Us Health Care Insurance

Welcome to this comprehensive exploration of the intricate world of U.S. Health Care Insurance, a topic of utmost importance for every individual in the United States. In this article, we will delve deep into the various aspects of health insurance, providing you with an expert-level understanding of the system, its benefits, and its challenges. As we navigate through the complexities, we aim to empower you with knowledge, ensuring you make informed decisions regarding your health and financial well-being.

Understanding the U.S. Health Care Insurance Landscape

The American health care insurance system is a multifaceted network, with a myriad of plans, providers, and policies. It is a complex ecosystem that influences the lives of millions, impacting their access to medical services and shaping their financial stability.

The Historical Evolution

The roots of health insurance in the U.S. can be traced back to the early 20th century. Initially, health insurance was primarily offered through employer-sponsored plans, a model that still dominates the market today. Over the years, the system has undergone significant transformations, driven by economic, social, and political factors.

A notable milestone was the introduction of Medicare and Medicaid in 1965, marking a pivotal shift towards providing universal healthcare coverage. These programs aimed to cater to the elderly and low-income populations, respectively, filling a critical gap in the existing insurance landscape.

Key Players and Stakeholders

The U.S. health insurance industry is a dynamic interplay between various entities, each playing a crucial role in shaping the system's structure and outcomes.

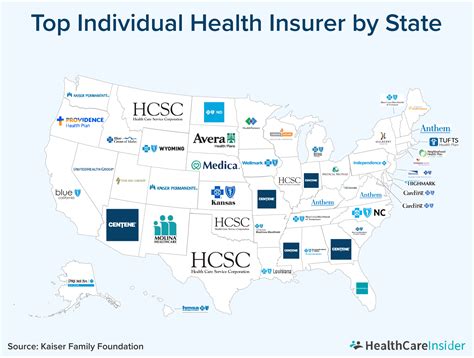

- Insurers: Insurance companies, both private and public, are at the forefront, offering a range of plans with varying coverage and premium structures.

- Employers: Many Americans obtain their health insurance through employer-sponsored group plans, making employers a significant stakeholder in the insurance landscape.

- Healthcare Providers: Hospitals, clinics, and individual practitioners negotiate rates with insurers, influencing the cost and availability of healthcare services.

- Government Entities: Federal and state governments play a regulatory role, setting standards and policies that govern the insurance market.

- Consumers: Ultimately, the insurance system revolves around the needs and choices of individual consumers, who navigate the complex web of plans and policies.

Types of Health Insurance Plans

The U.S. health insurance market offers a diverse array of plans, each designed to cater to different needs and preferences. Understanding the key types of plans is essential for making informed choices.

Employer-Sponsored Plans

The most common form of health insurance in the U.S. is employer-sponsored group plans. These plans are offered by employers as a benefit to their employees, with the premium costs typically shared between the employer and the employee. Group plans often provide a wider range of coverage and can be more cost-effective due to the larger pool of participants.

Individual Market Plans

For those who are self-employed, unemployed, or ineligible for employer-sponsored plans, the individual market provides a range of options. These plans are purchased directly from insurance companies or through government-run marketplaces, offering flexibility but often at a higher cost.

Government-Sponsored Programs

Medicare and Medicaid are the primary government-sponsored health insurance programs in the U.S. Medicare is a federal program providing health coverage for Americans aged 65 and older, as well as those with certain disabilities. Medicaid, on the other hand, is a joint federal and state program, offering coverage to low-income individuals and families.

Special Enrollment Plans

In certain circumstances, individuals may qualify for special enrollment periods, allowing them to enroll in a health plan outside of the standard open enrollment period. This could include changes in employment status, marital status, or the birth or adoption of a child.

Key Considerations for Choosing a Health Insurance Plan

Selecting the right health insurance plan is a critical decision that can significantly impact your financial and health outcomes. Here are some key factors to consider:

Coverage and Benefits

Review the plan's coverage details, including the types of services and treatments covered, as well as any limitations or exclusions. Consider your personal health needs and the potential costs associated with them.

Premium Costs

The monthly premium is a significant factor in your overall costs. Weigh the premium against the plan's coverage to determine if it aligns with your budget and health needs.

Out-of-Pocket Costs

In addition to premiums, you'll likely incur out-of-pocket costs such as deductibles, copayments, and coinsurance. These costs can vary widely between plans, so choose a plan that balances coverage with your ability to pay these expenses.

Network of Providers

Check if your preferred healthcare providers are in-network with the plan. Out-of-network care can be significantly more expensive, so it's crucial to understand the network's coverage.

Plan Flexibility and Options

Consider the plan's flexibility in terms of choosing providers, specialists, and treatments. Some plans may offer more freedom, while others may have stricter guidelines.

The Impact of Health Insurance on Access to Healthcare

Health insurance plays a pivotal role in determining an individual's access to healthcare services. Having insurance can mean the difference between timely and affordable care and potential financial hardship or limited access.

Financial Protection

One of the primary benefits of health insurance is the financial protection it provides. With insurance, individuals can access a wide range of medical services without the fear of overwhelming out-of-pocket expenses.

Preventive Care and Early Detection

Health insurance often covers preventive care services, encouraging individuals to seek regular check-ups and screenings. This early detection can lead to better health outcomes and more effective treatment options.

Specialized and Emergency Care

For specialized treatments or emergency situations, health insurance is crucial. Without insurance, the cost of such care can be prohibitively expensive, leading to delayed or inadequate treatment.

Challenges and Future Prospects

While health insurance provides numerous benefits, the U.S. system faces several challenges that impact its effectiveness and accessibility.

Affordability and Coverage Gaps

Despite the availability of insurance options, many Americans still struggle with affordability, leading to underinsurance or no insurance at all. This gap in coverage can result in limited access to healthcare services.

Regulatory and Policy Changes

The health insurance landscape is heavily influenced by regulatory and policy decisions at both the federal and state levels. Changes in policy can have significant impacts on the availability and cost of insurance, affecting millions of Americans.

Technological Innovations

The healthcare industry is rapidly evolving with technological advancements. From electronic health records to telemedicine, these innovations have the potential to revolutionize the way healthcare is delivered and accessed. Understanding and adapting to these changes is crucial for the future of health insurance.

Expert Insights and Recommendations

As an industry expert, here are some key recommendations for navigating the complex world of U.S. health care insurance:

- Stay informed about the latest policy changes and their potential impacts on your insurance options.

- Compare plans carefully, considering not just the premium but also the coverage, out-of-pocket costs, and provider networks.

- Explore government-sponsored programs like Medicare and Medicaid if you are eligible, as they often provide comprehensive coverage.

- Consider the long-term implications of your insurance choices, especially in terms of chronic conditions or potential future healthcare needs.

- Utilize resources and tools provided by insurance companies and government agencies to understand your rights and options.

Frequently Asked Questions

How do I know if I'm eligible for Medicare or Medicaid?

+Eligibility for Medicare and Medicaid is based on specific criteria. Medicare is primarily for individuals aged 65 and older, as well as those with certain disabilities. Medicaid, on the other hand, is for low-income individuals and families, with income and asset limits varying by state.

<div class="faq-item">

<div class="faq-question">

<h3>What is the difference between a PPO and an HMO plan?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>A PPO (Preferred Provider Organization) plan offers more flexibility in choosing healthcare providers, both in and out of network. HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician and receive referrals for specialist care, but they often have lower out-of-pocket costs.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>How can I reduce my health insurance costs?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There are several strategies to reduce health insurance costs. These include choosing a plan with a higher deductible or enrolling in a health savings account (HSA) to save for future medical expenses. Additionally, staying healthy and avoiding unnecessary medical expenses can help keep costs down.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>What happens if I miss the open enrollment period?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>If you miss the open enrollment period, you may still have options to obtain health insurance. You can explore special enrollment periods due to life events, such as losing your job or getting married. Alternatively, you may be eligible for coverage through government-sponsored programs like Medicaid.</p>

</div>

</div>

</div>