Top Auto Insurance Companies California

When it comes to auto insurance, having the right coverage is essential to protect yourself and your vehicle. California, being one of the most populous states in the United States, offers a wide range of insurance providers. Choosing the top auto insurance company can be a daunting task, but with the right information and insights, you can make an informed decision. In this comprehensive guide, we will delve into the world of auto insurance in California, exploring the leading companies, their offerings, and the factors that make them stand out.

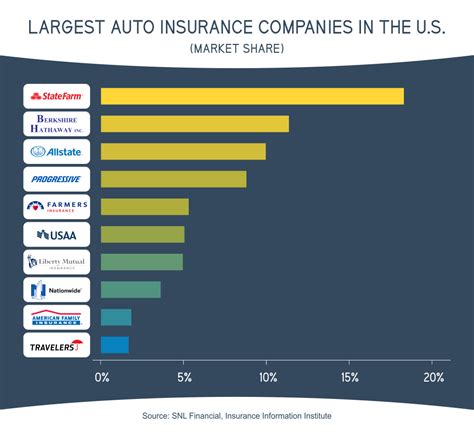

The Top Auto Insurance Companies in California

California’s insurance market is highly competitive, with numerous providers vying for customers. To help you navigate this landscape, we have compiled a list of the top auto insurance companies in the state, based on their overall performance, customer satisfaction, and financial stability.

1. State Farm

State Farm is a prominent player in the California auto insurance market, offering a comprehensive range of insurance products and services. With a strong focus on customer satisfaction, they provide personalized policies tailored to individual needs. State Farm’s extensive network of local agents ensures a high level of personalized service, making them a popular choice among Californians.

Key Features:

- Customizable coverage options.

- Discounts for safe driving, multiple vehicles, and good students.

- 24⁄7 customer support.

- Financial strength and stability.

2. Geico

Geico, known for its catchy slogans and innovative marketing campaigns, has a strong presence in California. They offer competitive rates and a user-friendly online platform, making it convenient for customers to manage their policies.

Key Features:

- Online and mobile app accessibility.

- Discounts for federal employees, military personnel, and good drivers.

- Flexible payment options.

- Excellent customer service ratings.

3. Progressive

Progressive is a well-established insurance provider, offering a wide array of coverage options. They are known for their innovative products, such as usage-based insurance and snapshot programs, which reward safe driving.

Key Features:

- Usage-based insurance for personalized rates.

- Snapshot program to track driving habits.

- Discounts for multiple policies and safe driving.

- Excellent customer support.

4. Allstate

Allstate is a trusted name in the insurance industry, providing a comprehensive range of auto insurance policies. They offer customizable coverage and a variety of discounts to suit different customer needs.

Key Features:

- Customizable coverage plans.

- Discounts for safe driving, loyalty, and multiple policies.

- 24⁄7 claims support.

- Financial stability and reliability.

5. Farmers Insurance

Farmers Insurance is a leading provider in California, known for its personalized approach to insurance. They offer a wide range of coverage options and provide excellent customer service through their network of local agents.

Key Features:

- Customizable coverage plans.

- Discounts for safe driving, multiple vehicles, and homeowners.

- 24-hour claims service.

- Strong financial standing.

Factors to Consider When Choosing an Auto Insurance Company

When selecting an auto insurance company, it’s essential to evaluate several key factors to ensure you choose the best provider for your needs. Here are some crucial aspects to consider:

Coverage Options

Evaluate the range of coverage options offered by the insurance company. Look for providers that offer comprehensive, collision, liability, and additional coverages like rental car reimbursement or roadside assistance.

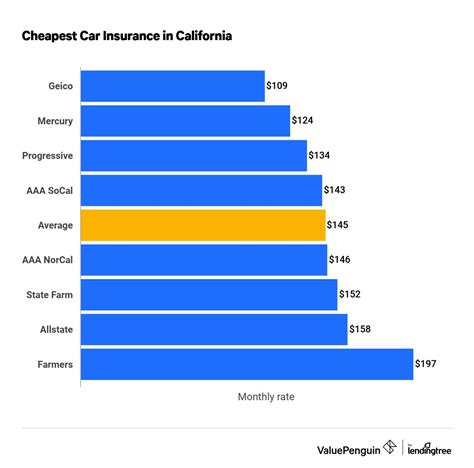

Pricing and Discounts

Compare the pricing structures and discounts available. Consider factors such as your driving history, vehicle type, and any applicable discounts (safe driver, multiple policies, etc.). Request quotes from multiple companies to find the most competitive rates.

Customer Service and Claims Process

Research the company’s reputation for customer service and claims handling. Look for providers with a track record of prompt and efficient claims processing. Check online reviews and ratings to get an idea of their customer satisfaction levels.

Financial Stability

Ensure the insurance company is financially stable and reliable. Check their financial ratings from reputable agencies like A.M. Best or Standard & Poor’s to assess their financial strength and ability to pay claims.

Additional Benefits and Perks

Explore any additional benefits or perks offered by the insurance company. This could include accident forgiveness, rental car discounts, or rewards programs. These added benefits can enhance your overall insurance experience.

Comparative Analysis: California’s Top Auto Insurance Companies

To provide a more in-depth comparison, let’s take a closer look at how the top auto insurance companies in California stack up against each other in various categories:

Coverage Options

| Company | Comprehensive Coverage | Collision Coverage | Liability Coverage | Additional Coverages |

|---|---|---|---|---|

| State Farm | ✓ | ✓ | ✓ | Rental Car, Roadside Assistance |

| Geico | ✓ | ✓ | ✓ | Rental Car, Mechanical Breakdown |

| Progressive | ✓ | ✓ | ✓ | Roadside Assistance, Usage-based Insurance |

| Allstate | ✓ | ✓ | ✓ | Rental Car, Accident Forgiveness |

| Farmers Insurance | ✓ | ✓ | ✓ | Roadside Assistance, Pet Injury Coverage |

Pricing and Discounts

Pricing structures and discount offerings can vary significantly between insurance companies. It’s recommended to obtain quotes from multiple providers to find the best rates for your specific circumstances.

Customer Service and Claims Process

All the top auto insurance companies in California have a strong focus on customer service and efficient claims processing. Online reviews and ratings generally reflect high levels of customer satisfaction.

Financial Stability

Each of the top auto insurance companies in California has a solid financial foundation, with high ratings from reputable agencies. This ensures their ability to pay claims and provides peace of mind to policyholders.

The Future of Auto Insurance in California

The auto insurance landscape in California is constantly evolving, driven by technological advancements and changing consumer needs. Here are some key trends and predictions for the future:

Telematics and Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive or telematics insurance, is gaining popularity. This technology uses data from your vehicle’s onboard diagnostics to assess driving habits and offer personalized rates. Companies like Progressive and Metromile are leading the way in this space.

Digitalization and Online Platforms

The insurance industry is increasingly embracing digital transformation. Online platforms and mobile apps are becoming the primary channels for customers to manage their policies, file claims, and communicate with insurance providers. Companies like Geico and Esurance are at the forefront of this digital revolution.

Enhanced Customer Experience

Insurance companies are investing in customer experience, aiming to provide seamless and personalized services. This includes streamlined claim processes, 24⁄7 customer support, and innovative tools to educate and assist policyholders.

Data Analytics and Risk Assessment

Advanced data analytics and risk assessment models are being utilized to better understand customer needs and offer more accurate pricing. This allows insurance companies to provide customized coverage and premiums based on individual driving behaviors and risk profiles.

Conclusion: Making an Informed Choice

Choosing the right auto insurance company in California is a decision that requires careful consideration. By evaluating the top providers based on coverage options, pricing, customer service, and financial stability, you can narrow down your choices. Remember to assess your specific needs and preferences, and don’t hesitate to seek advice from insurance professionals or utilize online resources to make an informed decision.

What is the average cost of auto insurance in California?

+The average cost of auto insurance in California can vary based on factors such as your age, driving record, and the type of vehicle you own. As of our latest data, the average annual premium for a minimum liability policy in California is around 600, while a full coverage policy averages around 1,500. However, these figures can fluctuate, so it’s best to obtain quotes specific to your circumstances.

Do I need to purchase additional coverages like rental car reimbursement or roadside assistance?

+Whether or not you need additional coverages depends on your personal circumstances and preferences. Rental car reimbursement and roadside assistance can provide peace of mind in certain situations, but they may also increase your premium. It’s recommended to assess your needs and evaluate the cost versus the potential benefits.

How can I save money on my auto insurance policy in California?

+There are several ways to save on your auto insurance policy. First, shop around and compare quotes from multiple providers. Additionally, take advantage of any applicable discounts, such as safe driver, multiple policy, or good student discounts. You can also consider increasing your deductible or adjusting your coverage limits to lower your premium.