United States Postal Service Insurance Claim

When it comes to shipping and handling packages, the United States Postal Service (USPS) is a trusted and widely used service provider. While USPS takes great care to ensure the safe delivery of mail and parcels, sometimes unforeseen circumstances can lead to damage or loss. In such situations, having insurance coverage can provide much-needed peace of mind and financial protection for both senders and recipients. In this comprehensive guide, we will delve into the process of filing an insurance claim with the USPS, exploring the steps involved, the coverage options available, and offering valuable insights to navigate this often complex process.

Understanding USPS Insurance Coverage

The USPS offers insurance services to protect against loss or damage to mail and packages. Understanding the types of coverage available is crucial when preparing to file a claim. Here’s an overview of the primary insurance options provided by the USPS:

Domestic Insurance

Domestic insurance is designed to cover mail and packages shipped within the United States. This type of coverage is available for a range of mail classes, including Priority Mail, First-Class Package Service, and Priority Mail Express.

- Priority Mail Insurance: This option provides coverage for loss or damage to items sent via Priority Mail. The insurance coverage is available up to 5,000, and the cost varies based on the declared value of the package.</li> <li><strong>First-Class Package Service Insurance:</strong> Similar to Priority Mail Insurance, this coverage is available for packages sent through the First-Class Package Service. The maximum coverage amount is 5,000, and the cost depends on the declared value.

- Priority Mail Express Insurance: Priority Mail Express comes with built-in insurance coverage of up to 100. However, for higher-value items, additional insurance can be purchased, offering coverage up to 5,000.

International Insurance

USPS also provides insurance for international shipments, ensuring protection for packages sent abroad. Here’s an overview of the international insurance options:

- Global Express Guaranteed: This service offers the highest level of insurance coverage for international shipments, with amounts ranging from 100 to 20,000. The cost of insurance depends on the declared value and the destination country.

- Priority Mail International: Priority Mail International insurance is available for packages with declared values up to 200. The insurance cost is included in the shipping rate.</li> <li><strong>First-Class Mail International:</strong> First-Class Mail International insurance is available for packages with declared values up to 400. The insurance cost is typically included in the shipping rate, but additional insurance can be purchased if needed.

Additional Insurance Options

In addition to the standard insurance coverage, USPS offers a few extra options to cater to specific needs:

- Registered Mail: Registered Mail provides extra security and tracking for valuable items. While it doesn’t offer insurance per se, it adds an additional layer of protection and requires a signature upon delivery.

- Certified Mail: Certified Mail provides proof of mailing and delivery. Although it doesn’t offer insurance, it can be a useful tool for tracking important documents.

- Extra Insurance: For higher-value items that exceed the standard insurance limits, USPS allows you to purchase extra insurance. This option can be added to most mail classes and provides coverage beyond the basic limits.

Filing a USPS Insurance Claim

When you encounter a situation where your mail or package has been damaged or lost, it’s essential to act promptly to initiate the insurance claim process. Here’s a step-by-step guide to help you navigate the process smoothly:

Step 1: Confirm Eligibility

Before initiating a claim, ensure that your shipment is eligible for insurance. Check the USPS website or refer to your shipping label to verify the mail class and the insurance coverage associated with it. Some mail classes, like Media Mail, are not eligible for insurance.

Step 2: Gather Documentation

Collect all the necessary documentation to support your claim. This typically includes:

- The original shipping label or a copy of the label with the tracking number.

- A receipt or proof of payment for the shipping service.

- Photos or videos of the damaged item or package.

- A detailed description of the item, including its value and any relevant receipts or appraisals.

- Any relevant insurance forms or documentation provided by USPS.

Step 3: Contact USPS

Reach out to USPS to initiate the insurance claim process. You can contact USPS Customer Service through their official website or by calling their toll-free number. Provide the necessary details, including your tracking number and a brief description of the issue.

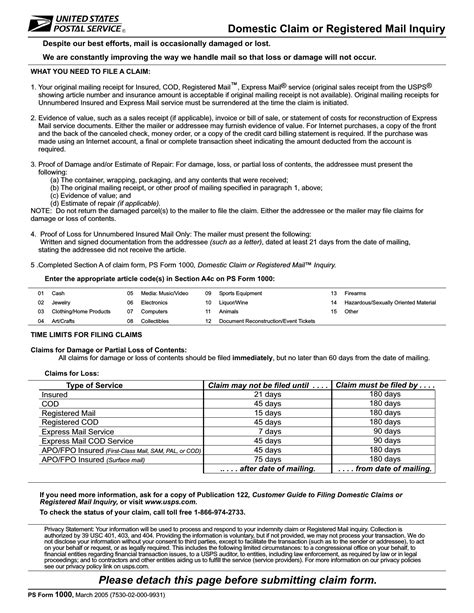

Step 4: Complete the Insurance Claim Form

USPS will provide you with the appropriate insurance claim form based on the type of insurance you purchased. Fill out the form accurately and provide all the requested information. Ensure that you attach all the supporting documentation mentioned in Step 2.

Step 5: Submit the Claim

Once you have completed the insurance claim form and gathered all the necessary documents, submit your claim to USPS. You can do this by mailing the completed form and supporting documents to the address provided by USPS or by submitting the form online through their website.

Step 6: Follow Up and Track Your Claim

After submitting your claim, it’s essential to follow up and track its progress. USPS will review your claim and may contact you for additional information or clarifications. Keep track of the claim status through the USPS website or by contacting their customer service team.

Tips for a Successful Insurance Claim

To increase your chances of a successful insurance claim, consider the following tips:

- Accurate Documentation: Ensure that all the documentation you provide is accurate and up-to-date. This includes receipts, appraisals, and detailed descriptions of the item.

- Photographic Evidence: Take clear and comprehensive photos or videos of the damaged item or package. Ensure that the images capture the extent of the damage and any unique identifying features of the item.

- Prompt Action: Act quickly when you discover damage or loss. The sooner you initiate the claim process, the easier it will be to gather the necessary evidence and documentation.

- Communication: Maintain open and regular communication with USPS throughout the claim process. Respond promptly to any requests for additional information and be transparent in your interactions.

- Review the Terms: Familiarize yourself with the insurance terms and conditions provided by USPS. Understanding the coverage limits, exclusions, and any specific requirements will help you navigate the claim process effectively.

Handling Denied Claims

In some cases, USPS may deny your insurance claim. If this happens, it’s important to understand the reasons behind the denial and take appropriate steps to resolve the issue. Here’s what you can do if your claim is denied:

Step 1: Understand the Denial

USPS will provide a reason for the denial of your claim. Review the denial notice carefully to understand the specific grounds for rejection. Common reasons for denial include inadequate documentation, late submission of the claim, or the item not meeting the insurance coverage criteria.

Step 2: Gather Additional Evidence

If your claim was denied due to insufficient evidence, gather additional documentation or evidence to support your case. This may include additional photos, videos, or even expert opinions or appraisals, depending on the nature of the item.

Step 3: Resubmit the Claim

With the new evidence in hand, resubmit your insurance claim to USPS. Include a detailed explanation of why you believe the claim should be approved, addressing any concerns or issues raised in the denial notice.

Step 4: Consider an Appeal

If your resubmitted claim is still denied, you may have the option to appeal the decision. USPS has an appeals process in place to review claims that have been denied. Follow the instructions provided by USPS to initiate the appeal, and ensure that you present a strong case with all the necessary supporting documentation.

Conclusion

Filing an insurance claim with the USPS can be a complex process, but with the right approach and preparation, you can navigate it successfully. By understanding the types of insurance coverage available, gathering the necessary documentation, and following the steps outlined in this guide, you can increase your chances of a favorable outcome. Remember, insurance claims are a way to protect your interests and ensure that you receive fair compensation for damaged or lost items. Stay diligent, communicate effectively, and don’t hesitate to seek assistance if needed.

How much does USPS insurance cost?

+The cost of USPS insurance varies depending on the type of insurance and the declared value of the package. For domestic insurance, the cost typically ranges from 2.35 to 4.15 for each $100 of declared value. International insurance costs can vary based on the destination country and the declared value.

Can I purchase insurance after shipping my package?

+In most cases, insurance must be purchased at the time of shipping. However, for Priority Mail Express, you can add additional insurance up to 60 minutes after the package has been accepted for delivery.

What is the time limit for filing an insurance claim with USPS?

+The time limit for filing an insurance claim with USPS depends on the mail class and the type of insurance. For Priority Mail, the deadline is 60 days from the date of mailing. For Priority Mail Express, the deadline is 90 days. It’s important to file your claim within these timeframes to ensure eligibility.

Can I file an insurance claim if my package was lost or stolen?

+Yes, you can file an insurance claim if your package was lost or stolen. However, it’s important to note that insurance coverage only applies to certain mail classes and may have limitations or exclusions. Ensure that your mail class is eligible for insurance and review the terms and conditions carefully.

What happens if my insurance claim is approved?

+If your insurance claim is approved, USPS will compensate you for the declared value of the lost or damaged item. The reimbursement will be made according to the terms and conditions of the insurance policy, and you may receive a check or have the funds credited to your account.