Travel Insurance To Us

In today's fast-paced and often unpredictable world, travel has become an integral part of many people's lives, whether for leisure, business, or a combination of both. As such, ensuring that your journeys are protected and that you have peace of mind is paramount. Travel insurance is a vital aspect of responsible travel planning, offering financial protection and assistance in case of unforeseen circumstances. This article will delve into the intricacies of travel insurance to the US, providing a comprehensive guide for travelers seeking to safeguard their adventures.

Understanding Travel Insurance for the United States

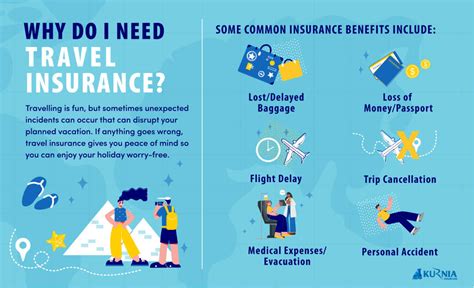

Travel insurance for the US is a specialized policy designed to cover a wide range of potential travel-related issues. From medical emergencies to trip cancellations, lost luggage, and more, these policies aim to mitigate the financial risks associated with traveling to one of the world’s most popular destinations. The US, with its diverse landscapes, vibrant cities, and unique cultural experiences, attracts millions of visitors each year. However, with this popularity comes a need for travelers to be prepared and protected, especially when it comes to unexpected events that could disrupt their journeys.

Key Coverage Areas of US Travel Insurance

Travel insurance policies for the US typically include a comprehensive set of benefits to address various potential issues. These may include:

- Medical and Dental Coverage: This is often the most crucial aspect of travel insurance. It covers expenses related to sudden illnesses, injuries, and even dental emergencies that occur during your trip. This coverage can be a lifesaver, especially in the US where healthcare costs can be exorbitant.

- Trip Cancellation and Interruption: If you need to cancel or cut short your trip due to unforeseen circumstances like severe weather, a family emergency, or even a natural disaster, this coverage ensures you don’t lose all your prepaid expenses.

- Emergency Evacuation: In the event of a natural disaster, political unrest, or a medical emergency that requires specialized treatment not available locally, this coverage provides for the costs of transporting you to a safe location or to a facility that can provide the necessary care.

- Lost or Delayed Baggage: Misplaced luggage can be a significant inconvenience, and this coverage helps reimburse you for essential items you may need to purchase in the interim.

- Personal Liability: This protects you in case you accidentally cause damage to property or bodily harm to someone else during your trip.

- Rental Car Damage: Many policies also offer coverage for damage to rental cars, which can be particularly useful in the US where renting a car is a common mode of transport.

Importance of Choosing the Right Policy

With a wide array of travel insurance providers and policies available, choosing the right one can be a daunting task. It’s essential to carefully review the terms and conditions, understand the exclusions, and ensure the policy aligns with your specific travel needs. Consider factors such as the length of your trip, the activities you plan to engage in, and any pre-existing medical conditions you might have. Some policies offer customizable options, allowing you to tailor the coverage to your preferences and budget.

| Coverage Type | Description |

|---|---|

| Medical Emergency | Covers sudden illnesses and injuries. |

| Trip Cancellation | Reimburses prepaid expenses if you need to cancel. |

| Emergency Evacuation | Provides for transport to safe locations or specialized medical facilities. |

| Lost Baggage | Reimburses for essential items if luggage is lost or delayed. |

| Rental Car Damage | Covers damage to rental vehicles. |

Traveling to the US: A Comprehensive Guide to Insurance

Traveling to the United States can be an exhilarating experience, offering a plethora of cultural, natural, and urban attractions. However, ensuring a smooth and stress-free journey requires careful planning, especially when it comes to travel insurance. This section will provide an in-depth guide to help travelers navigate the intricacies of travel insurance for their US adventures.

Assessing Your Insurance Needs

Before purchasing any travel insurance policy, it’s crucial to evaluate your specific needs and the potential risks associated with your trip. Consider the following factors:

- Duration of Stay: Longer trips may require more comprehensive coverage, especially if you plan to engage in various activities.

- Travel Activities: If you intend to participate in extreme sports or adventure activities, ensure your policy covers such pursuits. Some standard policies may exclude these activities.

- Pre-Existing Medical Conditions: If you have any ongoing health issues, it’s vital to choose a policy that covers pre-existing conditions. Otherwise, you may not be eligible for coverage if a related issue arises during your trip.

- Destination-Specific Risks: Research potential risks associated with your destination, such as natural disasters or political unrest. Ensure your policy covers such eventualities.

Comparing Insurance Providers and Policies

The market is abundant with travel insurance providers, each offering a unique set of policies. Here’s a guide to help you navigate the process of comparing and choosing the best option:

- Research Reputable Providers: Start by researching well-known and trusted travel insurance companies. Look for providers that have a good reputation and offer policies tailored to US travel.

- Compare Coverage and Benefits: Examine the fine print of each policy. Compare the coverage limits, exclusions, and any additional benefits or perks offered. Ensure the policy covers all the key areas you’ve identified as important for your trip.

- Consider Customer Reviews: Read reviews from previous customers to get an idea of the provider’s service quality and claim settlement process. This can provide valuable insights into the real-world experience of using the insurance.

- Evaluate Cost vs. Benefits: While cost is an important factor, it shouldn’t be the sole determinant. Assess the value of the policy based on the coverage it provides relative to the premium. A more expensive policy may be worth it if it offers superior benefits and a smoother claim process.

- Check for Customizable Options: Some providers offer the flexibility to customize your policy, allowing you to add or remove certain coverages based on your needs. This can be a cost-effective way to ensure you’re not paying for coverage you don’t need.

Understanding Exclusions and Limitations

Every travel insurance policy has certain exclusions and limitations. It’s crucial to understand these to avoid any unpleasant surprises in the event of a claim. Here are some common exclusions to be aware of:

- Pre-Existing Conditions: Many policies will not cover medical issues related to pre-existing conditions unless specifically stated otherwise.

- Hazardous Activities: Activities like skydiving, bungee jumping, or certain winter sports may be excluded from standard policies. Ensure your policy covers these if you plan to participate.

- Political Unrest and Natural Disasters: While some policies may cover trip cancellations due to these events, they may not cover personal injury or other losses. Check the fine print to understand the extent of coverage.

- Deliberate Actions: Actions taken knowingly to cause harm or damage may not be covered, such as engaging in fights or intentionally damaging property.

Filing a Claim: A Step-by-Step Guide

In the unfortunate event that you need to make a claim, having a clear understanding of the process can make it less stressful. Here’s a step-by-step guide:

- Notify the Insurance Company: As soon as possible, contact your insurance provider to inform them of the incident and initiate the claim process. Many providers have dedicated claim hotlines that are operational 24⁄7.

- Gather Necessary Documentation: This may include medical reports, police reports, receipts for expenses incurred, and any other relevant documents that support your claim. Keep digital copies of these as well.

- Complete the Claim Form: Your insurance provider will provide a claim form that needs to be filled out accurately and completely. Ensure you understand all the questions and provide detailed responses.

- Submit the Claim: Once you’ve gathered all the necessary documentation and completed the claim form, submit it to your insurance provider following their specified process. This may be via email, their online portal, or by post.

- Follow Up: Keep a record of all communications with the insurance company. If you don’t hear back within a reasonable timeframe, follow up to ensure your claim is being processed.

Additional Tips for a Smooth Journey

Here are some extra tips to ensure your journey to the US is as smooth and enjoyable as possible:

- Ensure your travel documents, including your passport and visa (if required), are valid and up-to-date.

- Make digital copies of all important documents and store them securely. This includes your travel insurance policy, itinerary, and any other important papers.

- Keep the emergency contact details of your insurance provider readily accessible during your trip.

- Understand the local laws and customs of the places you’re visiting to avoid any unintentional violations.

- Consider purchasing travel insurance that offers 24⁄7 assistance services, which can provide support for a range of issues, from medical emergencies to lost passports.

Can I purchase travel insurance after I've already started my trip to the US?

+While it's ideal to purchase travel insurance before your trip, some providers do offer coverage that can be purchased during the trip. However, this is often more expensive and may not cover pre-existing conditions or events that occurred before the policy was purchased.

What happens if I need to cancel my trip to the US due to a family emergency or severe weather conditions?

+If you have purchased travel insurance that includes trip cancellation coverage, you may be eligible for reimbursement of your prepaid expenses. However, you will typically need to provide documentation, such as a doctor's note or a weather alert, to support your claim.

Are there any activities or destinations in the US that are typically excluded from standard travel insurance policies?

+Yes, some activities like skiing, snowboarding, or extreme sports may require additional coverage. Additionally, certain destinations known for political unrest or natural disasters may also have specific exclusions. It's important to review your policy's fine print to understand these exclusions.

Travel insurance is a crucial aspect of responsible travel planning, offering peace of mind and financial protection during your journey. By understanding the nuances of travel insurance for the US and carefully selecting the right policy, you can ensure that your travels are as stress-free and enjoyable as possible.