Texas Home Insurance

In the vast state of Texas, where diversity in climate, geography, and population is a hallmark, the need for comprehensive home insurance is paramount. With a range of potential risks, from hurricanes along the coast to wildfires in the west and tornadoes across the state, understanding the nuances of Texas home insurance is essential for homeowners.

The Landscape of Texas Home Insurance

Texas is a unique market when it comes to home insurance. The state's size and varied weather patterns contribute to a complex insurance landscape. Homeowners in Texas must navigate a system that is often more intricate than in other states due to the wide range of potential risks.

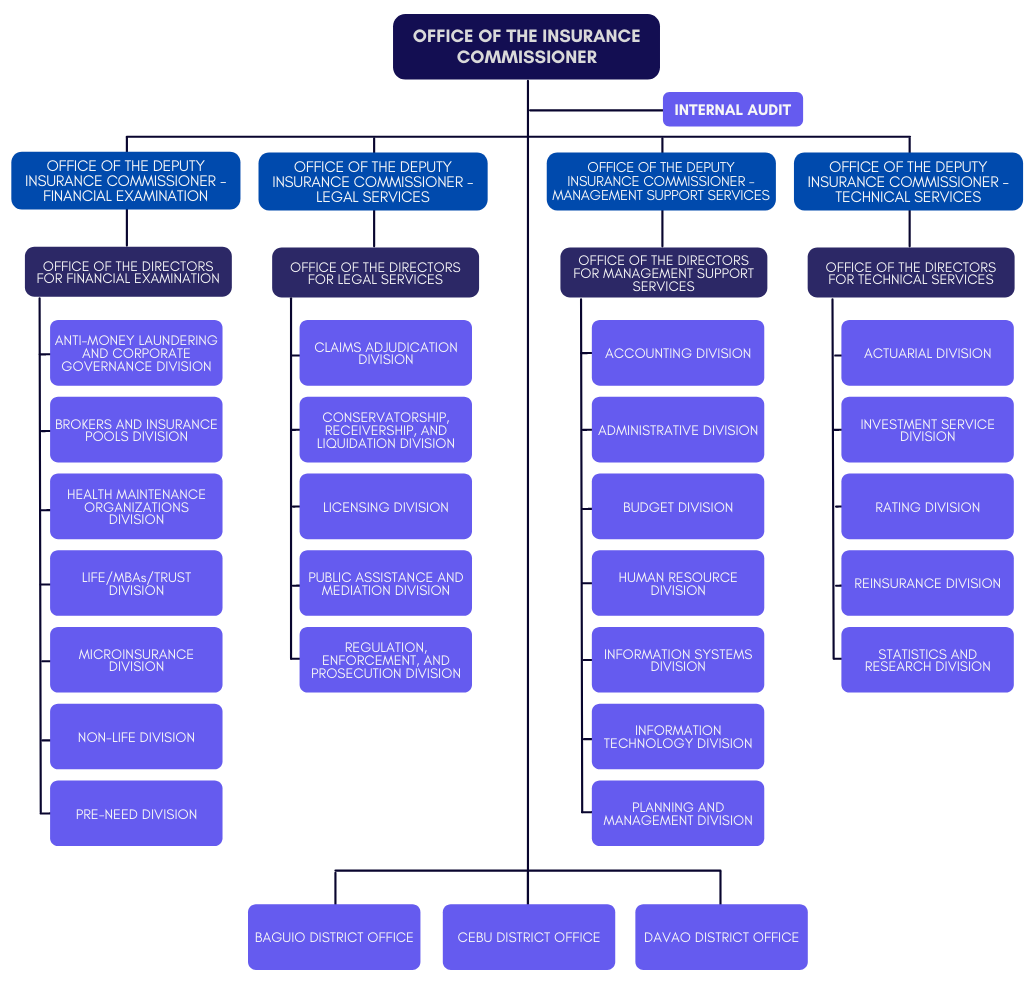

The Texas Department of Insurance (TDI) plays a crucial role in regulating the home insurance market. TDI ensures that insurance companies operating in the state provide fair and adequate coverage. This includes setting standards for policy offerings and resolving consumer complaints.

One of the key challenges for Texas homeowners is the potential for natural disasters. The state's vulnerability to hurricanes, particularly along the Gulf Coast, is a significant concern. According to the Insurance Information Institute, Texas has experienced some of the most costly hurricanes in U.S. history, with Hurricane Harvey in 2017 causing an estimated $125 billion in damage.

Beyond hurricanes, Texas is no stranger to other natural calamities. The western regions of the state are prone to wildfires, while the central and northern parts are at risk of tornadoes. Even hailstorms, which can cause extensive damage to homes and vehicles, are a regular occurrence across the state.

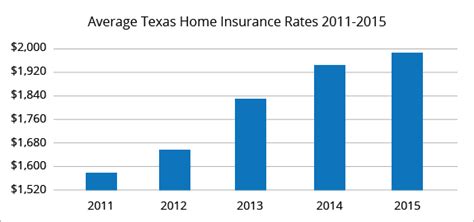

Given these diverse risks, Texas homeowners often find themselves facing higher insurance premiums compared to other states. The cost of coverage can vary significantly based on location, with coastal areas typically incurring higher costs due to the higher risk of hurricane damage.

Key Factors Influencing Texas Home Insurance Premiums

- Location: Coastal regions, given their vulnerability to hurricanes, tend to have higher premiums. Similarly, areas with a history of wildfires or frequent tornadoes may also face higher costs.

- Construction and Age of the Home: Homes built with hurricane-resistant materials or those that have been retrofitted with such features may qualify for lower premiums. The age of the home is also a factor, with older homes potentially requiring more extensive (and costly) repairs.

- Coverage Limits and Deductibles: Homeowners can choose higher deductibles to reduce their premium costs. However, it's essential to consider the potential out-of-pocket expenses in the event of a claim.

- Discounts and Bundling: Many insurance companies offer discounts for bundling home and auto insurance policies. Additionally, safety features like security systems or fire-resistant roofing can also lead to reduced premiums.

Despite the challenges, Texas homeowners have a range of options to manage their insurance costs effectively. Understanding these factors and taking proactive measures can help homeowners secure the right coverage at a competitive price.

Understanding the Coverage Options

Texas home insurance policies typically offer a range of coverage options, allowing homeowners to tailor their protection to their specific needs. Here's a breakdown of the key coverages:

Dwelling Coverage

This is the cornerstone of any home insurance policy. It provides protection for the physical structure of the home, including the roof, walls, and permanent fixtures. Dwelling coverage is essential for rebuilding or repairing your home in the event of a covered loss, such as fire, wind damage, or vandalism.

| Dwelling Coverage Highlights |

|---|

| Covers the physical structure of the home |

| Essential for rebuilding or repairing after a covered loss |

| Typically includes coverage for attached structures like garages and porches |

Personal Property Coverage

This coverage safeguards the personal belongings within your home. From furniture and appliances to clothing and electronics, personal property coverage ensures that your possessions are protected against theft, damage, or destruction due to a covered event.

| Personal Property Coverage Key Points |

|---|

| Protects personal belongings inside the home |

| Covers a range of perils, including fire, theft, and natural disasters |

| It's important to review the policy's specific limits and exclusions |

Liability Coverage

Liability coverage is a critical aspect of home insurance, providing protection in the event that someone is injured on your property or you are held legally responsible for causing injury or property damage to others. This coverage can help cover legal fees and any settlements or judgments against you.

| Liability Coverage Overview |

|---|

| Covers legal fees and settlements arising from injuries or property damage caused by the policyholder |

| Essential for protecting personal assets in the event of a lawsuit |

| Often includes coverage for medical expenses incurred by guests injured on the insured's property |

Additional Living Expenses (ALE) Coverage

In the event that your home becomes uninhabitable due to a covered loss, ALE coverage steps in. It provides reimbursement for additional living expenses incurred while you are temporarily displaced, such as hotel stays, restaurant meals, and other costs above your normal living expenses.

| Additional Living Expenses Coverage Details |

|---|

| Covers temporary living expenses when the insured's home is uninhabitable due to a covered loss |

| Typically includes coverage for hotel stays, meals, and other necessary expenses |

| Policyholders should review the specific limits and time frames for ALE coverage |

The Importance of Shopping Around

Given the diverse nature of the Texas home insurance market, it's essential to shop around for the best coverage and rates. The process of comparing policies and providers can be time-consuming, but it's a crucial step in ensuring you get the right protection at a competitive price.

Steps to Finding the Right Policy

- Assess Your Needs: Start by evaluating your specific needs. Consider factors like the age and construction of your home, the value of your personal belongings, and the potential risks in your area. This assessment will guide your choice of coverage options.

- Compare Policies: Obtain quotes from multiple insurance companies. Compare the coverage limits, deductibles, and any additional features or endorsements offered. Ensure you're comparing policies with similar coverage to make an accurate assessment.

- Check for Discounts: Many insurance companies offer discounts for various reasons. These can include multi-policy discounts (for bundling home and auto insurance), safety discounts (for features like smoke detectors or burglar alarms), and loyalty discounts for long-term customers.

- Read the Fine Print: Don't just focus on the price. Review the policy's exclusions and limitations to ensure you understand what's covered and what's not. This is crucial to avoid any surprises in the event of a claim.

- Consider Customer Service and Claims Handling: While it's important to find a competitive rate, also consider the reputation and reliability of the insurance company. Look for companies with a strong track record of customer satisfaction and efficient claims handling.

By following these steps and staying informed about your options, you can navigate the Texas home insurance market with confidence and secure the coverage that best suits your needs.

Texas Home Insurance and Natural Disasters

Texas' susceptibility to natural disasters, including hurricanes, tornadoes, and wildfires, underscores the critical need for comprehensive home insurance coverage. These events can cause devastating damage, often resulting in extensive repairs or even the complete loss of a home.

Hurricane Coverage

Hurricanes are a significant concern for Texas homeowners, particularly along the Gulf Coast. These powerful storms can bring heavy rainfall, storm surges, and high winds, all of which can cause severe damage to homes. Standard home insurance policies typically cover wind damage, but it's important to note that flood damage, which is often a consequence of hurricanes, is not included in standard policies.

To protect against flood damage, homeowners should consider purchasing a separate flood insurance policy through the National Flood Insurance Program (NFIP). This program, backed by the Federal Emergency Management Agency (FEMA), provides coverage for homes located in high-risk flood zones.

| Hurricane Coverage Key Points |

|---|

| Standard home insurance policies typically cover wind damage from hurricanes |

| Flood damage, a common consequence of hurricanes, is not covered by standard policies |

| Consider purchasing a separate flood insurance policy through the NFIP for comprehensive protection |

Tornado and Wildfire Coverage

Texas is also prone to tornadoes, which can strike with little warning and cause significant damage. Similarly, wildfires, though more prevalent in the western regions, can also pose a threat to homes across the state.

The good news is that standard home insurance policies generally cover damage caused by tornadoes and wildfires. This coverage extends to the physical structure of the home as well as personal belongings. However, it's essential to review your policy's specific terms and conditions, as some insurers may have different definitions of covered perils or may exclude certain types of damage.

| Tornado and Wildfire Coverage Overview |

|---|

| Standard home insurance policies typically cover damage caused by tornadoes and wildfires |

| Coverage includes the physical structure of the home and personal belongings |

| Review your policy's specific terms and conditions for any exclusions or limitations |

Preparing for Natural Disasters

While having the right insurance coverage is crucial, it's equally important to take proactive measures to prepare for natural disasters. Here are some tips:

- Stay informed about weather conditions and potential risks in your area. Sign up for local alerts and follow weather updates regularly.

- Create an emergency plan for your family, including an evacuation route and a meeting place in case you need to leave your home.

- Secure your home by installing hurricane shutters or impact-resistant windows and doors. These can help mitigate damage from high winds and flying debris.

- Maintain your property to reduce the risk of wildfire damage. This includes clearing away dead vegetation, creating a defensible space around your home, and ensuring easy access for emergency vehicles.

- Regularly review and update your home inventory. This will help expedite the claims process in the event of a loss.

By combining comprehensive insurance coverage with proactive disaster preparedness, Texas homeowners can better protect their homes and families from the state's unique weather challenges.

Navigating Texas Home Insurance Claims

When a covered loss occurs, understanding the claims process is essential for Texas homeowners. This process can be complex, but with the right knowledge and preparation, it becomes more manageable.

Reporting a Claim

The first step in the claims process is to report the loss to your insurance company as soon as possible. Most insurers provide multiple ways to report a claim, including online forms, phone calls, or mobile apps. Prompt reporting ensures that the claims process can begin promptly, which is especially important in the case of time-sensitive repairs.

When reporting a claim, have the following information ready:

- Your policy number

- A description of the damage or loss

- Photos or videos of the damage (if possible)

- Any relevant estimates or invoices for repairs or replacements

The Claims Investigation

After reporting your claim, the insurance company will initiate an investigation to assess the extent of the damage and determine the cause. This investigation is crucial for establishing whether the loss is covered under your policy.

During the investigation, the insurance company may send an adjuster to inspect the damage. The adjuster will document the loss, take photos, and gather information to assess the claim. It's important to cooperate fully with the adjuster and provide any necessary documentation or access to your property.

The adjuster's report will be used to determine the amount of the insurance settlement. This settlement will typically cover the cost of repairs or replacements, taking into account your policy's coverage limits, deductibles, and any applicable depreciation.

Understanding Your Policy's Coverage Limits

Every home insurance policy has specific coverage limits. These limits dictate the maximum amount the insurance company will pay for a covered loss. It's essential to understand these limits and ensure they align with the value of your home and personal belongings.

For example, if your home is insured for $200,000 and you suffer a total loss, the insurance company will pay up to the policy's limit of $200,000. However, if the cost of rebuilding your home exceeds this amount, you may be responsible for the difference.

Similarly, personal property coverage often has a sub-limit for certain high-value items, such as jewelry or artwork. If you own such items, it's crucial to review your policy and consider purchasing additional coverage or a separate rider to ensure they're adequately protected.

The Importance of Documentation

Documentation is key throughout the claims process. This includes not only providing evidence of the loss and damage but also keeping records of your interactions with the insurance company.

Take photos or videos of the damage as soon as it's safe to do so. These visual records can be invaluable in supporting your claim. Additionally, keep a record of all communications with your insurer, including dates, times, and the names of the representatives you speak with.

If you need to make temporary repairs to prevent further damage, keep the receipts for these expenses. They may be reimbursable under your policy's Additional Living Expenses (ALE) coverage.

Resolving Disputes

In some cases, disputes may arise between homeowners and their insurance companies. These disputes can stem from differences in the interpretation of policy terms, disagreements over the value of the loss, or delays in the claims process.

If you find yourself in a dispute with your insurer, it's essential to first try to resolve the issue directly with the company. Many insurance companies have dedicated claims advocates or ombudsmen who can help mediate these disputes.

If the dispute remains unresolved, you may need to consider more formal avenues, such as mediation or arbitration. In extreme cases, you may need to pursue legal action. However, it's important to consult with an attorney who specializes in insurance law to understand your rights and options.

By understanding the claims process and being proactive in your approach, Texas homeowners can navigate the complexities of home insurance claims with confidence and ensure they receive the coverage they deserve.

FAQ

What is the average cost of home insurance in Texas?

+The average cost of home insurance in Texas can vary significantly based on location, the value of the home, and the coverage limits chosen. According to recent data, the average annual premium in Texas is around 1,500, but this can range from under 1,000 to over $2,000 depending on these factors.

Does Texas require homeowners to have insurance?

+No, Texas does not have a statewide requirement for homeowners to carry insurance. However, if you have a mortgage on your home, your lender will likely require you to have adequate home