Types Of Life Insurance Besides Term

Unveiling the World of Life Insurance: Beyond Term Policies

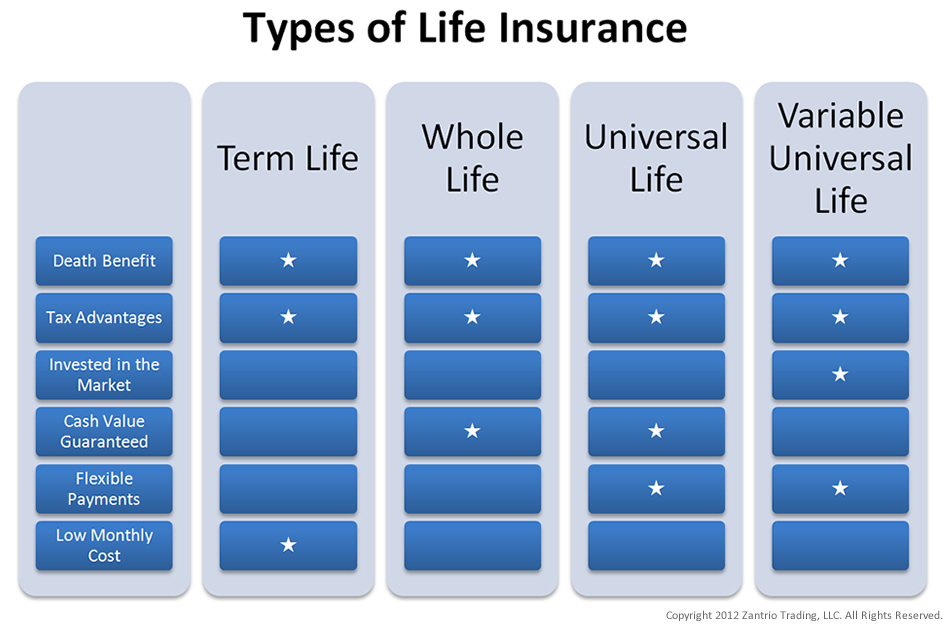

In the realm of financial planning and protection, life insurance stands as a cornerstone, offering individuals and families peace of mind and financial security. While term life insurance is often the first option that comes to mind, the insurance landscape is diverse and caters to various needs and preferences. This article delves into the realm of life insurance, shedding light on the array of options that exist beyond the conventional term policies.

Life insurance is a complex yet essential aspect of personal finance, providing a safety net for your loved ones in the event of your untimely demise. Beyond the basic term coverage, the market offers a plethora of policies tailored to specific financial goals, risk appetites, and life stages. Understanding these alternatives is crucial for making informed decisions that align with your unique circumstances.

Whole Life Insurance: The Timeless Coverage

Whole life insurance, also known as permanent life insurance, is a classic choice that offers lifetime coverage. Unlike term insurance, which provides coverage for a specified period, whole life policies remain in force as long as the premiums are paid. This makes it an attractive option for those seeking long-term financial protection and stability.

Key Features of Whole Life Insurance

- Guaranteed Death Benefit: Whole life policies guarantee a specific payout upon the insured's death, providing financial security for beneficiaries.

- Cash Value Accumulation: These policies accumulate cash value over time, which can be borrowed against or withdrawn, offering flexibility in financial planning.

- Fixed Premiums: Whole life insurance typically has level premiums, meaning the cost remains constant throughout the policy term, making it predictable and budget-friendly.

- Long-Term Financial Planning: With its longevity, whole life insurance can be a valuable tool for estate planning, business succession, and wealth transfer.

For instance, consider the case of Mr. Johnson, a successful entrepreneur who wants to ensure his business's continuity and provide for his family's long-term financial well-being. Whole life insurance would offer him the assurance that his loved ones are protected, and his business interests are safeguarded, regardless of unforeseen events.

Universal Life Insurance: Flexibility Meets Protection

Universal life insurance is a type of permanent life insurance that provides flexibility in premium payments and death benefits. It offers a unique blend of protection and investment, allowing policyholders to customize their coverage according to their changing needs.

Key Advantages of Universal Life Insurance

- Flexible Premiums: Policyholders can adjust the amount and frequency of premium payments, making it adaptable to changing financial circumstances.

- Cash Value Growth: Universal life insurance policies accumulate cash value, which can be used for various financial needs, such as retirement planning or emergency funds.

- Death Benefit Flexibility: The death benefit can be adjusted, allowing policyholders to increase or decrease coverage based on their needs and financial goals.

- Investment Options: Some universal life policies offer investment components, providing an opportunity for policyholders to grow their funds within the policy.

Take the example of Ms. Williams, a young professional with a growing family. Universal life insurance would enable her to increase her coverage as her family expands, while also utilizing the cash value for her children's education expenses or other financial milestones.

Variable Life Insurance: Growth Potential with Risk

Variable life insurance is a type of permanent life insurance that offers the potential for higher returns but also carries a higher level of risk. This policy combines life insurance coverage with an investment component, allowing policyholders to allocate their premiums to various investment options, such as stocks, bonds, and mutual funds.

Key Characteristics of Variable Life Insurance

- Investment Flexibility: Policyholders have the freedom to choose how their premiums are invested, providing an opportunity for potential higher returns.

- Death Benefit Variability: The death benefit in variable life insurance policies can fluctuate based on the performance of the chosen investments.

- Potential for Higher Returns: With the right investment choices, policyholders may achieve significant growth in their cash value, leading to a higher death benefit.

- Suitability for Risk Takers: This type of insurance is ideal for individuals who are comfortable with market risk and seek the potential for substantial growth.

Imagine Mr. Smith, a risk-averse investor who wants to maximize the growth potential of his life insurance policy. Variable life insurance would allow him to invest in a diversified portfolio, potentially leading to higher returns and a more substantial death benefit for his beneficiaries.

Guaranteed Issue Life Insurance: Coverage for All

Guaranteed issue life insurance is a unique type of policy that provides coverage to individuals who may not qualify for traditional life insurance due to health or age-related factors. This policy offers a simplified application process and does not require a medical exam, making it accessible to a wider range of individuals.

Key Attributes of Guaranteed Issue Life Insurance

- No Medical Exam Required: Applicants are not required to undergo a medical exam, making it ideal for individuals with health concerns or those who prefer a hassle-free application process.

- Simplified Application: The application process is straightforward and often involves answering a few basic health-related questions.

- Limited Coverage: Guaranteed issue policies typically have lower coverage limits compared to other life insurance types.

- Two-Year Waiting Period: There is often a two-year waiting period for the death benefit to be fully effective. Claims related to natural causes within this period may result in a reduced payout.

For individuals like Mrs. Garcia, who has a pre-existing medical condition, guaranteed issue life insurance provides a lifeline, offering her a chance to secure financial protection for her family without the hurdles of a traditional life insurance application.

Final Thoughts: Choosing the Right Life Insurance

The world of life insurance extends far beyond term policies, offering a range of options tailored to individual needs and circumstances. Whether it's the stability of whole life insurance, the flexibility of universal life, the growth potential of variable life, or the accessibility of guaranteed issue policies, there's a life insurance solution for everyone.

When selecting a life insurance policy, it's essential to consider your financial goals, risk tolerance, and long-term needs. Consulting with a financial advisor or insurance professional can provide valuable insights and guidance to ensure you make an informed decision that protects your loved ones and secures your financial future.

How do I determine which life insurance type is best for me?

+Choosing the right life insurance type depends on your financial goals, risk appetite, and personal circumstances. Consider your family’s needs, financial obligations, and long-term goals. Term life insurance may be suitable for those seeking coverage for a specific period, while permanent life insurance options like whole life, universal life, or variable life offer lifetime coverage and additional benefits. Consulting with a financial advisor can provide personalized guidance.

Can I switch from term life insurance to a permanent life insurance policy?

+Yes, it is possible to transition from term life insurance to a permanent life insurance policy. However, the process and options available may vary depending on your insurance provider and the terms of your existing policy. It’s advisable to review your policy and consult with your insurer or a financial advisor to understand the best approach for making the switch.

What are the potential drawbacks of variable life insurance?

+Variable life insurance carries higher risks compared to other life insurance types due to its investment component. The potential for higher returns also means there’s a risk of lower returns or even losses if the chosen investments perform poorly. Additionally, the death benefit can fluctuate, impacting the financial security provided to beneficiaries.

Is guaranteed issue life insurance a good option for everyone?

+Guaranteed issue life insurance has its advantages, especially for individuals with health concerns or those who may not qualify for traditional life insurance. However, it’s important to note that these policies often have limited coverage and a two-year waiting period. For individuals with specific financial needs and goals, other life insurance types may offer more comprehensive coverage and benefits.