Travel & Health Insurance

Embarking on international travel is an exciting prospect, but it comes with its fair share of complexities, especially when it comes to health and safety. Understanding the intricacies of travel and health insurance is crucial to ensure a seamless and worry-free journey. This comprehensive guide aims to delve into the world of travel insurance, shedding light on its importance, types, and best practices to help travelers make informed decisions.

In today's globalized world, travel has become more accessible and frequent, leading to an increased demand for comprehensive insurance coverage. Whether you're a leisure traveler exploring new destinations or a business professional attending international conferences, having adequate travel insurance is essential. It provides a safety net against unexpected medical emergencies, trip cancellations, lost luggage, and other travel-related mishaps.

The Importance of Travel and Health Insurance

Travel and health insurance serve as a critical safeguard for travelers, offering peace of mind and financial protection during their journeys. Here's why it's an indispensable component of any international trip:

Medical Emergencies

One of the primary concerns while traveling is the possibility of unexpected medical issues. From minor injuries to severe illnesses, medical emergencies can occur anytime and anywhere. Travel insurance provides coverage for medical treatments, hospital stays, and even emergency evacuations, ensuring that travelers receive the necessary care without incurring significant out-of-pocket expenses.

Trip Cancellations and Interruptions

Travel plans are often subject to change due to unforeseen circumstances. Whether it’s a natural disaster, a family emergency, or a sudden illness, trip cancellations or interruptions can be financially devastating. Travel insurance policies typically cover such situations, reimbursing travelers for non-refundable expenses and providing support to reschedule or cancel trips without incurring hefty losses.

Lost or Delayed Luggage

Luggage issues are a common headache for travelers. Losing checked bags or having them delayed can disrupt travel plans and cause unnecessary stress. Travel insurance policies often include coverage for these situations, offering reimbursement for essential items purchased during the delay or assistance in tracking down lost luggage.

Travel Document Support

Travel insurance providers offer assistance with travel document-related issues. This includes support in obtaining new travel documents, such as passports or visas, in case of loss or theft. They may also provide guidance and resources to help travelers navigate complex immigration processes, ensuring a smoother journey.

Types of Travel Insurance Policies

Travel insurance policies come in various forms, catering to different traveler needs and preferences. Understanding the different types of coverage is essential to choose the right policy for your journey. Here's a breakdown of the primary types of travel insurance:

Single-Trip Insurance

As the name suggests, single-trip insurance covers a specific journey or trip. It is ideal for travelers who have a clear itinerary and know the duration of their trip. This type of insurance provides comprehensive coverage for the entire trip, including medical emergencies, trip cancellations, and luggage issues.

Multi-Trip Insurance

Multi-trip insurance, also known as annual travel insurance, is designed for frequent travelers or those with flexible travel plans. It offers coverage for multiple trips within a year, typically with a maximum duration per trip. This policy is cost-effective for travelers who anticipate taking several trips, as it eliminates the need to purchase separate policies for each journey.

Business Travel Insurance

Business travel insurance is tailored to meet the unique needs of business travelers. It provides coverage for work-related trips, including medical emergencies, trip cancellations due to business reasons, and even coverage for business equipment or devices. This type of insurance ensures that business travelers can focus on their work without worrying about unexpected travel-related issues.

Student Travel Insurance

Student travel insurance is specifically designed for students studying abroad or traveling for educational purposes. It offers comprehensive coverage, including medical emergencies, trip cancellations, and even coverage for study-related expenses. This policy ensures that students can pursue their educational goals without worrying about financial burdens due to unexpected travel-related incidents.

Specialized Travel Insurance

In addition to the above, there are specialized travel insurance policies available for unique travel scenarios. For instance, adventure travel insurance covers high-risk activities like skiing, hiking, or extreme sports. Cruise travel insurance provides specific coverage for cruise vacations, including medical emergencies and trip interruptions. These specialized policies ensure that travelers can engage in their preferred activities with added peace of mind.

Key Considerations When Choosing Travel Insurance

When selecting a travel insurance policy, it's crucial to consider various factors to ensure you get the best coverage for your needs. Here are some key considerations:

Coverage Limits and Deductibles

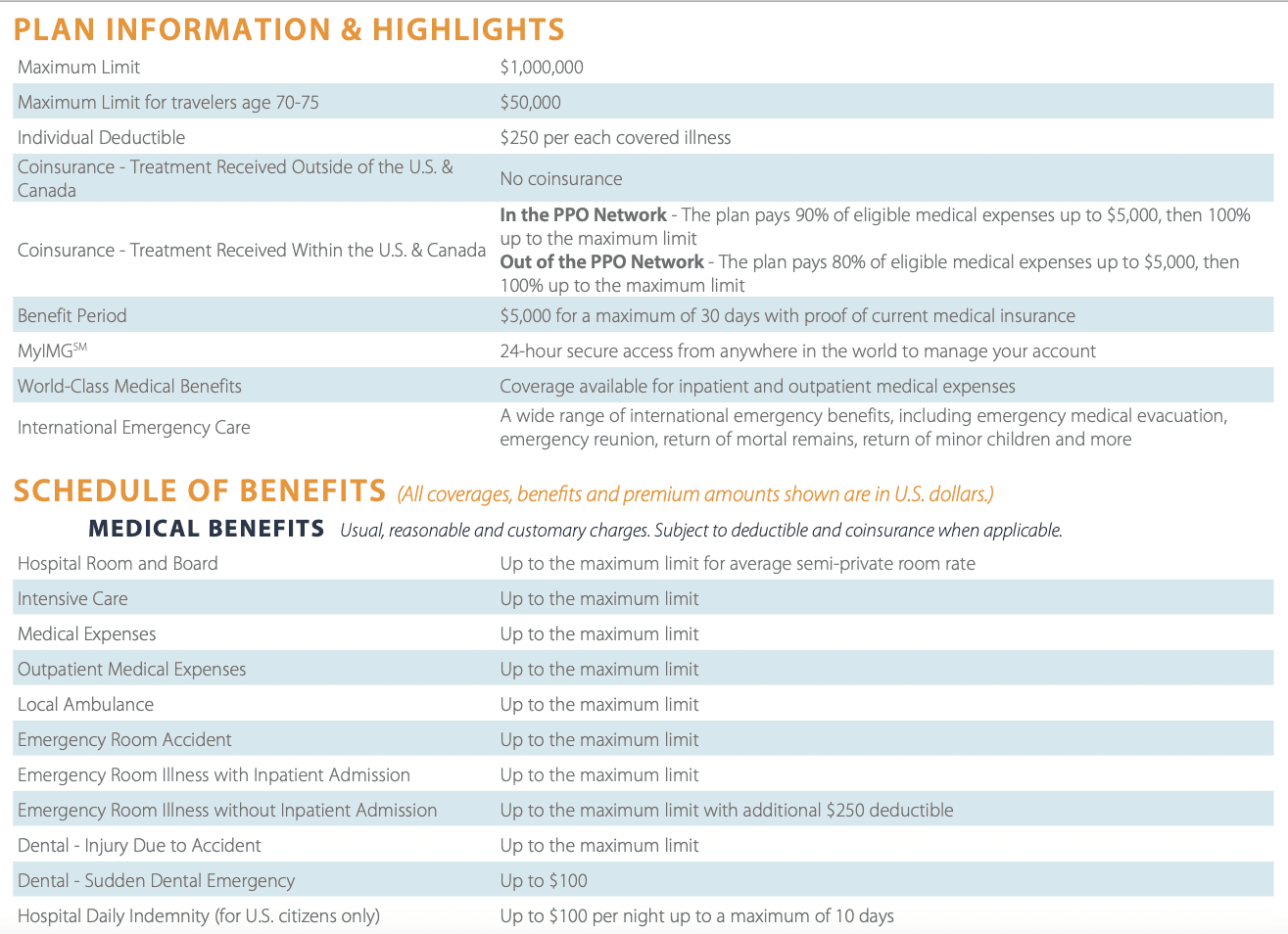

Review the coverage limits and deductibles of each policy. Ensure that the limits are sufficient to cover potential medical expenses or trip cancellations. Higher coverage limits often come with higher premiums, so strike a balance based on your budget and anticipated risks.

Pre-existing Medical Conditions

If you have pre-existing medical conditions, it’s essential to disclose them to the insurance provider. Some policies may exclude coverage for pre-existing conditions, while others may offer specific coverage with additional premiums. Being transparent about your health status ensures that you receive appropriate coverage.

Adventure Activities and Sports

If your travel plans involve adventurous activities or extreme sports, ensure that the policy covers these activities. Some standard travel insurance policies may exclude coverage for high-risk activities, so opting for specialized adventure travel insurance might be necessary.

Trip Duration and Flexibility

Consider the duration of your trip and choose a policy that aligns with your travel plans. Single-trip insurance is suitable for one-off journeys, while multi-trip insurance is ideal for frequent travelers. Ensure that the policy allows for trip extensions or modifications without incurring additional charges.

Reputation and Customer Service

Research the reputation of the insurance provider and their customer service record. Look for reviews and testimonials from previous customers to gauge their responsiveness and support. A reputable insurer with excellent customer service ensures that you receive timely assistance during your travels.

Understanding Policy Exclusions

While travel insurance provides comprehensive coverage, it's important to be aware of policy exclusions. These are situations or events that are not covered by the insurance policy. Here are some common exclusions to keep in mind:

Negligent or Reckless Behavior

Travel insurance policies often exclude coverage for incidents resulting from negligent or reckless behavior. This includes engaging in illegal activities, driving under the influence, or participating in dangerous activities without proper supervision.

Pre-existing Conditions

As mentioned earlier, pre-existing medical conditions may be excluded from coverage if not disclosed or specifically covered by the policy. It’s crucial to carefully review the policy documents to understand the extent of coverage for pre-existing conditions.

Natural Disasters and Acts of War

Travel insurance policies typically exclude coverage for natural disasters, such as hurricanes, earthquakes, or volcanic eruptions, unless specifically endorsed. Similarly, acts of war or terrorism may also be excluded from coverage.

Travel Advisory Warnings

If a destination has a travel advisory warning, insurance policies may exclude coverage for trips to those areas. It’s essential to stay informed about travel advisories and consider the risks before traveling to such regions.

How to Maximize Your Travel Insurance Benefits

To make the most of your travel insurance coverage, here are some tips and best practices:

Read the Policy Documents

Take the time to thoroughly read and understand the policy documents. Familiarize yourself with the coverage limits, exclusions, and claim procedures. This ensures that you know exactly what is covered and what steps to take in case of an emergency.

Keep All Receipts and Documentation

When filing a claim, you’ll need to provide supporting documentation, such as receipts, medical reports, and travel itineraries. Keep all relevant documents organized and easily accessible. This will streamline the claim process and ensure a quicker reimbursement.

Contact Your Insurer Promptly

In case of an emergency or unexpected situation, contact your insurance provider as soon as possible. They can guide you through the necessary steps and provide assistance. Prompt notification ensures that you receive the support you need and helps expedite the claim process.

Utilize Travel Insurance Apps

Many insurance providers offer mobile apps that provide convenient access to policy information, claim filing, and emergency assistance. Download and familiarize yourself with these apps before your trip. They can be invaluable tools during your travels.

Consider Travel Insurance Add-ons

Some insurance providers offer add-on coverage options to enhance your policy. These may include rental car insurance, trip interruption coverage, or even coverage for valuables. Evaluate your needs and consider adding these options to further customize your coverage.

Future Trends in Travel Insurance

The travel insurance industry is constantly evolving to meet the changing needs of travelers. Here are some trends and developments to watch out for:

Digitalization and Convenience

Travel insurance providers are embracing digitalization to enhance the customer experience. This includes online policy purchases, real-time claim tracking, and digital assistance during emergencies. The focus on convenience and accessibility will continue to shape the industry.

Personalized Coverage

With the rise of technology, insurance providers are offering more personalized coverage options. Travelers can now customize their policies based on their specific needs and preferences. This level of customization ensures that travelers receive tailored coverage that aligns with their unique travel plans.

Expanded Coverage for Mental Health

There’s a growing recognition of the importance of mental health support during travel. Insurance providers are expanding their coverage to include mental health-related issues, such as stress, anxiety, or depression. This reflects a broader shift towards prioritizing holistic well-being during travel.

Sustainable Travel Practices

Sustainability is becoming a key focus in the travel industry, and insurance providers are following suit. Some insurers are offering coverage for sustainable travel practices, such as eco-friendly accommodations or carbon offset programs. This aligns with the growing trend of responsible and conscious travel.

Data-Driven Risk Assessment

Insurance providers are leveraging data analytics to assess risks and offer more accurate coverage. By analyzing traveler data and patterns, insurers can provide tailored coverage options based on individual risk profiles. This data-driven approach ensures that travelers receive the most appropriate and cost-effective coverage.

Conclusion

Travel and health insurance is an indispensable component of any international journey. It provides a safety net against unexpected medical emergencies, trip cancellations, and other travel-related mishaps. By understanding the different types of policies, key considerations, and best practices, travelers can make informed decisions and ensure a worry-free travel experience.

As the travel insurance industry continues to evolve, travelers can expect more convenient, personalized, and sustainable coverage options. By staying informed and choosing the right policy, travelers can focus on enjoying their journeys without the burden of unforeseen expenses or worries.

How do I choose the right travel insurance policy for my needs?

+Consider factors such as your travel duration, activities, and potential risks. Review coverage limits, pre-existing condition coverage, and policy exclusions. Compare multiple policies to find the best fit for your needs and budget.

What happens if I need to cancel my trip due to unforeseen circumstances?

+If your policy covers trip cancellations, you may be eligible for reimbursement of non-refundable expenses. Ensure you understand the specific terms and conditions of your policy, including any exclusions or requirements for cancellation coverage.

Can I extend my travel insurance coverage while abroad?

+Some insurers allow policy extensions, but it’s best to check with your provider beforehand. Extending coverage may involve additional costs or specific procedures, so plan accordingly to avoid any gaps in coverage.