Unisured Motorist Insurance Coverage

Uninsured motorist insurance coverage is a critical aspect of personal auto insurance policies that provides protection for policyholders in the event of an accident involving an at-fault driver who lacks adequate insurance coverage. This coverage safeguards individuals from the financial burdens and potential hardships that can arise from such incidents. In this comprehensive article, we delve into the intricacies of uninsured motorist insurance, exploring its significance, how it works, and the benefits it offers to policyholders. By understanding this essential coverage, individuals can make informed decisions to ensure their financial security and peace of mind on the road.

Understanding Uninsured Motorist Insurance

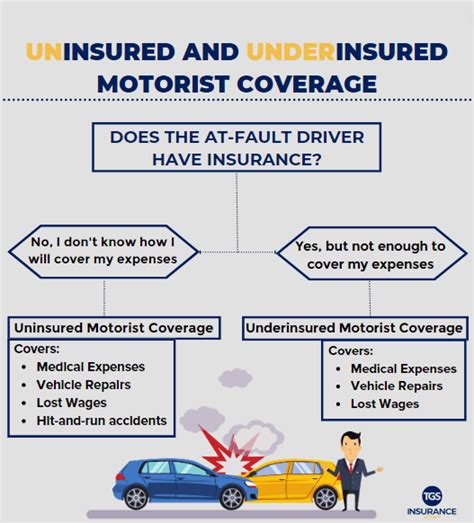

Uninsured motorist insurance serves as a safety net for drivers, offering financial protection in situations where the at-fault party lacks insurance or has insufficient coverage to compensate for damages and injuries sustained in an accident. This coverage acts as a crucial backup, ensuring that policyholders can receive compensation for their losses even when the responsible party is unable or unwilling to fulfill their financial obligations.

Key Components of Uninsured Motorist Insurance

Uninsured motorist insurance typically consists of two main components:

- Uninsured Motorist Bodily Injury (UMBI): This coverage pays for medical expenses, lost wages, and other related costs when the policyholder or their passengers are injured in an accident caused by an uninsured or underinsured driver.

- Uninsured Motorist Property Damage (UMPD): UMPD covers the cost of repairing or replacing the policyholder’s vehicle if it is damaged in an accident with an uninsured or underinsured driver.

It's important to note that the specific coverage and limits provided by uninsured motorist insurance may vary depending on the state and the individual insurance policy. Some states require uninsured motorist coverage, while others make it optional. Additionally, the coverage limits can be customized to meet the policyholder's specific needs and budget.

How Uninsured Motorist Insurance Works

Uninsured motorist insurance operates by stepping in to compensate policyholders when an at-fault driver lacks adequate insurance coverage. Here’s a step-by-step breakdown of how this coverage works:

- Accident Occurrence: An accident involving an uninsured or underinsured driver takes place.

- Notification: The policyholder promptly notifies their insurance company about the accident and provides relevant details, including the at-fault driver’s information.

- Investigation: The insurance company conducts an investigation to determine fault and assess the extent of damages and injuries.

- Coverage Application: If the at-fault driver is found to be uninsured or underinsured, the policyholder’s uninsured motorist coverage comes into play.

- Claim Settlement: The insurance company processes the claim, taking into account the policyholder’s coverage limits and the extent of their losses. The policyholder receives compensation for their injuries, medical expenses, property damage, and other covered expenses.

Uninsured Motorist Coverage Limits

Uninsured motorist insurance coverage limits are typically expressed in split limit or combined single limit formats. Split limits refer to separate coverage amounts for bodily injury and property damage, while a combined single limit applies to all covered damages combined.

| Coverage Type | Split Limit | Combined Single Limit |

|---|---|---|

| Bodily Injury | $25,000 per person / $50,000 per accident | N/A |

| Property Damage | $10,000 | N/A |

| Total Combined | $60,000 | $100,000 |

In this example, the policyholder has a split limit of $25,000 per person and $50,000 per accident for bodily injury coverage, and a separate limit of $10,000 for property damage. The combined single limit policy offers a single coverage amount of $100,000 for all covered damages.

Benefits of Uninsured Motorist Insurance

Uninsured motorist insurance offers several significant benefits to policyholders, including:

- Financial Protection: Uninsured motorist coverage provides financial security by covering medical expenses, lost wages, and other related costs resulting from an accident with an uninsured or underinsured driver.

- Legal Support: In cases where legal action is necessary to recover damages, uninsured motorist coverage may include legal support and representation, ensuring that policyholders have the resources to navigate the legal process effectively.

- Peace of Mind: Knowing that you have uninsured motorist coverage gives peace of mind, as it ensures that you are protected even when faced with an at-fault driver who lacks insurance. This coverage helps alleviate the financial burden and emotional stress that can arise from such situations.

- Additional Coverage Options: Uninsured motorist insurance often includes additional coverage options, such as underinsured motorist coverage, which provides protection when the at-fault driver’s insurance coverage is insufficient to fully compensate for damages and injuries.

Underinsured Motorist Coverage

Underinsured motorist coverage is an extension of uninsured motorist insurance, designed to protect policyholders when the at-fault driver’s insurance coverage is inadequate to cover the full extent of damages and injuries. This coverage bridges the gap between the at-fault driver’s coverage limits and the policyholder’s uninsured motorist coverage limits, ensuring comprehensive protection.

Real-World Examples

To illustrate the importance and benefits of uninsured motorist insurance, let’s consider a few real-world scenarios:

- Scenario 1: Hit-and-Run Accident: Imagine a policyholder is involved in a hit-and-run accident where the at-fault driver flees the scene. With uninsured motorist coverage, the policyholder can receive compensation for their injuries and property damage, even though the responsible driver cannot be identified or held accountable.

- Scenario 2: Underinsured Driver: In another instance, a policyholder is in an accident with a driver who has minimal insurance coverage. Uninsured motorist coverage steps in to cover the difference between the at-fault driver’s coverage limits and the policyholder’s uninsured motorist limits, ensuring they receive adequate compensation for their losses.

- Scenario 3: Multiple Injuries: A policyholder is involved in an accident with an uninsured driver, resulting in multiple injuries to themselves and their passengers. Uninsured motorist bodily injury coverage provides financial support for medical expenses, rehabilitation, and other related costs, ensuring that the policyholder and their passengers can access the necessary medical care without financial strain.

Future Implications and Industry Trends

As the automotive industry evolves, the role of uninsured motorist insurance is likely to adapt and expand. With the increasing prevalence of autonomous vehicles and shared mobility services, the risk landscape is shifting. Uninsured motorist coverage will need to address emerging risks and challenges associated with these new technologies and transportation models.

Additionally, the rise of ride-sharing platforms and gig economy workers has led to a growing number of uninsured or underinsured drivers on the roads. Uninsured motorist insurance will play a crucial role in protecting policyholders from the financial consequences of accidents involving these drivers.

Furthermore, advancements in technology and data analytics are expected to enhance the efficiency and accuracy of uninsured motorist claims processing. Insurance companies will leverage advanced analytics and artificial intelligence to streamline investigations and claims settlement, ensuring prompt and fair compensation for policyholders.

What is the difference between uninsured and underinsured motorist coverage?

+

Uninsured motorist coverage applies when the at-fault driver has no insurance, while underinsured motorist coverage comes into play when the at-fault driver’s insurance coverage is insufficient to fully compensate for damages and injuries.

Is uninsured motorist coverage mandatory in all states?

+

No, uninsured motorist coverage is mandatory in some states, while in others, it is optional. It’s important to check your state’s specific requirements and consider your personal risk tolerance when deciding on uninsured motorist coverage.

How do I determine the appropriate coverage limits for uninsured motorist insurance?

+

Determining the appropriate coverage limits involves considering your financial situation, the value of your assets, and your risk tolerance. It’s recommended to consult with an insurance professional who can guide you in selecting coverage limits that align with your specific needs.