Term Life Insurance Versus Whole Life

Unveiling the Differences: Term Life Insurance vs. Whole Life

In the realm of financial planning and risk management, life insurance stands as a cornerstone, offering individuals and families a sense of security and peace of mind. When considering life insurance options, two prevalent choices often come to the forefront: Term Life Insurance and Whole Life Insurance. These two policies, though serving the same overarching purpose, differ significantly in their structures, benefits, and long-term value. This in-depth exploration will dissect these differences, shedding light on the intricacies of each type of insurance and helping you make an informed decision that aligns with your financial goals and life stage.

Term Life Insurance: A Temporary Solution with Long-Term Impact

Term Life Insurance, as the name suggests, provides coverage for a specified period, typically ranging from 10 to 30 years. It is designed to offer protection during life stages when financial obligations are at their peak, such as when you have young children or substantial debt. The key feature of term life insurance is its affordability, making it an attractive option for those seeking comprehensive coverage without straining their budgets.

Key Characteristics of Term Life Insurance

-

Fixed Premium: Throughout the term, the insured pays a fixed premium, ensuring predictable financial planning.

-

Coverage Period: The policy's term can be customized to match the insured's needs, offering flexibility.

-

Renewability: Most term life policies allow for renewal, often with the option to convert to a permanent life insurance policy.

-

Death Benefit: Upon the insured's death during the term, the beneficiaries receive a lump-sum payment, known as the death benefit.

Term life insurance is particularly beneficial for individuals with temporary financial obligations or those seeking to cover specific expenses, such as a mortgage or children's education costs. The death benefit can provide a safety net, ensuring that loved ones are financially secure in the event of the policyholder's untimely demise.

Term Life Insurance in Action: A Real-World Example

Imagine Sarah, a 35-year-old with two young children and a substantial mortgage. She opts for a 20-year term life insurance policy with a $500,000 death benefit. During the term, Sarah pays a fixed premium of $250 per month. If Sarah were to pass away during this period, her beneficiaries would receive the $500,000, which could be used to pay off the mortgage, cover her children's education expenses, or provide a financial cushion for her family.

Whole Life Insurance: Permanent Protection, Permanent Benefits

Whole Life Insurance, often referred to as permanent life insurance, stands in contrast to term life insurance. This type of policy provides coverage for the insured's entire life, offering a lifetime guarantee of protection. Whole life insurance is a comprehensive financial tool that not only provides a death benefit but also accumulates cash value over time, making it an attractive option for those seeking long-term financial security and estate planning.

Key Characteristics of Whole Life Insurance

-

Guaranteed Coverage: Whole life insurance policies offer coverage for the insured's entire life, ensuring protection regardless of age or health status.

-

Cash Value Accumulation: A portion of the premium goes towards building cash value, which can be borrowed against or withdrawn, providing financial flexibility.

-

Fixed Premium: Similar to term life insurance, whole life policies have fixed premiums, allowing for stable financial planning.

-

Death Benefit: Upon the insured's death, the beneficiaries receive the death benefit, which can be a significant sum, especially if the policy has been in force for a long period.

Whole life insurance is particularly advantageous for those seeking a stable financial tool that can be used for various purposes, including wealth accumulation, estate planning, and providing a significant death benefit to loved ones. The cash value component allows policyholders to access funds in times of need, making it a versatile financial asset.

Whole Life Insurance: A Scenario for Understanding

Consider John, a 40-year-old businessman with a successful career. He opts for a whole life insurance policy with a $1,000,000 death benefit. Over time, his policy accumulates cash value, which he decides to use to supplement his retirement savings. As John ages, the cash value in his policy continues to grow, providing him with a substantial financial resource for his golden years.

Comparative Analysis: Term Life vs. Whole Life

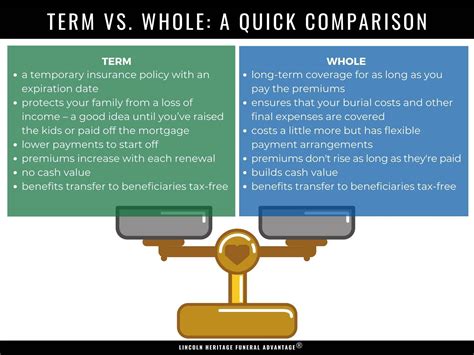

When comparing term life and whole life insurance, several key factors come into play. These include the purpose of insurance, the financial situation of the insured, and their long-term financial goals.

Purpose of Insurance

Term life insurance is often chosen when the primary goal is to provide financial protection during a specific period of high financial responsibility. It is ideal for covering short-term needs such as mortgage payments or children's education. On the other hand, whole life insurance is preferred when the objective is to secure long-term financial stability and leave a substantial legacy.

Financial Considerations

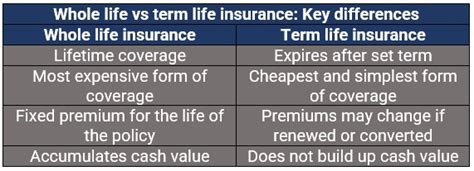

| Factor | Term Life | Whole Life |

|---|---|---|

| Premium | Generally lower, especially for younger individuals | Higher, but remains fixed throughout the policy |

| Cash Value | None | Accumulates over time, offering financial flexibility |

| Coverage Period | Limited to the term, often 10-30 years | Lifetime coverage, guaranteeing protection |

Flexibility and Control

Term life insurance offers flexibility in terms of coverage periods and the option to renew or convert to a permanent policy. However, whole life insurance provides a higher level of control and predictability, as the policy remains in force throughout the insured's life, and the cash value component can be utilized as needed.

Suitability for Different Life Stages

Term life insurance is often more suitable for younger individuals with temporary financial obligations. It provides adequate coverage without straining their budgets. On the other hand, whole life insurance is well-suited for those in their prime earning years who want to secure their financial future and leave a lasting legacy.

Making the Right Choice: Your Path to Financial Security

Choosing between term life and whole life insurance depends on your unique financial situation, goals, and life stage. Term life insurance offers a cost-effective solution for short-term financial protection, while whole life insurance provides a comprehensive financial tool with long-term benefits and flexibility.

It is essential to consult with a financial advisor or insurance professional who can guide you through the process, ensuring you make an informed decision that aligns with your needs. Remember, life insurance is not a one-size-fits-all solution, and understanding your options is key to making the right choice for your financial security and peace of mind.

Can I switch from term life insurance to whole life insurance later in life?

+Yes, it is often possible to convert a term life insurance policy to a whole life policy. However, the terms and conditions for conversion vary among insurance providers. It’s advisable to review your policy and consult with your insurance agent to understand the specific conversion options available to you.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage ends, and you will no longer have protection. However, some term life policies offer a conversion option, allowing you to convert your term policy to a permanent life insurance policy without undergoing a medical exam. It’s essential to review your policy terms to understand your options.

How does the cash value in whole life insurance work?

+The cash value in a whole life insurance policy accumulates over time. A portion of your premium goes towards building this cash value, which acts as a savings component. You can borrow against this cash value or use it to pay premiums. The cash value can be a valuable financial resource, but it’s important to understand the potential tax implications and the impact on your overall policy.