Usaa Online Car Insurance Quote

Welcome to this comprehensive guide on USAA's online car insurance quote process. As a member-focused financial services provider, USAA offers a convenient and efficient way to obtain car insurance quotes online. This article will delve into the specifics of the USAA car insurance quote process, providing an in-depth analysis and insights to help you make informed decisions about your coverage.

Understanding USAA Car Insurance Quotes

USAA, known for its dedication to military members and their families, extends its services to provide comprehensive car insurance coverage. Obtaining an online quote from USAA is a straightforward process that allows you to explore various coverage options and customize your policy to fit your needs. Here’s an overview of what you can expect when seeking a car insurance quote from USAA.

The Online Quoting Process

USAA’s online quoting platform is designed with user-friendliness in mind. To begin, you’ll need to visit the USAA website and navigate to the car insurance section. Here, you’ll find a step-by-step guide to obtaining a quote, which typically involves the following:

- Personal Information: Start by providing your basic details, including your name, date of birth, and contact information. This step ensures that USAA can tailor the quote to your specific needs.

- Vehicle Information: Enter details about your vehicle, such as the make, model, year, and VIN. USAA uses this information to assess the value and risk associated with your car.

- Coverage Selection: Choose the type and level of coverage you require. USAA offers a range of options, including liability, collision, comprehensive, and additional coverage enhancements. You can customize your policy to align with your preferences and budget.

- Driver Information: Provide details about the primary and any additional drivers on the policy. USAA considers factors such as driving history, age, and experience when calculating your premium.

- Discounts and Savings: USAA is known for its competitive rates and generous discounts. During the quoting process, you’ll have the opportunity to explore various discounts, such as those for safe driving, multi-policy bundling, and military affiliation.

- Review and Finalize: Once you’ve provided all the necessary information, USAA will generate a personalized quote. Review the details, including coverage limits, deductibles, and the estimated annual premium. You can make adjustments or proceed to purchase the policy if you’re satisfied with the quote.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you from financial loss in the event of an at-fault accident, covering bodily injury and property damage claims made against you. |

| Collision Coverage | Covers damage to your vehicle resulting from a collision, regardless of fault. This coverage is essential for protecting your vehicle's value. |

| Comprehensive Coverage | Provides protection against non-collision incidents, such as theft, vandalism, natural disasters, and animal collisions. It helps cover the cost of repairs or replacements. |

| Additional Coverages | USAA offers various optional coverages, including rental car coverage, roadside assistance, and gap insurance. These enhancements can provide added peace of mind. |

Benefits of USAA Car Insurance

Choosing USAA for your car insurance needs comes with several advantages:

- Competitive Rates: USAA is renowned for offering competitive insurance rates, particularly for military members and their families. The online quoting process allows you to compare rates and find the best value for your specific situation.

- Comprehensive Coverage: USAA provides a range of coverage options to ensure you can customize your policy to fit your needs. Whether you require basic liability coverage or extensive protection, USAA has you covered.

- Military-Focused Discounts: USAA offers unique discounts to military members, including active duty, veterans, and their families. These discounts can significantly reduce your insurance premiums, making USAA an attractive option for those with military affiliations.

- Excellent Customer Service: USAA is consistently recognized for its exceptional customer service. Their dedicated team is readily available to assist with any queries or concerns you may have throughout the quoting and policy management process.

- Digital Convenience: The online quoting platform is user-friendly and accessible, allowing you to obtain quotes quickly and conveniently. Additionally, USAA provides a range of digital tools and resources to manage your policy and stay informed about your coverage.

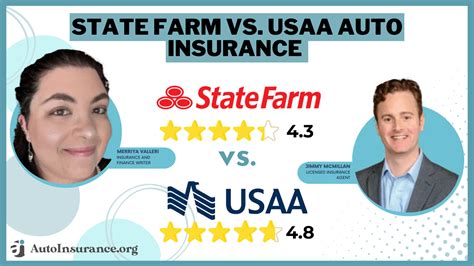

Performance Analysis and Industry Comparison

USAA’s car insurance offerings have consistently received high marks from industry experts and customers alike. Let’s delve into some key performance indicators and compare USAA’s car insurance with other leading providers.

Financial Strength and Stability

USAA maintains an exceptional financial strength rating, as assessed by independent rating agencies. This rating reflects USAA’s ability to meet its financial obligations and provides reassurance to policyholders. With a strong financial foundation, USAA can offer stable and reliable coverage.

Customer Satisfaction and Claims Handling

Customer satisfaction is a key focus for USAA, and it consistently ranks highly in industry surveys. USAA’s dedication to providing prompt and efficient claims handling has earned it a reputation for excellence. Policyholders appreciate the seamless process and the support they receive during claims settlement.

Industry Comparison

When comparing USAA’s car insurance to other leading providers, several key factors stand out:

- Price: USAA often offers competitive pricing, particularly for military members. While prices may vary based on individual circumstances, USAA’s rates are generally favorable compared to industry averages.

- Coverage Options: USAA provides a comprehensive range of coverage options, allowing policyholders to customize their policies. This flexibility is a significant advantage, especially for those with unique insurance needs.

- Discounts: USAA’s military-focused discounts are a distinctive feature. These discounts can result in substantial savings, making USAA an attractive choice for military families.

- Digital Experience: USAA’s digital platform is highly regarded for its user-friendliness and convenience. The online quoting process and policy management tools are intuitive, providing a seamless experience for tech-savvy individuals.

Future Implications and Industry Trends

As the insurance industry evolves, USAA remains at the forefront, adapting to changing trends and technologies. Here’s a glimpse into the future of USAA’s car insurance offerings and the industry as a whole.

Technology Integration

USAA continues to invest in technology to enhance the customer experience. Expect further improvements in the online quoting platform, with features like real-time quotes and more personalized recommendations. Additionally, USAA may explore innovative technologies such as telematics and usage-based insurance, offering policyholders even more control over their coverage.

Expanded Coverage Options

USAA is likely to expand its coverage options to meet the evolving needs of its members. This may include introducing new endorsements and coverage enhancements to address specific concerns, such as autonomous vehicle technology or cyber risks associated with connected cars.

Community Engagement

USAA’s commitment to its military community is a cornerstone of its success. Expect continued initiatives and partnerships aimed at supporting military families and addressing their unique insurance needs. USAA’s focus on community engagement will remain a key differentiator in the industry.

Environmental Initiatives

With increasing awareness of environmental sustainability, USAA may explore ways to incorporate eco-friendly practices into its insurance offerings. This could involve promoting electric vehicle ownership, offering incentives for green driving habits, or partnering with sustainable transportation initiatives.

In Conclusion

USAA’s online car insurance quote process is a testament to its commitment to providing accessible and tailored coverage to its members. With a focus on user experience, competitive rates, and comprehensive coverage options, USAA continues to set the bar high in the insurance industry. As the future unfolds, USAA is well-positioned to adapt and innovate, ensuring its members receive the best possible insurance experience.

How accurate are USAA’s online car insurance quotes?

+USAA’s online quotes are designed to provide a personalized estimate based on the information you provide. While they are generally accurate, it’s important to note that the final premium may vary slightly during the policy underwriting process. Factors such as driving history, credit score, and specific vehicle details can impact the final quote.

Can I bundle my car insurance with other USAA policies to save money?

+Absolutely! USAA encourages policyholders to bundle their car insurance with other USAA policies, such as homeowners or renters insurance. Bundling can result in significant savings, as USAA offers generous multi-policy discounts. By combining your insurance needs with USAA, you can enjoy comprehensive coverage and lower premiums.

What factors influence the cost of USAA car insurance quotes?

+Several factors contribute to the cost of USAA car insurance quotes, including your driving history, the make and model of your vehicle, your coverage choices, and any applicable discounts. Additionally, your age, gender, and marital status may also impact your premium. It’s essential to review these factors and customize your coverage to find the best value.