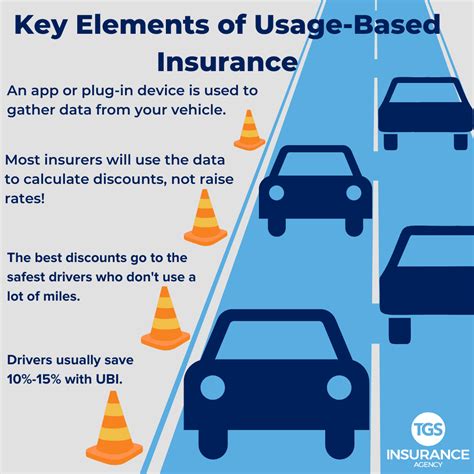

Usagebased Insurance

In the dynamic landscape of the insurance industry, there's a growing trend towards innovative pricing models, and one of the most intriguing is Usage-Based Insurance (UBI). This approach challenges traditional insurance models by proposing a new paradigm: instead of charging a flat rate, UBI adapts premiums to the actual usage and behavior of policyholders. As we delve into this concept, we'll explore its mechanics, benefits, and potential impact on the future of insurance.

Understanding Usage-Based Insurance

Usage-Based Insurance, often referred to as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD), is a pricing model that calculates insurance premiums based on the individual driving behavior and usage patterns of a vehicle. This paradigm shift from the conventional model, which primarily considers factors like age, gender, and vehicle type, offers a more personalized and dynamic approach to insurance pricing.

How UBI Works

UBI employs advanced telematics technology to track and analyze various driving parameters. Telematics devices, which can be installed in vehicles or integrated into smartphones, collect data on driving habits, including speed, acceleration, braking patterns, distance traveled, and even the time of day when the vehicle is in use. This data is then transmitted to the insurance provider, where it is processed and used to determine the insurance premium.

The key advantage of UBI is its ability to offer a more accurate risk assessment. By analyzing real-time driving behavior, insurance companies can more precisely calculate the likelihood of an accident and, consequently, the potential cost of claims. This data-driven approach allows insurers to offer personalized premiums, rewarding safe drivers with lower rates and providing a more equitable pricing structure.

Benefits of Usage-Based Insurance

UBI presents a myriad of benefits for both insurance providers and policyholders. For insurers, it offers a more accurate risk assessment, potentially leading to a reduction in fraudulent claims and a more efficient claims management process. This improved risk profiling can also help insurers better manage their overall risk exposure, leading to more stable premium rates and improved profitability.

For policyholders, the primary advantage is the potential for significant savings. Safe drivers, who historically may have paid higher premiums due to their age or gender, can now benefit from lower rates based on their actual driving behavior. Additionally, UBI encourages safer driving habits, as policyholders are incentivized to drive more cautiously, knowing that their premiums will reflect their improved safety record.

| Benefit | Description |

|---|---|

| Personalized Pricing | UBI offers tailored premiums based on individual driving behavior, ensuring fairer rates. |

| Encourages Safe Driving | Policyholders are motivated to drive more safely, leading to improved road safety. |

| Potential Cost Savings | Safe drivers can enjoy lower premiums, resulting in significant savings over time. |

| Data-Driven Risk Assessment | Insurers can more accurately assess risk, leading to improved claims management and reduced fraud. |

Implementing UBI: A Real-World Perspective

The concept of Usage-Based Insurance is not merely theoretical; it is already being implemented by various insurance providers worldwide. One notable example is the UBI program offered by XYZ Insurance Company, which has seen tremendous success in incentivizing safer driving behaviors among its policyholders.

XYZ's program utilizes advanced telematics devices that track driving behavior and provide real-time feedback to drivers. This feedback includes metrics such as smooth braking, efficient acceleration, and overall driving efficiency. Policyholders are rewarded with points for every safe driving behavior, which can be redeemed for discounts on their insurance premiums.

The results of XYZ's UBI program have been impressive. Over the past year, the company has seen a 15% reduction in claims among its UBI policyholders, directly attributed to the safer driving habits encouraged by the program. This has not only led to significant cost savings for policyholders but has also improved the overall safety of roads in the regions where XYZ operates.

The Technological Edge

The success of UBI programs like XYZ’s is largely dependent on the advanced telematics technology used. These devices, which are often small and discreet, can provide incredibly detailed data on driving behavior. This data is then securely transmitted to insurance providers, who use sophisticated algorithms to analyze the information and determine the appropriate premiums.

The integration of telematics with smartphone technology has further enhanced the accessibility and convenience of UBI programs. Many insurers now offer apps that can turn smartphones into telematics devices, providing an affordable and convenient way for policyholders to participate in UBI programs. This technology has made UBI more accessible to a wider range of drivers, particularly those who may not have access to traditional telematics devices.

Challenges and Future Implications

While Usage-Based Insurance offers numerous benefits, it also presents certain challenges and considerations. One of the primary concerns is privacy. The collection and transmission of driving data raise questions about the potential for data misuse or unauthorized access. Insurers must therefore ensure robust data security measures are in place to protect policyholder information.

Another challenge is the potential for selection bias. UBI programs may attract a higher proportion of safe drivers, leading to a less diverse risk pool. This could potentially impact the overall profitability of insurance providers, as they may not be adequately capturing the risks associated with less safe drivers. Balancing the benefits of UBI with the need for a diverse risk pool is a key challenge for insurers moving forward.

The Road Ahead

As the insurance industry continues to evolve, Usage-Based Insurance is poised to play a significant role in shaping the future of the sector. The increasing adoption of connected vehicles and the Internet of Things (IoT) will further enhance the potential of UBI, providing even more detailed and accurate driving data. This data-driven approach will not only revolutionize insurance pricing but also contribute to improved road safety and more sustainable mobility solutions.

In conclusion, Usage-Based Insurance represents a significant innovation in the insurance industry, offering personalized pricing and encouraging safer driving behaviors. While there are challenges to be addressed, the potential benefits of UBI are compelling. As this model continues to gain traction, it will be fascinating to observe its impact on the insurance landscape and the broader mobility ecosystem.

How does UBI impact the insurance industry’s profitability?

+UBI can positively impact profitability by offering a more accurate risk assessment. By better understanding driving behavior, insurers can more effectively manage their risk exposure, leading to more stable premium rates and reduced claims costs. However, the challenge lies in maintaining a diverse risk pool to ensure long-term profitability.

Are there any privacy concerns with UBI programs?

+Yes, the collection and transmission of driving data raise privacy concerns. Insurers must ensure that they have robust data security measures in place to protect policyholder information. Additionally, clear and transparent policies regarding data usage and sharing are essential to building trust with policyholders.

How can UBI encourage safer driving behaviors?

+UBI incentivizes safer driving by directly linking premiums to driving behavior. Policyholders are motivated to drive more cautiously, knowing that their premiums will reflect their improved safety record. Many UBI programs also provide real-time feedback, helping drivers understand and improve their driving habits.