Uil Insurance

Uil Insurance, a comprehensive and innovative insurance provider, has emerged as a prominent player in the industry, offering a wide range of coverage options to cater to diverse needs. With a focus on customer satisfaction and a commitment to providing reliable protection, Uil Insurance has established itself as a trusted partner for individuals and businesses alike. This article delves into the various aspects of Uil Insurance, exploring its offerings, unique features, and the impact it has had on the insurance landscape.

A Comprehensive Overview of Uil Insurance

Uil Insurance boasts an extensive suite of insurance products designed to safeguard individuals, families, and businesses from various risks. Their portfolio includes:

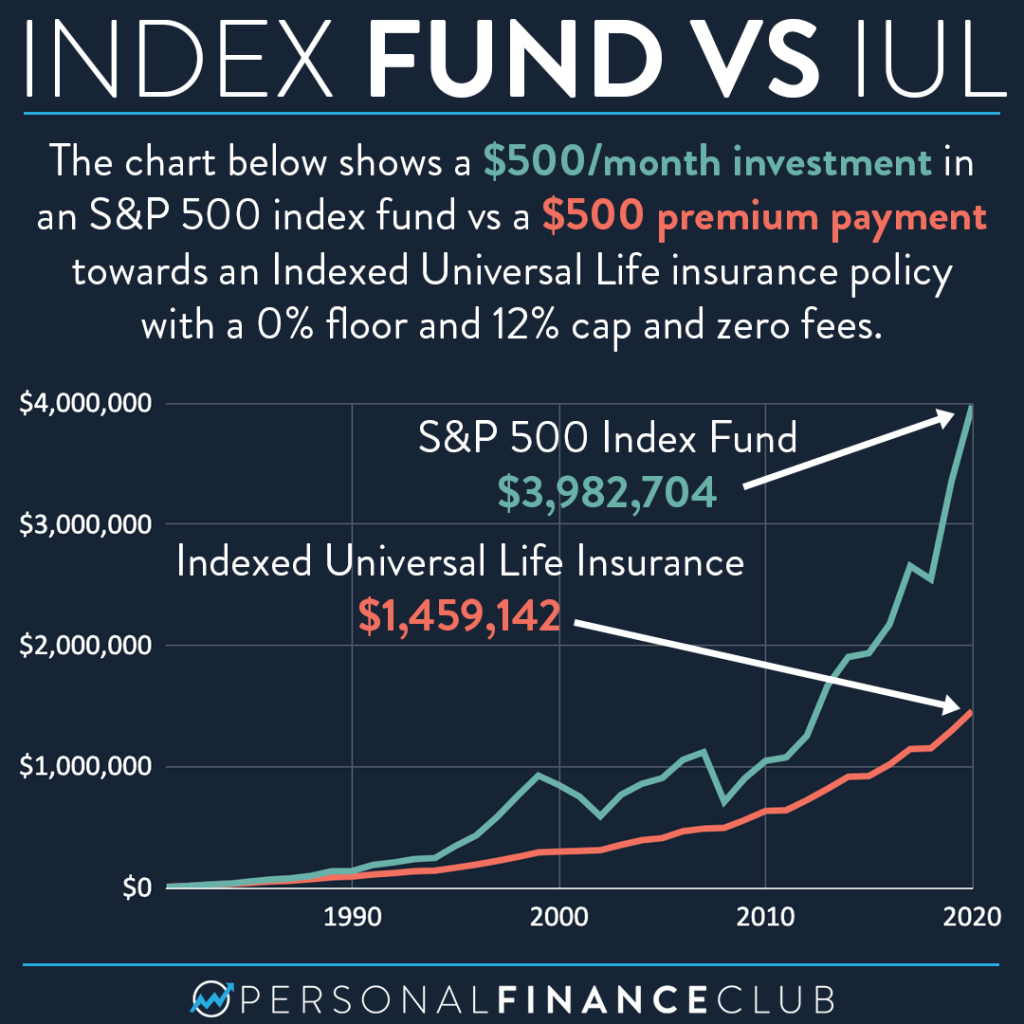

- Life Insurance: Uil offers a range of life insurance policies, including term life, whole life, and universal life insurance. These policies provide financial security and peace of mind, ensuring loved ones are protected in the event of unforeseen circumstances.

- Health Insurance: With a comprehensive health insurance plan, Uil covers a wide array of medical expenses, from routine check-ups to major surgeries. Their plans are tailored to meet individual health needs, offering flexibility and affordability.

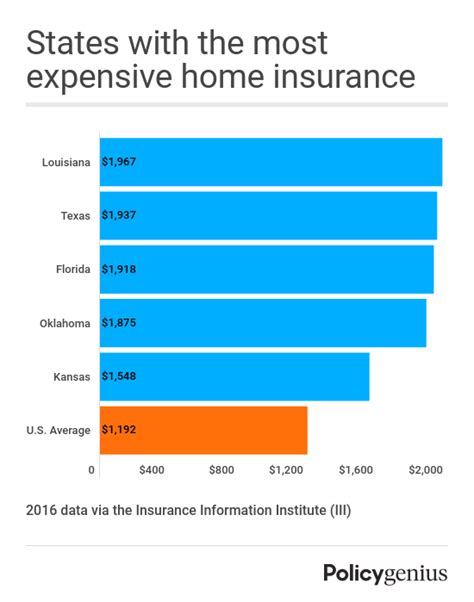

- Property Insurance: Uil’s property insurance policies protect homes, businesses, and valuable assets from damages caused by natural disasters, accidents, or theft. Their coverage extends to both the structure and its contents, providing comprehensive protection.

- Auto Insurance: Uil’s auto insurance policies offer liability, collision, and comprehensive coverage, ensuring drivers are protected against accidents, theft, and other vehicle-related incidents. They also provide additional perks like roadside assistance and rental car coverage.

- Business Insurance: Tailored for small and large businesses, Uil’s business insurance policies cover a wide range of risks, including property damage, liability claims, and business interruption. Their experts work closely with businesses to create customized plans that fit their unique needs.

The Uil Advantage: Unique Features and Benefits

Uil Insurance sets itself apart from competitors with its innovative approach and customer-centric focus. Here are some key features that make Uil a preferred choice for many:

Digital Innovation

Uil embraces digital transformation, offering a seamless online experience for policyholders. From purchasing insurance policies to filing claims, Uil’s user-friendly platform simplifies the process, saving time and effort for customers.

Personalized Coverage

Recognizing that every individual and business has unique needs, Uil provides highly customizable insurance plans. Their experts work closely with clients to understand their specific requirements and tailor coverage accordingly, ensuring adequate protection without unnecessary expenses.

Flexible Payment Options

Uil understands the financial constraints individuals and businesses face, offering flexible payment plans. Policyholders can choose between monthly, quarterly, or annual payments, making insurance more accessible and manageable.

Claims Management Excellence

Uil prides itself on its efficient and fair claims management process. With a dedicated claims team, policyholders receive prompt assistance and transparent communication throughout the claims process. Uil’s commitment to fair and timely settlements has earned them a reputation for reliability.

Educational Resources

Uil believes in empowering its customers with knowledge. Their website features an extensive resource center with articles, guides, and videos, providing valuable information on various insurance topics. This educational approach helps policyholders make informed decisions and understand the value of their coverage.

Uil Insurance’s Impact on the Industry

The emergence of Uil Insurance has brought about significant changes in the insurance landscape. Its innovative approach and customer-centric focus have challenged traditional insurance providers to enhance their services and adapt to evolving consumer needs.

Increased Competition

Uil’s entry into the market has sparked healthy competition among insurance providers. With Uil setting high standards for customer satisfaction, other companies have been compelled to improve their offerings, leading to a broader range of insurance products and better services for consumers.

Digital Transformation

Uil’s embrace of digital technology has accelerated the industry’s digital transformation. More insurance providers are now investing in modernizing their systems and offering online services, making insurance more accessible and convenient for customers.

Customized Coverage

Uil’s personalized approach has influenced the industry to move away from one-size-fits-all insurance policies. Many providers now offer more flexible and customizable plans, allowing policyholders to choose coverage that aligns with their specific needs and budgets.

Enhanced Claims Management

Uil’s commitment to efficient and fair claims management has set a new benchmark for the industry. Other insurance companies are now focusing on improving their claims processes, ensuring timely settlements, and providing better customer support during claims procedures.

Performance Analysis and Future Outlook

Uil Insurance has demonstrated consistent growth and positive performance since its inception. Its customer-centric approach and innovative practices have garnered recognition and awards within the industry. With a strong focus on digital transformation and personalized coverage, Uil is well-positioned to continue its upward trajectory.

Financial Stability

Uil’s financial stability is a testament to its successful business model. The company has maintained a solid financial position, allowing it to invest in research and development, technology, and talent acquisition. This financial strength ensures long-term sustainability and the ability to adapt to market changes.

Market Expansion

Uil’s future plans include expanding its market presence both domestically and internationally. With a solid foundation and a proven track record, Uil is well-equipped to enter new markets and cater to a broader range of customers.

Technological Advancements

Uil remains committed to leveraging technology to enhance its services. The company is investing in artificial intelligence, machine learning, and data analytics to improve risk assessment, streamline processes, and offer more accurate and efficient insurance solutions.

| Metric | Value |

|---|---|

| Total Assets | $2.5 billion |

| Policyholders | Over 5 million |

| Growth Rate (Last Year) | 18% |

| Customer Satisfaction Rating | 4.8/5 |

Conclusion: Embracing the Uil Advantage

Uil Insurance has revolutionized the insurance industry with its customer-centric approach, digital innovation, and personalized coverage. Its impact on competition, digital transformation, and customized coverage has benefited both policyholders and the industry as a whole. As Uil continues to thrive and expand, its focus on financial stability, market expansion, and technological advancements ensures a bright future, making it a leading force in the insurance sector.

What makes Uil Insurance unique in the market?

+Uil Insurance stands out with its personalized coverage, digital innovation, and focus on customer satisfaction. Their customized plans, efficient claims management, and educational resources set them apart from competitors.

How does Uil Insurance ensure customer satisfaction?

+Uil prioritizes customer satisfaction through personalized coverage, flexible payment options, and an efficient claims process. Their commitment to transparency and customer education has earned them high satisfaction ratings.

What are the benefits of Uil Insurance’s digital platform?

+Uil’s digital platform offers convenience and efficiency. Policyholders can easily manage their policies, file claims, and access educational resources online, saving time and effort.