Top Health Insurance Providers In Usa

The United States health insurance market is diverse and highly regulated, offering a range of coverage options to meet the varying needs of individuals and families across the nation. With a focus on comprehensive coverage, affordability, and accessibility, several leading health insurance providers have emerged as key players in the industry. This article aims to explore the top health insurance providers in the USA, highlighting their unique features, coverage offerings, and the impact they have on the healthcare landscape.

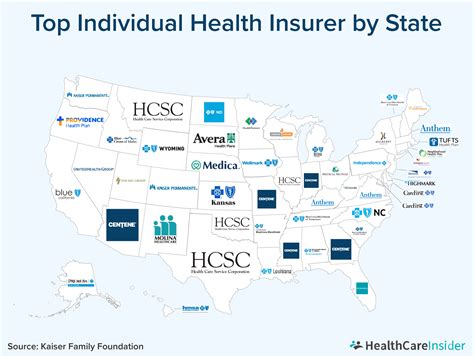

Leading the Way: Top Health Insurance Providers in the USA

In the vast and competitive landscape of the American health insurance industry, several providers have distinguished themselves through their comprehensive plans, innovative approaches, and commitment to ensuring access to quality healthcare. Here, we delve into the characteristics and contributions of some of the leading health insurance providers in the USA.

UnitedHealthcare: A Comprehensive Approach to Healthcare

UnitedHealthcare stands out as one of the most prominent players in the US health insurance market. With a comprehensive suite of insurance plans, UnitedHealthcare caters to a diverse range of individuals and businesses. Their plans encompass a wide variety of coverage options, including individual and family plans, employer-sponsored plans, and Medicare and Medicaid programs. One of the key strengths of UnitedHealthcare is its nationwide network, ensuring that policyholders have access to a vast array of healthcare providers and facilities across the country.

UnitedHealthcare's commitment to innovation is evident in its digital health initiatives. The company has invested significantly in developing digital tools and resources that enhance the healthcare experience. Their mobile apps and online portals provide policyholders with convenient access to their health records, claims information, and other valuable resources. Additionally, UnitedHealthcare's telehealth services have played a crucial role in expanding access to healthcare, particularly in remote or underserved areas.

In terms of coverage, UnitedHealthcare offers a broad range of plan options to meet the diverse needs of its policyholders. These include HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization) plans, as well as POS (Point of Service) plans. The company's Medicare Advantage plans provide comprehensive coverage for seniors, while its Medicaid plans ensure access to essential healthcare services for low-income individuals and families. UnitedHealthcare's dental and vision plans further enhance its comprehensive approach to healthcare.

| Category | UnitedHealthcare |

|---|---|

| Plan Types | HMO, PPO, POS, Medicare Advantage, Medicaid, Dental, Vision |

| Network Size | Over 1.3 million healthcare professionals and 6,500 hospitals nationwide |

| Digital Health Initiatives | Mobile apps, online portals, telehealth services |

Blue Cross Blue Shield: A Trusted Name in Healthcare Coverage

Blue Cross Blue Shield (BCBS) is a renowned name in the US health insurance industry, known for its wide network and comprehensive coverage options. With a history spanning over eight decades, BCBS has established itself as a trusted provider, offering a diverse range of insurance plans to meet the unique needs of individuals, families, and businesses.

One of the key strengths of BCBS is its extensive network of healthcare providers. With a nationwide footprint, BCBS ensures that policyholders have access to a vast array of medical professionals and facilities, promoting convenience and choice. This extensive network is particularly beneficial for individuals who require specialized care or those who frequently travel.

BCBS's portfolio of insurance plans is comprehensive, covering a wide spectrum of healthcare needs. Their plans include individual and family coverage, employer-sponsored group plans, and Medicare and Medicaid programs. BCBS's Medicare Advantage plans offer additional benefits and cost-saving opportunities for seniors, while their Medicaid plans ensure essential healthcare services for low-income individuals and families.

In addition to its core insurance offerings, BCBS has made significant investments in digital health solutions. Their mobile apps and online portals provide policyholders with convenient access to their health information, claims status, and other valuable resources. BCBS's telehealth services have also played a crucial role in expanding access to healthcare, particularly in rural or underserved areas.

| Category | Blue Cross Blue Shield |

|---|---|

| Plan Types | Individual, Family, Group, Medicare Advantage, Medicaid |

| Network Size | Over 1.2 million healthcare professionals and 5,500 hospitals nationwide |

| Digital Health Initiatives | Mobile apps, online portals, telehealth services |

Aetna: A Legacy of Innovation in Health Insurance

Aetna, a well-established name in the US health insurance industry, has a rich history spanning over 160 years. Known for its commitment to innovation and customer-centric approach, Aetna has consistently delivered comprehensive coverage and excellent service to its policyholders. With a diverse portfolio of insurance plans, Aetna caters to the unique needs of individuals, families, and businesses across the nation.

Aetna's innovative spirit is evident in its digital health initiatives. The company has made significant investments in mobile technology and online platforms, offering policyholders convenient access to their health records, claims information, and other valuable resources. Aetna's mobile app, for instance, provides a user-friendly interface that allows policyholders to manage their health plans, view their coverage details, and access helpful health tools and resources.

In terms of coverage, Aetna offers a wide range of plan options to meet the diverse needs of its policyholders. These include HMO, PPO, and EPO (Exclusive Provider Organization) plans, as well as Medicare Advantage and Medicaid programs. Aetna's Medicare Advantage plans provide comprehensive coverage for seniors, while its Medicaid plans ensure access to essential healthcare services for low-income individuals and families.

Aetna's dental and vision plans further enhance its comprehensive approach to healthcare. These plans offer additional coverage and cost-saving opportunities for policyholders, ensuring that they can maintain their oral and vision health alongside their medical coverage.

| Category | Aetna |

|---|---|

| Plan Types | HMO, PPO, EPO, Medicare Advantage, Medicaid, Dental, Vision |

| Network Size | Over 1.1 million healthcare professionals and 5,000 hospitals nationwide |

| Digital Health Initiatives | Mobile app, online portals, telehealth services |

Cigna: A Focus on Whole-Person Health

Cigna, a leading global health service company, has made a significant impact on the US health insurance landscape with its unique approach to healthcare. At the core of Cigna’s philosophy is the belief in whole-person health, which recognizes the interconnectedness of physical, mental, and emotional well-being. This holistic perspective sets Cigna apart and has earned it a reputation for comprehensive coverage and innovative health solutions.

Cigna's whole-person health approach is evident in its comprehensive suite of insurance plans. The company offers a wide range of coverage options, including individual and family plans, employer-sponsored group plans, and Medicare and Medicaid programs. Cigna's Medicare Advantage plans provide enhanced benefits and cost-saving opportunities for seniors, while its Medicaid plans ensure access to essential healthcare services for low-income individuals and families.

One of Cigna's key strengths is its focus on mental health. The company has invested significantly in mental health resources and support programs, recognizing the importance of emotional well-being in overall health. Cigna's mental health initiatives include access to licensed therapists, online resources, and support groups, ensuring that policyholders can address their mental health needs alongside their physical health concerns.

In addition to its comprehensive insurance plans, Cigna has made significant strides in digital health. The company's mobile app and online portals provide policyholders with convenient access to their health information, claims status, and other valuable resources. Cigna's telehealth services have also played a crucial role in expanding access to healthcare, particularly for individuals who may face barriers in accessing traditional healthcare settings.

| Category | Cigna |

|---|---|

| Plan Types | Individual, Family, Group, Medicare Advantage, Medicaid |

| Network Size | Over 1 million healthcare professionals and 4,500 hospitals nationwide |

| Digital Health Initiatives | Mobile app, online portals, telehealth services |

Humana: Empowering Healthy Living

Humana, a leading health and well-being company, has made a significant impact on the US health insurance landscape with its commitment to empowering individuals to lead healthier lives. At the heart of Humana’s philosophy is the belief that health is a journey, and the company strives to provide comprehensive support and resources to help policyholders navigate this journey successfully.

Humana's insurance plans are designed with a holistic approach in mind. The company offers a diverse range of coverage options, including individual and family plans, employer-sponsored group plans, and Medicare and Medicaid programs. Humana's Medicare Advantage plans provide enhanced benefits and cost-saving opportunities for seniors, while its Medicaid plans ensure access to essential healthcare services for low-income individuals and families.

One of Humana's key strengths is its focus on wellness and prevention. The company has developed a wide range of wellness programs and resources to help policyholders take control of their health. These programs include health coaching, fitness and nutrition support, and disease management tools, empowering individuals to make informed decisions about their health and well-being.

In addition to its comprehensive insurance offerings, Humana has made significant investments in digital health solutions. The company's mobile app and online portals provide policyholders with convenient access to their health records, claims information, and other valuable resources. Humana's telehealth services have also played a crucial role in expanding access to healthcare, particularly for individuals who may face barriers in accessing traditional healthcare settings.

| Category | Humana |

|---|---|

| Plan Types | Individual, Family, Group, Medicare Advantage, Medicaid |

| Network Size | Over 800,000 healthcare professionals and 3,500 hospitals nationwide |

| Digital Health Initiatives | Mobile app, online portals, telehealth services |

Conclusion: Navigating the Complex World of Health Insurance

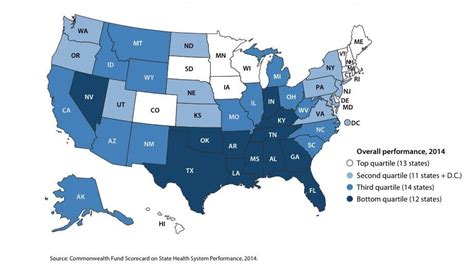

The US health insurance landscape is a complex and ever-evolving arena, with numerous providers offering a wide array of coverage options. This article has highlighted some of the leading health insurance providers in the USA, showcasing their unique strengths, comprehensive coverage, and innovative approaches to healthcare. From UnitedHealthcare’s extensive network and digital health initiatives to Blue Cross Blue Shield’s trusted legacy, and from Aetna’s commitment to innovation to Cigna’s focus on whole-person health and Humana’s emphasis on empowering healthy living, each provider brings a distinct value proposition to the market.

As individuals and businesses navigate the complexities of choosing the right health insurance provider, it is essential to consider factors such as coverage options, network size, digital health capabilities, and customer service. By understanding the unique offerings of these leading providers, consumers can make informed decisions to ensure they have the coverage they need to access quality healthcare and maintain their well-being.

In an industry as dynamic as health insurance, staying informed and educated is key to making the best choices for one's health and financial needs. By exploring the diverse range of options available, individuals can take control of their healthcare journey and make decisions that align with their unique circumstances and goals.

How do I choose the right health insurance provider for my needs?

+Choosing the right health insurance provider involves several key considerations. First, evaluate your specific healthcare needs and preferences. Consider factors such as the type of coverage you require (e.g., individual, family, or employer-sponsored), the network of healthcare providers you prefer, and any additional services or benefits that are important to you. Research and compare the plans offered by different providers, taking into account factors like premiums, deductibles, copays, and out-of-pocket maximums. Read reviews and seek recommendations from trusted sources to gauge customer satisfaction and the provider’s reputation. Additionally, assess the provider’s digital health capabilities and customer service to ensure a seamless and supportive experience.