Type Of Auto Insurance Coverage

Understanding the different types of auto insurance coverage is crucial for anyone looking to protect their vehicle and themselves financially. Auto insurance is a complex subject, with various policies and coverage options available, each designed to address specific risks and liabilities associated with owning and operating a motor vehicle. This article aims to provide a comprehensive guide to the different types of auto insurance coverage, helping you make informed decisions to ensure you have the right protection for your needs.

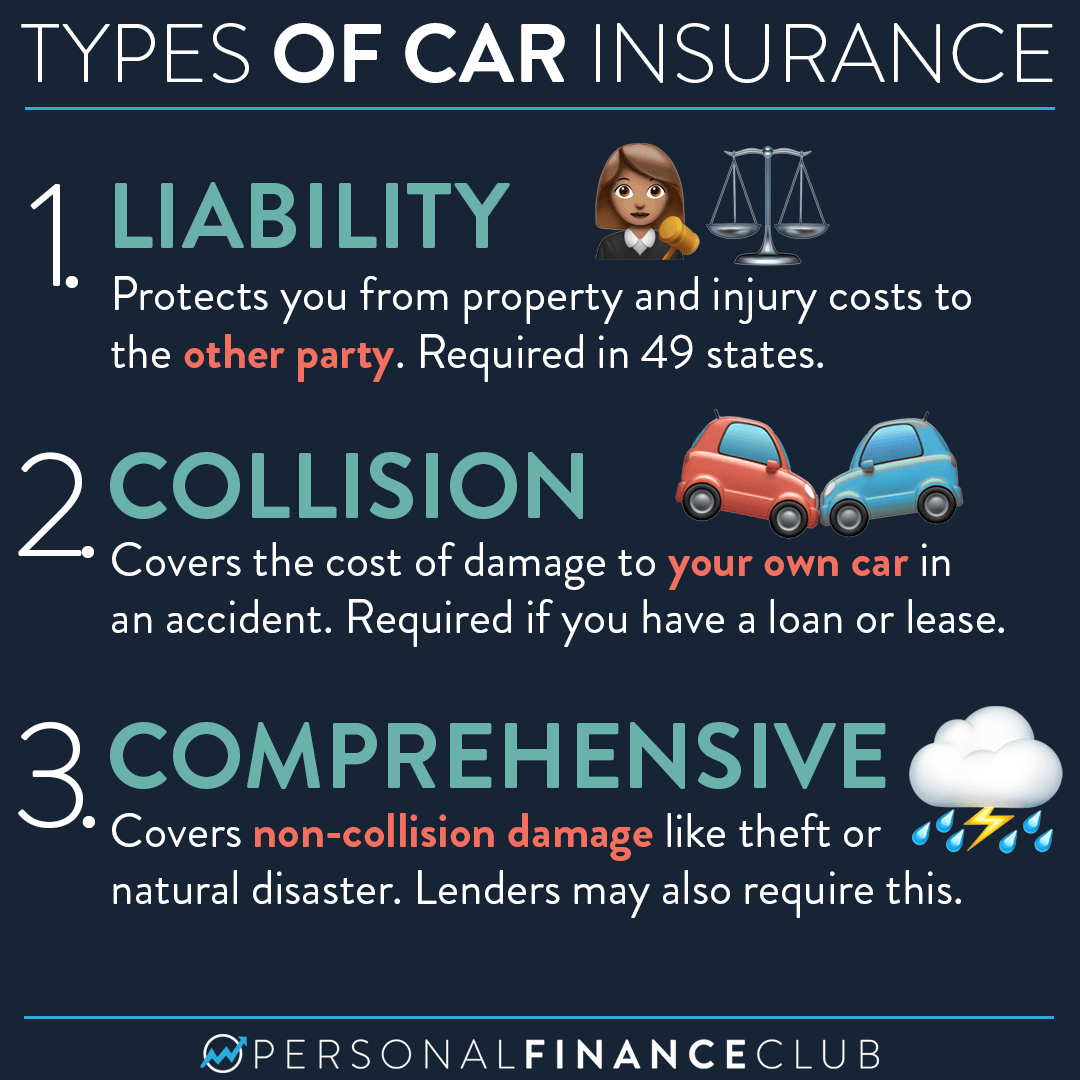

Liability Coverage: Protecting Others

Liability coverage is the most fundamental type of auto insurance and is often mandatory by law. It provides financial protection in the event that you are found legally responsible for causing an accident that results in bodily injury or property damage to others.

Bodily Injury Liability

Bodily injury liability coverage protects you from claims made by others for injuries they sustain in an accident caused by you. This coverage typically includes medical expenses, lost wages, and pain and suffering. It’s important to note that the limits of this coverage can vary greatly depending on your policy, and it’s recommended to choose limits that provide adequate protection.

| Coverage Type | Description |

|---|---|

| Bodily Injury Per Person | The maximum amount your insurance will pay for injuries to one person. |

| Bodily Injury Per Accident | The maximum amount your insurance will pay for injuries to multiple people in one accident. |

Property Damage Liability

Property damage liability coverage covers the cost of repairing or replacing others’ property damaged in an accident for which you are responsible. This could include vehicles, buildings, fences, and other property. Like bodily injury liability, it’s crucial to select appropriate limits to ensure you are adequately protected.

| Coverage Type | Description |

|---|---|

| Property Damage Liability | The maximum amount your insurance will pay for property damage in an accident. |

Comprehensive and Collision Coverage: Protecting Your Vehicle

Comprehensive and collision coverage are two types of auto insurance that provide protection for your own vehicle, rather than for other people or property.

Collision Coverage

Collision coverage is designed to cover the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault. This coverage is particularly beneficial if you own a newer or more expensive vehicle, as it can help cover the full cost of repairs or provide a replacement vehicle if yours is totaled.

| Coverage Type | Description |

|---|---|

| Collision Deductible | The amount you pay out-of-pocket before your insurance coverage kicks in. |

| Collision Coverage Limit | The maximum amount your insurance will pay for collision-related damages. |

Comprehensive Coverage

Comprehensive coverage, often referred to as “other than collision” coverage, protects your vehicle from damage caused by events other than collisions. This includes theft, vandalism, natural disasters, and damage caused by animals. Comprehensive coverage is an important addition to your policy if you want to ensure your vehicle is protected from a wide range of potential risks.

| Coverage Type | Description |

|---|---|

| Comprehensive Deductible | The amount you must pay out-of-pocket before your comprehensive coverage applies. |

| Comprehensive Coverage Limit | The maximum amount your insurance will pay for comprehensive-related claims. |

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage are designed to cover the medical expenses and other related costs incurred by you and your passengers in the event of an accident, regardless of fault.

Personal Injury Protection (PIP)

PIP coverage, often mandatory in no-fault states, provides benefits for medical expenses, lost wages, and other related costs for you and your passengers. It can also cover funeral expenses and provide compensation for pain and suffering. PIP coverage ensures that you and your passengers are taken care of financially after an accident, regardless of who is at fault.

| Coverage Type | Description |

|---|---|

| PIP Coverage Limit | The maximum amount your insurance will pay for PIP-related expenses. |

Medical Payments Coverage

Medical Payments coverage, or MedPay, is similar to PIP but typically has lower limits and a broader range of coverage. It covers medical expenses for you and your passengers, regardless of fault, and can also cover funeral expenses. MedPay is often an affordable option to ensure you have some medical coverage in the event of an accident.

| Coverage Type | Description |

|---|---|

| Medical Payments Coverage Limit | The maximum amount your insurance will pay for medical-related expenses. |

Uninsured/Underinsured Motorist Coverage

Uninsured and Underinsured Motorist coverage provides protection for you and your passengers in the event that you are involved in an accident with a driver who either has no insurance or does not have enough insurance to cover the damages.

Uninsured Motorist Coverage

Uninsured Motorist coverage protects you when an at-fault driver in an accident does not have liability insurance. This coverage can help cover your medical expenses, lost wages, and other related costs. It ensures that you are not left financially responsible for an accident caused by an uninsured driver.

Underinsured Motorist Coverage

Underinsured Motorist coverage comes into play when the at-fault driver’s liability insurance limits are not sufficient to cover the full extent of the damages caused by the accident. This coverage can help bridge the gap between the other driver’s insurance limits and the actual cost of your injuries and property damage.

| Coverage Type | Description |

|---|---|

| Uninsured/Underinsured Motorist Coverage Limit | The maximum amount your insurance will pay for claims related to uninsured or underinsured motorists. |

Additional Coverage Options

Beyond the basic types of auto insurance coverage, there are several additional options that you may want to consider based on your specific needs and circumstances.

Rental Car Coverage

Rental car coverage, also known as loss damage waiver (LDW), provides protection when you rent a car. It covers the cost of renting a replacement vehicle if your own car is damaged or stolen. This coverage can be particularly useful if you frequently rent cars or plan to do so in the future.

Gap Insurance

Gap insurance, or Guaranteed Auto Protection, is designed to cover the difference between the actual cash value of your vehicle and the amount you still owe on your auto loan or lease. This coverage is especially important if you have a newer vehicle or one with a high loan-to-value ratio, as it ensures you are not left with a financial burden if your vehicle is totaled.

Roadside Assistance

Roadside assistance coverage provides emergency services such as towing, battery jumps, flat tire changes, and fuel delivery. This coverage can be a lifesaver in unexpected situations, offering peace of mind and quick assistance when you need it most.

Custom Parts and Equipment Coverage

If you have customized your vehicle with aftermarket parts or equipment, this coverage ensures that these modifications are protected in the event of an accident or other covered loss. It’s an important consideration for vehicle enthusiasts who have invested in enhancing their rides.

Accidental Death and Dismemberment (AD&D) Coverage

AD&D coverage provides a benefit payment to your beneficiaries in the event of your death or dismemberment (loss of a limb or other body part) resulting from a covered auto accident. This coverage can provide financial security for your loved ones in the event of a tragic accident.

Conclusion: Tailoring Your Auto Insurance Coverage

Choosing the right auto insurance coverage is a highly personal decision that depends on a variety of factors, including your state’s laws, your financial situation, and your specific needs. It’s important to review your coverage regularly and adjust it as your circumstances change. By understanding the different types of auto insurance coverage available, you can make informed choices to ensure you have the protection you need.

What is the difference between liability and collision coverage?

+Liability coverage is for accidents where you are at fault and covers the cost of injuries and property damage to others. Collision coverage, on the other hand, covers the cost of repairing or replacing your own vehicle after an accident, regardless of fault.

Is comprehensive coverage necessary for all vehicles?

+Comprehensive coverage is beneficial for all vehicles, as it provides protection against a wide range of risks beyond collisions. However, the decision to include comprehensive coverage in your policy depends on factors such as the value of your vehicle, your budget, and your personal risk tolerance.

How does PIP coverage differ from Medical Payments coverage?

+PIP coverage is typically more comprehensive and often mandatory in no-fault states. It covers a broader range of expenses, including lost wages and pain and suffering. Medical Payments coverage, while similar, usually has lower limits and a more limited scope of coverage.

Why is uninsured motorist coverage important?

+Uninsured motorist coverage is crucial because it provides protection for you and your passengers in the event that you are involved in an accident with a driver who has no liability insurance. Without this coverage, you would be left to cover the costs of your injuries and property damage out of pocket.