Types Of Permanent Life Insurance

Unveiling the Different Types of Permanent Life Insurance: A Comprehensive Guide

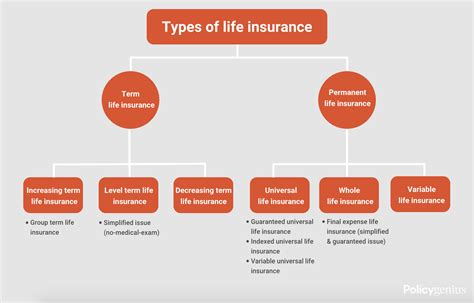

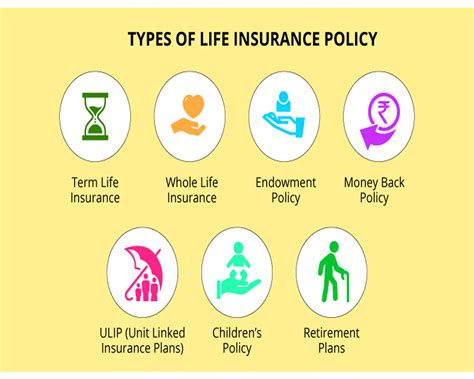

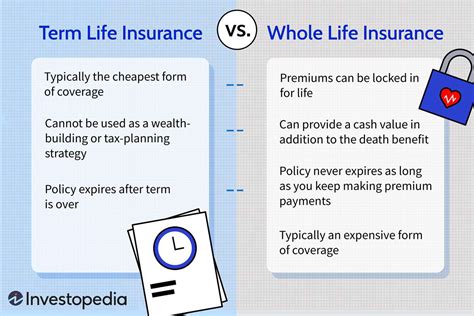

Permanent life insurance is an essential financial tool that provides long-term coverage and builds cash value over time. Unlike term life insurance, which offers coverage for a specific period, permanent life insurance remains in force for the insured's entire life, as long as the premiums are paid. This type of insurance is designed to offer financial protection and security to policyholders and their beneficiaries, ensuring a legacy for future generations.

In this comprehensive guide, we will delve into the various types of permanent life insurance policies available in the market, exploring their unique features, benefits, and suitability for different individuals and their financial goals. By understanding the nuances of each type, you can make an informed decision and choose the policy that best aligns with your needs and aspirations.

Whole Life Insurance: The Traditional Anchor of Permanent Coverage

Whole life insurance is the cornerstone of permanent life insurance policies. It provides lifelong coverage, ensuring that the insured's beneficiaries receive a guaranteed death benefit, regardless of when the insured passes away. Whole life insurance is characterized by its consistent and predictable premiums, which remain fixed throughout the policy's duration. This stability offers peace of mind and allows policyholders to plan their finances with confidence.

One of the key advantages of whole life insurance is its cash value accumulation. A portion of the premiums paid goes towards building a cash value account within the policy. This cash value grows tax-deferred over time and can be accessed through policy loans or withdrawals, providing a source of funds for various financial needs, such as education expenses, emergency funds, or even retirement income. The cash value can also be used to pay premiums during financial hardships, ensuring the policy remains active.

Whole life insurance policies often include flexible investment options, allowing policyholders to choose how their cash value is invested. These options may include fixed-income investments, equity-based funds, or a combination of both. By diversifying the investment strategy, policyholders can optimize their cash value growth and potentially increase their policy's overall value.

| Key Features of Whole Life Insurance |

|---|

| Fixed Premiums |

| Guaranteed Death Benefit |

| Cash Value Accumulation |

| Flexible Investment Options |

Universal Life Insurance: Customizable and Flexible Protection

Universal life insurance offers a more flexible approach to permanent life insurance. This type of policy allows policyholders to adjust their premiums and death benefit amounts over time, providing greater control and customization. Universal life insurance is particularly appealing to those who value flexibility and the ability to adapt their coverage to changing life circumstances.

One of the key advantages of universal life insurance is its ability to offer a more cost-effective solution compared to whole life insurance. Policyholders can choose to pay higher premiums during their peak earning years, building a larger cash value reserve. This reserve can then be used to cover future premiums, ensuring the policy remains active even if the insured's financial situation changes.

Universal life insurance policies also offer investment options similar to whole life insurance, allowing policyholders to choose how their cash value is invested. However, unlike whole life insurance, universal life insurance provides the flexibility to change investment strategies over time, enabling policyholders to respond to market conditions and optimize their returns.

| Key Features of Universal Life Insurance |

|---|

| Flexible Premiums and Death Benefit |

| Cost-Effective Solution |

| Cash Value Accumulation |

| Flexible Investment Options |

Variable Life Insurance: Tailored Investment-Focused Protection

Variable life insurance takes a unique approach to permanent life insurance by offering policyholders the opportunity to invest their premiums in a variety of investment options, including stocks, bonds, and mutual funds. This type of policy provides the potential for higher returns but also carries a higher level of risk compared to whole or universal life insurance.

The key advantage of variable life insurance is its potential for significant cash value growth. By investing in a range of financial instruments, policyholders can aim for higher returns and build a substantial cash value over time. This can be particularly beneficial for those seeking to maximize their wealth accumulation and leave a larger legacy for their beneficiaries.

However, it's important to note that variable life insurance also carries the risk of potential losses. If the chosen investments perform poorly, the policy's cash value and death benefit may decrease. Policyholders must carefully consider their risk tolerance and investment strategy to ensure they make informed decisions that align with their financial goals.

| Key Features of Variable Life Insurance |

|---|

| Investment-Focused Premiums |

| Potential for Higher Returns |

| Risk of Investment Losses |

| Cash Value Growth Potential |

Guaranteed Universal Life Insurance: Balancing Flexibility and Stability

Guaranteed universal life insurance (GUL) combines the flexibility of universal life insurance with the stability of a guaranteed death benefit. This type of policy offers a fixed death benefit, ensuring that the insured's beneficiaries receive a predetermined amount upon the insured's passing. GUL policies also provide the flexibility to adjust premiums and death benefit amounts, similar to universal life insurance.

One of the key advantages of GUL insurance is its affordability. The guaranteed death benefit allows policyholders to secure a substantial coverage amount at a relatively lower cost compared to whole life insurance. This makes GUL insurance an attractive option for those seeking comprehensive coverage without the higher premiums associated with whole life policies.

GUL policies often include a variety of riders, which are optional add-ons that can enhance the policy's benefits. These riders may include accelerated death benefits, which provide access to a portion of the death benefit if the insured is diagnosed with a terminal illness, or waiver of premium riders, which waive premium payments if the insured becomes disabled.

| Key Features of Guaranteed Universal Life Insurance |

|---|

| Fixed Death Benefit |

| Affordable Coverage |

| Flexible Premiums |

| Riders for Enhanced Benefits |

Indexed Universal Life Insurance: Leveraging Market Performance

Indexed universal life insurance (IUL) is a unique type of permanent life insurance that combines the flexibility of universal life insurance with the potential for higher returns by linking policy performance to a market index, such as the S&P 500. This type of policy offers the opportunity to participate in market growth while also providing a level of protection against market downturns.

The key advantage of IUL insurance is its potential for significant cash value growth. By linking policy performance to a market index, policyholders can benefit from market upswings without the risk of direct investment. The policy's cash value grows based on the index's performance, offering the potential for higher returns compared to traditional life insurance policies.

IUL policies also provide a level of protection against market downturns. If the market index performs poorly, the policy's cash value may experience a decrease, but it is typically capped at a certain percentage, ensuring that the policyholder does not suffer significant losses. This feature provides a safety net, making IUL insurance an attractive option for those seeking growth potential with a degree of security.

| Key Features of Indexed Universal Life Insurance |

|---|

| Linked to Market Index Performance |

| Potential for Higher Returns |

| Protection Against Market Downturns |

| Flexible Premiums and Death Benefit |

Conclusion: Choosing the Right Type of Permanent Life Insurance

Permanent life insurance is a powerful financial tool that offers lifelong coverage and the potential for wealth accumulation. The different types of permanent life insurance policies, including whole life, universal life, variable life, guaranteed universal life, and indexed universal life, each bring unique features and benefits to the table. By understanding these policies and their nuances, individuals can make informed decisions and choose the type of permanent life insurance that best aligns with their financial goals, risk tolerance, and legacy planning aspirations.

It's important to consult with a qualified financial advisor or insurance professional to determine the most suitable type of permanent life insurance for your specific circumstances. They can guide you through the process, help you assess your needs, and ensure you make a well-informed decision that provides the protection and financial security you deserve.

What is the difference between whole life and universal life insurance?

+

Whole life insurance offers fixed premiums and a guaranteed death benefit, providing long-term financial security. Universal life insurance, on the other hand, provides flexibility in premiums and death benefit amounts, allowing policyholders to customize their coverage based on changing life circumstances.

How does variable life insurance differ from other types of permanent life insurance?

+

Variable life insurance focuses on investment-based premiums, allowing policyholders to potentially achieve higher returns. However, it also carries a higher risk compared to whole or universal life insurance, as the policy’s performance is tied to the chosen investments.

What are the advantages of guaranteed universal life insurance (GUL)?

+

GUL insurance offers a fixed death benefit at an affordable cost. It combines the flexibility of universal life insurance with the stability of a guaranteed death benefit, making it an attractive option for those seeking comprehensive coverage without high premiums.

How does indexed universal life insurance (IUL) work, and what are its benefits?

+

IUL insurance links policy performance to a market index, allowing policyholders to participate in market growth while providing protection against significant losses. It offers the potential for higher returns with a level of security, making it an appealing choice for those seeking a balance between growth and stability.