Travel Insurance Berkshire Hathaway

In the world of travel, one of the most important aspects to consider is protection. Travel insurance acts as a safety net, providing peace of mind and financial security during unforeseen circumstances. Berkshire Hathaway, a renowned name in the insurance industry, has ventured into travel insurance, offering comprehensive coverage options. In this article, we will delve into the world of Travel Insurance by Berkshire Hathaway, exploring its features, benefits, and how it can enhance your travel experiences.

Understanding Travel Insurance Berkshire Hathaway

Travel Insurance by Berkshire Hathaway is a specialized insurance product designed to cater to the unique needs of travelers. It offers a range of coverage options to protect against various travel-related risks and emergencies. With a focus on providing reliable and comprehensive protection, Berkshire Hathaway has developed a suite of travel insurance plans to suit different travel styles and preferences.

Key Features and Benefits

The travel insurance plans offered by Berkshire Hathaway come packed with essential features that cater to travelers’ diverse needs. Here’s an overview of some of the key benefits:

- Trip Cancellation and Interruption Coverage: This feature provides financial protection if your trip is canceled or interrupted due to unforeseen circumstances, such as severe weather, illness, or other covered events. It covers non-refundable expenses, ensuring you don’t incur significant losses.

- Medical and Dental Emergency Coverage: Traveling to new destinations can sometimes result in unexpected medical emergencies. Berkshire Hathaway’s travel insurance offers comprehensive medical and dental coverage, including emergency medical transportation and treatment expenses.

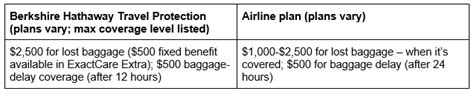

- Baggage and Personal Effects Protection: Luggage can often be a source of worry when traveling. With Berkshire Hathaway’s travel insurance, you’ll have peace of mind knowing that your baggage and personal items are insured against loss, damage, or theft during your trip.

- Trip Delay Assistance: Delays are an inevitable part of travel. The travel insurance plan covers expenses incurred due to trip delays, providing reimbursement for meals, accommodations, and other necessary expenses during the delay period.

- Emergency Evacuation and Repatriation: In the event of a severe medical emergency or a natural disaster, the insurance plan includes coverage for emergency evacuation and repatriation, ensuring you receive the necessary medical care and assistance to return home safely.

- 24⁄7 Travel Assistance Services: Berkshire Hathaway’s travel insurance provides a dedicated 24⁄7 travel assistance hotline. This service offers support and guidance for various travel-related issues, including emergency medical referrals, legal assistance, and help with lost travel documents.

Personalized Coverage Options

One of the standout features of Travel Insurance by Berkshire Hathaway is its flexibility. The insurance plans are designed to cater to different travel styles and preferences, allowing travelers to choose coverage options that align with their specific needs. Whether you’re an adventure seeker, a business traveler, or a leisure traveler, there’s a plan tailored just for you.

For instance, adventure seekers can opt for plans that offer additional coverage for extreme sports and outdoor activities. Business travelers can benefit from plans that include coverage for business-related expenses and emergency work cancellations. Leisure travelers can choose comprehensive plans that cover a wide range of travel-related incidents.

Traveling with Confidence

Travel insurance is not just about financial protection; it’s about giving travelers the confidence to explore the world without worry. With Berkshire Hathaway’s travel insurance, you can embark on your journeys knowing that you’re protected against unforeseen circumstances. Whether it’s a spontaneous adventure or a well-planned vacation, the insurance plan ensures you can focus on creating unforgettable memories without the stress of potential travel mishaps.

| Coverage Category | Coverage Options |

|---|---|

| Trip Cancellation/Interruption | Covers non-refundable expenses |

| Medical/Dental Emergencies | Includes emergency transportation and treatment |

| Baggage Protection | Covers loss, damage, and theft of personal items |

| Trip Delay Assistance | Reimburses expenses during delays |

| Emergency Evacuation/Repatriation | Provides assistance for medical emergencies and natural disasters |

FAQ

What are the eligibility criteria for Travel Insurance by Berkshire Hathaway?

+Travel Insurance by Berkshire Hathaway is available to individuals who are residents of the United States and are 18 years or older. It is important to note that pre-existing medical conditions may be subject to specific eligibility criteria and additional coverage options.

How do I purchase Travel Insurance from Berkshire Hathaway?

+You can purchase Travel Insurance by Berkshire Hathaway directly through their website or by contacting their customer service team. The process is straightforward, and you can choose the coverage options that best suit your travel plans.

Can I customize my travel insurance plan to include specific activities or destinations?

+Absolutely! Berkshire Hathaway offers customizable travel insurance plans, allowing you to tailor your coverage to include specific activities like adventure sports or coverage for certain destinations. This ensures you have the protection you need for your unique travel experiences.

What should I do if I need to make a claim under my Travel Insurance policy?

+In the event of a covered loss or emergency, you should contact the Berkshire Hathaway Travel Insurance claims team as soon as possible. They will guide you through the claims process and provide the necessary assistance to ensure a smooth and efficient resolution.

Are there any exclusions or limitations to the travel insurance coverage provided by Berkshire Hathaway?

+Yes, like any insurance policy, there are certain exclusions and limitations. It is important to carefully review the policy document to understand what is and is not covered. Some common exclusions may include acts of war, certain pre-existing medical conditions, and intentionally self-inflicted injuries.