Texas Health Insurance Marketplace

The Texas Health Insurance Marketplace, also known as the Texas Health Insurance Exchange, is a crucial platform for residents of the Lone Star State to access affordable health insurance plans. Established under the Affordable Care Act (ACA), the marketplace plays a vital role in providing Texans with a range of healthcare coverage options, ensuring that individuals and families have access to essential medical services.

Understanding the Texas Health Insurance Marketplace

The Texas Health Insurance Marketplace serves as a centralized hub where individuals, families, and small businesses can compare and purchase health insurance plans. It was created as a result of the federal healthcare reform, offering Texans a transparent and competitive environment to find suitable healthcare coverage. The marketplace operates under the guidance of the U.S. Department of Health and Human Services and is specifically tailored to meet the unique healthcare needs of Texas residents.

Each year, the Texas Health Insurance Marketplace opens during the Open Enrollment Period, typically lasting from November to December. This window provides an opportunity for Texans to review their current health insurance plans, explore new options, and make changes to their coverage. It's a critical time for individuals to ensure they have the right healthcare protection for the upcoming year.

During the Open Enrollment Period, residents can access the marketplace through the official HealthCare.gov website or by visiting the Texas Department of Insurance website. These platforms provide a user-friendly interface, allowing individuals to compare plans, assess their eligibility for subsidies, and enroll in the most suitable health insurance option for their needs.

Key Features of the Texas Health Insurance Marketplace

The Texas Health Insurance Marketplace offers a wide range of features and benefits, making it an essential resource for Texans seeking healthcare coverage:

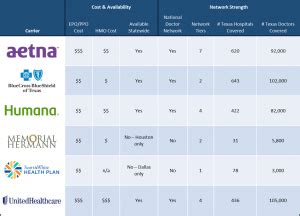

- Plan Comparison: The marketplace presents a comprehensive list of health insurance plans from various providers, enabling individuals to compare benefits, premiums, deductibles, and out-of-pocket costs side by side. This feature ensures that Texans can make informed decisions based on their specific healthcare requirements and budget.

- Premium Tax Credits: For those who qualify, the marketplace offers premium tax credits, which can significantly reduce the cost of monthly premiums. These credits are based on factors like income and family size, providing financial assistance to ensure that healthcare remains accessible to all.

- Cost-Sharing Reductions: Additionally, the marketplace provides cost-sharing reductions for eligible individuals, which can lower their out-of-pocket expenses for deductibles, copayments, and coinsurance. This feature ensures that Texans with lower incomes can afford the necessary healthcare services without facing excessive financial burdens.

- Medicaid and CHIP Integration: The Texas Health Insurance Marketplace integrates with Medicaid and the Children's Health Insurance Program (CHIP), making it easier for eligible residents to access these vital government-funded healthcare programs. This integration streamlines the enrollment process and ensures that Texans in need can receive the coverage they deserve.

Navigating the Texas Health Insurance Marketplace

Navigating the Texas Health Insurance Marketplace can be a straightforward process with the right guidance. Here's a step-by-step breakdown to help you understand how to make the most of this essential platform:

- Eligibility Check: The first step is to determine your eligibility for healthcare coverage through the marketplace. This involves assessing your income, family size, and other relevant factors. You can use the eligibility calculator on the HealthCare.gov website to get a quick estimate of your eligibility status.

- Plan Comparison: Once you know you're eligible, it's time to compare the available health insurance plans. The marketplace provides a user-friendly interface where you can filter plans based on your specific needs, such as preferred healthcare providers, prescription drug coverage, and more. Take your time to review the benefits and costs of each plan to find the best fit for your circumstances.

- Assess Premium Tax Credits: If you qualify for premium tax credits, it's crucial to understand how these credits can reduce your monthly premiums. The marketplace will calculate your estimated premium tax credit based on your income and family size. This information will help you determine the most cost-effective plan for your situation.

- Consider Cost-Sharing Reductions: Similarly, if you're eligible for cost-sharing reductions, these can significantly lower your out-of-pocket expenses. The marketplace will assess your eligibility and provide an estimate of the potential savings. This information will further refine your plan selection, ensuring you choose a plan that aligns with your financial needs.

- Enroll in Your Chosen Plan: Once you've found the right health insurance plan, the next step is to enroll. The marketplace will guide you through the enrollment process, which typically involves providing personal and financial information. It's essential to review the plan details and understand the coverage benefits before finalizing your enrollment.

- Review and Renew: Health insurance plans and premiums can change from year to year. Therefore, it's crucial to review your coverage annually during the Open Enrollment Period. This allows you to ensure your plan still meets your needs and to explore any new options that may be available. Staying proactive in managing your healthcare coverage is essential to maintaining access to quality medical services.

Texas-Specific Considerations

While the Texas Health Insurance Marketplace follows the guidelines set by the Affordable Care Act, there are some state-specific considerations to keep in mind:

- Medicaid Expansion: Texas has not expanded its Medicaid program under the ACA. This means that eligibility for Medicaid in Texas is limited to specific categories, such as pregnant women, children, and individuals with disabilities. If you believe you may qualify for Medicaid, it's important to review the eligibility criteria and apply through the appropriate channels.

- Alternative Coverage Options: In addition to the marketplace, Texans have the option to purchase health insurance directly from insurance providers or through private exchanges. While these alternatives may offer more flexibility, it's essential to compare the benefits and costs carefully to ensure you're getting the coverage you need at a reasonable price.

| Texas Health Insurance Marketplace Key Statistics |

|---|

| Open Enrollment Period: November 1 to December 15 |

| Number of Qualified Health Plans (QHPs) in 2023: 441 |

| Average Premium Tax Credit in 2023: $470/month |

| Number of Marketplace Enrollees in 2023: 1.15 million |

Frequently Asked Questions

What is the Texas Health Insurance Marketplace?

+The Texas Health Insurance Marketplace is an online platform established under the Affordable Care Act (ACA) to help Texans access affordable health insurance plans. It provides a centralized location where individuals, families, and small businesses can compare and purchase healthcare coverage options.

When is the Open Enrollment Period for the Texas Health Insurance Marketplace?

+The Open Enrollment Period for the Texas Health Insurance Marketplace typically runs from November 1 to December 15 each year. This is the time when individuals can review their current plans, explore new options, and enroll in or make changes to their health insurance coverage for the upcoming year.

How do I know if I’m eligible for premium tax credits or cost-sharing reductions through the marketplace?

+Eligibility for premium tax credits and cost-sharing reductions is determined based on your income, family size, and other factors. You can use the eligibility calculator on the HealthCare.gov website to get an estimate of your eligibility status. Additionally, the marketplace will assess your eligibility during the enrollment process and provide information on any potential savings you may qualify for.

Can I enroll in the Texas Health Insurance Marketplace outside of the Open Enrollment Period?

+In general, enrollment in the Texas Health Insurance Marketplace is only possible during the Open Enrollment Period. However, there are certain qualifying life events, such as losing your job, getting married, or having a baby, that may allow you to enroll outside of this period. It’s important to review the qualifying life events and their specific requirements to determine if you are eligible for a Special Enrollment Period.

What happens if I don’t have health insurance in Texas?

+In Texas, there is no state-mandated requirement to have health insurance. However, having health insurance is crucial to protect your financial well-being and ensure access to necessary medical care. Without insurance, you may face significant out-of-pocket costs for healthcare services, which can be financially burdensome. The Texas Health Insurance Marketplace provides an opportunity to obtain affordable coverage and avoid these potential financial risks.