Texas Unemployment Insurance Number

The Texas Unemployment Insurance (UI) program plays a crucial role in providing financial assistance to eligible workers who have lost their jobs through no fault of their own. The program aims to offer temporary income support and help individuals maintain their economic stability during periods of unemployment. Understanding the UI system and how to navigate it is essential for both employers and employees in the Lone Star State.

Understanding the Texas Unemployment Insurance Program

Texas Unemployment Insurance, managed by the Texas Workforce Commission (TWC), is a vital safety net for job seekers. The program operates under specific guidelines and eligibility criteria, ensuring that those in need receive timely benefits. This comprehensive guide aims to unravel the intricacies of the UI system, offering a clear understanding of the process and its impact on Texas’ workforce.

Eligibility Criteria

To qualify for Texas UI benefits, individuals must meet certain conditions. Firstly, they should have worked for an employer who pays UI taxes to the state. This is a crucial criterion as it determines their eligibility. Secondly, applicants must have earned a minimum amount during their base period, which is usually the first four of the last five completed calendar quarters before their claim.

| Eligibility Factor | Details |

|---|---|

| Work Status | Must be unemployed through no fault of their own. |

| Earnings | Earned wages in at least two quarters of the base period. |

| Monetary Value | Wages must total at least 1.5 times the highest quarter's earnings. |

For instance, if an applicant's highest-earning quarter brought in $6,000, their total earnings for the base period should be at least $9,000 ($6,000 x 1.5) to qualify.

The Application Process

Applying for Texas UI benefits is a straightforward process. Individuals can start by visiting the TWC’s official website, where they can find a user-friendly online application form. The form requires basic personal information, employment history, and reasons for unemployment.

Once the application is submitted, the TWC reviews it to ensure the applicant meets all eligibility criteria. If approved, the applicant will receive their benefits via their chosen method, whether it's direct deposit or a debit card.

Navigating the System: A Step-by-Step Guide

For those new to the Texas UI system, here’s a detailed guide to help navigate the process smoothly.

Step 1: Check Your Eligibility

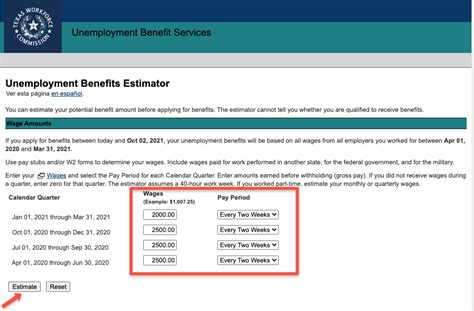

Before applying, it’s crucial to understand if you meet the eligibility requirements. Use the TWC’s UI Eligibility Estimator to determine your initial eligibility. This tool considers your work history and earnings to provide a preliminary assessment.

Step 2: Gather Necessary Documents

To ensure a smooth application process, gather the following documents:

- Social Security Number or Alien Registration Number

- Driver's license or state-issued ID

- Contact information for all employers in the last 18 months

- Dates of employment and reasons for leaving each job

Step 3: Apply Online

Visit the TWC’s UI Online portal and create an account. This secure platform allows you to apply for benefits, check your claim status, and manage your account.

Step 4: Weekly Certifications

Once your claim is approved, you must certify your eligibility weekly to continue receiving benefits. This involves confirming your employment status and actively seeking work. The TWC provides an easy-to-use weekly certification tool to simplify this process.

Step 5: Explore Additional Resources

The TWC offers various resources to support job seekers. These include job search assistance, career counseling, and training programs. Utilize these resources to enhance your employability and explore new career paths.

Impact and Benefits of Texas Unemployment Insurance

The Texas UI program has a significant impact on the state’s economy and workforce. By providing a safety net for unemployed workers, it helps stabilize the local economy and supports individuals during challenging times. Here’s a closer look at the benefits and impact of the program.

Economic Stability

UI benefits act as a temporary income replacement, allowing individuals to meet their basic needs while they search for new employment. This stability helps prevent financial hardship and maintains consumer spending, which is vital for the state’s economy.

Job Seeker Support

The TWC’s comprehensive support services go beyond financial assistance. The agency offers career guidance, resume assistance, and job placement services. These resources empower job seekers to enhance their skills, explore new career paths, and find suitable employment.

Business and Employer Benefits

The UI program also benefits businesses and employers in Texas. By ensuring a stable workforce, the program helps maintain a skilled talent pool. Additionally, the TWC provides resources and incentives for employers to invest in their workforce, improve employee retention, and enhance overall productivity.

Conclusion: A Comprehensive Support System

Texas Unemployment Insurance is a well-structured program designed to support workers and the state’s economy. By understanding the eligibility criteria, application process, and the benefits it offers, individuals and employers can navigate the system effectively. The TWC’s commitment to providing accessible resources and support ensures that Texas remains a strong and resilient economic hub.

Frequently Asked Questions

How long does it take to receive UI benefits after applying in Texas?

+The processing time for UI claims in Texas can vary. Typically, it takes about 2-3 weeks from the date of your application for the TWC to review and process your claim. However, during periods of high volume, such as economic downturns, the processing time may be longer.

Can I apply for UI benefits if I quit my job?

+In general, quitting a job voluntarily may make you ineligible for UI benefits. However, there are certain circumstances where quitting may be considered a valid reason for unemployment, such as unsafe working conditions or a substantial change in the terms of employment. It’s best to consult the TWC’s guidelines or seek professional advice in such cases.

Are there any income restrictions for UI benefits in Texas?

+There are no specific income restrictions for UI benefits in Texas. However, your eligibility and benefit amount are calculated based on your previous earnings. The higher your earnings, the higher your potential benefit amount. It’s important to note that UI benefits are intended to provide a temporary income replacement, not to match your previous salary.