Unbrella Insurance Policy

Welcome to this comprehensive guide on Umbrella Insurance, a vital aspect of personal risk management. This type of insurance policy provides an extra layer of financial protection, offering an additional safety net beyond your standard liability coverage. In today's complex and unpredictable world, the importance of comprehensive insurance coverage cannot be overstated. This article aims to delve deep into the world of Umbrella Insurance, exploring its intricacies, benefits, and how it can safeguard your financial future.

Understanding Umbrella Insurance: A Comprehensive Overview

Umbrella Insurance, also known as Excess Liability Insurance, is a specialized form of liability coverage that goes beyond the limits of your standard homeowners, auto, or renters insurance policies. It acts as a crucial safety net, offering an extra layer of protection in the event of catastrophic liability claims or lawsuits. This type of insurance is particularly beneficial for individuals and families with significant assets to protect, as it can help shield their financial well-being from unexpected and potentially devastating losses.

The primary purpose of Umbrella Insurance is to provide an additional layer of liability coverage. This means that once the limits of your underlying policies (such as your auto or homeowners insurance) are reached, your Umbrella Insurance kicks in to cover any remaining costs. For instance, if you're sued for an accident that exceeds the liability limits of your auto insurance policy, your Umbrella Insurance policy would step in to cover the additional costs.

Key Features and Benefits of Umbrella Insurance

- Enhanced Liability Protection: Umbrella Insurance significantly increases your liability coverage limits, providing an extra layer of protection against potential lawsuits and liability claims.

- Broad Coverage: This type of insurance typically covers a wide range of liability risks, including personal injury, property damage, and even certain types of professional liability claims.

- Cost-Effective Solution: Despite offering extensive coverage, Umbrella Insurance policies are often surprisingly affordable, making them an excellent value proposition for those seeking comprehensive protection.

- Flexibility: Umbrella Insurance policies can be customized to meet individual needs, allowing policyholders to choose coverage limits that align with their specific assets and financial situation.

One of the most notable advantages of Umbrella Insurance is its ability to provide peace of mind. By ensuring that you have adequate liability coverage, you can rest assured knowing that your financial future is protected, even in the face of unforeseen circumstances.

Real-World Applications and Examples

To better understand the importance and practical applications of Umbrella Insurance, let’s explore some real-world scenarios where this type of coverage could prove invaluable.

Scenario 1: Auto Accident with Severe Injuries

Imagine you’re involved in an auto accident where the other driver sustains serious injuries. Medical bills, lost wages, and potential rehabilitation costs can quickly add up. If the injured party sues you for damages exceeding your auto insurance policy’s liability limits, your financial stability could be at risk. However, with an Umbrella Insurance policy in place, you would have the additional coverage needed to cover these excess costs, potentially saving you from significant financial hardship.

Scenario 2: Home Liability Claims

Consider a situation where a guest at your home suffers an injury due to a slippery floor or a defective product. If the guest decides to sue you, and the resulting damages exceed the limits of your homeowners insurance policy, your Umbrella Insurance policy would step in to provide coverage for the excess amount, helping to protect your assets.

Scenario 3: Professional Liability

For professionals, such as consultants, freelancers, or business owners, Umbrella Insurance can provide an extra layer of protection against professional liability claims. In the event of a lawsuit related to your professional services, an Umbrella Insurance policy can cover legal fees and potential damages, offering valuable financial support.

Technical Specifications and Performance Analysis

When considering an Umbrella Insurance policy, it’s essential to understand the technical specifications and performance aspects to ensure you’re getting the right coverage for your needs.

Coverage Limits and Deductibles

Umbrella Insurance policies typically offer coverage limits ranging from 1 million to 5 million or more. The chosen limit should align with your personal assets and potential liability risks. Additionally, Umbrella Insurance policies often have higher deductibles compared to standard liability policies, so it’s crucial to review and understand these details.

| Coverage Limit | Premium |

|---|---|

| $1 Million | $150 - $300 per year |

| $2 Million | $200 - $400 per year |

| $5 Million | $500 - $1,000 per year |

It's important to note that the premium costs can vary depending on several factors, including your location, the amount of coverage you choose, and your personal risk profile.

Exclusions and Limitations

Like any insurance policy, Umbrella Insurance policies have exclusions and limitations. It’s crucial to review these carefully to understand what is and isn’t covered. Some common exclusions may include intentional acts, certain business-related liabilities, and specific types of professional liability claims.

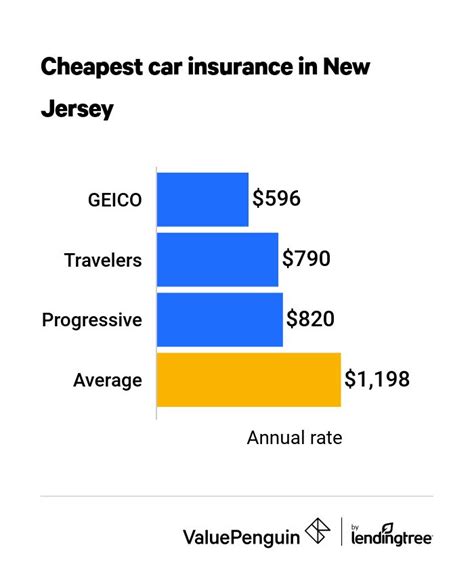

Choosing the Right Umbrella Insurance Provider

Selecting the right Umbrella Insurance provider is crucial to ensure you receive the best coverage and service. Here are some key factors to consider when making your choice:

- Financial Strength: Opt for an insurance provider with a strong financial rating to ensure they can honor their commitments even in challenging economic times.

- Policy Features and Customization: Look for providers that offer flexible policies with customizable coverage limits to suit your specific needs.

- Claims Handling: Research the provider's reputation for efficient and fair claims handling. Prompt and fair claims settlement is crucial in times of need.

- Customer Service: Choose a provider known for excellent customer service, as this can make a significant difference in your overall experience.

Future Implications and Industry Insights

As society becomes increasingly litigious and the costs of lawsuits continue to rise, the importance of Umbrella Insurance is likely to grow. This type of insurance is becoming an essential component of a comprehensive financial protection strategy for individuals and businesses alike.

Looking ahead, we can expect to see continued innovation in the Umbrella Insurance market. Providers may offer more specialized coverage options to cater to specific industries or professions, further enhancing the value and relevance of this type of insurance.

Additionally, with the rise of remote work and the gig economy, the need for professional liability coverage is expanding. Umbrella Insurance policies that offer enhanced protection for professionals working in these dynamic environments could become increasingly popular.

Conclusion

Umbrella Insurance is a critical tool for safeguarding your financial future. By providing an extra layer of liability coverage, it offers peace of mind and protection against potentially devastating financial losses. Whether you’re a homeowner, a business owner, or a professional, understanding the benefits and implications of Umbrella Insurance is essential for effective risk management.

We hope this guide has provided valuable insights into the world of Umbrella Insurance. Remember, when it comes to insurance, knowledge is power, and being well-informed is the first step toward making the right choices for your financial well-being.

How much does Umbrella Insurance typically cost?

+The cost of Umbrella Insurance can vary depending on several factors, including your location, the amount of coverage you choose, and your personal risk profile. Generally, premiums range from 150 to 1,000 per year for coverage limits of 1 million to 5 million. It’s important to get quotes from multiple providers to find the best value for your needs.

Is Umbrella Insurance necessary for everyone?

+While not everyone may need Umbrella Insurance, it is highly recommended for individuals and families with significant assets or potential liability risks. If you own a home, have substantial savings or investments, or are in a profession with potential liability exposure, Umbrella Insurance can provide crucial protection.

Can Umbrella Insurance be used for business-related liabilities?

+Umbrella Insurance policies typically exclude business-related liabilities. However, many providers offer specialized business liability policies or endorsements that can be added to your Umbrella Insurance policy to provide additional coverage for your business activities.