with excellent health:

| Age | Annual Premium for $500,000 Coverage |

|---|---|

| 25 years | $300 |

| 35 years | $450 |

| 45 years | $750 |

| 55 years | $1,200 |

As this table demonstrates, the premiums increase significantly with age, reflecting the higher risk associated with insuring older individuals.

Lifestyle Choices and Risk Assessment

Your lifestyle choices and overall risk assessment also play a pivotal role in determining your term life insurance premiums. Insurance providers consider various factors such as your occupation, hobbies, and any high-risk activities you engage in. For instance, if you work in a hazardous industry or enjoy extreme sports, your premiums may be higher due to the increased risk of injury or death.

Consider the following example: John, a 35-year-old man, leads an active lifestyle. He enjoys skydiving and works as a construction worker. Despite being in good health, his lifestyle choices increase the risk of accidents. As a result, his term life insurance premiums are likely to be higher than those of a similar-aged individual with a less risky lifestyle.

Coverage Amount and Policy Duration

The amount of coverage you choose and the duration of your policy are other critical factors influencing your term life insurance premiums. Generally, higher coverage amounts and longer policy durations result in higher premiums. This is because the insurance provider assumes more financial responsibility over an extended period, increasing the potential payout.

For instance, if you opt for a $1,000,000 coverage policy with a 30-year term, your premiums will likely be higher than if you chose a $500,000 coverage policy with a 20-year term. This is due to the increased financial risk the insurance provider assumes over the longer term and the larger potential payout.

Gender and Family History

Gender and family history are also considered in the premium calculation process. Historically, men have paid higher premiums than women due to generally shorter life expectancies and higher rates of risky behaviors. However, this gap has narrowed in recent years as more women have entered traditionally male-dominated occupations and engaged in similar risk behaviors.

Family history is another important factor. If your family has a history of certain health conditions, such as heart disease or cancer, your premiums may be higher due to the increased risk of developing these conditions yourself.

Location and Marital Status

Your location and marital status can also impact your term life insurance premiums. Different states and regions have varying mortality rates, which can affect the cost of insurance. Additionally, married individuals often pay lower premiums than single individuals due to the financial stability and responsibility that marriage often entails.

Strategies to Optimize Your Term Life Insurance Premiums

While various factors influence your term life insurance premiums, there are strategies you can employ to optimize these costs and secure the best possible coverage for your budget. In this section, we explore practical approaches to managing your term life insurance costs effectively.

Choose the Right Coverage Amount

One of the most effective ways to manage your term life insurance premiums is by carefully choosing the right coverage amount. While it's essential to ensure you have adequate coverage to protect your loved ones, overinsuring can lead to unnecessary expenses. Assess your financial obligations and future goals to determine the coverage amount that best suits your needs.

For instance, if you have a mortgage, consider the amount needed to pay off the remaining balance in the event of your untimely death. This ensures your family isn't burdened with a large debt, providing them with the financial stability they need during a difficult time.

Consider a Shorter Policy Term

Opting for a shorter policy term can be a strategic way to reduce your term life insurance premiums. Shorter terms generally result in lower premiums as the insurance provider assumes less financial risk over a shorter period. If your financial situation and family obligations change over time, you can always adjust your coverage or policy term accordingly.

For example, if you're a young professional just starting your career, you may opt for a 10-year term policy to cover your immediate financial needs. As your career progresses and your financial obligations change, you can reassess your coverage needs and potentially extend or renew your policy with a longer term.

Bundle Policies and Compare Providers

Bundling your insurance policies, such as combining your term life insurance with other types of insurance like auto or home insurance, can often result in discounts and reduced premiums. Additionally, comparing quotes from multiple insurance providers is crucial to finding the best deal. Each provider has its own premium calculation methodology, so shopping around can reveal significant differences in costs.

Online insurance comparison platforms can be a valuable tool for quickly and easily obtaining multiple quotes. These platforms often provide detailed breakdowns of the coverage and premiums offered by various providers, making it simple to compare and choose the option that best fits your needs and budget.

Maintain a Healthy Lifestyle

Maintaining a healthy lifestyle is not only beneficial for your overall well-being but can also positively impact your term life insurance premiums. Insurance providers often offer discounts or reduced premiums to individuals who lead healthy lives, as this reduces their risk profile. Regular exercise, a balanced diet, and avoiding risky behaviors can all contribute to lower premiums.

For instance, non-smokers often qualify for reduced premiums due to the significantly lower health risks associated with smoking. Additionally, maintaining a healthy weight and regularly engaging in physical activity can demonstrate a commitment to a healthy lifestyle, which may be rewarded with lower insurance costs.

Consider Term Conversion Options

When purchasing a term life insurance policy, it's essential to understand the conversion options available. Many term policies allow you to convert your term coverage to a permanent life insurance policy without undergoing a new medical exam. This can be particularly beneficial if your health status has changed or if you want to maintain coverage beyond the original term.

While converting your term policy may result in higher premiums compared to starting a new policy, it can be a valuable option if you want to ensure continuous coverage without the risk of being declined due to changes in your health status.

The Future of Term Life Insurance Premiums

The landscape of term life insurance is continually evolving, influenced by advancements in technology, changes in societal trends, and shifts in the insurance industry. Understanding these future implications is crucial for making informed decisions about your term life insurance coverage and managing your premiums effectively.

Technological Advancements and Premium Calculations

Advancements in technology, particularly in the realm of data analytics and artificial intelligence, are revolutionizing the way insurance premiums are calculated. Insurance providers are increasingly leveraging big data and predictive analytics to assess risk and determine premiums more accurately. This shift towards data-driven premium calculations can lead to more precise pricing, potentially benefiting consumers by offering more competitive rates.

For instance, the use of wearable technology and health monitoring devices can provide insurance providers with real-time data on an individual's health and lifestyle. This data can be used to dynamically adjust premiums, rewarding individuals who maintain a healthy lifestyle with lower costs. Additionally, these technological advancements can streamline the insurance application process, making it more efficient and less costly for both consumers and providers.

Changing Societal Trends and Lifestyle Factors

Societal trends and lifestyle factors are also expected to influence the future of term life insurance premiums. As societal norms evolve, so do the risks associated with various behaviors and occupations. For instance, the increasing prevalence of remote work and the gig economy may impact the way insurance providers assess risk and calculate premiums for individuals in these non-traditional work arrangements.

Furthermore, changing societal attitudes towards health and wellness could influence the way insurance providers view certain behaviors and lifestyle choices. For example, the growing awareness of the importance of mental health may lead to a shift in the way insurance providers assess risk factors associated with mental health conditions, potentially resulting in more inclusive and fair premium calculations.

Industry Shifts and Regulatory Changes

The insurance industry is subject to various shifts and regulatory changes that can impact the calculation and pricing of term life insurance premiums. These changes can arise from a range of factors, including new legislation, shifts in market dynamics, and changes in consumer behavior. Staying informed about these industry developments is crucial for understanding how they may impact your term life insurance premiums.

For instance, changes in tax laws or regulations governing the insurance industry can influence the cost of doing business for insurance providers, which may be passed on to consumers in the form of higher premiums. Conversely, regulatory changes aimed at increasing competition or consumer protection could lead to more affordable premiums and a wider range of coverage options.

FAQ: Term Life Insurance Premiums

How often do term life insurance premiums change?

+Term life insurance premiums typically remain fixed for the duration of the policy term. However, if you choose to renew your policy, the premiums may change based on various factors, including your age, health status, and the prevailing market rates.

Can I negotiate my term life insurance premiums?

+While it's generally not possible to negotiate term life insurance premiums directly, you can take steps to optimize your premiums. This includes choosing the right coverage amount, considering a shorter policy term, and maintaining a healthy lifestyle. Additionally, comparing quotes from multiple providers can help you find the most competitive rates.

What happens if I miss a premium payment for my term life insurance policy?

+Missing a premium payment can have serious consequences for your term life insurance policy. Most policies have a grace period, typically 30 days, during which you can make the overdue payment without any penalty. If you fail to make the payment within the grace period, your policy may lapse, and you'll lose coverage. It's crucial to stay up-to-date with your premium payments to maintain uninterrupted coverage.

Are there any tax benefits associated with term life insurance premiums?

+Term life insurance premiums are generally not tax-deductible for individuals. However, if you own a business and purchase a term life insurance policy as part of a business insurance plan, the premiums may be tax-deductible as a business expense. It's always advisable to consult with a tax professional to understand the specific tax implications in your situation.

Understanding the factors that influence term life insurance premiums is crucial for making informed decisions about your financial protection. By carefully considering these factors and implementing the strategies outlined above, you can effectively manage your term life insurance costs, ensuring you have the coverage you need without breaking the bank.