Travel Insurance For Europe

In the vast landscape of international travel, Europe stands out as a destination brimming with cultural richness, historical significance, and an array of diverse experiences. However, amidst the excitement of planning a European adventure, it's essential to recognize the importance of travel insurance, a critical aspect often overlooked until an unforeseen event occurs.

Travel insurance for Europe provides a safety net, ensuring that travelers can navigate the continent with peace of mind. It covers a range of potential mishaps, from medical emergencies and trip cancellations to lost luggage and personal liability. This article aims to delve into the intricacies of travel insurance for Europe, offering a comprehensive guide to help travelers make informed decisions and ensure a stress-free journey.

Understanding the Need for Travel Insurance in Europe

Traveling to Europe, with its diverse landscapes and vibrant cities, can be an unforgettable experience. However, it’s crucial to recognize that unexpected situations can arise, ranging from minor inconveniences to serious emergencies. This is where travel insurance steps in as a vital safeguard.

Consider the following scenarios that travel insurance can help mitigate:

- Medical Emergencies: Europe, while known for its excellent healthcare, can also present challenges when it comes to medical costs. A simple injury or illness can lead to significant expenses, especially if specialized treatment is required.

- Trip Cancellations or Delays: Unforeseen circumstances like natural disasters, severe weather, or even personal emergencies back home can disrupt travel plans. Travel insurance can provide coverage for these situations, ensuring you don't lose out financially.

- Lost or Stolen Belongings: Luggage or personal items going missing can be a major setback, especially when traveling. Insurance can offer reimbursement for these losses, helping to minimize the financial impact.

- Legal or Liability Issues: In a foreign country, legal matters or accidental liability can be particularly complex and costly. Travel insurance can provide assistance and coverage in such scenarios.

Key Features and Benefits of Travel Insurance for Europe

Travel insurance policies tailored for Europe typically offer a comprehensive range of features to cater to the diverse needs of travelers. Here’s a closer look at some of the key benefits:

Medical and Emergency Assistance

The cornerstone of most travel insurance policies, medical coverage ensures that travelers have access to necessary healthcare services while abroad. This includes coverage for accidents, illnesses, and even dental emergencies. Many policies also provide for emergency medical evacuations, ensuring timely and safe transport to appropriate medical facilities.

Additionally, travelers can benefit from 24/7 emergency assistance services, providing them with immediate support in case of a medical crisis.

Trip Cancellation and Interruption

This coverage is especially valuable for travelers who may need to cancel or interrupt their trip due to unforeseen circumstances. It can reimburse non-refundable trip costs in cases of severe weather, natural disasters, or personal emergencies that prevent travel.

Baggage and Personal Belongings

Travel insurance policies often cover lost, stolen, or damaged luggage and personal effects. This coverage can provide a financial cushion, helping travelers replace essential items without incurring substantial expenses.

Travel Delay Coverage

Delays can be a significant inconvenience during travel. With travel delay coverage, travelers can receive reimbursement for additional expenses incurred due to delays caused by factors like severe weather or mechanical issues.

Personal Liability and Legal Assistance

In the event of an accident or incident resulting in property damage or personal injury to others, personal liability coverage can provide financial protection. Additionally, legal assistance services can offer support in navigating foreign legal systems.

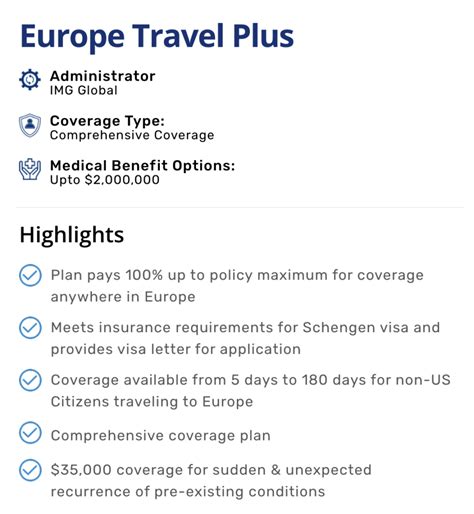

Choosing the Right Travel Insurance Policy for Europe

Selecting the appropriate travel insurance policy for a European trip requires careful consideration of several factors. Here’s a guide to help travelers make an informed decision:

Assess Your Specific Needs

Every traveler’s needs are unique. Consider factors like the duration of your trip, the countries you’ll be visiting, and any specific activities you plan to engage in. For instance, if you’re planning an adventurous trip with activities like skiing or hiking, ensure your policy covers these activities.

Compare Policies and Providers

The market is filled with various travel insurance providers, each offering unique policies. Compare different policies based on coverage, exclusions, and premium costs. Look for reputable providers with a solid track record of claims handling.

Check for Pre-existing Condition Coverage

If you have any pre-existing medical conditions, ensure your policy provides coverage for them. Some policies may exclude coverage for pre-existing conditions, so it’s essential to understand the terms and conditions thoroughly.

Review Exclusions and Limitations

While insurance policies offer comprehensive coverage, they also come with exclusions and limitations. Be sure to read the fine print to understand what’s covered and what’s not. This ensures you’re aware of any potential gaps in coverage.

Consider Additional Benefits

Apart from the standard coverage, some policies offer additional benefits like travel assistance services, rental car coverage, or even coverage for adventures sports. Evaluate these add-ons to see if they align with your travel plans.

Choose the Right Deductible and Coverage Limits

Policies often offer different deductible options and coverage limits. Choose a deductible you’re comfortable with, and ensure the coverage limits are sufficient for your needs. Higher limits usually mean more comprehensive coverage.

Real-Life Scenarios: How Travel Insurance Can Help

Understanding the potential benefits of travel insurance is one thing, but seeing how it plays out in real-life scenarios can provide a clearer picture. Here are a couple of stories that highlight the value of travel insurance in Europe:

Story 1: Medical Emergency in Paris

Imagine a traveler, let’s call her Sarah, who sustained a serious injury while sightseeing in Paris. Without travel insurance, she would have had to navigate the French healthcare system, potentially facing significant out-of-pocket expenses. However, with her travel insurance policy, she received immediate medical assistance, including coverage for emergency transportation to a nearby hospital, specialist care, and even assistance with translating medical documents.

Story 2: Trip Interruption Due to Natural Disaster

Consider a group of travelers planning a hiking trip in the Swiss Alps. Unbeknownst to them, a severe storm hits the region, causing landslides and rendering roads inaccessible. Without travel insurance, they would have faced the prospect of losing their non-refundable trip costs. However, their travel insurance policy covered trip interruptions due to natural disasters, providing them with financial protection and allowing them to reschedule their trip.

Making the Most of Your Travel Insurance Policy

Once you’ve selected and purchased your travel insurance policy, it’s important to understand how to maximize its benefits. Here are some tips:

Read and Understand Your Policy

Take the time to thoroughly read and understand your policy documents. This ensures you’re aware of what’s covered, what’s excluded, and the steps to take in case of a claim.

Keep Important Documents Handy

Make sure to carry your insurance policy documents, emergency contact numbers, and other relevant information with you during your trip. Having these readily available can make the claims process smoother.

Know the Claims Process

Familiarize yourself with the claims process outlined in your policy. This includes understanding what documentation is required and how to submit a claim. Being prepared can help expedite the process and ensure a smoother experience.

Utilize Emergency Assistance Services

Many travel insurance policies offer 24⁄7 emergency assistance services. Don’t hesitate to use these services in case of an emergency. They can provide immediate support, guidance, and resources to help navigate through challenging situations.

Conclusion: Travel with Confidence in Europe

Traveling to Europe is an exciting adventure, and with the right travel insurance policy, it can be a stress-free one too. By understanding the need for travel insurance, choosing the right policy, and knowing how to utilize its benefits, travelers can embark on their European journey with confidence, knowing they’re protected against unforeseen circumstances.

Frequently Asked Questions

What are the most common reasons for claiming travel insurance in Europe?

+

The most common reasons for claiming travel insurance in Europe include medical emergencies, trip cancellations due to unforeseen circumstances, and lost or stolen belongings. Other reasons may include travel delays, personal liability issues, and accidents during activities.

How do I choose the right travel insurance provider for Europe?

+

When choosing a travel insurance provider for Europe, consider factors like coverage limits, pre-existing condition coverage, reputation for claims handling, and additional benefits. Compare policies from multiple providers to find the best fit for your needs.

Can I get travel insurance if I have a pre-existing medical condition?

+

Yes, many travel insurance providers offer coverage for pre-existing medical conditions. However, it’s important to declare these conditions accurately during the application process and understand any potential exclusions or limitations. Some providers may require additional information or medical certificates.

What happens if I need to cancel my trip to Europe due to an emergency?

+

If you have to cancel your trip to Europe due to an emergency, your travel insurance policy may provide coverage for non-refundable trip costs. This typically includes situations like severe weather, natural disasters, or personal emergencies. However, it’s essential to review your policy’s terms and conditions to understand the specific coverage and any potential exclusions.

How soon should I purchase travel insurance for my European trip?

+

It’s generally recommended to purchase travel insurance as soon as you book your trip to Europe. This ensures you’re covered from the moment you make your travel arrangements. Some policies may have specific timelines for certain coverages, so it’s best to review the policy details to understand the coverage period.