Travelers Home Insurance Quote

Travelers Home Insurance is a renowned provider in the insurance industry, offering comprehensive coverage options to homeowners across the United States. Understanding the importance of tailored protection for your home, Travelers aims to provide accurate and competitive quotes to ensure you find the right coverage at an affordable price. In this article, we will delve into the process of obtaining a Travelers Home Insurance quote, exploring the key factors that influence rates and providing valuable insights to help you make an informed decision.

Understanding Travelers Home Insurance Quotes

Travelers Home Insurance offers a wide range of coverage options, allowing homeowners to customize their policies based on their specific needs. The quote process begins with an assessment of various factors that contribute to the overall risk associated with insuring your home. These factors include the location, age, and construction of your home, as well as any additional features or upgrades that may impact the cost of insurance.

By evaluating these elements, Travelers can provide a personalized quote that reflects the unique characteristics of your property. It's important to note that quotes are not set in stone and may be subject to change based on additional information provided during the application process. Travelers strives to offer accurate and competitive rates, ensuring that homeowners receive the coverage they need without unnecessary financial burden.

Factors Influencing Travelers Home Insurance Quotes

Several key factors play a significant role in determining the cost of your Travelers Home Insurance quote. These factors include:

- Location: The geographical location of your home is a crucial factor. Different regions have varying levels of risk, such as susceptibility to natural disasters like hurricanes, tornadoes, or wildfires. Travelers considers these regional risks when calculating your quote.

- Home Construction and Age: The construction materials and age of your home impact its vulnerability to damage. Older homes may require more extensive coverage, as they may be more susceptible to certain types of damage. Travelers takes into account the construction quality and age of your home when assessing the quote.

- Home Value and Size: The value and size of your home directly influence the cost of insurance. A larger home with higher-end finishes and valuable possessions will generally require more extensive coverage, resulting in a higher premium.

- Deductibles and Coverage Limits: Travelers offers flexibility in choosing deductibles and coverage limits. Opting for higher deductibles can lower your premium, while selecting higher coverage limits ensures more comprehensive protection. It's essential to strike a balance between affordability and adequate coverage.

- Additional Features and Upgrades : Upgrades such as security systems, storm shutters, or reinforced roofing can impact your insurance quote. These features demonstrate a commitment to risk mitigation and may result in lower premiums. Travelers recognizes these enhancements and adjusts quotes accordingly.

| Factor | Description |

|---|---|

| Location | Regional risks, including natural disasters, influence the quote. |

| Home Construction and Age | The construction materials and age of your home impact the vulnerability to damage. |

| Home Value and Size | The size and value of your home determine the extent of coverage needed. |

| Deductibles and Coverage Limits | Choosing higher deductibles can lower premiums, while higher coverage limits provide more protection. |

| Additional Features and Upgrades | Upgrades like security systems or storm shutters can lead to lower insurance costs. |

The Travelers Home Insurance Quote Process

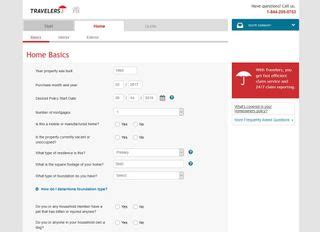

The process of obtaining a Travelers Home Insurance quote is designed to be straightforward and convenient. Here’s a step-by-step guide to help you navigate the quote process:

- Gather Information: Before initiating the quote process, gather essential information about your home. This includes details such as the address, construction materials, age, square footage, and any notable upgrades or additions. Having this information readily available will streamline the quote process.

- Contact Travelers: You can contact Travelers Home Insurance through their official website or by calling their customer service hotline. Travelers provides multiple channels for communication, ensuring accessibility and convenience for potential customers.

- Provide Home Details: During the quote process, you will be asked to provide specific details about your home. This information helps Travelers assess the risks associated with your property and determine an accurate quote. Be prepared to share details such as the type of roof, any recent renovations, and the value of your possessions.

- Discuss Coverage Options: Travelers offers a range of coverage options to protect your home and its contents. Discuss your specific needs and concerns with a Travelers representative. They can guide you through the different coverage options, such as liability protection, personal property coverage, and additional living expenses, ensuring you understand the benefits and costs associated with each.

- Review and Compare Quotes: Travelers will provide you with a personalized quote based on the information you have provided. Take the time to review the quote thoroughly, paying attention to the coverage limits, deductibles, and any exclusions or limitations. Compare the quote with other insurance providers to ensure you are getting the best value for your money.

- Make an Informed Decision: After reviewing and comparing quotes, make an informed decision about whether Travelers Home Insurance is the right choice for you. Consider factors such as coverage adequacy, customer service reputation, and the overall value offered. If you have any questions or concerns, don't hesitate to reach out to Travelers for further clarification.

Tips for Optimizing Your Travelers Home Insurance Quote

To ensure you receive the most accurate and competitive Travelers Home Insurance quote, consider the following tips:

- Shop Around: Compare quotes from multiple insurance providers, including Travelers, to gain a comprehensive understanding of the market rates. This will help you identify the best value for your insurance needs.

- Bundle Policies: If you have multiple insurance needs, such as auto insurance or umbrella policies, consider bundling them with your home insurance. Many insurance providers, including Travelers, offer discounts for bundling multiple policies, resulting in potential savings.

- Review Coverage Annually: Insurance needs can change over time. Regularly review your coverage to ensure it aligns with your current circumstances. This includes considering any recent renovations, changes in possessions, or shifts in your financial situation. By staying updated, you can optimize your coverage and potentially lower your insurance costs.

- Maintain a Clean Claims History: A clean claims history can positively impact your insurance quote. Avoid making unnecessary claims for minor issues, as this may result in higher premiums. By practicing responsible claim management, you can maintain a positive relationship with your insurance provider and potentially enjoy more favorable rates.

Travelers Home Insurance: A Trusted Provider

Travelers Home Insurance has established itself as a trusted provider in the insurance industry, known for its comprehensive coverage options and dedication to customer satisfaction. With a rich history spanning over 160 years, Travelers has earned a reputation for reliability and innovation. The company’s commitment to staying at the forefront of the industry ensures that homeowners receive the protection they need, tailored to their unique circumstances.

Benefits of Choosing Travelers Home Insurance

Travelers Home Insurance offers a multitude of benefits to homeowners, including:

- Comprehensive Coverage: Travelers provides a wide range of coverage options, allowing homeowners to customize their policies based on their specific needs. From standard coverage for structural damage to specialized endorsements for valuable possessions, Travelers ensures that your home and belongings are adequately protected.

- Experienced Claims Handling: Travelers boasts a team of experienced claims professionals who are dedicated to providing efficient and compassionate support during times of need. With a focus on timely claim resolution, Travelers aims to minimize the stress and inconvenience associated with insurance claims.

- Innovative Tools and Resources: Travelers understands the importance of staying ahead in the digital age. They offer a range of innovative tools and resources to enhance the customer experience. This includes online policy management, mobile apps for convenient access, and digital claim filing, ensuring that homeowners can manage their insurance needs with ease and efficiency.

- Excellent Customer Service: Travelers prioritizes customer satisfaction and is renowned for its exceptional customer service. The company's dedicated team of professionals is committed to providing personalized support, answering questions, and addressing concerns promptly. With a focus on building long-term relationships, Travelers ensures that homeowners receive the guidance and assistance they need throughout their insurance journey.

The Future of Travelers Home Insurance

As the insurance industry continues to evolve, Travelers Home Insurance remains committed to staying at the forefront of innovation. The company is continuously investing in technology and digital solutions to enhance the customer experience and streamline the insurance process. By leveraging data analytics and emerging technologies, Travelers aims to provide even more accurate and personalized quotes, ensuring that homeowners receive the coverage they need at competitive rates.

Additionally, Travelers is focused on expanding its reach and accessibility. The company is actively working to make insurance more inclusive and affordable for a wider range of homeowners. Through partnerships and initiatives, Travelers aims to break down barriers and provide equal access to quality insurance coverage, ensuring that every homeowner can protect their most valuable asset.

Conclusion

Travelers Home Insurance is a trusted provider, offering comprehensive coverage and exceptional customer service. By understanding the factors that influence insurance quotes and following the provided tips, homeowners can obtain accurate and competitive quotes from Travelers. With its rich history, innovative approach, and dedication to customer satisfaction, Travelers continues to be a leading choice for homeowners seeking reliable and tailored insurance protection.

How long does it take to receive a Travelers Home Insurance quote?

+

The time it takes to receive a Travelers Home Insurance quote can vary depending on several factors. Generally, you can expect to receive a quote within a few business days after providing the necessary information. However, in some cases, it may take longer if additional details or documentation are required. Travelers aims to provide timely quotes, but it’s essential to be patient and provide accurate information to ensure an accurate assessment of your insurance needs.

Can I customize my Travelers Home Insurance policy to include specific coverage options?

+

Absolutely! Travelers Home Insurance understands that every homeowner has unique needs. They offer a wide range of coverage options, allowing you to customize your policy to suit your specific circumstances. Whether you require additional coverage for valuable possessions, liability protection, or coverage for specific risks, Travelers can work with you to create a personalized policy that provides the protection you need.

Are there any discounts available with Travelers Home Insurance?

+

Yes, Travelers Home Insurance offers a variety of discounts to help homeowners save on their insurance premiums. These discounts may include multi-policy discounts for bundling your home and auto insurance, loyalty discounts for long-term customers, and safety discounts for homes equipped with certain safety features like smoke detectors or security systems. It’s always worth inquiring about potential discounts when obtaining a quote to maximize your savings.