Top Best Health Insurance

In the realm of healthcare, securing the right health insurance plan is akin to finding a reliable shield, protecting you from the unexpected twists and turns of life. With the myriad of options available, choosing the top health insurance that aligns perfectly with your needs and circumstances can be a daunting task. This article aims to provide an in-depth analysis, guiding you through the intricate world of health insurance, and helping you make an informed decision that best suits your health and financial well-being.

Understanding Health Insurance: The Basics

Health insurance is a vital financial tool that offers coverage for medical and surgical expenses. It serves as a safeguard, ensuring that you receive the necessary healthcare services without incurring a significant financial burden. This protection is especially crucial in countries like the United States, where medical costs can be astronomical.

Health insurance plans come in various forms, each with its unique set of benefits and coverage options. Some common types include:

- HMO (Health Maintenance Organization): This plan typically requires you to select a primary care physician (PCP) who coordinates your care. You must choose your healthcare providers from the plan's network, and referrals are often needed for specialist care.

- PPO (Preferred Provider Organization): With a PPO, you have more flexibility in choosing your healthcare providers, both within and outside the network. However, you'll generally pay less if you use in-network providers.

- EPO (Exclusive Provider Organization): Similar to a PPO, an EPO plan limits you to a specific network of healthcare providers. The key difference is that EPOs typically don't cover out-of-network care, except in emergencies.

- POS (Point of Service): A POS plan combines elements of both HMO and PPO plans. You choose a primary care physician who coordinates your care, but you have the option to see out-of-network providers for an additional cost.

- Indemnity Plans: Also known as fee-for-service plans, these traditional plans allow you to choose any healthcare provider without a network restriction. However, you typically pay more out-of-pocket.

The Top Health Insurance Plans: A Comprehensive Review

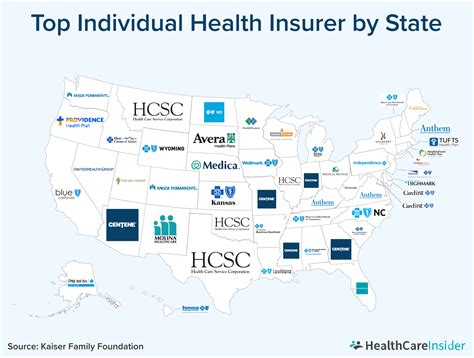

When evaluating the top health insurance options, several key factors come into play. These include the breadth of coverage, the network of healthcare providers, the plan’s reputation and financial stability, customer service and reviews, and of course, the cost.

1. Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a household name in the health insurance industry. With a vast network of over 90 million members and a presence in all 50 states, BCBS offers a wide range of plan options, from HMO to PPO, catering to diverse healthcare needs. Their plans are known for their comprehensive coverage, including preventive care, prescription drugs, and specialty services.

BCBS plans often provide access to a broad network of healthcare providers, ensuring you can find the right specialist or facility for your needs. They also offer innovative wellness programs and tools to help members manage their health effectively. With a strong reputation for financial stability and customer service, BCBS consistently ranks among the top health insurance providers.

2. UnitedHealthcare

UnitedHealthcare is another industry leader, serving millions of individuals and families across the United States. Their portfolio includes a variety of health insurance plans, including HMO, PPO, and EPO options. UnitedHealthcare is particularly renowned for its emphasis on preventive care and wellness, with many plans covering annual check-ups, screenings, and vaccinations at no additional cost.

One of the standout features of UnitedHealthcare plans is their user-friendly online tools and mobile apps, which provide members with easy access to their health records, claim status, and other important information. UnitedHealthcare's extensive network of healthcare providers ensures that members have a wide range of choices when seeking medical care.

3. Aetna

Aetna, now part of the CVS Health family, offers a comprehensive suite of health insurance plans. Their offerings include a range of HMO, PPO, and EPO plans, ensuring that individuals and families can find a plan that fits their unique healthcare needs. Aetna is particularly well-known for its focus on innovation and technology, with digital tools that simplify the healthcare experience.

Aetna's plans often include access to their nationwide network of healthcare providers, ensuring members have convenient access to high-quality care. Additionally, Aetna's commitment to preventive care and wellness is evident in many of their plans, which cover various preventive services at no additional cost.

4. Cigna

Cigna is a global health service company, offering a wide range of health insurance plans to individuals and families. Their plans include HMO, PPO, and POS options, ensuring a diverse selection to cater to various healthcare needs. Cigna is particularly known for its emphasis on personalized care and its commitment to helping members navigate the complex healthcare system.

Cigna's plans often include access to their extensive network of healthcare providers, ensuring members can find the right care, when and where they need it. Many Cigna plans also cover a range of wellness and preventive services, encouraging members to take a proactive approach to their health.

5. Humana

Humana is a leading health and wellness company, offering a comprehensive range of health insurance plans. Their portfolio includes HMO, PPO, and Medicare Advantage plans, ensuring a wide variety of options to suit different healthcare needs. Humana is particularly renowned for its focus on seniors and Medicare beneficiaries, offering specialized plans and services tailored to their unique requirements.

Humana's plans often include access to their network of healthcare providers, ensuring members have a range of choices when seeking medical care. Many of their plans also include wellness programs and tools to help members manage their health effectively.

| Health Insurance Provider | Plan Types | Key Features |

|---|---|---|

| Blue Cross Blue Shield | HMO, PPO | Comprehensive coverage, broad network, wellness programs |

| UnitedHealthcare | HMO, PPO, EPO | Emphasis on preventive care, user-friendly digital tools |

| Aetna | HMO, PPO, EPO | Innovation and technology focus, nationwide provider network |

| Cigna | HMO, PPO, POS | Personalized care, extensive provider network, wellness programs |

| Humana | HMO, PPO, Medicare Advantage | Specialized plans for seniors, wellness programs |

Factors to Consider When Choosing a Health Insurance Plan

When evaluating health insurance plans, several critical factors should be taken into consideration:

- Coverage and Benefits: Assess the plan's coverage for various healthcare services, including preventive care, prescription drugs, mental health services, and specialty treatments. Ensure the plan covers your specific healthcare needs.

- Network of Providers: Evaluate the plan's network of healthcare providers, including hospitals, clinics, and specialists. Ensure that your preferred doctors and facilities are included in the network.

- Cost and Out-of-Pocket Expenses: Consider the plan's premium, deductibles, copayments, and coinsurance. Weigh these against your budget and expected healthcare needs.

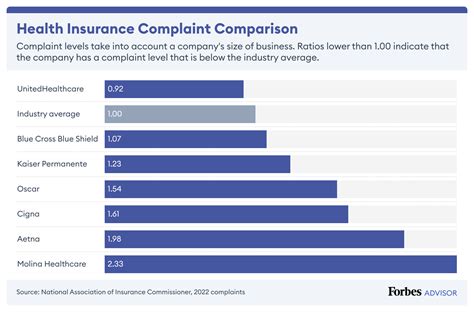

- Reputation and Financial Stability: Research the insurer's reputation and financial stability. A strong, financially stable insurer can ensure the longevity of your coverage and the timely payment of claims.

- Customer Service and Reviews: Read customer reviews and assess the insurer's customer service. Responsive and helpful customer service can make a significant difference in your overall experience.

Making an Informed Decision

Choosing the right health insurance plan is a crucial decision that can significantly impact your health and financial well-being. By thoroughly researching and comparing different plans, considering your specific healthcare needs and circumstances, and evaluating the factors outlined above, you can make an informed decision that best suits your needs.

Remember, health insurance is a vital tool to protect yourself and your loved ones from unexpected medical costs. With the right plan, you can access the care you need without breaking the bank. Take the time to understand your options, and don't hesitate to seek guidance from insurance professionals or financial advisors if needed.

How do I choose the right health insurance plan for my family?

+When selecting a health insurance plan for your family, consider your family’s unique healthcare needs, including any ongoing medical conditions or prescription medications. Evaluate the plan’s coverage for these specific needs, as well as for preventive care and specialty services. Also, consider the plan’s network of providers to ensure that your preferred doctors and facilities are included.

What are some common exclusions in health insurance plans?

+Common exclusions in health insurance plans may include cosmetic procedures, certain elective surgeries, pre-existing conditions (depending on the plan and waiting periods), and services deemed “experimental” or “investigational” by the insurer. It’s crucial to carefully review the plan’s benefits and exclusions to understand what is and isn’t covered.

How can I save money on health insurance premiums?

+To save money on health insurance premiums, consider opting for a higher deductible or a plan with a lower premium. You can also explore health savings accounts (HSAs) or flexible spending accounts (FSAs), which allow you to set aside pre-tax dollars for qualified medical expenses. Additionally, some insurers offer discounts or incentives for healthy behaviors or participation in wellness programs.

What should I do if I have a complaint about my health insurance plan?

+If you have a complaint or issue with your health insurance plan, the first step is to contact your insurer’s customer service department. They can help address your concern or direct you to the appropriate department. If your issue is not resolved, you can file a formal complaint with your state’s insurance department or consumer protection agency. It’s also advisable to keep detailed records of your interactions with the insurer.