Total Home Insurance

When it comes to safeguarding your home and its valuable contents, Total Home Insurance stands out as a comprehensive and reliable solution. With an increasing focus on protecting our personal assets, understanding the intricacies of home insurance is crucial. This in-depth article aims to explore the key aspects of Total Home Insurance, offering valuable insights and a comprehensive analysis to help you make informed decisions about your home's security.

The Importance of Total Home Insurance

In the face of unforeseen circumstances, from natural disasters to accidents, Total Home Insurance emerges as a vital shield, offering peace of mind and financial protection. It covers a wide range of risks, ensuring that your home and its contents are safeguarded against potential losses. Whether you’re dealing with a burst pipe, a fire incident, or severe weather damage, this insurance policy has got you covered.

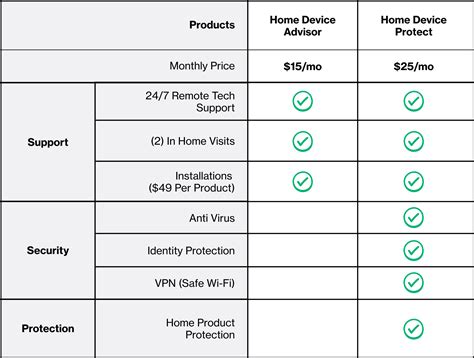

One of the standout features of Total Home Insurance is its customization. It allows policyholders to tailor their coverage to fit their specific needs. Whether you own a modest apartment or a luxurious estate, the insurance provider offers flexible plans to suit different lifestyles and property types. This level of personalization ensures that every policyholder receives adequate coverage without paying for unnecessary add-ons.

Understanding the Coverage

Total Home Insurance offers a comprehensive suite of coverage options, each designed to address specific risks and potential losses. Here’s a breakdown of the key components:

- Dwelling Coverage: This is the foundation of your policy, covering the physical structure of your home, including walls, roofs, and permanent fixtures. It ensures that if your home suffers damage due to a covered event, you'll have the financial means to repair or rebuild it.

- Personal Property Coverage: Your home is filled with valuable possessions, from furniture and electronics to clothing and jewelry. This coverage protects these items in case of theft, damage, or destruction. It provides reimbursement for the actual cash value or replacement cost of the lost items, ensuring you can restore your home to its pre-loss condition.

- Liability Coverage: Accidents can happen, and if someone gets injured on your property or you're found liable for causing property damage to others, this coverage steps in. It provides protection against lawsuits and covers medical expenses for injured parties, up to the limits specified in your policy.

- Additional Living Expenses: In the event that your home becomes uninhabitable due to a covered loss, this coverage steps in to reimburse you for the additional costs of temporary housing and living expenses until your home is repaired or rebuilt.

- Loss of Use Coverage: Similar to Additional Living Expenses, this coverage compensates for the loss of use of your home due to a covered event. It can include expenses for hotel stays, restaurant meals, and other necessary expenditures until you can return to your home.

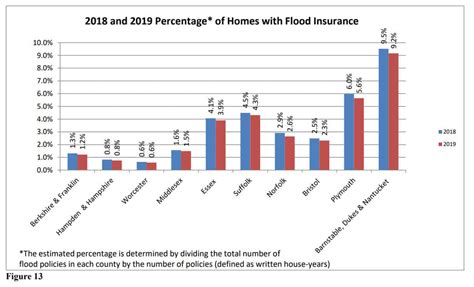

Additionally, Total Home Insurance often includes optional coverages to address specific needs. These can include coverage for high-value items like artwork or jewelry, flood insurance (which is typically not covered by standard home insurance policies), and identity theft protection. These optional add-ons allow policyholders to customize their coverage further, ensuring they have the protection they need for their unique circumstances.

Real-Life Benefits of Total Home Insurance

The value of Total Home Insurance becomes apparent when examining real-life scenarios. For instance, imagine a severe storm causes a tree to fall on your roof, resulting in significant damage. With Total Home Insurance, you can rest assured that the repairs will be covered, minimizing the financial burden. Or, consider a break-in where valuable electronics and jewelry are stolen. The Personal Property Coverage can provide compensation for these losses, helping you replace the stolen items.

Furthermore, Total Home Insurance offers invaluable support during the claims process. The insurance provider assigns dedicated claims adjusters who work closely with policyholders to assess the damage, estimate repair costs, and ensure a smooth and timely resolution. This personalized approach ensures that policyholders receive the necessary guidance and support throughout the claims process, reducing stress and uncertainty during challenging times.

| Coverage Type | Key Benefits |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home, ensuring financial support for repairs or rebuilding in case of damage. |

| Personal Property Coverage | Covers the cost of replacing or repairing valuable possessions lost due to theft, damage, or destruction. |

| Liability Coverage | Provides protection against lawsuits and covers medical expenses for injured parties on your property. |

| Additional Living Expenses | Reimburses temporary living expenses if your home becomes uninhabitable due to a covered loss. |

| Loss of Use Coverage | Compensates for the loss of use of your home, covering expenses like hotel stays and meals during the repair or rebuilding process. |

Comparative Analysis: Total Home Insurance vs. Other Providers

In a competitive market, Total Home Insurance stands out for its comprehensive coverage and personalized approach. Let’s compare it with other leading providers to understand its unique advantages.

Coverage and Customization

Total Home Insurance excels in offering a wide range of coverage options, ensuring policyholders can tailor their policies to fit their specific needs. Unlike some providers that offer standardized packages, Total Home Insurance understands that every home is unique, and its coverage reflects this diversity. From dwelling coverage to personal liability, the policy provides extensive protection against various risks.

Moreover, Total Home Insurance allows policyholders to enhance their coverage with optional add-ons. These additional coverages can include protection for high-value items, identity theft coverage, and specialized policies for unique circumstances, such as vacation homes or rental properties. This level of customization ensures that policyholders receive the precise coverage they require, without paying for unnecessary add-ons.

Claims Process and Customer Support

The claims process is a critical aspect of any insurance policy, and Total Home Insurance excels in this area. The provider assigns dedicated claims adjusters to each policyholder, ensuring a personalized and efficient claims process. These adjusters work closely with policyholders to assess damage, estimate repair costs, and guide them through the entire process, providing valuable support and peace of mind during challenging times.

Total Home Insurance also stands out for its customer-centric approach. The provider offers a 24/7 customer support hotline, ensuring policyholders can access assistance whenever needed. Whether it's a simple query or a complex claim, the support team is readily available to provide guidance and support. This level of accessibility and responsiveness sets Total Home Insurance apart from competitors, fostering a strong sense of trust and confidence among its policyholders.

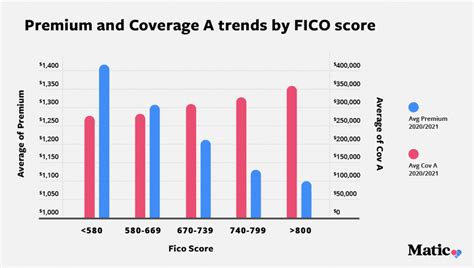

Pricing and Value for Money

When it comes to pricing, Total Home Insurance offers competitive rates without compromising on coverage. The provider understands that homeowners seek value for their money, and its policies are designed to provide extensive protection at affordable rates. By offering customizable coverage options, Total Home Insurance ensures that policyholders only pay for the coverage they need, avoiding unnecessary expenses.

Furthermore, Total Home Insurance's pricing structure is transparent and straightforward. Policyholders can easily understand the cost of their coverage and make informed decisions based on their specific needs and budget. The provider's commitment to transparency and value for money has earned it a reputation for being a reliable and trusted partner in the insurance industry.

Future Implications and Industry Insights

As the insurance industry continues to evolve, Total Home Insurance is well-positioned to adapt and meet the changing needs of its policyholders. With a focus on innovation and customer-centric approaches, the provider is investing in digital technologies to enhance the overall insurance experience.

One of the key future implications for Total Home Insurance is the integration of smart home technologies. By leveraging data analytics and Internet of Things (IoT) devices, the provider can offer more precise and personalized coverage. For instance, smart sensors can detect water leaks early on, preventing significant damage and reducing the financial burden on policyholders. This integration of technology into insurance policies is a significant step towards enhancing protection and peace of mind for homeowners.

Additionally, Total Home Insurance is exploring partnerships with property management companies and real estate developers to offer specialized coverage for rental properties and new construction. This strategic move allows the provider to tap into emerging markets and cater to the unique needs of these sectors. By offering tailored coverage and support, Total Home Insurance can further solidify its position as a trusted partner in the insurance industry.

In conclusion, Total Home Insurance stands as a reliable and comprehensive solution for safeguarding your home and its contents. With its customizable coverage options, dedicated claims support, and competitive pricing, it offers unparalleled value and peace of mind. As the insurance landscape continues to evolve, Total Home Insurance remains at the forefront, adapting to meet the changing needs of its policyholders and staying ahead of the competition.

What are the key benefits of Total Home Insurance over other providers?

+

Total Home Insurance offers a range of benefits, including customizable coverage options, a dedicated claims process with personal adjusters, and 24⁄7 customer support. These features provide policyholders with a tailored and supportive experience, ensuring peace of mind and efficient claims resolution.

How does Total Home Insurance determine the cost of my policy?

+

The cost of your policy is determined by several factors, including the location and value of your home, the level of coverage you choose, and any additional optional coverages you add. Total Home Insurance provides transparent pricing, ensuring you understand the cost of your coverage.

What should I do in case of a covered loss or emergency?

+

In the event of a covered loss or emergency, contact Total Home Insurance immediately. They will guide you through the claims process, assigning a dedicated adjuster to assess the damage and estimate repair costs. The provider offers 24⁄7 support, ensuring you receive timely assistance.

Can I customize my Total Home Insurance policy to fit my specific needs?

+

Absolutely! Total Home Insurance understands that every home is unique, and it offers customizable coverage options to fit your specific needs. You can choose the level of coverage you require and add optional coverages for high-value items or specialized circumstances.

How does Total Home Insurance handle customer complaints or disputes?

+

Total Home Insurance is committed to resolving customer complaints and disputes promptly and fairly. They have a dedicated customer support team that handles such matters, ensuring open communication and a fair resolution process. The provider aims to maintain a positive relationship with its policyholders.