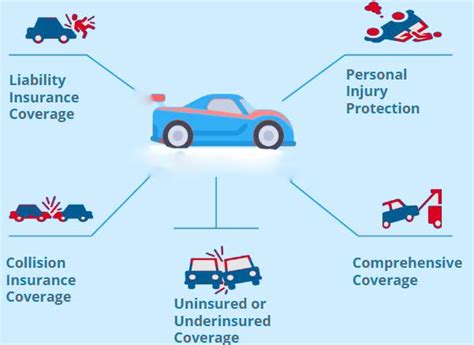

Types Of Auto Insurance

Understanding the various types of auto insurance is crucial for any vehicle owner, as it ensures you have the right coverage for your needs. Auto insurance, also known as motor insurance, is a contract between an insurance provider and a policyholder, offering financial protection against losses and liabilities associated with owning and operating a vehicle. This protection comes in different forms, and knowing the specifics of each type can help you make informed decisions when purchasing insurance.

Liability Insurance

Liability insurance is the most fundamental type of auto insurance. It provides coverage for bodily injury and property damage that you, as the policyholder, may cause to others while operating your vehicle. This coverage is mandatory in most states and is designed to protect you against financial loss in the event of an at-fault accident. Liability insurance typically includes two main components: Bodily Injury Liability and Property Damage Liability.

| Coverage Type | Description |

|---|---|

| Bodily Injury Liability | Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by you. |

| Property Damage Liability | Pays for repairs or replacement of property damaged in an accident, including vehicles, structures, and personal belongings. |

State-Specific Liability Requirements

Each state has its own liability insurance requirements, typically expressed in limits of coverage. For instance, the state of California mandates a minimum liability coverage of 15,000 for bodily injury per person</strong>, <strong>30,000 for bodily injury per accident, and $5,000 for property damage per accident, known as 15/30/5 coverage.

Collision Insurance

Collision insurance covers the cost of repairing or replacing your vehicle after an accident, regardless of fault. This type of insurance is particularly valuable for newer vehicles or those with a high replacement value. Collision coverage can help mitigate the financial impact of an accident, ensuring you’re not left with a large bill for vehicle repairs.

Collision Coverage Details

- Deductibles: Collision insurance often comes with a deductible, which is the amount you pay out of pocket before your insurance kicks in. Higher deductibles can lead to lower premiums.

- Coverage Limits: The amount of coverage you choose will impact your premium. It’s important to strike a balance between adequate coverage and affordability.

Comprehensive Insurance

Comprehensive insurance, also known as “other than collision” coverage, protects against damage to your vehicle caused by incidents other than collisions. This can include events like theft, vandalism, natural disasters, falling objects, and damage caused by animals. Comprehensive insurance provides an extra layer of protection for your vehicle, ensuring you’re covered for a wide range of unforeseen circumstances.

Examples of Comprehensive Coverage

- Damage from a tree branch falling on your car during a storm.

- Theft of your vehicle or its parts.

- Damage caused by a collision with an animal, such as a deer.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of auto insurance that covers medical expenses and lost wages for the policyholder and their passengers, regardless of fault. PIP is a no-fault insurance, meaning it provides benefits without regard to who caused the accident. This coverage is mandatory in some states and is designed to ensure prompt payment of medical bills and other related expenses after an accident.

PIP Coverage Benefits

- Medical Expenses: Covers doctor visits, hospital stays, and prescription medications.

- Lost Income: Reimburses a portion of wages lost due to injuries sustained in the accident.

- Rehabilitation Costs: Pays for physical therapy, chiropractic care, and other rehabilitation services.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist coverage provides protection in the event of an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage is designed to protect you from financial loss in these situations and is particularly important given the potential for significant financial liability in the event of an accident.

Scenarios for Uninsured/Underinsured Coverage

- You’re involved in a hit-and-run accident and the at-fault driver cannot be identified.

- An underinsured driver causes an accident, but their liability coverage is insufficient to cover your damages.

Medical Payments Coverage

Medical Payments coverage, often referred to as “MedPay,” provides coverage for medical expenses for the policyholder and their passengers, regardless of fault. This coverage is similar to Personal Injury Protection (PIP) but may have some differences in terms of covered expenses and state-specific requirements. MedPay is a valuable addition to your auto insurance policy, ensuring prompt payment of medical bills after an accident.

MedPay vs. PIP

While both cover medical expenses, PIP often provides more comprehensive coverage, including lost wages and rehabilitation costs. MedPay is typically a more limited coverage, focusing primarily on medical expenses.

Conclusion

Understanding the different types of auto insurance is essential for making informed decisions about your coverage. From liability insurance, which is mandatory in most states, to optional coverages like collision, comprehensive, and uninsured/underinsured motorist coverage, each type of insurance serves a specific purpose. By tailoring your auto insurance policy to your needs, you can ensure you’re protected against a wide range of risks and liabilities associated with owning and operating a vehicle.

What is the main purpose of liability insurance in auto insurance policies?

+Liability insurance is designed to protect the policyholder financially in the event they are found at fault in an accident. It covers bodily injury and property damage claims made against the policyholder by others involved in the accident.

How does comprehensive insurance differ from collision insurance in auto policies?

+Collision insurance covers damage to your vehicle caused by a collision with another vehicle or object, regardless of fault. Comprehensive insurance, on the other hand, covers damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

What is the primary benefit of Personal Injury Protection (PIP) in auto insurance?

+PIP provides prompt payment of medical expenses and other related costs for the policyholder and their passengers, regardless of fault in an accident. This coverage ensures that necessary medical care is accessible without delay.