Usaa Home Insurance Cost

Home insurance is a vital aspect of protecting your most valuable asset, and it's essential to understand the costs associated with it. USAA, a well-known insurance provider, offers comprehensive home insurance coverage tailored to meet the needs of its members. In this article, we will delve into the various factors that influence USAA home insurance costs and provide you with a comprehensive analysis to help you make informed decisions.

Understanding USAA Home Insurance Costs

The cost of USAA home insurance can vary significantly depending on numerous factors. It’s important to note that USAA provides coverage for both standard and high-value homes, ensuring a range of options for its members. Let’s explore the key aspects that impact the cost of USAA home insurance.

Coverage Options and Limits

USAA offers a variety of coverage options to cater to different needs and preferences. The coverage limits you choose will directly impact your insurance premium. Here are some common coverage options:

- Dwelling Coverage: This protects the physical structure of your home, including the walls, roof, and foundation. The coverage limit should be set at the estimated cost to rebuild your home, taking into account current construction costs.

- Personal Property Coverage: This covers the contents of your home, such as furniture, electronics, and clothing. You can opt for actual cash value or replacement cost coverage, with the latter providing more comprehensive protection.

- Liability Coverage: This safeguards you against legal liabilities arising from accidents or injuries that occur on your property. Higher liability limits offer greater protection but may result in a higher premium.

- Additional Coverages: USAA provides optional coverages like water backup, identity theft protection, and equipment breakdown coverage, which can further customize your policy but may add to the overall cost.

Location and Risk Factors

The location of your home plays a significant role in determining insurance costs. Areas prone to natural disasters like hurricanes, earthquakes, or wildfires typically have higher insurance premiums due to the increased risk. Additionally, factors such as crime rates, proximity to fire stations, and historical claims data for your area can influence the cost.

| Risk Factor | Impact on Cost |

|---|---|

| Natural Disasters | Areas with a high risk of natural disasters may experience higher premiums. |

| Crime Rates | Homes in neighborhoods with higher crime rates may face increased insurance costs. |

| Proximity to Fire Stations | Homes located farther from fire stations might see higher premiums due to potential response time delays. |

Home Construction and Age

The construction and age of your home are crucial factors in assessing insurance costs. Older homes may require more extensive repairs or have outdated electrical or plumbing systems, increasing the risk of claims. Similarly, homes with unique architectural features or those constructed with costly materials might attract higher premiums.

Deductibles and Discounts

Choosing a higher deductible can lower your insurance premium. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially sharing more of the risk, which can result in cost savings.

USAA offers various discounts to its members, which can significantly reduce the cost of home insurance. Some common discounts include:

- Multi-Policy Discount: Bundling your home and auto insurance with USAA can lead to substantial savings.

- Safety Features Discount: Homes equipped with security systems, fire alarms, or other safety features may qualify for discounts.

- Loyalty Discount: Long-term USAA members often receive loyalty discounts as a reward for their continued membership.

- Automatic Payments Discount: Setting up automatic payments for your insurance premium can result in a small discount.

Credit Score and Claims History

Your credit score can influence the cost of your home insurance. Insurance providers often use credit-based insurance scores to assess risk, and a higher credit score may result in a lower premium. Additionally, a clean claims history can also work in your favor, as insurers prefer policyholders who have not filed frequent or costly claims.

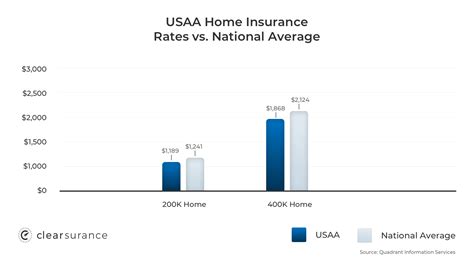

Real-Life Examples and Data

To provide a clearer understanding of USAA home insurance costs, let’s examine some real-life examples and data. These scenarios will give you an idea of the range of premiums you might expect based on different factors.

Standard Home Example

Consider a standard, single-family home located in a suburban area with moderate risk factors. The home is 20 years old, has basic construction, and is insured with USAA. The coverage limits chosen are:

- Dwelling Coverage: 250,000</li> <li>Personal Property Coverage: 100,000 (Replacement Cost)

- Liability Coverage: $300,000

With these coverage limits and assuming the homeowner has a good credit score and no recent claims, the annual premium for this standard home might fall within the range of $1,200 to $1,500.

High-Value Home Example

Now, let’s look at an example of a high-value home. This home is located in a desirable neighborhood with excellent fire protection and a low crime rate. It is a newly constructed, custom-built home with high-end finishes and unique architectural features. The coverage limits chosen are:

- Dwelling Coverage: 1,000,000</li> <li>Personal Property Coverage: 500,000 (Replacement Cost)

- Liability Coverage: $1,000,000

Given the home's value and unique features, the annual premium for this high-value home could range from $3,500 to $5,000, depending on the homeowner's credit score and claims history.

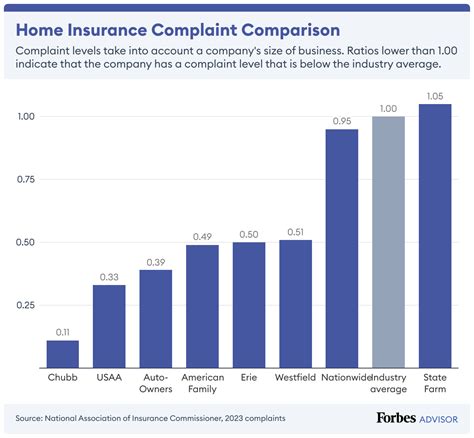

Performance Analysis and Expert Insights

USAA is renowned for its excellent customer service and competitive pricing. They consistently rank among the top insurance providers for military families and veterans. Their home insurance policies offer comprehensive coverage and include additional benefits like disaster preparedness resources and claims assistance.

One unique aspect of USAA's home insurance is their focus on military families. They understand the unique challenges faced by service members and their families, offering specialized coverage options and discounts tailored to their needs. USAA's commitment to serving the military community sets them apart in the insurance industry.

Future Implications and Considerations

As you consider USAA home insurance, it’s essential to keep a few key points in mind. Firstly, regularly reviewing and updating your coverage limits is crucial to ensure you have adequate protection without overpaying. As your home’s value changes or you make significant upgrades, adjusting your coverage limits accordingly will help maintain the right balance.

Additionally, it's worthwhile to explore the various discounts offered by USAA. By taking advantage of these discounts and optimizing your coverage choices, you can potentially save a significant amount on your home insurance premiums. Remember, every situation is unique, so it's always a good idea to consult with a USAA insurance expert to tailor a policy that suits your specific needs.

Frequently Asked Questions

Can I customize my USAA home insurance policy to meet my specific needs?

+Absolutely! USAA offers a range of coverage options and limits, allowing you to customize your policy based on your home’s value, contents, and liability needs. This flexibility ensures you get the right coverage without paying for unnecessary extras.

Are there any discounts available for USAA home insurance?

+Yes, USAA provides various discounts, including multi-policy discounts for bundling home and auto insurance, safety feature discounts for homes with security systems, and loyalty discounts for long-term members. These discounts can significantly reduce your insurance premiums.

How often should I review my USAA home insurance policy?

+It’s recommended to review your policy annually or whenever significant changes occur in your home’s value, construction, or contents. Regular reviews ensure your coverage remains up-to-date and adequate for your needs.