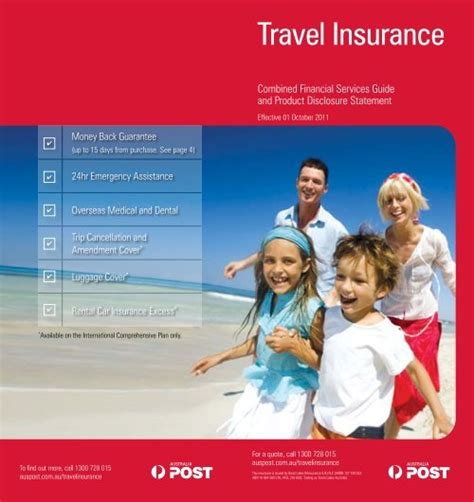

Travel Insurance Au

In today's fast-paced world, travel has become an integral part of our lives, offering us the opportunity to explore new destinations, immerse ourselves in diverse cultures, and create lasting memories. However, with the excitement of travel comes the potential for unforeseen circumstances, such as trip cancellations, medical emergencies, or lost luggage. This is where travel insurance steps in as a crucial companion for your journeys, providing peace of mind and financial protection during your adventures.

Australia, a land of breathtaking natural wonders and vibrant cities, attracts millions of tourists each year. From the iconic Sydney Harbour Bridge to the rugged beauty of the Outback, the Land Down Under offers an unforgettable travel experience. With its diverse landscapes and vibrant culture, Australia presents a unique set of travel challenges and opportunities. As such, understanding the importance of travel insurance in Australia is essential for any traveler, ensuring a seamless and stress-free journey.

The Significance of Travel Insurance in Australia

Travel insurance is an essential safeguard for travelers, offering protection against a range of unexpected events that could disrupt your trip. In Australia, where adventure sports, remote destinations, and unique wildlife encounters are common, having comprehensive travel insurance is not just a luxury but a necessity.

The significance of travel insurance in Australia can be highlighted through several key aspects. Firstly, medical coverage is of utmost importance. Australia boasts a vast and diverse landscape, with many remote areas where medical facilities may be limited. In such situations, travel insurance can provide the necessary coverage for emergency medical treatments, evacuations, and even repatriation if required. This ensures that travelers can access the medical care they need without incurring significant financial burdens.

Secondly, trip cancellation and interruption coverage is vital. Australia's popularity as a travel destination means that many travelers plan their trips well in advance. However, unforeseen circumstances such as illness, natural disasters, or family emergencies can lead to trip cancellations or interruptions. Travel insurance can reimburse travelers for their pre-paid trip costs, providing financial relief during such challenging times.

Furthermore, luggage and personal effects coverage is another critical aspect of travel insurance. Australia's diverse climate and adventurous activities can sometimes lead to lost or damaged luggage. Travel insurance can provide compensation for these losses, ensuring that travelers are not left financially stranded without their essential items.

Understanding Travel Insurance Policies for Australia

When it comes to travel insurance for Australia, it’s crucial to understand the various policy options and their specific coverage details. Each insurance provider offers unique plans tailored to different travel needs and budgets. Here’s a closer look at some key aspects to consider when choosing a travel insurance policy for your Australian adventure.

Medical Expense Coverage

Medical expense coverage is a cornerstone of any travel insurance policy, especially when traveling to a country like Australia with its unique medical system. Ensure your policy covers a wide range of medical emergencies, including doctor visits, hospital stays, prescription medications, and emergency dental care. Look for policies that provide coverage for pre-existing medical conditions as well, as these can sometimes be excluded from standard plans.

| Medical Coverage | Policy Provider |

|---|---|

| Comprehensive Emergency Care | Travel Guard |

| Specialist Consultations | World Nomads |

| Prescription Medication | InsureMyTrip |

Additionally, consider the medical evacuation and repatriation coverage offered by different providers. Medical evacuations can be costly, especially in remote areas, so ensuring adequate coverage for these scenarios is vital. Repatriation coverage can assist with the cost of returning home in the event of a serious illness or injury, providing peace of mind during your travels.

Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage is another critical aspect of travel insurance for Australia. With the country’s diverse range of attractions and activities, travelers often plan their trips months in advance. However, unforeseen circumstances can lead to trip cancellations or interruptions. Here’s a breakdown of what to look for in this coverage:

- Cancellation Coverage: Ensure your policy covers cancellation due to various reasons, including personal illness, travel partner's illness, natural disasters, or even terrorism. Look for policies that offer a high percentage of reimbursement for your prepaid trip costs.

- Interruption Coverage: This covers situations where your trip must be interrupted and you need to return home early. Reasons could include the death or serious illness of a family member, a terrorist incident at your destination, or a natural disaster.

- Covered Events: Review the list of covered events carefully. Some policies may have specific exclusions, such as pre-existing medical conditions or certain adventure activities. Ensure that the policy aligns with your travel plans and any potential risks you might encounter.

Luggage and Personal Effects Coverage

Australia’s diverse climate and adventurous activities can sometimes lead to lost or damaged luggage. Travel insurance can provide valuable coverage for these unfortunate incidents. Here’s what to consider when reviewing luggage and personal effects coverage:

- Luggage Delay: This coverage kicks in when your luggage is delayed by the airline for a certain period, typically 24 hours. It reimburses you for the essential items you need to purchase during this delay.

- Lost or Damaged Luggage: Ensure your policy covers the replacement cost of your luggage and personal items if they are lost, stolen, or damaged during your trip. Consider the policy's sub-limits and whether they align with the value of your belongings.

- Adventure Activities: If you plan to engage in adventure sports or activities like skydiving, surfing, or hiking, check if your policy covers any damage or loss of equipment related to these activities. Some policies may have specific exclusions for high-risk activities, so be sure to review the fine print.

Real-Life Scenarios and Benefits of Travel Insurance in Australia

Travel insurance in Australia is not just a theoretical concept; it’s a practical safeguard that has proven its worth time and again for travelers facing unexpected situations. Here are some real-life scenarios that highlight the importance and benefits of travel insurance while exploring the Land Down Under.

Scenario 1: Medical Emergency

Imagine you’re hiking the breathtaking trails of the Blue Mountains when you slip and sustain a serious ankle injury. Without travel insurance, you might face daunting medical bills and the challenge of arranging emergency transportation. However, with comprehensive travel insurance, you can access prompt medical care, potentially including an emergency helicopter evacuation, with minimal out-of-pocket expenses.

Scenario 2: Trip Cancellation

You’ve planned a dream vacation to explore the Great Barrier Reef, but a week before your departure, a family member falls critically ill. Canceling your trip would result in significant financial loss. Fortunately, with travel insurance, you can claim a refund for your non-refundable trip costs, providing much-needed financial relief during a stressful time.

Scenario 3: Luggage Loss

Upon arriving in Sydney, you discover that your luggage has been lost or delayed. This can be a major inconvenience, especially if you’re planning to explore multiple destinations during your trip. Travel insurance with luggage coverage can provide compensation for essential items you need to purchase during the delay, ensuring you can continue your journey without significant financial strain.

Choosing the Right Travel Insurance Provider for Australia

With numerous travel insurance providers offering policies tailored for Australia, selecting the right one can be a daunting task. Here are some key considerations to guide your decision-making process and help you choose a travel insurance provider that best suits your needs.

Coverage Options

The first step is to evaluate the coverage options offered by different providers. Ensure that the policy covers all the essential aspects of your trip, including medical emergencies, trip cancellations, and luggage loss. Look for policies that provide comprehensive coverage for a wide range of scenarios, especially those that align with your travel plans and potential risks.

Policy Exclusions

Understanding the policy exclusions is crucial. Some providers may have specific exclusions for certain activities, pre-existing medical conditions, or particular destinations. Ensure that the policy you choose does not exclude any activities or destinations you plan to engage in or visit during your trip to Australia.

Reputation and Reliability

Choose a travel insurance provider with a solid reputation and a track record of reliability. Look for providers who have been in the industry for a significant period and have a history of prompt claim settlements. Online reviews and ratings can provide valuable insights into the provider’s customer service and claim handling processes.

Customer Service and Claim Support

Excellent customer service and efficient claim support are essential when selecting a travel insurance provider. Ensure that the provider offers 24⁄7 customer support, as emergencies can arise at any time during your trip. Additionally, check the claim process, including the required documentation and the average time it takes to process claims.

Cost and Value

While it’s important to consider the cost of travel insurance, it’s equally crucial to assess the value you’re receiving. Compare the coverage, exclusions, and additional benefits offered by different providers. Choose a policy that provides the best coverage for your needs at a competitive price.

Future Implications and the Evolving Landscape of Travel Insurance in Australia

The travel insurance landscape in Australia is evolving, driven by changing traveler needs, emerging technologies, and the increasing awareness of the importance of financial protection during travel. As the industry adapts to these changes, several key trends and developments are shaping the future of travel insurance in the Land Down Under.

Digital Transformation

The digital age has revolutionized the way travel insurance is purchased and managed. Travelers now expect a seamless, digital experience when it comes to purchasing insurance policies and filing claims. As such, travel insurance providers in Australia are investing in digital platforms and mobile apps to enhance the customer experience.

These digital tools not only simplify the policy purchasing process but also provide real-time updates and assistance during trips. For instance, some apps offer interactive features like trip tracking, emergency assistance, and claim submission, making it easier for travelers to manage their insurance needs on the go.

Customized Coverage

One-size-fits-all travel insurance policies are becoming a thing of the past. Travelers now seek personalized coverage that aligns with their specific travel needs and preferences. In response, insurance providers are offering more flexible and customizable policies.

For instance, travelers can now choose add-on coverage for specific activities, such as adventure sports or golf, or opt for enhanced medical coverage for pre-existing conditions. This level of customization ensures that travelers receive the protection they need without paying for unnecessary coverage.

Enhanced Medical Benefits

With Australia’s diverse landscape and unique medical system, medical coverage is a critical aspect of travel insurance. Insurance providers are recognizing this and enhancing their medical benefits to provide better protection for travelers.

This includes expanding coverage for pre-existing conditions, offering higher limits for medical expenses, and providing more comprehensive emergency medical evacuation coverage. Additionally, some providers are partnering with healthcare providers to offer exclusive benefits, such as discounted medical services or priority access to certain facilities.

Traveler Education and Awareness

The travel insurance industry in Australia is also focusing on educating travelers about the importance of insurance and the potential risks they may face during their trips. This involves raising awareness about the range of insurance options available, the benefits of comprehensive coverage, and the potential consequences of traveling without insurance.

Travel insurance providers are leveraging digital platforms and social media to reach a wider audience and provide informative content. This not only helps travelers make more informed decisions but also reduces the number of uninsured travelers, ultimately contributing to a safer and more secure travel environment.

What are the essential aspects to consider when purchasing travel insurance for Australia?

+When purchasing travel insurance for Australia, it’s crucial to consider medical coverage, trip cancellation and interruption coverage, and luggage and personal effects coverage. Ensure your policy covers a wide range of medical emergencies, including pre-existing conditions. Look for comprehensive cancellation and interruption coverage that aligns with your travel plans. Finally, review luggage coverage to ensure it covers potential losses or delays during your trip.

How can I compare different travel insurance policies to find the best one for my Australian trip?

+Comparing travel insurance policies involves evaluating coverage options, policy exclusions, reputation and reliability, customer service, and cost. Review the coverage to ensure it aligns with your needs, understand the exclusions, and choose a provider with a solid reputation and efficient claim support. Finally, assess the value you’re receiving for the cost of the policy.

Are there any specific activities or destinations in Australia that require additional travel insurance coverage?

+Australia offers a range of adventure activities and remote destinations. If you plan to engage in activities like skydiving, surfing, or hiking, or if you’re visiting remote areas, consider additional coverage for these scenarios. Some policies may have specific exclusions for high-risk activities, so ensure your policy covers your intended activities and destinations.