Unimployment Insurance

Unemployment insurance is a crucial social safety net that provides financial assistance to individuals who have lost their jobs through no fault of their own. This comprehensive system aims to support those facing unemployment, offering temporary income support while they search for new employment opportunities. With an increasing number of people experiencing job loss due to various economic and societal factors, understanding unemployment insurance and its benefits is more important than ever.

The Purpose and Functionality of Unemployment Insurance

Unemployment insurance, often referred to as UI, serves as a vital component of the social security system in many countries. Its primary objective is to mitigate the financial burden that arises when individuals unexpectedly find themselves without employment. By providing a temporary income, UI helps to stabilize the economic situation of unemployed individuals, allowing them to meet their basic needs while actively seeking new work.

The functionality of unemployment insurance is designed to be straightforward and accessible. When an individual becomes unemployed, they can apply for UI benefits through their respective state or national agency. The eligibility criteria typically include having worked a certain number of hours or weeks in a specified period before becoming unemployed, and meeting specific requirements such as actively seeking employment during the benefit period.

Eligibility and Qualifications

Eligibility for unemployment insurance varies across jurisdictions, but certain common criteria are often considered. These include having worked a minimum number of hours or weeks in a set period, having earned a certain minimum amount of income during that time, and being unemployed through no fault of one’s own. For instance, if an individual is dismissed due to poor performance or misconduct, they may not be eligible for UI benefits.

In the United States, the eligibility criteria are primarily determined by individual states. Each state has its own set of requirements, including the base period for earnings, the minimum amount of earnings, and the monetary value of the weekly benefit. The base period is typically the first four of the last five completed calendar quarters before the application for benefits. During this period, the individual must have earned wages from covered employment to qualify for UI benefits.

| State | Base Period | Minimum Earnings | Weekly Benefit Amount |

|---|---|---|---|

| California | The first four of the last five completed calendar quarters | $1,300 in one quarter, or a total of $900 across two quarters | Up to $450 per week |

| New York | The first four of the last five completed calendar quarters | $2,250 in one quarter, or $5,625 across four quarters | 50% of average weekly wages, up to a maximum of $504 |

| Texas | The first four of the last five completed calendar quarters | $1,500 in one quarter, or a total of $3,000 across two quarters | 50% of average weekly wages, up to a maximum of $521 |

These variations in eligibility criteria and benefit amounts across states highlight the importance of understanding the specific requirements in one's jurisdiction. It is essential for individuals to familiarize themselves with the rules and regulations of their respective states to ensure they meet the necessary qualifications for UI benefits.

The Impact and Importance of Unemployment Insurance

Unemployment insurance plays a pivotal role in supporting the economic well-being of individuals and communities during periods of job loss. Its impact extends beyond the immediate financial relief it provides, contributing to broader societal and economic stability.

Economic Stability and Consumer Spending

UI benefits have a direct and positive impact on consumer spending, which is a key driver of economic growth. When individuals receive unemployment insurance, they are more likely to continue spending on essential goods and services, supporting local businesses and maintaining economic activity. This spending helps to prevent a downward spiral in the economy, as reduced consumer spending can lead to further job losses and economic recession.

A study conducted by the U.S. Department of Labor found that every dollar spent on unemployment insurance benefits generates approximately $1.64 in economic activity. This multiplier effect underscores the importance of UI in stimulating economic growth and preventing a deeper recession during times of high unemployment.

Social Safety Net and Mental Health

Unemployment insurance serves as a vital social safety net, providing a sense of security and stability to individuals facing job loss. This support can significantly reduce the stress and anxiety associated with unemployment, which in turn has a positive impact on mental health. By offering a financial safety net, UI helps to alleviate the immediate financial pressures that can exacerbate mental health issues, allowing individuals to focus on their well-being and job search.

Additionally, unemployment insurance can help to reduce the stigma associated with job loss. By providing a structured support system, UI sends a message that unemployment is a normal part of life and not a personal failure. This can help individuals maintain their self-esteem and dignity during a challenging period, fostering a more positive and resilient mindset.

Navigating the Unemployment Insurance Process

Understanding the process and requirements for unemployment insurance is crucial to ensuring a smooth and timely application. While the specifics may vary across jurisdictions, the general steps and considerations remain similar.

Application and Documentation

The application process for unemployment insurance typically involves completing an online or in-person application form. This form will require personal information, employment details, and the reason for unemployment. It is essential to provide accurate and complete information to avoid delays or denials in the application process.

Supporting documentation may also be required to prove eligibility. This can include pay stubs, employment contracts, or other evidence of employment and earnings. It is important to gather and organize these documents before applying to ensure a swift and seamless process.

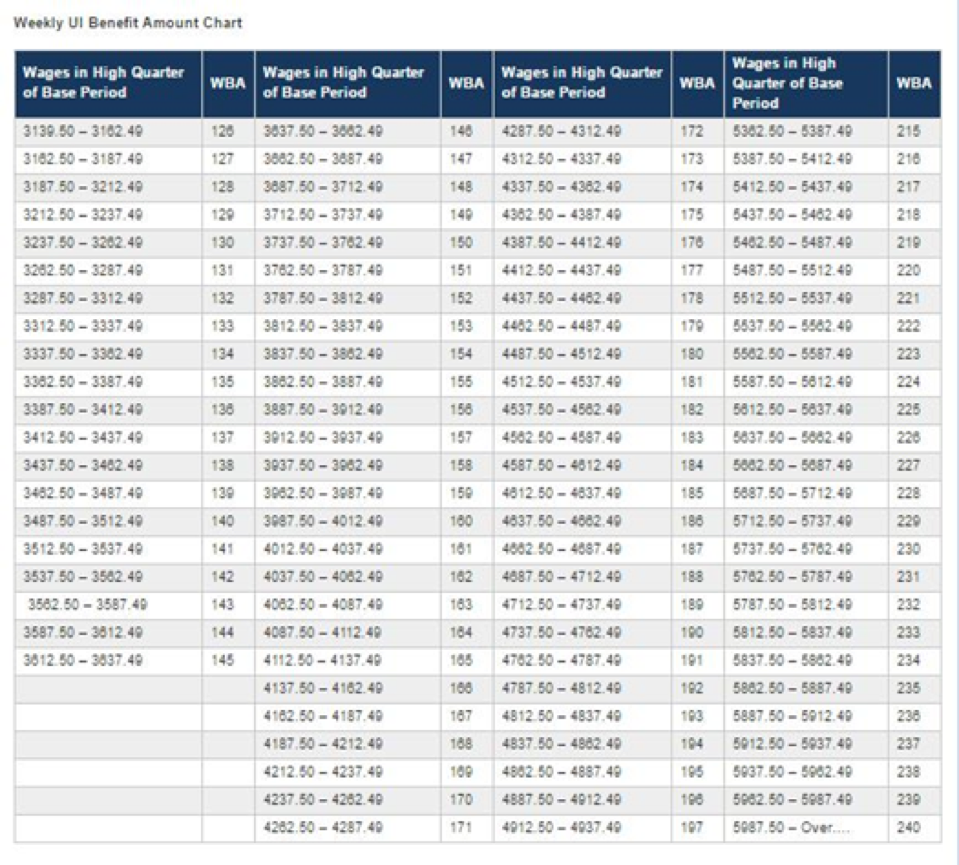

Benefit Amounts and Duration

The amount of unemployment insurance benefits an individual receives is typically based on their previous earnings. Most jurisdictions use a formula that calculates a percentage of the individual’s average weekly wage during a specified base period. This ensures that the benefit amount is proportional to the individual’s previous earnings, providing a more equitable distribution of support.

The duration of UI benefits also varies across jurisdictions. In the United States, the standard benefit period is typically 26 weeks, although this can be extended during periods of high unemployment or for individuals with certain circumstances. It is important for beneficiaries to understand the duration of their benefits to plan their job search and financial strategies accordingly.

The Future of Unemployment Insurance

As the nature of work and employment continues to evolve, the future of unemployment insurance is a subject of ongoing discussion and innovation. With the rise of gig economy jobs, remote work, and changing employment dynamics, traditional UI systems may need to adapt to provide adequate support to a broader range of workers.

Expanding Coverage and Eligibility

One of the key challenges in the future of unemployment insurance is expanding coverage to include more types of workers. Currently, many self-employed individuals, gig workers, and part-time employees may not be eligible for traditional UI benefits. As these types of employment become more prevalent, there is a growing need to develop new systems or adapt existing ones to provide support to these workers.

Some countries and states have already taken steps in this direction. For instance, New Jersey has implemented a Self-Employed and Independent Contractor Unemployment Benefits Program, which provides UI benefits to eligible self-employed individuals and independent contractors. Such initiatives demonstrate the potential for UI systems to evolve and adapt to the changing nature of work.

Technological Advancements and Digital Solutions

The integration of technology and digital solutions is another area of focus for the future of unemployment insurance. Online platforms and mobile apps can streamline the application process, making it more accessible and efficient for beneficiaries. Additionally, these digital tools can facilitate better communication between beneficiaries and UI agencies, providing real-time updates and information on benefit status and eligibility.

Furthermore, technology can play a crucial role in data analysis and predictive modeling. By leveraging data-driven insights, UI agencies can better understand employment trends, identify potential gaps in coverage, and anticipate future needs. This proactive approach can help ensure that UI systems remain effective and responsive to the evolving needs of the workforce.

How long does it take to receive unemployment insurance benefits after applying?

+The time it takes to receive unemployment insurance benefits can vary depending on several factors, including the jurisdiction and the efficiency of the UI agency. In some cases, it may take a few weeks for the initial application to be processed and the first payment to be issued. It is important to start the application process promptly to avoid delays in receiving benefits.

Can unemployment insurance benefits be extended beyond the standard benefit period?

+Yes, in certain circumstances, unemployment insurance benefits can be extended beyond the standard benefit period. This is typically done during periods of high unemployment or for individuals with specific circumstances, such as those with a medical condition or caring for a family member. However, the criteria and availability of extended benefits may vary across jurisdictions.

What happens if I find a new job while receiving unemployment insurance benefits?

+If you find a new job while receiving unemployment insurance benefits, it is important to notify the UI agency promptly. In most cases, your benefits will be terminated once you start earning wages from your new employment. However, if your new job is part-time or temporary, you may still be eligible for partial UI benefits. It is best to consult with your local UI agency for specific guidelines and regulations.