Usaa Car Insurance Number

When it comes to car insurance, choosing the right provider is crucial to ensure you have the coverage you need. USAA, a well-known insurance company, offers a range of policies tailored to meet the needs of its members. This article will delve into the world of USAA car insurance, exploring its unique features, benefits, and the steps to obtain your USAA car insurance number. By understanding the process and the value it brings, you can make an informed decision about your insurance coverage.

Understanding USAA Car Insurance

USAA, or United Services Automobile Association, is an insurance provider that has been serving military members, veterans, and their families for over nine decades. Their car insurance policies are designed with the specific needs of this community in mind, offering comprehensive coverage at competitive rates. USAA’s commitment to its members is reflected in its reputation for excellent customer service and its range of insurance products.

USAA car insurance provides coverage for a wide range of vehicles, from cars and motorcycles to RVs and boats. The policies offer standard coverage options such as liability, collision, and comprehensive insurance, as well as additional features like rental car reimbursement and emergency roadside assistance. One of the unique aspects of USAA car insurance is its discounts and rewards program, which can significantly reduce the cost of insurance for eligible members.

USAA's discounts are tailored to its military and veteran members, recognizing the unique circumstances and needs of this community. For example, USAA offers a Military Installment Credit, which provides a discount for members who are stationed overseas or deployed. They also offer a Safe Driver Discount, rewarding members who maintain a clean driving record, and a Loyalty Discount for members who have been with USAA for an extended period.

| Discount Name | Description |

|---|---|

| Military Installment Credit | Discount for members stationed overseas or deployed. |

| Safe Driver Discount | Reward for maintaining a clean driving record. |

| Loyalty Discount | Discount for long-term USAA members. |

| Multi-Policy Discount | Savings for members with multiple insurance policies with USAA. |

| New Vehicle Discount | Discount for insuring a new car. |

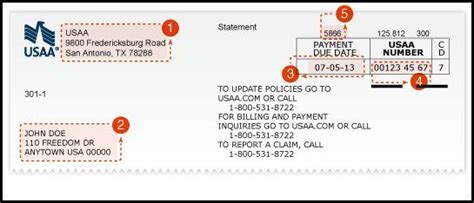

The USAA Car Insurance Number

The USAA car insurance number is a unique identifier assigned to each policyholder. It serves as a reference for your insurance policy and is used for various purposes, including making payments, filing claims, and contacting USAA for assistance. Understanding and having easy access to your USAA car insurance number is essential for efficient policy management.

How to Obtain Your USAA Car Insurance Number

Obtaining your USAA car insurance number is a straightforward process. Once you have purchased your car insurance policy with USAA, you will receive a policy document or an email confirmation that includes your insurance number. This number is typically a combination of letters and numbers, unique to your policy.

If you have difficulty locating your USAA car insurance number, there are a few methods to retrieve it:

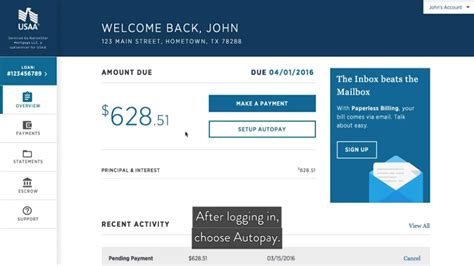

- Online Account: If you have an online account with USAA, log in to your account and navigate to the "My Policies" section. Your car insurance policy and its corresponding number should be listed there.

- Mobile App: USAA members can also access their insurance information through the USAA mobile app. Open the app, log in, and look for your car insurance policy details, where your insurance number will be displayed.

- Contact USAA: If you prefer, you can contact USAA's customer service team. They can provide your insurance number over the phone or through secure online messaging within your USAA account.

Using Your USAA Car Insurance Number

Your USAA car insurance number is a vital tool for managing your policy. Here are some scenarios where you will need it:

- Making Payments: When it's time to pay your insurance premium, you will need your insurance number to complete the payment process. USAA offers various payment methods, including online payments, automatic payments, and payments through the USAA mobile app.

- Filing Claims: In the event of an accident or incident that requires a claim, your insurance number will be necessary to initiate the claims process. USAA provides a straightforward online claims process, or you can contact their claims department directly.

- Policy Management: Your insurance number allows you to access and manage your policy details online or through the USAA mobile app. You can view your coverage, make policy changes, and update your personal information.

Benefits of USAA Car Insurance

USAA car insurance offers a range of benefits that set it apart from other insurance providers. Here are some key advantages:

Comprehensive Coverage

USAA car insurance policies provide comprehensive coverage to protect you and your vehicle. This includes liability coverage for bodily injury and property damage, as well as coverage for your own vehicle in the event of an accident, theft, or other covered incidents. USAA’s policies can be tailored to meet your specific needs, ensuring you have the right coverage at an affordable price.

Military-Friendly Discounts

As mentioned earlier, USAA’s discounts are designed with its military and veteran members in mind. These discounts can significantly reduce the cost of insurance, making it more affordable for those who serve or have served in the military. By recognizing the unique circumstances of military life, USAA demonstrates its commitment to supporting its members.

Excellent Customer Service

USAA is renowned for its outstanding customer service. The company consistently ranks highly in customer satisfaction surveys, with members praising the responsiveness and helpfulness of USAA’s customer service representatives. Whether you have questions about your policy, need assistance with a claim, or require roadside assistance, USAA’s customer service team is there to help.

Digital Convenience

In today’s digital age, USAA understands the importance of convenience and accessibility. Their online and mobile platforms offer a seamless experience for policy management, payments, and claims filing. With the USAA mobile app, you can access your insurance information, make payments, and even file claims from the palm of your hand.

Additional Perks

USAA goes beyond traditional car insurance by offering additional perks and benefits to its members. These may include emergency roadside assistance, rental car reimbursement, and travel assistance programs. USAA also provides resources and tools to help members stay informed about their insurance coverage and make educated decisions.

Conclusion: Why Choose USAA Car Insurance

USAA car insurance is a popular choice for military members, veterans, and their families due to its comprehensive coverage, military-friendly discounts, and exceptional customer service. By understanding the process of obtaining your USAA car insurance number and exploring the benefits of USAA’s policies, you can make an informed decision about your insurance coverage. Remember, having the right car insurance is essential to protect yourself, your vehicle, and your finances in the event of an accident or unexpected incident.

How can I qualify for USAA car insurance?

+To qualify for USAA car insurance, you must be a current or former member of the U.S. military, or a spouse or dependent child of a current or former military member. USAA also extends eligibility to cadets and midshipmen at certain U.S. service academies and ROTC candidates at accredited colleges and universities.

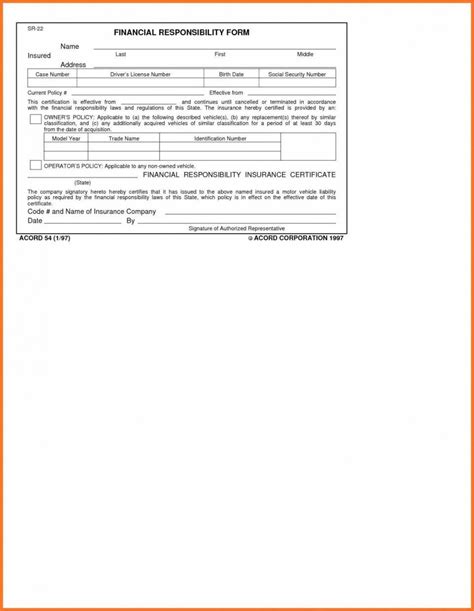

What types of coverage does USAA car insurance offer?

+USAA car insurance offers a range of coverage options, including liability coverage, collision coverage, comprehensive coverage, personal injury protection (PIP), medical payments coverage, uninsured/underinsured motorist coverage, and rental car reimbursement. You can tailor your policy to meet your specific needs.

How do I file a claim with USAA car insurance?

+To file a claim with USAA car insurance, you can start the process online through your USAA account or the USAA mobile app. Alternatively, you can call USAA’s 24⁄7 claims hotline. USAA will guide you through the claims process, providing support and assistance every step of the way.