Top 10 Insurance Company Stocks

Navigating the Insurance Sector: A Comprehensive Guide to the Top 10 Insurance Company Stocks

In the dynamic world of finance, the insurance sector plays a pivotal role, offering stability and growth potential to investors. This comprehensive guide aims to shed light on the top 10 insurance company stocks, providing an in-depth analysis to assist investors in making informed decisions. By exploring key performance indicators, growth prospects, and industry trends, we aim to empower investors with the knowledge needed to navigate this sector effectively.

1. Berkshire Hathaway Inc. (BRK.A, BRK.B)

Berkshire Hathaway, the renowned conglomerate led by Warren Buffett, holds a significant presence in the insurance industry. With its diverse portfolio, including property and casualty insurance, Berkshire Hathaway offers investors a stable income stream and potential for long-term growth. The company’s strong financial position and disciplined investment approach have contributed to its success.

Key Metrics:

- Market Capitalization: $650.27 billion (as of January 2024)

- 5-Year Average Annual Return: 15.72%

- P/E Ratio: 25.95 (as of January 2024)

Unique Strategies:

Berkshire Hathaway’s success lies in its long-term investment philosophy and focus on value creation. The company often invests in other insurance businesses, allowing it to capitalize on industry trends and market opportunities.

2. Chubb Limited (CB)

Chubb Limited, a leading global provider of property and casualty insurance, has established itself as a prominent player in the industry. With a strong focus on underwriting excellence and risk management, Chubb offers a range of insurance products catering to individuals and businesses.

Performance Highlights:

- 5-Year Annual Return: 12.68%

- Gross Written Premiums: 42.3 billion (2023)</li> <li>Net Income: 5.2 billion (2023)

Risk Management Expertise:

Chubb’s expertise lies in its ability to identify and mitigate risks effectively. This has enabled the company to maintain a stable growth trajectory, even in challenging market conditions.

3. Progressive Corporation (PGR)

Progressive Corporation is a prominent player in the insurance industry, specializing in auto insurance. With a focus on innovation and customer-centric approach, Progressive has gained a strong market position. The company’s use of technology and data analytics sets it apart, offering efficient and personalized insurance solutions.

Key Financials:

- Market Cap: 58.36 billion (as of January 2024)</li> <li>5-Year Average Annual Return: 14.17%</li> <li>Net Premiums Written: 40.8 billion (2023)

Innovation in Insurance:

Progressive’s innovative use of technology, such as its Snapshot program, allows customers to customize their insurance plans based on their driving habits. This approach has driven customer loyalty and contributed to the company’s success.

4. Prudential Financial, Inc. (PRU)

Prudential Financial is a leading provider of life insurance and financial services. With a strong focus on retirement solutions and wealth management, Prudential caters to a diverse range of clients. The company’s expertise lies in helping individuals and businesses plan for the future, offering a comprehensive suite of insurance products.

Industry Leadership:

- Assets Under Management: 1.6 trillion (as of Q3 2023)</li> <li>Total Revenue: 49.5 billion (2023)

- Net Income: $4.7 billion (2023)

Retirement Solutions:

Prudential’s retirement solutions are tailored to meet the evolving needs of individuals, providing a secure financial future. The company’s expertise in this domain has contributed to its industry leadership.

5. Aon plc (AON)

Aon plc is a global professional services firm with a strong presence in the insurance industry. Offering a wide range of risk management and insurance brokerage services, Aon provides tailored solutions to businesses and individuals. The company’s expertise lies in helping clients navigate complex risk landscapes.

Market Position:

- Market Cap: 65.83 billion (as of January 2024)</li> <li>Revenue: 13.9 billion (2023)

- Operating Income: $2.9 billion (2023)

Risk Advisory Services:

Aon’s risk advisory services are highly regarded, providing clients with insights and strategies to mitigate potential risks effectively. This expertise has contributed to the company’s strong market position.

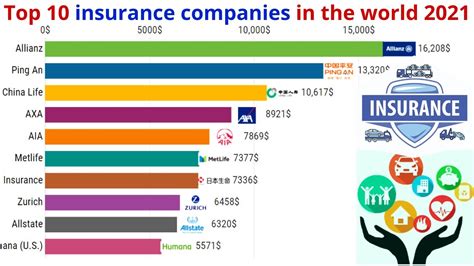

6. Allianz SE (ALIZY)

Allianz SE, a global leader in the insurance industry, offers a comprehensive range of insurance and financial services. With a presence in over 70 countries, Allianz provides a diverse portfolio of products, catering to individuals and businesses worldwide. The company’s focus on digital innovation and customer-centric approach has driven its success.

Global Reach:

- Total Assets: €979 billion (as of Q3 2023)

- Revenue: €139.3 billion (2023)

- Operating Profit: €11.8 billion (2023)

Digital Transformation:

Allianz’s commitment to digital transformation has enhanced its operational efficiency and customer experience. The company’s digital initiatives have contributed to its global success and market leadership.

7. AXA (AXAHY)

AXA, a French multinational insurance firm, is known for its comprehensive range of insurance products and services. With a focus on innovation and sustainability, AXA offers a diverse portfolio, catering to individuals and businesses. The company’s expertise lies in providing tailored solutions to meet the evolving needs of its clients.

Sustainable Leadership:

- Market Cap: €68.1 billion (as of January 2024)

- Revenue: €90.7 billion (2023)

- Net Income: €5.6 billion (2023)

Sustainable Investing:

AXA’s commitment to sustainable investing and environmental initiatives has positioned it as a leader in the field. The company’s focus on responsible investing has attracted investors seeking socially responsible investment opportunities.

8. MetLife, Inc. (MET)

MetLife, Inc. is a leading provider of life insurance and employee benefits. With a strong focus on retirement planning and financial wellness, MetLife offers a comprehensive suite of insurance products. The company’s expertise lies in helping individuals and businesses navigate complex financial landscapes.

Financial Wellness Expertise:

- Market Cap: 43.57 billion (as of January 2024)</li> <li>Total Assets: 728.4 billion (as of Q3 2023)

- Net Income: $4.8 billion (2023)

Employee Benefits Solutions:

MetLife’s employee benefits solutions are tailored to meet the unique needs of businesses, offering comprehensive coverage and support to employees.

9. Aflac Incorporated (AFL)

Aflac Incorporated is a leading provider of supplemental insurance, specializing in cancer and critical illness coverage. With a focus on providing financial protection and peace of mind, Aflac offers a range of products tailored to meet the specific needs of its clients.

Specialized Insurance Solutions:

- Market Cap: 31.48 billion (as of January 2024)</li> <li>Total Premiums: 20.4 billion (2023)

- Net Income: $2.3 billion (2023)

Cancer and Critical Illness Coverage:

Aflac’s specialized insurance solutions have gained recognition for their ability to provide financial support during critical illnesses. This focus on specialized coverage has contributed to the company’s success.

10. Travelers Companies, Inc. (TRV)

Travelers Companies, Inc. is a prominent provider of property and casualty insurance. With a focus on risk management and customer satisfaction, Travelers offers a range of insurance products tailored to meet the diverse needs of its clients. The company’s expertise lies in providing comprehensive coverage and exceptional service.

Risk Management Leadership:

- Market Cap: 40.9 billion (as of January 2024)</li> <li>Gross Written Premiums: 32.5 billion (2023)

- Net Income: $3.3 billion (2023)

Customer-Centric Approach:

Travelers’ commitment to customer satisfaction and tailored risk management solutions has driven its success. The company’s focus on understanding individual needs has contributed to its strong market position.

FAQs

How do insurance stocks perform during economic downturns?

+

Insurance stocks are often considered defensive investments, meaning they tend to perform relatively well during economic downturns. This is because insurance companies provide essential services, and people still need insurance coverage regardless of economic conditions. However, it’s important to note that performance can vary among different insurance companies and sectors.

What factors should investors consider when evaluating insurance stocks?

+

When evaluating insurance stocks, investors should consider factors such as the company’s financial strength, underwriting discipline, investment portfolio performance, and risk management capabilities. Additionally, understanding the company’s business model, growth prospects, and market position is crucial. It’s also beneficial to assess the regulatory environment and industry trends that may impact the insurance sector.

Are there any risks associated with investing in insurance stocks?

+

Like any investment, there are risks associated with investing in insurance stocks. These risks include market volatility, changes in interest rates, regulatory changes, and the potential for increased competition. Additionally, insurance companies are exposed to various risks, such as natural disasters, litigation, and changes in consumer behavior. It’s important for investors to conduct thorough research and assess these risks before making investment decisions.

How do insurance stocks fit into a diversified investment portfolio?

+

Insurance stocks can be a valuable addition to a diversified investment portfolio. They often exhibit lower volatility compared to other sectors, providing stability and risk mitigation. Including insurance stocks in a portfolio can help balance risk and return, especially during periods of market uncertainty. However, it’s essential to maintain a well-diversified portfolio across different sectors and asset classes to manage risk effectively.

What are some potential growth opportunities for insurance companies in the future?

+

The insurance industry is constantly evolving, and there are several growth opportunities for insurance companies in the future. These include expanding into new markets, developing innovative products to meet changing consumer needs, leveraging technology for improved efficiency and customer experience, and exploring partnerships or acquisitions to enhance market presence. Additionally, the growing demand for insurance coverage in emerging economies presents significant growth potential.