Travel Insurance Medical Insurance

In today's world, travel has become more accessible and convenient than ever before. Whether it's a quick weekend getaway or an extended adventure, travelers often prioritize the experience and the memories they'll create. However, it's crucial to remember that unexpected medical emergencies can occur during travels, and having adequate insurance coverage is essential to ensure a safe and stress-free journey.

This comprehensive guide will delve into the world of travel insurance and medical insurance, exploring their differences, importance, and how they can protect you and your loved ones while exploring new destinations. We'll uncover the benefits, coverage options, and real-life scenarios where these insurance policies have made a significant impact.

Understanding Travel Insurance and Medical Insurance

Travel insurance and medical insurance are two distinct types of coverage that serve different purposes, although they often overlap in certain aspects. Understanding the nuances between them is crucial for travelers to make informed decisions and choose the right protection for their journeys.

Travel Insurance: A Comprehensive Companion for Your Journey

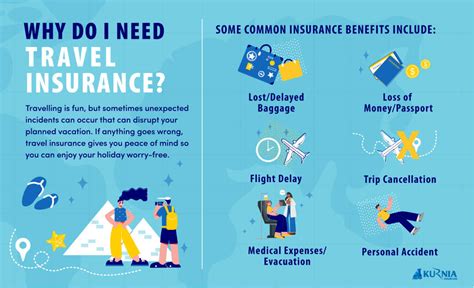

Travel insurance is designed to provide a comprehensive safety net for travelers, covering a wide range of potential issues that may arise during a trip. It offers protection against unexpected events such as trip cancellations, delays, lost luggage, personal accidents, and medical emergencies.

Key features of travel insurance include:

- Trip Cancellation and Interruption: Reimburses travelers for non-refundable expenses if their trip is canceled or interrupted due to covered reasons like severe weather, illness, or other unforeseen circumstances.

- Medical and Dental Emergencies: Provides coverage for emergency medical and dental treatments, including transportation to the nearest medical facility and evacuation back home if necessary.

- Travel Delays and Missed Connections: Offers compensation for additional expenses incurred due to travel delays or missed connections, helping travelers stay comfortable during unexpected layovers.

- Lost or Stolen Luggage: Reimburses the cost of essential items if luggage is lost, stolen, or delayed, ensuring travelers can continue their journey without major disruptions.

- Personal Liability and Legal Assistance: Protects travelers from legal liabilities arising from accidental injuries or property damage during their trip, and provides access to legal assistance if needed.

Travel insurance policies vary in coverage and limits, so it's essential to carefully review the terms and conditions before purchasing. Some policies may include additional benefits like rental car coverage, adventure sports coverage, or even trip cancellation for any reason, which provides more flexibility for travelers.

Medical Insurance: Essential Protection for Your Health

Medical insurance, often referred to as health insurance, focuses primarily on providing coverage for medical expenses and treatments. It is a vital aspect of personal health management and can be particularly important when traveling to destinations with different healthcare systems and costs.

Key features of medical insurance include:

- Coverage for Doctor Visits and Hospitalization: Pays for the cost of medical treatments, surgeries, and hospital stays, ensuring access to necessary healthcare services.

- Prescription Medication Coverage: Helps cover the cost of prescription drugs, ensuring travelers can access the medications they need while away from home.

- Pre-existing Condition Coverage: Depending on the policy, some medical insurance plans may provide coverage for certain pre-existing conditions, allowing travelers with ongoing health issues to seek necessary treatments while traveling.

- Preventive Care and Wellness Services: Offers coverage for routine check-ups, vaccinations, and other preventive healthcare measures, promoting overall wellness during travels.

- Dental and Vision Care: Provides coverage for dental emergencies, vision-related issues, and necessary eye care services, ensuring travelers' vision and oral health are not compromised.

Medical insurance policies can vary significantly in terms of coverage limits, deductibles, and out-of-pocket expenses. It's crucial to review the policy details and ensure it aligns with your specific healthcare needs, especially when traveling to countries with high healthcare costs.

Why Travel Insurance and Medical Insurance are Essential

Traveling is an exciting adventure, but it also comes with inherent risks and uncertainties. Medical emergencies, unexpected injuries, or even simple accidents can happen at any time, and being unprepared can lead to significant financial burdens and stress.

Financial Protection and Peace of Mind

One of the primary reasons to invest in travel and medical insurance is financial protection. Medical treatments, especially in foreign countries, can be extremely expensive, and without insurance coverage, travelers may be left with a mountain of debt. Travel insurance provides a safety net, ensuring that unexpected expenses are covered, allowing travelers to focus on their recovery and well-being rather than financial worries.

Additionally, travel insurance offers peace of mind by covering other trip-related expenses. If a traveler needs to cancel their trip due to a covered reason, travel insurance can reimburse non-refundable costs, preventing significant financial losses. It also provides assistance in case of lost luggage or travel delays, ensuring travelers have the support they need to continue their journey smoothly.

Access to Quality Healthcare

Having medical insurance while traveling ensures access to quality healthcare services, regardless of the destination. In some countries, healthcare systems may be vastly different from what travelers are accustomed to, and finding suitable medical facilities can be challenging. Medical insurance provides a network of trusted healthcare providers, ensuring travelers receive timely and appropriate care.

Moreover, medical insurance often includes coverage for emergency medical evacuations, which can be a lifesaver in remote or rural areas. In such cases, the insurance company coordinates and covers the cost of transporting the traveler to a more advanced medical facility, ensuring they receive the specialized care they need.

Real-Life Scenarios: The Impact of Insurance Coverage

To understand the true value of travel and medical insurance, let's explore some real-life scenarios where these policies made a significant difference in travelers' experiences:

| Scenario | Impact of Insurance |

|---|---|

| A traveler experiences a severe allergic reaction while hiking in a remote area. Medical insurance covers the cost of emergency transportation to a hospital and provides access to specialized care, ensuring a full recovery. | Without insurance, the traveler would have faced significant financial burden and potentially delayed treatment due to the remote location. |

| A family's vacation is abruptly interrupted when one of the members falls ill and requires hospitalization. Travel insurance covers the cost of the hospital stay, additional accommodation, and even arranges for the family's safe return home. | Without insurance, the family would have faced financial strain and the emotional stress of managing the situation without support. |

| A business traveler's laptop is stolen during a trip. Travel insurance reimburses the cost of a new laptop, ensuring the traveler can continue their work and avoid delays in projects. | Without insurance, the traveler would have incurred the full cost of replacing the laptop, potentially affecting their professional obligations. |

These scenarios highlight the real-world impact of travel and medical insurance, demonstrating how these policies can turn a potentially disastrous situation into a manageable and even positive experience.

Choosing the Right Travel and Medical Insurance

Selecting the appropriate travel and medical insurance policies requires careful consideration of several factors. Here are some key aspects to keep in mind when making your choice:

Destination and Duration

The destination and duration of your trip play a significant role in determining the level of insurance coverage you need. Some countries have higher healthcare costs, and certain destinations may pose more risks due to political instability or natural disasters. Consider the specific needs and risks associated with your travel plans when choosing insurance.

Coverage Limits and Deductibles

Review the coverage limits and deductibles of each policy. Ensure that the limits are sufficient to cover potential medical expenses, especially if you're traveling to a high-cost destination. Understand the deductibles and any out-of-pocket expenses you may need to pay, as these can vary significantly between policies.

Pre-existing Conditions

If you have any pre-existing medical conditions, it's crucial to choose a policy that provides coverage for these conditions. Some travel insurance policies exclude coverage for pre-existing conditions, so carefully review the fine print to ensure you're adequately protected.

Adventure Activities and Sports

If your travel plans include adventurous activities like skiing, scuba diving, or hiking, ensure that your travel insurance policy covers these activities. Certain policies may have exclusions for high-risk activities, so it's essential to choose a policy that aligns with your intended travel experiences.

Reputation and Customer Service

Research the reputation and customer service of the insurance provider. Look for companies with a track record of prompt claim settlements and positive customer reviews. Having a reliable and responsive insurance company can make a significant difference in how smoothly your insurance claims are handled.

Maximizing Your Insurance Benefits

To ensure you get the most out of your travel and medical insurance, consider the following tips:

- Read the Policy Documents: Take the time to thoroughly read and understand the policy documents. This will help you familiarize yourself with the coverage, exclusions, and any specific requirements for making claims.

- Keep Important Contact Information Handy: Store the contact details of your insurance provider and any emergency hotlines in your phone or travel documents. In case of an emergency, having this information readily available can be crucial.

- Understand the Claim Process: Familiarize yourself with the claim process and any necessary documentation. Knowing what is required and how to submit claims efficiently can streamline the process and ensure timely reimbursement.

- Review Exclusions: Be aware of any exclusions or limitations in your policy. Understanding what is not covered will help you make informed decisions during your trip and avoid potential pitfalls.

- Consider Additional Coverage: Depending on your travel plans and personal circumstances, you may want to explore additional coverage options, such as travel delay coverage, rental car insurance, or adventure sports coverage.

The Future of Travel and Medical Insurance

The travel and medical insurance industries are continuously evolving to meet the changing needs and expectations of travelers. Here are some trends and developments to watch out for in the future:

Digitalization and Convenience

Insurance providers are increasingly embracing digital technologies to enhance the customer experience. Expect to see more user-friendly online platforms for policy purchases, claim submissions, and tracking. Mobile apps and digital wallets will likely play a more significant role, providing travelers with convenient access to their insurance details and benefits.

Personalized Coverage Options

The insurance industry is moving towards offering more personalized coverage options. Travelers will have the flexibility to choose specific add-ons or customize their policies to align with their unique travel needs and preferences. This level of customization ensures that travelers receive the protection they desire without paying for unnecessary coverage.

Enhanced Emergency Assistance

Travel insurance providers are focusing on providing more comprehensive emergency assistance services. This includes 24/7 emergency hotlines, access to multilingual support, and coordination of medical evacuations and transportation. These enhanced services ensure that travelers receive prompt and effective assistance during times of need.

Integration with Travel Platforms

Travel insurance is likely to become more seamlessly integrated with popular travel platforms and booking websites. Travelers will be able to easily compare and purchase insurance policies alongside their travel bookings, making the process more convenient and streamlined.

Conclusion

Travel insurance and medical insurance are indispensable companions for any traveler. They provide financial protection, peace of mind, and access to quality healthcare, ensuring that travelers can fully embrace their journeys without the worry of unforeseen circumstances. By understanding the differences between these insurance types, carefully selecting the right policies, and maximizing their benefits, travelers can embark on their adventures with confidence and security.

As the travel and insurance industries continue to evolve, travelers can look forward to even more innovative and personalized coverage options. With the right insurance protection, the world becomes a safer and more accessible place to explore, making every journey a memorable and stress-free experience.

What is the difference between travel insurance and medical insurance?

+Travel insurance provides a comprehensive safety net for travelers, covering various aspects of a trip, including trip cancellations, medical emergencies, and lost luggage. Medical insurance, on the other hand, primarily focuses on providing coverage for medical expenses and treatments, ensuring access to necessary healthcare services.

Why is it important to have travel insurance and medical insurance when traveling?

+Travel insurance and medical insurance are essential for financial protection and peace of mind. They cover unexpected expenses, provide access to quality healthcare, and offer assistance in case of emergencies, ensuring travelers can focus on their well-being and continue their journey smoothly.

How can I choose the right travel and medical insurance policies for my trip?

+When choosing insurance policies, consider factors such as destination, duration, coverage limits, deductibles, pre-existing conditions, adventure activities, and the reputation of the insurance provider. Review the policy documents carefully and understand the exclusions to ensure you’re adequately protected.

What are some future trends in travel and medical insurance?

+Future trends in travel and medical insurance include digitalization for enhanced convenience, personalized coverage options, improved emergency assistance services, and seamless integration with travel platforms. These developments aim to provide travelers with more accessible and tailored insurance solutions.

Related Terms:

- Best travel insurance medical insurance

- International travel insurance medical insurance

- Allianz travel insurance

- Travel health insurance international

- GeoBlue travel insurance

- AAA travel health insurance