Texas Health Insurance Exchange Marketplace

Welcome to the comprehensive guide to the Texas Health Insurance Exchange Marketplace, an essential resource for Texans seeking to navigate the world of health insurance options. With the introduction of the Affordable Care Act (ACA) in 2010, health insurance marketplaces, also known as exchanges, have played a pivotal role in providing affordable and accessible healthcare coverage to millions of Americans. In this article, we will delve into the specifics of the Texas Health Insurance Exchange, its historical context, and the key aspects that make it a vital component of the state's healthcare system.

Understanding the Texas Health Insurance Exchange

The Texas Health Insurance Exchange, officially known as the Texas Health Insurance Marketplace, is an online platform designed to simplify the process of purchasing health insurance for individuals and families residing in the state of Texas. Established as a result of the Affordable Care Act, this marketplace serves as a centralized hub where Texans can compare and purchase health insurance plans from various providers, all in one convenient location.

The primary goal of the Texas Health Insurance Exchange is to increase competition among insurance providers, thus driving down costs and improving the overall accessibility of healthcare coverage for Texans. By creating a transparent and competitive environment, the exchange aims to empower individuals to make informed decisions about their healthcare needs and to find the most suitable and affordable insurance plans.

Key Features of the Texas Health Insurance Exchange

The Texas Health Insurance Exchange offers a range of features and benefits to assist Texans in their quest for affordable healthcare coverage. Here are some of the key aspects:

- Plan Comparison Tools: The exchange provides an intuitive platform that allows users to compare different health insurance plans based on factors such as cost, coverage, and provider networks. This feature enables individuals to easily assess and select the plan that best aligns with their specific healthcare needs and budget.

- Eligibility and Subsidies: The Texas Health Insurance Exchange helps individuals determine their eligibility for various healthcare programs, including Medicaid, the Children's Health Insurance Program (CHIP), and premium tax credits. These subsidies can significantly reduce the cost of insurance premiums, making healthcare coverage more affordable for low- and middle-income households.

- Open Enrollment Periods: Similar to other health insurance marketplaces, the Texas exchange operates on an annual open enrollment period. During this time, individuals can enroll in a new health insurance plan or make changes to their existing coverage. It's important for Texans to stay informed about these enrollment periods to ensure they have continuous coverage throughout the year.

- Special Enrollment Periods: In addition to the annual open enrollment, the Texas Health Insurance Exchange offers special enrollment periods for qualifying life events, such as marriage, divorce, birth of a child, or loss of existing coverage. These special enrollment periods allow individuals to enroll outside of the regular open enrollment window, ensuring they have access to healthcare coverage when they need it most.

By utilizing the Texas Health Insurance Exchange, individuals can take advantage of the competitive insurance landscape, compare plans, and access financial assistance to obtain the coverage they need. The exchange plays a crucial role in bridging the gap between uninsured Texans and affordable, quality healthcare.

Historical Context and Development of the Texas Health Insurance Exchange

The journey towards establishing the Texas Health Insurance Exchange began with the passage of the Affordable Care Act (ACA) in 2010. The ACA aimed to reform the American healthcare system by expanding access to healthcare coverage and reducing healthcare disparities. As part of this landmark legislation, health insurance marketplaces were established to facilitate the enrollment process and provide a platform for individuals to shop for insurance plans.

In the initial years following the implementation of the ACA, Texas opted not to establish its own state-based health insurance exchange. Instead, the federal government stepped in to operate a federally facilitated marketplace for the state. However, as time progressed, the state of Texas recognized the importance of having a state-specific exchange tailored to the unique needs and demographics of its population.

In 2019, Texas took a significant step forward by launching its own state-based health insurance exchange, the Texas Health Insurance Marketplace. This move reflected the state's commitment to providing Texans with a more localized and personalized healthcare insurance experience. The development of the Texas exchange involved collaboration between state agencies, healthcare experts, and insurance providers to create a user-friendly platform that met the specific requirements of the state's residents.

The Benefits of a State-Based Exchange

The establishment of a state-based health insurance exchange brings several advantages to Texans. Firstly, it allows the state to have more control over the design and functionality of the marketplace, ensuring that it aligns with the unique healthcare landscape of Texas. This includes the ability to incorporate state-specific programs and initiatives aimed at improving access to healthcare and reducing costs.

Secondly, a state-based exchange provides Texans with a more localized experience. The platform can be tailored to include insurance providers that have a strong presence in the state, offering a wider range of plan options. Additionally, it allows for better integration with state-specific healthcare initiatives and programs, such as the Texas Women's Health Program and the Texas Children's Health Insurance Program (CHIP), making it easier for Texans to access these services.

Navigating the Texas Health Insurance Exchange

The Texas Health Insurance Exchange is designed to be user-friendly and accessible to individuals of all ages and backgrounds. Whether you’re a first-time user or a returning visitor, here’s a step-by-step guide to help you navigate the platform effectively:

- Access the Exchange: Start by visiting the official website of the Texas Health Insurance Marketplace. The URL is typically available on the state's healthcare agency website or through a simple online search. Ensure you are accessing the official and secure platform to protect your personal information.

- Create an Account: If you are a new user, you will need to create an account by providing basic personal information such as your name, date of birth, and contact details. This account will serve as your secure portal for accessing and managing your health insurance plans.

- Determine Eligibility: Once you have logged into your account, the exchange will guide you through a series of questions to determine your eligibility for various healthcare programs. This includes assessing your income, household size, and other factors to determine if you qualify for Medicaid, CHIP, or premium tax credits.

- Compare Plans: After determining your eligibility, you can proceed to compare different health insurance plans offered by various providers. The exchange provides a comprehensive comparison tool that allows you to filter plans based on your specific needs, such as cost, coverage, and provider networks. Take your time to review the details of each plan, including copays, deductibles, and out-of-pocket maximums, to find the one that best suits your healthcare requirements.

- Select a Plan: Once you have identified the plan that meets your needs and budget, you can proceed with the enrollment process. The exchange will guide you through the steps to complete your application and select your chosen plan. It's important to carefully review all the terms and conditions before finalizing your enrollment.

- Manage Your Account: After enrolling in a health insurance plan, you can use your account to manage your coverage. This includes updating your personal information, viewing your plan details, and accessing important documents such as your insurance card and summary of benefits. You can also make changes to your plan during the annual open enrollment period or if you experience a qualifying life event.

Navigating the Texas Health Insurance Exchange becomes easier with each visit as you become more familiar with the platform and its features. The exchange aims to provide a seamless and efficient experience, ensuring that Texans can access the healthcare coverage they need with minimal hassle.

Insurance Providers and Plan Options

The Texas Health Insurance Exchange boasts a diverse range of insurance providers, offering Texans a wide array of plan options to choose from. As of [current year], the exchange has partnerships with the following insurance companies:

- Blue Cross Blue Shield of Texas

- UnitedHealthcare

- Aetna

- Humana

- Assurant Health

- Oscar Health

- Ambetter

- and more...

Each of these insurance providers offers a variety of health insurance plans, including:

- Bronze Plans: These plans typically have lower premiums but higher out-of-pocket costs, making them suitable for individuals who prioritize lower monthly payments and expect minimal healthcare utilization.

- Silver Plans: Silver plans strike a balance between cost and coverage, offering a good combination of premiums and out-of-pocket expenses. They are often a popular choice for individuals who anticipate moderate healthcare needs.

- Gold Plans: Gold plans provide more comprehensive coverage with higher premiums and lower out-of-pocket costs. These plans are ideal for individuals who anticipate frequent healthcare utilization or have specific medical needs that require extensive coverage.

- Catastrophic Plans: These plans are primarily designed for individuals under the age of 30 or those who qualify due to financial hardship. They offer minimal coverage but can be a cost-effective option for those who rarely require medical services.

When comparing plans, it's important to consider not only the premiums but also the deductibles, copays, and out-of-pocket maximums. Additionally, reviewing the provider networks and covered services ensures that you select a plan that aligns with your healthcare preferences and needs.

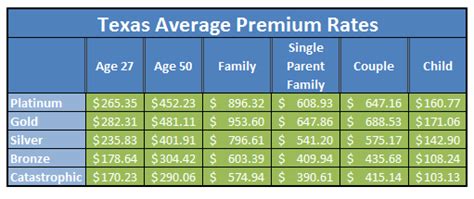

Plan Costs and Subsidies

The cost of health insurance plans on the Texas Health Insurance Exchange varies depending on several factors, including the plan type, the insurance provider, and the specific coverage options chosen. Here’s a breakdown of the typical costs and the financial assistance available:

| Plan Type | Average Monthly Premium | Financial Assistance |

|---|---|---|

| Bronze Plans | $[bronze_premium] | May be eligible for premium tax credits based on income |

| Silver Plans | $[silver_premium] | Premium tax credits and cost-sharing reductions for low- and middle-income households |

| Gold Plans | $[gold_premium] | Cost-sharing reductions for low-income households |

| Catastrophic Plans | $[catastrophic_premium] | Limited financial assistance available for qualifying individuals |

It's important to note that these average monthly premiums are subject to change annually and may vary depending on the specific plan and insurance provider. Additionally, the financial assistance available, such as premium tax credits and cost-sharing reductions, can significantly reduce the overall cost of insurance premiums, making healthcare coverage more affordable for many Texans.

Enrollment Periods and Deadlines

The Texas Health Insurance Exchange operates on an annual open enrollment period, allowing individuals to enroll in or change their health insurance plans. Understanding these enrollment periods and deadlines is crucial to ensure continuous coverage and avoid gaps in healthcare.

Annual Open Enrollment Period

The annual open enrollment period for the Texas Health Insurance Exchange typically runs from November 1st to December 15th each year. During this time, individuals can:

- Enroll in a new health insurance plan

- Switch to a different plan offered by the same or a different insurance provider

- Make changes to their existing coverage, such as adding or removing dependents

- Update their personal information and contact details

It's important to note that the open enrollment period is the only time when individuals can make changes to their coverage without experiencing a qualifying life event. Outside of this period, individuals may only make changes to their plans if they have a qualifying event, such as marriage, divorce, birth of a child, or loss of existing coverage.

Special Enrollment Periods

In addition to the annual open enrollment, the Texas Health Insurance Exchange offers special enrollment periods for qualifying life events. These special enrollment periods allow individuals to enroll outside of the regular open enrollment window, ensuring they have access to healthcare coverage when they need it most.

Here are some common qualifying life events that trigger a special enrollment period:

- Marriage or divorce

- Birth or adoption of a child

- Loss of existing coverage due to job loss, change in employment, or other reasons

- Gaining or losing Medicaid or CHIP coverage

- Moving to a new state or county

When a qualifying life event occurs, individuals have a limited window of time, typically 60 days from the event, to enroll in a new health insurance plan. It's important to act promptly during these special enrollment periods to avoid any gaps in coverage.

Assistance and Resources for Enrolling

The Texas Health Insurance Exchange recognizes that enrolling in health insurance can be a complex process, especially for individuals who may have limited experience or face language barriers. To ensure that all Texans have equal access to healthcare coverage, the exchange offers a range of assistance and resources to support individuals throughout the enrollment process.

Navigator Programs

Navigator programs are a crucial component of the Texas Health Insurance Exchange, providing in-person assistance to individuals who need help navigating the exchange and understanding their healthcare options. These navigators are trained professionals who offer unbiased guidance and support, helping individuals make informed decisions about their healthcare coverage.

Navigator programs are typically hosted by community organizations, healthcare providers, or non-profit groups. They provide a range of services, including:

- Assisting individuals in creating their online accounts on the exchange

- Explaining the different insurance plan options and their benefits

- Helping individuals determine their eligibility for Medicaid, CHIP, or premium tax credits

- Providing language assistance for individuals who speak languages other than English

- Offering ongoing support and guidance throughout the enrollment process

To find a navigator program near you, you can visit the official website of the Texas Health Insurance Marketplace or contact the state's healthcare agency for guidance.

Online Resources and Help Centers

In addition to in-person assistance, the Texas Health Insurance Exchange provides a wealth of online resources and help centers to support individuals throughout the enrollment process. These resources are accessible 24⁄7 and can be a valuable tool for those who prefer self-service options or have limited time.

Here are some of the online resources available on the Texas Health Insurance Marketplace website:

- Plan Comparison Tools: Interactive tools that allow individuals to compare different insurance plans based on cost, coverage, and provider networks.

- Eligibility Calculators: Online calculators that help individuals assess their eligibility for Medicaid, CHIP, or premium tax credits based on their income and household size.

- Frequently Asked Questions (FAQ) Section: A comprehensive list of common questions and answers related to the exchange, enrollment process, and insurance plan options.

- Help Center Articles: Detailed articles providing step-by-step guides on various aspects of the enrollment process, from creating an account to selecting a plan.

- Contact Information: Direct contact details for the Texas Health Insurance Marketplace, including phone numbers and email addresses, to reach out for assistance.

By utilizing these online resources, individuals can gain a better understanding of the enrollment process, explore their insurance options, and make informed decisions about their healthcare coverage.

Future Implications and Ongoing Initiatives

The Texas Health Insurance Exchange has made significant strides in improving access to healthcare coverage for Texans, but the journey towards universal healthcare coverage is an ongoing process. As the healthcare landscape continues to evolve, the exchange remains committed to addressing the unique healthcare needs of the state’s diverse population.

Expanding Coverage and Access

One of the key focuses of the Texas Health Insurance Exchange is to expand healthcare coverage and improve access to quality healthcare services for all Texans. The exchange aims to achieve this by:

- Enhancing outreach and education efforts to reach underserved communities and raise awareness about the availability of affordable healthcare options.

- Collaborating with healthcare providers, community organizations, and advocacy groups to identify and address barriers to healthcare access, particularly for vulnerable populations such as low-income individuals, racial and ethnic minorities, and rural residents.

- Exploring innovative approaches to healthcare delivery, such as telehealth services and community-based health centers, to improve access to care in underserved areas.

Advocating for Healthcare Reform

The Texas Health Insurance Exchange also plays a crucial role in advocating for healthcare reform at the state and federal levels. By working closely with policymakers and stakeholders, the exchange aims to shape policies that promote affordable and accessible healthcare for all Texans.

Some of the key initiatives and reforms the exchange supports