Us Insurance Health

In the complex landscape of healthcare, understanding your rights and options is crucial. This comprehensive guide aims to demystify health insurance in the United States, offering an in-depth exploration of its intricacies, from policy types to claim processes. We'll delve into the evolving world of US health insurance, providing insights and tools to empower you in navigating this critical aspect of modern life.

Unraveling the Complexity of US Health Insurance

The American healthcare system is renowned for its complexity, and health insurance plays a pivotal role in navigating it. With a multitude of plans, providers, and policies, choosing the right coverage can be daunting. This section aims to simplify the process, offering a clear overview of the key elements and considerations.

Types of Health Insurance Policies

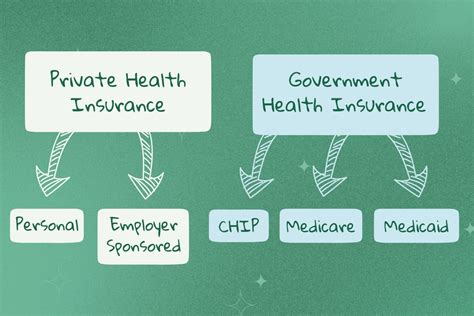

Health insurance policies in the US come in various forms, each designed to meet specific needs. The most common types include:

- Individual Plans: Customized to cover an individual’s medical needs, these plans offer flexibility and can be tailored to one’s specific health requirements.

- Family Plans: Designed to provide comprehensive coverage for entire families, these policies ensure that all members receive the necessary medical attention.

- Employer-Provided Plans: Many employers offer health insurance as part of their benefits package. These plans can be cost-effective and often provide additional perks like vision and dental coverage.

- Government-Funded Plans: For those who meet specific eligibility criteria, government-funded plans like Medicaid and Medicare offer essential healthcare coverage.

Each type of plan has its own set of advantages and considerations. For instance, individual plans offer the freedom to choose your healthcare providers, while employer-provided plans may have a more limited network of in-network doctors.

Understanding Health Insurance Networks

Health insurance networks refer to the group of healthcare providers (doctors, hospitals, and specialists) that have agreed to offer their services at discounted rates to members of a particular health plan. These networks can be:

- HMO (Health Maintenance Organization): HMO plans typically require you to choose a primary care physician (PCP) who coordinates all your healthcare needs. Any specialists you see must be referred by your PCP, and all services must be received within the HMO network.

- PPO (Preferred Provider Organization): PPO plans offer more flexibility, allowing you to see any healthcare provider, whether in or out of network. However, using in-network providers often results in lower out-of-pocket costs.

- EPO (Exclusive Provider Organization): Similar to PPO plans, EPO plans have a network of preferred providers. The key difference is that EPO plans typically don’t cover out-of-network care, except in emergencies.

Understanding these network types is crucial, as they can significantly impact the cost and convenience of your healthcare.

Navigating the Policy and Claim Process

Once you’ve chosen a health insurance plan, understanding the policy and claim process is essential. This involves:

- Policy Familiarization: Take the time to read and understand your policy document. This will help you know what’s covered, what’s not, and any specific conditions or exclusions.

- Understanding Deductibles and Co-Pays: Deductibles are the amount you must pay out-of-pocket before your insurance coverage kicks in. Co-pays, on the other hand, are fixed amounts you pay for covered services after meeting your deductible.

- Filing Claims: When you receive healthcare services, you or your provider will need to file a claim with your insurance company. This involves submitting relevant paperwork, including medical records and billing information.

- Appealing Denied Claims: If a claim is denied, you have the right to appeal. The process typically involves providing additional documentation or information to support your case.

Staying informed and organized throughout the policy and claim process is key to ensuring you receive the coverage you're entitled to.

Demystifying Healthcare Costs and Coverage

Understanding the costs associated with healthcare is essential to making informed decisions about your health insurance. This section aims to break down the various costs and coverage elements, offering clarity and insight.

Breaking Down Healthcare Costs

Healthcare costs can be complex and vary widely depending on the type of care, the provider, and your insurance coverage. Here’s a breakdown of the key cost components:

| Cost Component | Description |

|---|---|

| Premiums | The amount you pay monthly to maintain your health insurance coverage. Premiums can vary based on the type of plan, coverage level, and your personal factors like age and location. |

| Deductibles | The amount you must pay out-of-pocket before your insurance coverage starts. Deductibles can range from a few hundred to several thousand dollars, and they reset annually. |

| Co-Pays | Fixed amounts you pay for covered services after meeting your deductible. Co-pays are typically lower for in-network providers. |

| Co-Insurance | A percentage of the total cost of a covered service that you pay, while your insurance company pays the rest. For example, if your co-insurance is 20%, you’ll pay 20% of the cost, and your insurance will cover the remaining 80%. |

| Out-of-Pocket Maximum | The maximum amount you’ll pay out-of-pocket for covered services in a year. Once you reach this limit, your insurance covers 100% of the cost for covered services. |

Maximizing Your Coverage

To ensure you’re getting the most out of your health insurance coverage, consider the following:

- Choose the Right Plan: Assess your healthcare needs and choose a plan that aligns with them. Consider factors like your typical healthcare expenses, prescription drug needs, and any specific medical conditions.

- Utilize In-Network Providers: Using in-network providers can significantly reduce your out-of-pocket costs. Check your insurance company’s website or call their customer service to confirm if a provider is in-network.

- Understand Exclusions: Every health insurance plan has exclusions - services or conditions that aren’t covered. Make sure you’re aware of these exclusions to avoid unexpected costs.

- Take Advantage of Preventive Care: Many health insurance plans cover preventive services like vaccinations, screenings, and check-ups at no cost to you. Utilize these services to maintain your health and catch potential issues early.

Navigating the Cost of Chronic Conditions

If you have a chronic condition, managing the cost of your healthcare can be a significant challenge. Here are some strategies to help:

- Choose a Plan with Specialized Chronic Condition Coverage: Some health insurance plans offer specific benefits for managing chronic conditions. These might include reduced co-pays for certain medications or access to specialized care teams.

- Utilize Mail-Order Pharmacies: Many insurance companies offer mail-order pharmacy services, which can provide significant savings on prescription medications, especially for long-term treatments.

- Consider Clinical Trials: For certain conditions, clinical trials can offer access to cutting-edge treatments and often cover the cost of participation.

- Explore Financial Assistance Programs: Many pharmaceutical companies and healthcare providers offer financial assistance programs for those struggling to afford their medications or treatments.

Empowering Consumers with Health Insurance Literacy

Health insurance literacy is a critical tool for consumers to make informed decisions about their healthcare and coverage. This section aims to provide practical tips and resources to enhance your understanding and empower your choices.

Understanding Your Rights and Responsibilities

As a health insurance consumer, you have certain rights and responsibilities. Understanding these is crucial to ensuring you receive the care and coverage you’re entitled to. Here’s a breakdown:

- Right to Choice: You have the right to choose your healthcare providers, as long as they’re within your insurance network. If you prefer an out-of-network provider, you can still use them, but you may incur higher out-of-pocket costs.

- Right to Appeal: If your insurance company denies a claim, you have the right to appeal the decision. This process typically involves submitting additional information or documentation to support your case.

- Responsibility to Understand Your Plan: It’s your responsibility to read and understand your insurance policy. This includes knowing what’s covered, what’s not, and any specific conditions or exclusions.

- Responsibility to Pay Your Share: You’re responsible for paying your premiums on time and any out-of-pocket costs, like deductibles, co-pays, and co-insurance, as outlined in your policy.

Resources for Health Insurance Education

There are numerous resources available to help you enhance your health insurance literacy. These include:

- Insurance Company Websites: Most insurance companies provide comprehensive information on their websites, including policy details, provider networks, and claim processes.

- Government Resources: The US government offers a wealth of information and resources through websites like Healthcare.gov and Medicare.gov. These sites provide guidance on understanding health insurance, choosing a plan, and navigating the healthcare system.

- Independent Health Insurance Guides: There are several independent organizations and websites that offer unbiased guidance and resources on health insurance. These can be particularly useful for comparing plans and understanding industry trends.

- Community Health Centers: Local community health centers often provide educational resources and workshops on health insurance, particularly for those who may have difficulty accessing information online.

Conclusion: Navigating the Future of Health Insurance

The world of health insurance is continually evolving, with new plans, policies, and technologies shaping the landscape. As consumers, staying informed and proactive is key to ensuring we receive the healthcare we need and deserve. This comprehensive guide aims to provide a solid foundation for understanding health insurance, but it’s just the beginning. Continue to explore, learn, and advocate for your healthcare rights, and don’t hesitate to seek out additional resources and support as needed.

What is the Affordable Care Act (ACA) and how does it impact health insurance in the US?

+The Affordable Care Act, often referred to as Obamacare, was a landmark healthcare reform law in the United States. It aimed to increase the quality and affordability of health insurance, reduce the number of uninsured Americans, and provide consumers with more rights and protections. The ACA introduced several key provisions, including the requirement for most Americans to have health insurance (individual mandate), the expansion of Medicaid, and the establishment of Health Insurance Marketplaces (also known as Exchanges) where individuals and small businesses can purchase health plans.

How do I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves several factors. Consider your typical healthcare needs and expenses, whether you have any ongoing medical conditions, the cost of premiums and out-of-pocket expenses, and the size of the insurance company’s provider network. Also, review the plan’s coverage details, including any exclusions and limitations. If you’re eligible for multiple plans, compare them side-by-side to find the best fit for your needs and budget.

What happens if I can’t afford health insurance premiums?

+If you’re unable to afford health insurance premiums, there are a few options to consider. First, check if you’re eligible for government-funded programs like Medicaid or the Children’s Health Insurance Program (CHIP). If you’re eligible for the Health Insurance Marketplace, you may qualify for premium tax credits that can lower your monthly costs. Additionally, some states offer state-based programs or financial assistance for those with low incomes. It’s important to explore all available options to ensure you have adequate healthcare coverage.