V.s.p. Eye Insurance And Coverage

Vision-specific insurance, often referred to as VSP or vision care insurance, is a vital component of comprehensive healthcare coverage. It provides individuals with access to essential eye care services, ensuring their visual health is maintained and any issues are promptly addressed. This article delves into the intricacies of VSP Eye Insurance, exploring its coverage, benefits, and the impact it has on individuals' overall well-being.

Understanding VSP Eye Insurance

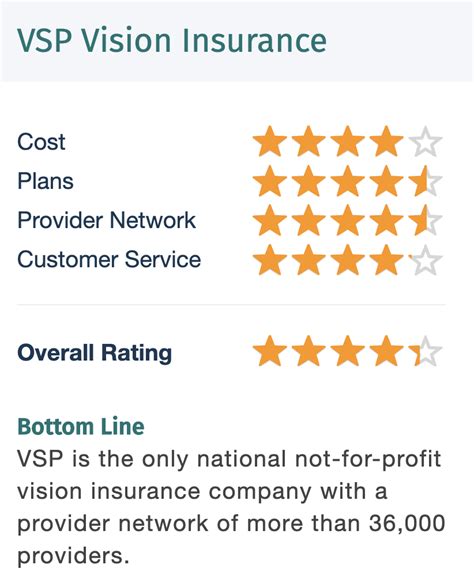

VSP, or Vision Service Plan, is a leading provider of vision insurance in the United States. It offers a range of plans designed to cover various eye care needs, from routine eye exams to specialized treatments. Understanding the coverage provided by VSP is essential for individuals to make informed decisions about their eye health and to maximize the benefits of their insurance plan.

VSP's vision insurance plans typically cover a comprehensive range of services, including:

- Eye Examinations: Annual comprehensive eye exams are crucial for detecting any potential vision problems or eye diseases. VSP covers these exams, ensuring that individuals can schedule regular check-ups without financial burden.

- Prescription Eyewear: VSP plans often include coverage for prescription eyeglasses or contact lenses. This allows individuals to obtain the necessary corrective lenses to improve their vision.

- Specialty Services: Depending on the plan, VSP may cover specialty services such as laser vision correction, cataract surgery, and other advanced eye procedures.

- Eye Health Management: VSP insurance also extends to the management of various eye conditions, including glaucoma, macular degeneration, and diabetic retinopathy. This coverage ensures individuals receive the necessary treatments and medications to manage their eye health effectively.

Key Benefits of VSP Eye Insurance

The benefits of VSP Eye Insurance are extensive and have a significant impact on individuals’ overall quality of life. Here are some key advantages:

- Cost Savings: Eye care services can be expensive, especially for those without insurance. VSP insurance plans offer substantial cost savings, making eye exams, glasses, and specialized treatments more affordable.

- Early Detection and Prevention: Regular eye exams covered by VSP allow for the early detection of vision problems and eye diseases. This early intervention can prevent more severe issues and even vision loss, emphasizing the importance of proactive eye care.

- Access to Specialists: VSP's network of providers includes eye care specialists such as ophthalmologists and optometrists. This ensures that individuals have access to the most qualified professionals for their specific eye needs.

- Flexibility and Customization: VSP offers a variety of plan options, allowing individuals to choose a plan that best suits their eye care requirements and budget. This flexibility ensures that everyone can find a plan that meets their unique needs.

- Convenience: With a VSP plan, individuals can easily locate in-network providers through the VSP network directory, making it convenient to schedule appointments and receive covered services.

VSP Coverage and Plan Details

VSP Eye Insurance plans vary in terms of coverage and benefits. Here is a breakdown of some common plan features:

| Plan Type | Coverage Highlights |

|---|---|

| Basic Plan | Annual eye exams, limited coverage for glasses or contacts, and basic eye health management. |

| Standard Plan | Enhanced coverage for eye exams, increased allowance for prescription eyewear, and expanded coverage for specialty services. |

| Premium Plan | Comprehensive coverage including annual eye exams, a generous allowance for glasses or contacts, and full coverage for specialty services such as LASIK and cataract surgery. |

It's important to note that specific plan details may vary based on the provider and the individual's location. Additionally, some plans may offer additional benefits such as discounts on laser vision correction or vision-related wellness programs.

Maximizing Your VSP Benefits

To make the most of your VSP Eye Insurance, consider the following tips:

- Schedule Regular Eye Exams: Take advantage of your annual eye exam benefit to maintain your eye health and detect any potential issues early on.

- Understand Your Plan: Review your plan details carefully to understand the specific coverage and benefits you are entitled to. This knowledge will help you make informed decisions about your eye care.

- Explore In-Network Providers: Utilize the VSP network directory to find in-network providers in your area. This ensures you receive the maximum coverage and benefits under your plan.

- Stay Informed: Keep up-to-date with any changes or updates to your VSP plan. This may include new benefits, coverage enhancements, or provider network additions.

- Consider Supplemental Coverage: If you have specific eye health concerns or require specialized treatments, explore the option of supplemental insurance to enhance your VSP coverage.

Future of Vision Insurance and VSP

The landscape of vision insurance is constantly evolving, and VSP is at the forefront of these changes. As technology advances and eye care becomes more specialized, VSP is adapting its plans to meet the evolving needs of its members. Here are some insights into the future of VSP Eye Insurance:

- Technology Integration: VSP is exploring ways to incorporate technology into its plans, such as telemedicine services for eye care consultations and the use of artificial intelligence for early detection of eye diseases.

- Expanded Coverage: In response to the growing demand for specialized eye care, VSP is expanding its coverage to include more advanced procedures and treatments. This ensures that individuals with complex eye conditions have access to the necessary care.

- Wellness Programs: VSP is placing a greater emphasis on vision wellness, offering programs and resources to promote healthy vision habits and prevent eye-related issues.

- Collaboration with Providers: VSP is strengthening its partnerships with eye care providers to improve the overall patient experience and ensure that members receive the highest quality of care.

Conclusion

VSP Eye Insurance plays a crucial role in ensuring individuals have access to comprehensive eye care. By understanding the coverage, benefits, and plan details, individuals can make informed decisions about their eye health and take advantage of the cost savings and early detection advantages offered by VSP. As the future of vision insurance evolves, VSP remains committed to providing innovative and accessible eye care solutions, ensuring that individuals can maintain healthy vision for years to come.

Can I choose my own eye care provider under VSP insurance?

+Yes, VSP offers a network of providers, and you can choose an in-network eye care professional. However, it’s important to check the network directory to ensure your preferred provider is included.

Does VSP insurance cover refractive surgery like LASIK?

+Yes, certain VSP plans include coverage for refractive surgery, including LASIK. However, the level of coverage may vary based on the plan chosen.

Are there any age restrictions for VSP insurance coverage?

+VSP insurance plans are typically available to individuals of all ages, including children and seniors. However, specific plan details may vary, so it’s important to review the plan documents.