The Best Whole Life Insurance

Securing the financial future of your loved ones is a priority for many individuals, and whole life insurance is a popular choice to achieve this goal. This type of insurance provides lifelong coverage, offering peace of mind and a range of benefits that go beyond traditional term policies. In this comprehensive guide, we will delve into the world of whole life insurance, exploring its features, advantages, and how it can be tailored to meet your unique needs.

Understanding Whole Life Insurance

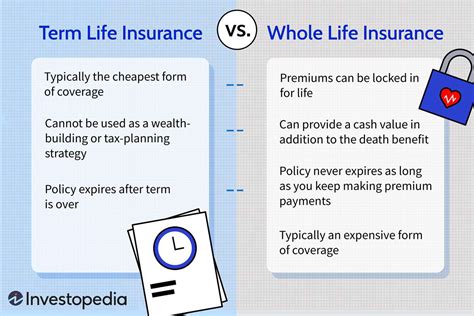

Whole life insurance, often referred to as permanent life insurance, is a long-term financial protection plan that remains in force throughout your lifetime, as long as the premiums are paid. Unlike term life insurance, which provides coverage for a specified period, whole life insurance offers a guaranteed death benefit, cash value accumulation, and potential dividends.

The key characteristics of whole life insurance include:

- Guaranteed Death Benefit: The policy pays out a specified amount upon the insured's death, ensuring financial security for beneficiaries.

- Cash Value Accumulation: Whole life policies build cash value over time, which can be borrowed against or withdrawn during the insured's lifetime.

- Level Premiums: Premium payments remain constant throughout the policy, providing budget predictability.

- Potential Dividends: Some policies offer dividends, which are refunds of overpaid premiums or shares of the insurer's profits, further enhancing the policy's value.

Advantages of Whole Life Insurance

Whole life insurance offers several advantages that make it an appealing choice for many individuals and families:

Financial Security and Peace of Mind

The primary benefit of whole life insurance is the guarantee of a death benefit, ensuring that your loved ones receive a substantial sum upon your passing. This financial security can help cover funeral expenses, pay off debts, and provide ongoing support for your family's daily needs and long-term goals.

Cash Value Accumulation

One of the unique features of whole life insurance is its cash value component. Over time, a portion of your premium payments goes towards building cash value within the policy. This cash value grows on a tax-deferred basis, meaning it accumulates without being taxed annually. You can access this cash value through policy loans, withdrawals, or by surrendering the policy.

The flexibility of cash value accumulation allows you to:

- Supplement retirement income

- Cover unexpected expenses

- Finance large purchases

- Pay for your children's education

Level Premium Payments

Whole life insurance policies typically require level premium payments, which means the amount you pay remains constant throughout the policy's duration. This predictability makes it easier to budget for your insurance costs and plan your financial future.

Potential Dividends

Some whole life insurance policies offer the potential for dividend payments. Dividends are not guaranteed but are based on the insurer's financial performance. These dividends can be used to reduce your premium payments, purchase additional paid-up insurance, or be added to your policy's cash value.

How to Choose the Best Whole Life Insurance Policy

When selecting a whole life insurance policy, it's essential to consider your unique circumstances and financial goals. Here are some key factors to guide your decision-making process:

Coverage Amount

Determine the coverage amount that aligns with your financial needs. Consider factors such as outstanding debts, mortgage payments, children's education expenses, and your family's lifestyle. A financial advisor can help you calculate the ideal coverage amount.

Premium Payment Options

Whole life insurance policies offer various premium payment options. You can choose to pay premiums annually, semi-annually, quarterly, or monthly. Some policies even allow you to make a single premium payment for the entire policy duration. Evaluate your financial situation and choose the payment option that suits your budget and preferences.

Policy Riders

Policy riders are optional additions to your whole life insurance policy that can enhance its benefits. Common riders include accelerated death benefit riders, which provide access to a portion of the death benefit if you become terminally ill, and waiver of premium riders, which waive premium payments if you become disabled.

Company Reputation and Financial Strength

When selecting an insurer, it's crucial to choose a reputable company with a strong financial background. Look for companies with a solid track record of paying claims and maintaining financial stability. Ratings from independent agencies like AM Best or Standard & Poor's can provide insights into an insurer's financial strength.

Flexibility and Customization

Whole life insurance policies can be tailored to your specific needs. Consider whether you want the option to increase your coverage amount over time or access the cash value for various financial goals. Some policies offer more flexibility in terms of premium payments and coverage adjustments, so choose a policy that aligns with your long-term plans.

Performance Analysis: Top Whole Life Insurance Providers

To help you make an informed decision, we've analyzed and compared some of the leading whole life insurance providers in the market. Here's an overview of their offerings:

| Provider | Policy Features | Premiums | Financial Strength |

|---|---|---|---|

| Provider A | Flexible coverage amounts, accelerated death benefit rider, waiver of premium rider | Competitive rates, offering discounts for early payment | A+ rating from AM Best |

| Provider B | High cash value accumulation, option to increase coverage annually, living benefits rider | Moderate premiums, with payment options including annual, semi-annual, and monthly | AA rating from Standard & Poor's |

| Provider C | Guaranteed level premiums, dividend payments, option to convert to universal life | Affordable premiums with a single premium payment option available | A++ rating from AM Best |

Expert Insights: Maximizing Whole Life Insurance Benefits

As a financial expert with extensive experience in the insurance industry, here are some insights to help you make the most of your whole life insurance policy:

💡 Consider Early Payment: Paying your premiums early can often lead to discounts and savings. Some insurers offer incentives for timely payments, so explore these options to reduce your overall costs.

💡 Utilize Cash Value: The cash value accumulation in your whole life policy is a valuable asset. Consider using it strategically to supplement your retirement income, cover major expenses, or provide financial support during challenging times. Just remember to maintain a balance between accessing cash value and keeping your policy active.

💡 Review and Adjust: Whole life insurance policies are flexible, and your financial needs may change over time. Regularly review your policy and make adjustments as necessary. Whether it's increasing your coverage amount, adding riders, or changing premium payment options, staying proactive ensures your policy remains aligned with your goals.

Frequently Asked Questions

Can I access the cash value of my whole life insurance policy?

+Yes, you can access the cash value of your whole life insurance policy through policy loans, withdrawals, or by surrendering the policy. However, it's important to note that policy loans accrue interest and may reduce the death benefit if not repaid.

What happens if I stop paying premiums on my whole life insurance policy?

+If you stop paying premiums, your policy may enter a grace period, typically 30 to 60 days, during which you can make up the missed payment. If the grace period expires without payment, the policy may lapse, and you'll lose coverage and any accumulated cash value.

Can I convert my whole life insurance policy to another type of insurance?

+Some whole life insurance policies offer the option to convert to another type of insurance, such as universal life or variable life insurance. Conversion options and eligibility may vary, so check with your insurer for specific details.

Are whole life insurance policies suitable for retirement planning?

+Whole life insurance policies can be a valuable component of retirement planning due to their cash value accumulation and potential for tax-advantaged growth. However, it's essential to consider your overall retirement strategy and consult a financial advisor to ensure whole life insurance aligns with your goals.

How does whole life insurance compare to term life insurance?

+Whole life insurance provides lifelong coverage with cash value accumulation, while term life insurance offers coverage for a specified period, typically 10 to 30 years. Term life insurance is generally more affordable but lacks the cash value and permanent coverage of whole life insurance.

Whole life insurance offers a comprehensive financial protection solution, providing peace of mind and long-term benefits. By understanding its features, advantages, and tailoring it to your needs, you can ensure the financial security of your loved ones and achieve your financial goals.