The Cheap Car Insurance

Securing affordable car insurance is a priority for many vehicle owners, as it can significantly impact their overall financial well-being. With the cost of living rising and budgets tightening, finding ways to reduce expenses is essential. This comprehensive guide will delve into the world of cheap car insurance, exploring strategies, industry insights, and real-world examples to help you navigate the process effectively and make informed decisions.

Understanding the Basics of Car Insurance

Car insurance is a legal requirement in most countries and serves as a financial safety net for drivers. It provides coverage for various situations, including accidents, theft, and damage to your vehicle. The cost of car insurance can vary widely depending on several factors, and understanding these factors is crucial to finding the best deal.

Factors Influencing Car Insurance Rates

- Driver Profile: Your age, gender, driving history, and location play a significant role in determining your insurance premium. Younger drivers and those with a history of accidents or traffic violations may face higher rates.

- Vehicle Type: The make, model, and age of your vehicle impact insurance costs. Sports cars and luxury vehicles often have higher premiums due to their repair costs.

- Coverage Options: The level of coverage you choose affects your premium. Comprehensive and collision coverage offer more protection but come at a higher cost.

- Deductibles: Opting for a higher deductible (the amount you pay out of pocket before insurance kicks in) can lower your monthly premiums.

- Discounts: Many insurance companies offer discounts for safe driving, multiple policies, and other factors. Understanding these discounts can help you save.

Researching and Comparing Insurance Providers

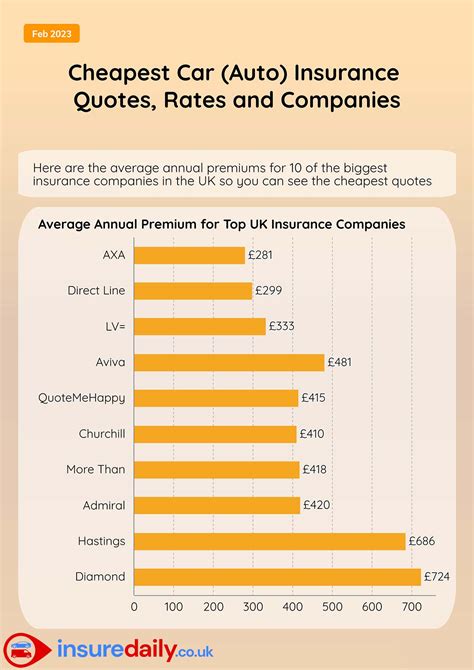

The car insurance market is highly competitive, and prices can vary significantly between providers. Conducting thorough research is essential to finding the most affordable option that suits your needs.

Start by obtaining quotes from multiple insurance companies. Online quote tools can provide a quick and convenient way to compare rates. Consider factors such as coverage limits, deductibles, and any additional benefits or perks offered by each provider.

| Insurance Company | Average Premium | Coverage Highlights |

|---|---|---|

| Provider A | $500/year | Accident forgiveness, roadside assistance |

| Provider B | $650/year | Discounts for safe driving, multi-policy |

| Provider C | $480/year | Comprehensive coverage, low deductibles |

When comparing quotes, pay attention to the fine print. Ensure that the coverage limits and deductibles align with your requirements. Consider the reputation and financial stability of the insurance company to ensure they will be there when you need them.

Strategies for Obtaining Cheap Car Insurance

Finding cheap car insurance requires a strategic approach. Here are some proven strategies to help you secure the best rates:

Shop Around and Negotiate

Don’t settle for the first quote you receive. Shopping around and negotiating with insurance providers can yield significant savings. When you have multiple quotes, you gain leverage to negotiate better terms and rates.

Contact insurance companies directly and discuss your specific needs and budget. Many providers are willing to offer discounts or adjust coverage to fit your requirements. Don’t be afraid to ask for a better deal; it’s a competitive market, and insurance companies want your business.

Utilize Online Comparison Tools

Online comparison tools have revolutionized the insurance shopping experience. These platforms allow you to input your information once and receive multiple quotes from various providers. They provide a quick and efficient way to compare rates and coverage options.

However, keep in mind that these tools may not consider all the factors that could impact your premium. It’s essential to verify the quotes with the insurance companies directly to ensure accuracy.

Improve Your Driving Record

Your driving history is a significant factor in determining your insurance rates. A clean driving record with no accidents or violations can lead to substantial savings.

If you have a less-than-perfect driving record, consider taking defensive driving courses. These courses can improve your driving skills and may even qualify you for insurance discounts. Additionally, maintaining a good driving record over time can lead to reduced premiums as you demonstrate your commitment to safe driving.

Explore Discounts and Bundling Options

Insurance companies offer a variety of discounts to attract customers. Common discounts include safe driving, multiple policies (such as bundling car and home insurance), and loyalty rewards.

Research the discounts available and discuss them with your insurance provider. Some companies may also offer discounts for specific occupations, membership in certain organizations, or even for maintaining a good credit score.

Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is an innovative approach to car insurance. It uses technology to track your driving habits, such as mileage, speed, and braking patterns.

By installing a small device or using a smartphone app, insurance companies can gather data about your driving behavior. Those who drive safely and less frequently may be eligible for lower premiums. This option is ideal for low-mileage drivers or those who prioritize safety.

Analyzing Performance and Making Adjustments

Once you’ve secured cheap car insurance, it’s essential to regularly review and analyze your policy to ensure it continues to meet your needs and provides the best value.

Regular Policy Reviews

Set a reminder to review your car insurance policy annually or whenever your circumstances change. Life events such as getting married, buying a new car, or moving to a new location can impact your insurance needs and rates.

During your policy review, assess whether your coverage limits are adequate and if any adjustments are necessary. Consider whether you can increase your deductible to lower your premiums, especially if your financial situation has improved.

Monitor Market Changes

The car insurance market is dynamic, with rates and offerings evolving over time. Stay informed about market trends and changes in the industry. Insurance companies may introduce new discounts, benefits, or coverage options that could benefit you.

Keep an eye on competitors’ rates and offerings. If you find a better deal elsewhere, don’t hesitate to switch providers. Loyalty is not always rewarded in the insurance industry, so be willing to shop around periodically to ensure you’re getting the best value.

Leverage Technology and Digital Tools

In today’s digital age, insurance companies are leveraging technology to enhance the customer experience and provide added value. Take advantage of online portals and mobile apps offered by your insurance provider.

These tools often provide real-time policy management, allowing you to make changes, view claims history, and access important documents. Some providers even offer digital accident reporting and claims submission, streamlining the process and potentially reducing the time it takes to resolve an issue.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer preferences. Staying informed about these trends can help you make more informed decisions about your coverage.

The Rise of Autonomous Vehicles

The development and adoption of autonomous vehicles (AVs) are expected to have a significant impact on car insurance. As AV technology advances, the number of accidents caused by human error is likely to decrease, potentially leading to lower insurance premiums.

However, the introduction of AVs also brings new challenges, such as determining liability in accidents and understanding the unique risks associated with this technology. Insurance companies are actively researching and developing coverage options for AVs to stay ahead of the curve.

Increased Focus on Telematics

Usage-based insurance, as mentioned earlier, is gaining traction as a way to offer personalized premiums based on individual driving behavior. Telematics technology is expected to become even more advanced, allowing for more precise data collection and analysis.

This shift towards telematics-based insurance may result in more tailored coverage options, with premiums reflecting an individual’s actual driving habits rather than generalized risk profiles. It could also incentivize safer driving practices, leading to a safer road environment.

Embracing Digital Transformation

The insurance industry is embracing digital transformation to enhance customer experiences and operational efficiency. Digital platforms and chatbots are becoming increasingly common, providing quick and convenient access to policy information and claims processing.

As technology advances, we can expect further innovations in the way insurance is delivered and managed. This could include the use of artificial intelligence for faster claims processing and more accurate risk assessment, ultimately benefiting consumers with improved services and potentially lower costs.

Frequently Asked Questions

What is the cheapest car insurance option available?

+The cheapest car insurance option varies based on individual circumstances. Factors like age, location, and driving record play a significant role. It’s essential to shop around and compare quotes from multiple providers to find the most affordable coverage for your specific situation.

Can I get cheap car insurance with a less-than-perfect driving record?

+Yes, it is possible to find affordable car insurance even with a less-than-perfect driving record. Many insurance companies offer discounts for safe driving and accident forgiveness programs. Additionally, shopping around and comparing quotes can help you find providers who specialize in offering coverage for drivers with violations or accidents.

How often should I review my car insurance policy?

+It is recommended to review your car insurance policy at least once a year, or whenever your circumstances change significantly. Regular policy reviews ensure that your coverage remains adequate and that you are not overpaying for unnecessary coverage. Additionally, staying up-to-date with market trends and changes in the insurance industry can help you identify potential savings opportunities.

What are some common discounts offered by car insurance providers?

+Car insurance providers offer a variety of discounts to attract customers. Common discounts include safe driving, multiple policies (bundling car and home insurance), good student discounts, loyalty rewards, and occupational discounts. It’s worth inquiring about these discounts with your insurance provider to see if you qualify and can reduce your premiums.

How will the rise of autonomous vehicles impact car insurance rates?

+The widespread adoption of autonomous vehicles is expected to have a significant impact on car insurance rates. As AV technology reduces accidents caused by human error, insurance premiums are likely to decrease over time. However, determining liability in AV-related accidents and understanding the unique risks associated with this technology will be crucial in shaping future insurance policies and rates.