Tn Health Insurance

In Tennessee, health insurance is a vital aspect of ensuring the well-being and financial security of its residents. With a diverse range of plans and options available, understanding the nuances of TN health insurance is essential for individuals and families to make informed decisions. This comprehensive guide aims to delve into the specifics of health insurance in Tennessee, providing an in-depth analysis of the plans, coverage, and benefits tailored to meet the unique needs of the state's population.

Understanding TN Health Insurance Plans

Tennessee offers a variety of health insurance plans, each designed to cater to different demographics and requirements. These plans can be broadly categorized into:

- Individual and Family Plans: Tailored for those without employer-sponsored coverage, these plans offer a range of options, from comprehensive to more cost-effective options, to suit individual and family needs.

- Employer-Sponsored Plans: Many employers in Tennessee provide health insurance benefits to their employees. These plans often cover a portion of the premium costs and may offer additional perks, such as flexible spending accounts.

- Medicaid and TennCare: Tennessee's Medicaid program, known as TennCare, provides health coverage to low-income individuals and families. It ensures access to essential healthcare services for those who meet the eligibility criteria.

- Medicare: For Tennessee residents aged 65 and above, or those with specific disabilities, Medicare is a federal health insurance program that offers comprehensive coverage.

- Short-Term Health Insurance: These plans provide temporary coverage for individuals between jobs or during periods of transition. They are typically more affordable but offer limited benefits and may not cover pre-existing conditions.

Key Considerations for Choosing a Plan

When selecting a health insurance plan in Tennessee, several factors come into play. These include:

- Premium Costs: The monthly premium is a significant consideration. Plans with lower premiums often have higher deductibles and out-of-pocket expenses, so it's essential to strike a balance between affordability and coverage.

- Coverage and Benefits: Different plans offer varying levels of coverage for medical services, prescriptions, and specialist care. Understanding what's included and excluded is crucial to ensure you receive the necessary healthcare.

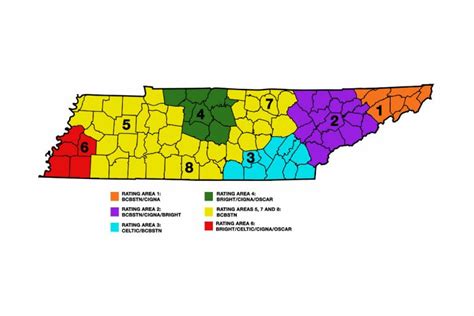

- Network of Providers: Health insurance plans typically have networks of preferred providers, including doctors, hospitals, and pharmacies. Choosing a plan with a network that includes your preferred healthcare providers can be beneficial.

- Pre-existing Conditions: If you have a pre-existing health condition, ensuring that your plan covers these conditions is vital. Some plans may have waiting periods or exclusions for pre-existing conditions, so thorough research is necessary.

- Dental and Vision Coverage: Many health insurance plans do not include dental or vision coverage. If these are essential to you, consider plans that offer these as add-on benefits or explore separate dental and vision insurance options.

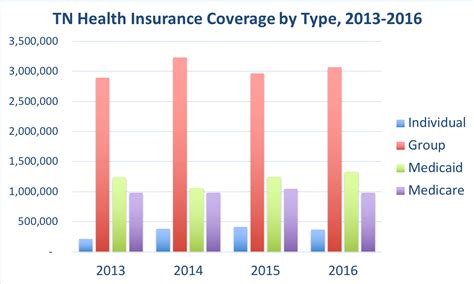

Analyzing TN Health Insurance Coverage

Tennessee health insurance plans provide coverage for a wide range of medical services and treatments. Here’s a breakdown of some key areas of coverage:

Hospitalization and Surgical Procedures

Most health insurance plans in Tennessee offer coverage for inpatient and outpatient hospital services, including:

- Hospital stays for medical or surgical treatments.

- Emergency room visits.

- Surgical procedures, both major and minor.

- Post-operative care and rehabilitation.

Doctor Visits and Specialist Care

Primary care physician (PCP) visits are typically covered under health insurance plans. Additionally, plans often include coverage for specialist care, such as:

- Cardiologists.

- Oncologists.

- Neurologists.

- Orthopedic specialists.

- Psychiatrists and mental health professionals.

Prescription Drugs

Prescription drug coverage is a critical component of health insurance plans. Tennessee plans typically offer:

- A list of covered medications, known as a formulary.

- Discounts on prescription drugs, with varying levels of coverage depending on the plan.

- Options for mail-order prescriptions, which can be more cost-effective for long-term medications.

Preventive Care and Wellness Programs

Many Tennessee health insurance plans prioritize preventive care to maintain good health and catch potential issues early. Coverage may include:

- Annual physical exams and wellness checks.

- Immunizations and vaccinations.

- Screenings for cancer, heart disease, and other conditions.

- Nutritional counseling and weight management programs.

- Smoking cessation support.

The Cost of TN Health Insurance

The cost of health insurance in Tennessee varies based on several factors, including the type of plan, coverage level, and the individual’s or family’s demographics. Here’s a closer look at the financial aspects of health insurance in the state:

Premium Costs

Premiums are the monthly payments made to maintain health insurance coverage. In Tennessee, the average monthly premium for an individual plan ranges from 250 to 500, while family plans can cost between 700 and 1,500 per month. These premiums can be affected by factors such as age, location, and the plan’s coverage level.

| Plan Type | Average Monthly Premium |

|---|---|

| Individual | $250 - $500 |

| Family | $700 - $1,500 |

Deductibles and Out-of-Pocket Expenses

Deductibles and out-of-pocket expenses are additional costs associated with health insurance. Deductibles are the amount an insured person must pay out of pocket before the insurance company starts covering costs. Out-of-pocket expenses include deductibles, copayments, and coinsurance.

In Tennessee, the average deductible for an individual plan ranges from $2,000 to $4,000, while family plans typically have deductibles between $4,000 and $8,000. Copayments, which are fixed amounts paid for services like doctor visits or prescriptions, can vary depending on the plan and the specific service.

| Plan Type | Average Deductible |

|---|---|

| Individual | $2,000 - $4,000 |

| Family | $4,000 - $8,000 |

Financial Assistance and Subsidies

Tennessee residents who purchase health insurance through the Health Insurance Marketplace may be eligible for financial assistance to help cover the cost of premiums. This assistance is provided in the form of premium tax credits, which can lower the monthly premium cost. Additionally, those with low incomes may qualify for Medicaid (TennCare) coverage, which provides comprehensive health insurance at little to no cost.

Future Outlook and Trends in TN Health Insurance

The landscape of health insurance in Tennessee is continually evolving, influenced by both state and federal policies. Here are some key trends and considerations for the future:

Affordability and Access

Ensuring affordable and accessible health insurance remains a priority for Tennessee. The state has taken steps to enhance access to coverage, particularly for those with low incomes. Efforts include expanding Medicaid eligibility and implementing programs to reduce the financial burden on individuals and families.

Focus on Preventive Care

Tennessee’s health insurance plans are increasingly emphasizing preventive care to promote overall wellness and reduce the need for costly treatments. This trend is expected to continue, with a greater focus on health education, disease prevention, and early intervention.

Telehealth and Digital Health Services

The COVID-19 pandemic accelerated the adoption of telehealth and digital health services, and this trend is likely to persist in Tennessee. Health insurance plans are expected to continue integrating these services, offering convenient and accessible care options for policyholders.

Pharmaceutical Innovations

The pharmaceutical industry is rapidly evolving, with new drugs and treatments becoming available. Tennessee health insurance plans will need to adapt to cover these advancements, ensuring access to essential medications while managing costs.

Population Health Management

Health insurance providers in Tennessee are increasingly adopting population health management strategies. This approach focuses on identifying and addressing the unique healthcare needs of specific communities or populations, with the goal of improving overall health outcomes and reducing costs.

Conclusion

Understanding the intricacies of health insurance in Tennessee is crucial for residents to make informed decisions about their coverage. With a range of plan options, comprehensive coverage, and evolving trends, individuals and families can navigate the healthcare system effectively and access the care they need. As the healthcare landscape continues to evolve, staying informed about the latest developments in TN health insurance is essential for maintaining optimal health and financial well-being.

What is the best health insurance plan in Tennessee for families?

+The “best” health insurance plan for families in Tennessee depends on various factors, including the family’s healthcare needs, budget, and preferred providers. It’s recommended to consider plans with comprehensive coverage, including pediatric care, maternity benefits, and access to a wide network of pediatricians and specialists. Additionally, plans with family-friendly features like flexible spending accounts or health savings accounts can be beneficial for managing out-of-pocket expenses.

Are there any low-cost health insurance options for individuals in Tennessee?

+Yes, Tennessee offers low-cost health insurance options for individuals, particularly through the Health Insurance Marketplace. These plans, known as “catastrophic plans,” provide basic coverage for unexpected medical emergencies and typically have lower premiums. However, it’s important to note that these plans often have higher deductibles and may not cover preventive care or certain services. Financial assistance in the form of premium tax credits may also be available for eligible individuals, making coverage more affordable.

How does TennCare (Medicaid) work in Tennessee?

+TennCare, Tennessee’s Medicaid program, provides comprehensive health coverage to eligible low-income individuals and families. Eligibility is determined based on income, household size, and other factors. TennCare covers a wide range of services, including doctor visits, hospital stays, prescriptions, and mental health services. Enrollment is typically done through the Health Insurance Marketplace, and beneficiaries receive a TennCare ID card for accessing services.