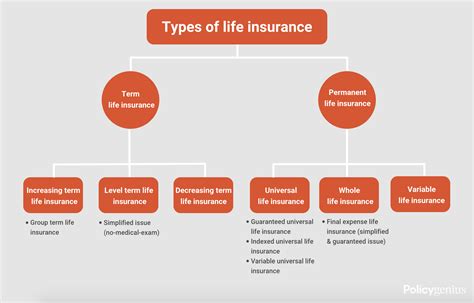

Types Life Insurance

Life insurance is an essential financial tool that provides peace of mind and security to individuals and their loved ones. With various types of life insurance policies available, understanding the nuances and benefits of each can be crucial in making informed decisions. In this comprehensive guide, we delve into the different types of life insurance, exploring their unique features, advantages, and real-world applications.

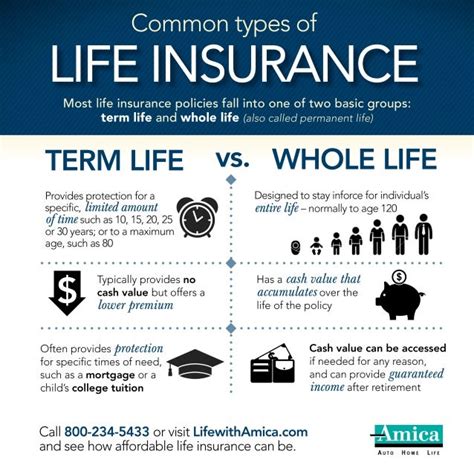

Term Life Insurance

Term life insurance is a fundamental type of coverage that offers protection for a specified period, known as the term. This type of policy provides a death benefit to the beneficiaries in the event of the policyholder’s demise during the term. Here’s a closer look at term life insurance and its key attributes:

Policy Features

- Coverage Period: Term life insurance typically offers coverage for a fixed duration, ranging from 10 to 30 years. Policyholders can choose a term that aligns with their specific needs and life stage.

- Affordable Premiums: One of the significant advantages of term life insurance is its affordability. Premiums are generally lower compared to other types of life insurance, making it an accessible option for individuals on a budget.

- Renewal Options: Most term life policies provide the flexibility to renew the coverage at the end of the term. Renewal may involve a medical exam or a change in premium rates based on the policyholder’s age and health status.

- Conversion Privilege: Some term life policies offer the option to convert the coverage to a permanent life insurance policy without undergoing a medical exam. This feature can be beneficial for individuals who wish to transition to permanent coverage later in life.

Real-World Applications

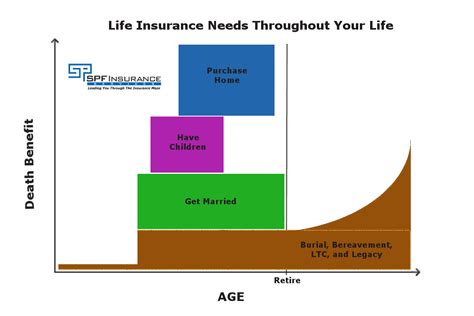

Term life insurance is an excellent choice for individuals seeking temporary coverage to protect their families during specific life stages. For instance, a young couple with growing children might opt for term life insurance to ensure financial stability in the event of an untimely demise. The coverage can help cover mortgage payments, education expenses, and daily living costs, providing a safety net for the surviving family members.

Whole Life Insurance

Whole life insurance, also known as permanent or cash value life insurance, offers lifelong coverage and accumulates cash value over time. Unlike term life insurance, whole life policies provide a guaranteed death benefit and offer additional financial benefits. Here’s an overview of whole life insurance and its unique characteristics:

Policy Features

- Lifetime Coverage: Whole life insurance policies provide coverage for the policyholder’s entire life, ensuring peace of mind and financial security.

- Guaranteed Death Benefit: The policy guarantees a specified death benefit to the beneficiaries upon the policyholder’s passing. This benefit remains fixed throughout the policy’s duration.

- Cash Value Accumulation: Whole life insurance policies build cash value over time, which can be accessed through policy loans or withdrawals. The cash value grows tax-deferred, providing a valuable financial asset.

- Fixed Premiums: Policyholders pay a fixed premium amount throughout the policy’s duration, offering predictability and stability in financial planning.

- Policy Loans and Withdrawals: Policyholders can borrow against the cash value or withdraw a portion of it, subject to certain conditions and limitations.

Real-World Applications

Whole life insurance is an ideal choice for individuals seeking long-term financial protection and stability. It is often preferred by those with significant financial obligations, such as business owners or individuals with substantial debt. The cash value accumulation feature allows policyholders to build a financial reserve, which can be used for various purposes, including retirement planning, estate planning, or covering unexpected expenses.

Universal Life Insurance

Universal life insurance is a flexible type of permanent life insurance that offers policyholders control over their premiums and death benefits. This type of policy combines the protection of life insurance with the flexibility of a cash value account. Here’s an exploration of universal life insurance and its key attributes:

Policy Features

- Flexible Premiums: Universal life insurance allows policyholders to adjust their premium payments within certain limits. This flexibility accommodates changing financial circumstances and enables policyholders to customize their coverage.

- Adjustable Death Benefit: Policyholders can increase or decrease the death benefit amount based on their needs and financial goals. This feature provides adaptability as life circumstances evolve.

- Cash Value Account: Similar to whole life insurance, universal life policies build cash value over time. However, the growth of the cash value account is tied to the performance of an underlying investment account, offering potential for higher returns.

- Policy Loans and Withdrawals: Policyholders can access the cash value through policy loans or withdrawals, providing financial flexibility.

- Death Benefit Guarantee: Despite the flexibility in premiums and death benefits, universal life insurance policies typically guarantee a minimum death benefit, ensuring protection for beneficiaries.

Real-World Applications

Universal life insurance is an attractive option for individuals seeking a balance between financial flexibility and long-term protection. It is particularly beneficial for those with fluctuating income or those who wish to optimize their insurance coverage based on changing financial goals. The ability to adjust premiums and death benefits allows policyholders to make informed decisions aligned with their financial strategies.

Variable Life Insurance

Variable life insurance is a type of permanent life insurance that offers policyholders the opportunity to invest a portion of their premiums in different investment vehicles. This type of policy combines the protection of life insurance with the potential for higher investment returns. Here’s an insight into variable life insurance and its unique features:

Policy Features

- Investment Options: Variable life insurance policies provide policyholders with a range of investment options, such as stocks, bonds, and mutual funds. The policyholder’s premiums are allocated to these investments, offering the potential for higher returns.

- Flexible Premiums: Similar to universal life insurance, variable life policies allow policyholders to adjust their premium payments within certain limits. This flexibility enables policyholders to manage their coverage based on their financial circumstances.

- Cash Value Growth: The cash value account in variable life insurance grows based on the performance of the chosen investments. Policyholders can monitor and adjust their investment strategy to align with their risk tolerance and financial goals.

- Death Benefit Guarantee: Despite the investment component, variable life insurance policies typically guarantee a minimum death benefit, ensuring financial protection for beneficiaries.

Real-World Applications

Variable life insurance is an attractive choice for individuals who are comfortable with investment risk and seek the potential for higher returns. It is often preferred by those with a long-term financial horizon and a desire to maximize their investment potential. The ability to choose investment options allows policyholders to tailor their coverage to their specific financial goals and risk appetite.

Guaranteed Issue Life Insurance

Guaranteed issue life insurance is a specialized type of policy designed for individuals who may have difficulty securing traditional life insurance due to health or age-related factors. This type of insurance offers simplified underwriting and guarantees coverage without a medical exam. Here’s an overview of guaranteed issue life insurance and its unique characteristics:

Policy Features

- Simplified Underwriting: Guaranteed issue life insurance policies have a streamlined application process, often without the need for a medical exam. This simplifies the application procedure and makes it accessible to individuals with pre-existing health conditions.

- Guaranteed Acceptance: Policyholders are guaranteed acceptance regardless of their health status or age. This feature provides coverage to individuals who may be denied traditional life insurance due to health reasons.

- Limited Coverage: Guaranteed issue life insurance policies typically offer lower coverage amounts compared to traditional life insurance. The death benefit may be limited, ranging from 5,000 to 25,000.

- Waiting Period: Some guaranteed issue policies have a waiting period before the full death benefit becomes effective. During this period, the policy may only cover accidental deaths or provide a limited death benefit.

Real-World Applications

Guaranteed issue life insurance is a valuable option for individuals who face challenges in securing traditional life insurance. It provides a safety net for those with health concerns or limited access to standard insurance policies. While the coverage amounts may be lower, it ensures that beneficiaries receive a financial benefit in the event of the policyholder’s passing.

Group Life Insurance

Group life insurance is a type of coverage offered through an employer, association, or other organization. This type of policy provides life insurance benefits to a group of individuals, often at a discounted rate. Here’s an exploration of group life insurance and its key features:

Policy Features

- Employer-Provided Coverage: Group life insurance is typically offered as a benefit by employers or organizations. It provides life insurance coverage to employees or members at a group rate, often at a more affordable cost.

- Simplified Application Process: Group life insurance policies often have a simplified application process, requiring minimal paperwork and no medical exam. This convenience makes it accessible to a larger group of individuals.

- Coverage Amounts: The coverage amounts in group life insurance policies can vary, but they are typically lower compared to individual life insurance policies. However, the coverage can be a valuable supplement to an individual’s financial plan.

- Portability: In some cases, group life insurance policies can be portable, meaning employees can continue their coverage even after leaving the employer. This feature provides flexibility and continuity in life insurance coverage.

Real-World Applications

Group life insurance is an attractive option for employees or members of organizations who seek affordable life insurance coverage. It provides a convenient and cost-effective way to secure financial protection for oneself and one’s family. The simplified application process and potential portability make it an accessible choice for many individuals.

Conclusion: Choosing the Right Life Insurance

Understanding the different types of life insurance is crucial in making informed decisions about your financial protection and the well-being of your loved ones. Each type of life insurance policy has its unique features, advantages, and real-world applications. Whether you seek temporary coverage, long-term financial stability, investment opportunities, or simplified underwriting, there is a life insurance policy tailored to your needs.

When choosing the right life insurance, consider your life stage, financial goals, and the level of protection you desire. Consult with financial advisors or insurance professionals to assess your specific needs and explore the various policy options available. Remember, life insurance is a powerful tool to secure your family's future and provide the peace of mind that comes with financial security.

How do I know which type of life insurance is best for me?

+The choice of life insurance type depends on your specific needs, financial goals, and life stage. Consider factors such as coverage duration, affordability, cash value accumulation, and flexibility. Consulting with a financial advisor can help you assess your options and make an informed decision.

Can I have more than one type of life insurance policy?

+Yes, it is possible to have multiple life insurance policies. Some individuals choose to combine term life insurance with permanent life insurance to maximize their coverage and financial benefits. However, it’s essential to carefully evaluate your needs and consult with a professional to ensure an optimal strategy.

Are there any tax benefits associated with life insurance policies?

+Yes, certain types of life insurance policies, such as whole life and universal life, offer tax advantages. The cash value accumulation within these policies grows tax-deferred, and policy loans or withdrawals may have favorable tax treatment. Consult a tax advisor to understand the specific tax benefits applicable to your policy.

What happens if I outlive my term life insurance policy?

+If you outlive your term life insurance policy, the coverage expires, and you no longer have protection. However, many term life policies offer the option to renew the coverage or convert it to a permanent life insurance policy, providing continued protection.