Travel Insurance Quote Comparison

Welcome to the ultimate guide on comparing travel insurance quotes! In today's fast-paced world, where travel plans can change in an instant, having the right travel insurance is crucial. With countless options available, navigating the market can be daunting. That's why we've created this comprehensive article, tailored for search engines and packed with valuable insights, to help you make informed decisions when comparing travel insurance quotes.

Understanding the Travel Insurance Landscape

Travel insurance is a safeguard for your journey, offering protection against unforeseen circumstances. From trip cancellations to medical emergencies, it provides peace of mind and financial security. With a vast array of providers and policies, understanding the nuances is key to finding the perfect coverage.

When embarking on a travel insurance quest, you'll encounter various types, each designed to cater to different needs. Comprehensive plans offer extensive coverage, including trip cancellations, medical expenses, and lost luggage. Medical-only plans focus on providing extensive healthcare benefits, ideal for travelers with existing health conditions. Cancellation-only plans are tailored for those who prioritize flexibility, covering unforeseen events that lead to trip cancellations.

Moreover, travel insurance policies come with diverse features and benefits. Some policies offer evacuation coverage, ensuring prompt and safe transportation to appropriate medical facilities. Adventure sports coverage is a must for thrill-seekers, providing protection for activities like skiing, hiking, or scuba diving. Trip interruption benefits reimburse travelers for additional expenses incurred due to unexpected disruptions.

Comparing Quotes: A Step-by-Step Guide

Comparing travel insurance quotes is an art, and with the right approach, you can find the best value for your money. Here’s a step-by-step guide to ensure a seamless and informed decision-making process:

1. Define Your Travel Needs

Start by understanding your specific travel requirements. Consider factors like the duration of your trip, your destination(s), and any activities you plan to indulge in. For instance, if you’re embarking on a hiking expedition, adventure sports coverage becomes crucial. Similarly, if you’re traveling with valuable gadgets, consider adding personal effects coverage.

2. Research Reputable Providers

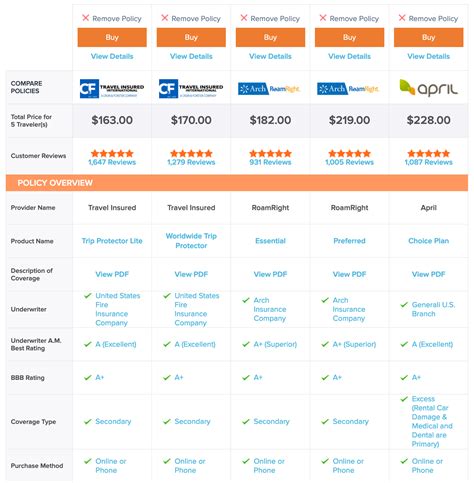

With the travel insurance market teeming with options, it’s essential to choose reputable providers. Look for companies with a solid track record, positive customer reviews, and prompt claim settlement processes. Websites like InsureMyTrip and Squaremouth offer comprehensive platforms to compare multiple providers side by side.

3. Analyze Coverage Details

Dive deep into the coverage details of each policy. Ensure the policy aligns with your travel needs. Check for medical expense limits, trip cancellation coverage, and baggage protection. Pay attention to policy exclusions as well, as they can vary widely between providers.

4. Consider Add-on Benefits

Many travel insurance policies offer add-on benefits, allowing you to customize your coverage. Consider adding rental car insurance, trip interruption coverage, or personal liability protection if they align with your travel plans.

5. Compare Prices and Discounts

Price is an essential factor, but it shouldn’t be the sole deciding criterion. Compare prices across different providers, but also keep an eye out for discounts and promotions. Many providers offer discounts for purchasing policies online or for insuring multiple trips in a year.

6. Review Policy Exclusions

While it’s exciting to focus on coverage benefits, don’t forget to scrutinize the policy exclusions. Common exclusions include pre-existing medical conditions, war-related incidents, and extreme sports activities. Ensure you understand the exclusions to avoid any unpleasant surprises during your trip.

7. Evaluate Customer Service and Claim Process

Travel insurance is not just about the policy; it’s also about the support you receive. Research the provider’s customer service reputation and claim process. Look for providers with a 24⁄7 customer helpline and a streamlined claim process to ensure prompt assistance when needed.

8. Read Reviews and Testimonials

Real-life experiences can provide valuable insights. Read reviews and testimonials from fellow travelers who have used the insurance provider’s services. Their feedback can shed light on the policy’s performance, claim settlement process, and overall customer satisfaction.

The Impact of Travel Destinations

Your travel destination plays a significant role in determining the type of travel insurance you should opt for. Here’s a quick breakdown of how different destinations can influence your insurance needs:

| Destination Type | Recommended Coverage |

|---|---|

| Domestic Travel | Medical-only plans or comprehensive plans with trip cancellation coverage. |

| International Travel | Comprehensive plans with high medical expense limits and evacuation coverage. |

| Adventure Travel | Adventure sports coverage, personal liability protection, and trip interruption benefits. |

| Family Travel | Family-specific plans with child-friendly benefits and comprehensive medical coverage. |

| Business Travel | |

| Trip cancellation coverage, rental car insurance, and business equipment protection. |

Remember, while these are general recommendations, it's essential to tailor your coverage based on your specific travel plans and requirements.

Navigating Common Challenges

Comparing travel insurance quotes can present unique challenges. Here are some common pitfalls and strategies to overcome them:

1. Understanding Jargon

Travel insurance policies often come with complex jargon. Break down the terminology and seek clarification if needed. Websites like TravelInsurance.com offer comprehensive glossaries to help you decipher insurance terms.

2. Comparing Apples to Apples

When comparing quotes, ensure you’re comparing similar policies. Different providers may offer varying coverage levels for the same benefit. Use comparison tools to ensure an apples-to-apples comparison.

3. Pre-existing Conditions

If you have pre-existing medical conditions, it’s crucial to disclose them during the quote process. Some providers offer specific coverage for pre-existing conditions, ensuring you’re adequately protected.

4. Policy Limits and Deductibles

Pay close attention to policy limits and deductibles. Higher limits and lower deductibles often mean more comprehensive coverage, but they can also impact the premium. Find the right balance based on your travel needs.

5. Policy Cancellation and Refunds

Understand the provider’s policy cancellation and refund process. Some providers offer a grace period for cancellations, while others may charge a fee. Ensure you’re comfortable with the terms before purchasing.

The Future of Travel Insurance

The travel insurance industry is evolving rapidly, driven by technological advancements and changing consumer needs. Here’s a glimpse into the future of travel insurance:

1. Digitalization and Instant Coverage

With the rise of digital platforms, travel insurance providers are offering instant coverage options. Travelers can now purchase policies online, often within minutes, ensuring seamless protection for last-minute trips.

2. Personalized Plans

The future of travel insurance lies in personalized plans. Providers are leveraging data analytics to offer tailored coverage based on individual travel preferences and needs. This ensures travelers receive the right coverage without paying for unnecessary benefits.

3. Enhanced Customer Experience

Travel insurance providers are focusing on enhancing the customer experience. This includes 24⁄7 customer support, seamless claim processes, and integrated digital tools for policy management and claim tracking.

4. Environmental and Ethical Considerations

With growing environmental consciousness, travel insurance providers are incorporating sustainability and ethical practices into their offerings. Some providers offer eco-friendly travel insurance plans, supporting carbon offset initiatives and sustainable tourism practices.

Conclusion

Comparing travel insurance quotes is an essential step in ensuring a safe and enjoyable travel experience. By understanding your travel needs, researching reputable providers, and analyzing coverage details, you can find the perfect policy. Remember, travel insurance is a valuable investment, providing peace of mind and financial protection. So, embark on your travel adventures with confidence, knowing you’re covered every step of the way.

How do I know if I need travel insurance for my trip?

+Travel insurance is recommended for all types of trips, especially those involving international travel or adventure activities. It provides financial protection and peace of mind in case of unforeseen circumstances.

What factors should I consider when comparing travel insurance quotes?

+When comparing quotes, consider coverage limits, policy exclusions, customer reviews, and the provider’s claim settlement process. Tailor your coverage based on your travel needs and budget.

Can I purchase travel insurance if I have a pre-existing medical condition?

+Yes, many travel insurance providers offer coverage for pre-existing conditions. However, it’s crucial to disclose these conditions during the quote process to ensure adequate protection.