Vehicle Insurance Full Coverage

Vehicle insurance, often referred to as car insurance or auto insurance, is an essential aspect of responsible vehicle ownership. It provides financial protection against various risks and liabilities associated with owning and operating a motor vehicle. Full coverage insurance is a comprehensive policy that offers extensive protection, covering a wide range of potential damages and losses. In this in-depth exploration, we will delve into the intricacies of vehicle insurance full coverage, shedding light on its benefits, components, and importance in safeguarding your vehicle and financial well-being.

Understanding Vehicle Insurance Full Coverage

Vehicle insurance full coverage, as the name suggests, is a comprehensive insurance policy designed to offer maximum protection for vehicle owners. It combines multiple types of coverage into a single policy, ensuring that you are prepared for a variety of unexpected situations and potential risks. Unlike basic liability-only insurance, full coverage provides a more holistic approach to vehicle protection.

Full coverage insurance typically includes the following key components:

- Collision Coverage: This coverage pays for damages to your vehicle when you are at fault in an accident. It covers repairs or the replacement cost of your vehicle if it's deemed a total loss.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against non-collision incidents, such as theft, vandalism, natural disasters, and damage caused by animals. It provides financial assistance for repairs or replacement.

- Liability Coverage: While liability coverage is often considered separately, it's a crucial component of full coverage insurance. It protects you against claims arising from bodily injury or property damage caused by you to others in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you're involved in an accident with a driver who has insufficient or no insurance coverage. It helps cover your medical bills and other related expenses.

- Medical Payments Coverage: Medical payments coverage, also known as Personal Injury Protection (PIP), covers medical expenses for you and your passengers after an accident, regardless of who is at fault.

- Rental Car Reimbursement: In the event that your vehicle is being repaired after an insured incident, this coverage provides a rental car allowance to ensure you have temporary transportation.

- Roadside Assistance: Full coverage policies often include roadside assistance, offering services like towing, flat tire changes, battery jumps, and fuel delivery in case of emergencies.

The Benefits of Vehicle Insurance Full Coverage

Opting for vehicle insurance full coverage offers numerous advantages, providing a robust safety net for vehicle owners. Here are some key benefits:

Financial Protection in Various Scenarios

Full coverage insurance ensures that you are financially protected in a wide range of situations. Whether it’s an accident caused by you, damage from natural disasters, or even theft, this policy provides coverage for repairs or replacement costs, minimizing out-of-pocket expenses.

Peace of Mind

With full coverage insurance, you can drive with peace of mind, knowing that you are adequately protected. The comprehensive nature of the policy reduces the financial burden and stress associated with unexpected vehicle-related incidents.

Enhanced Safety for Passengers

Full coverage insurance includes medical payments coverage, which ensures that you and your passengers receive necessary medical attention after an accident. This coverage provides quick access to healthcare services without worrying about immediate payment.

Compliance with Legal Requirements

In many regions, having adequate liability insurance is a legal requirement for vehicle ownership. Full coverage insurance typically includes liability coverage, ensuring that you meet these legal obligations.

Customizable Coverage

Full coverage insurance policies are highly customizable. You can tailor your coverage to your specific needs and budget. Insurance providers offer various options, allowing you to choose the level of protection that suits your vehicle and driving habits.

Factors Influencing Full Coverage Insurance Rates

The cost of vehicle insurance full coverage can vary significantly based on several factors. Understanding these factors can help you make informed decisions when choosing an insurance policy.

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining insurance rates. Luxury vehicles and high-performance cars often have higher insurance premiums due to their expensive repair costs.

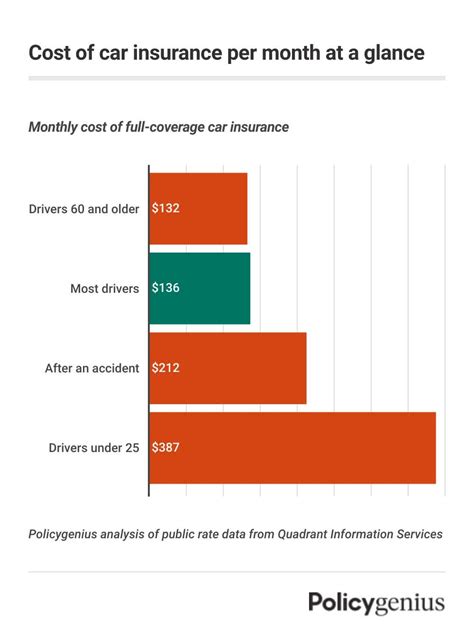

Driver’s Profile

Your driving history and personal details influence insurance rates. Factors such as age, gender, driving experience, and claims history are considered. Younger drivers and those with a history of accidents or violations may face higher premiums.

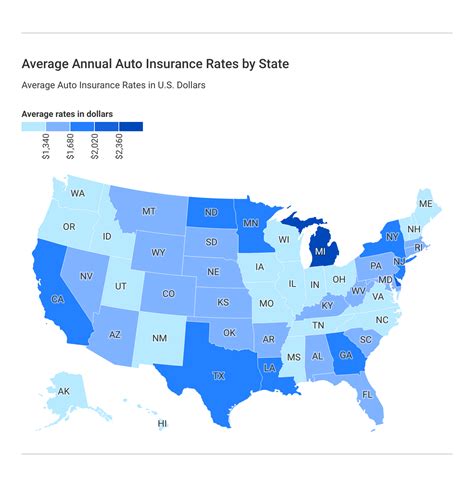

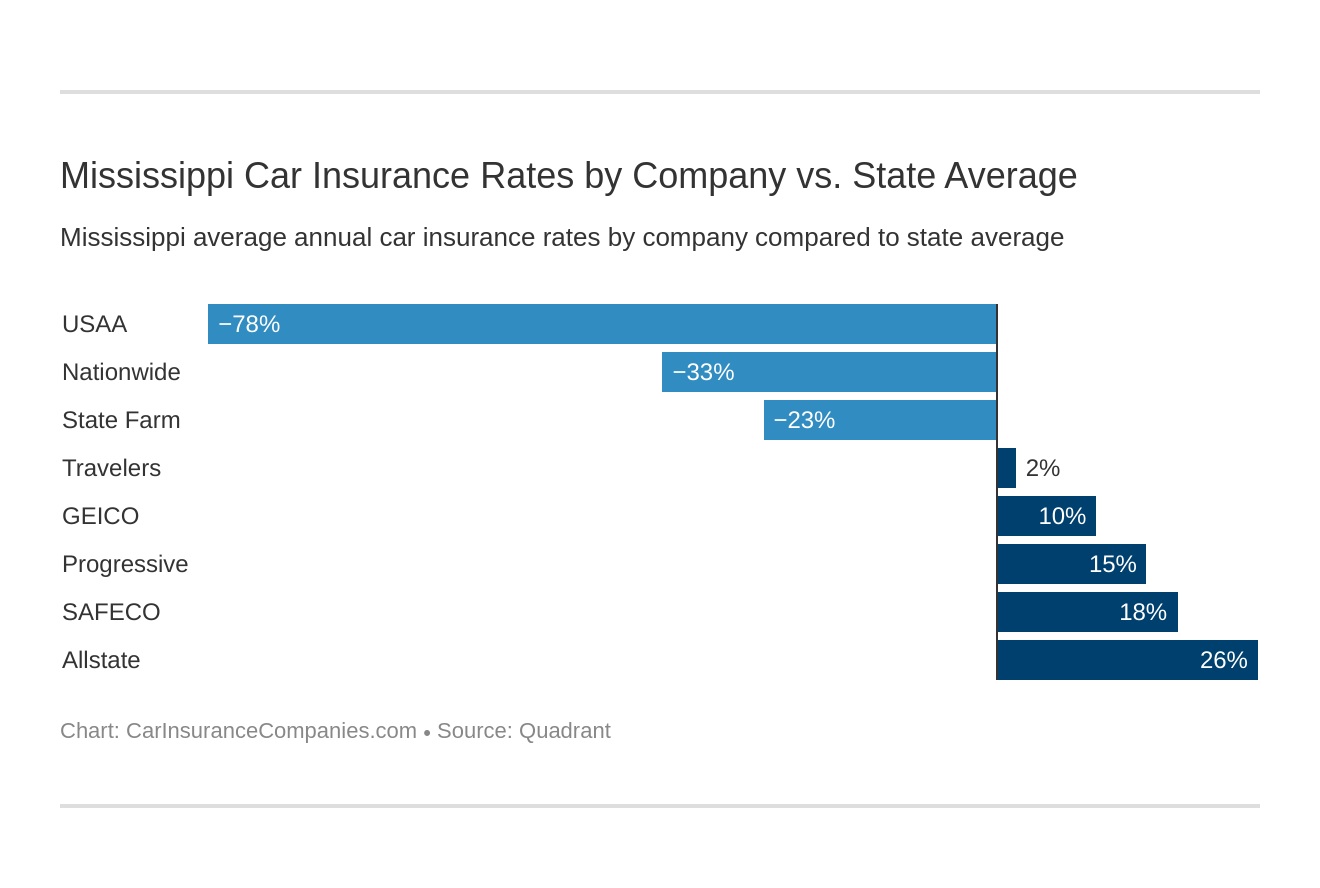

Location

The geographical location where you reside and drive can impact insurance rates. Areas with high crime rates, frequent natural disasters, or dense traffic may result in higher premiums.

Coverage Limits and Deductibles

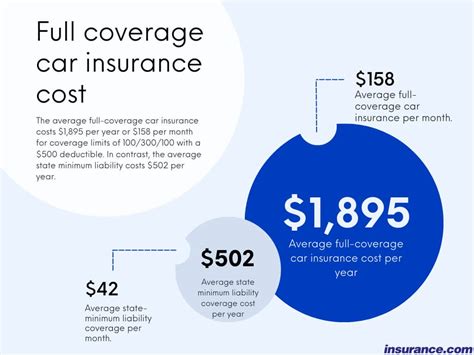

The coverage limits you choose and the deductibles you’re willing to pay also affect the cost of your insurance. Higher coverage limits and lower deductibles typically result in higher premiums.

Discounts and Bundling

Insurance providers often offer discounts for various reasons. You may qualify for discounts based on factors like good driving records, safe vehicle features, or bundling multiple insurance policies (e.g., home and auto) with the same provider.

Performance Analysis: Real-World Examples

To illustrate the benefits of vehicle insurance full coverage, let’s consider a few real-world scenarios:

Scenario 1: Collision with Another Vehicle

Imagine you’re involved in a collision with another vehicle while driving. If you have full coverage insurance, the collision coverage will kick in, covering the repairs or replacement of your vehicle. Additionally, liability coverage ensures that any damages caused to the other party’s vehicle are also covered.

Scenario 2: Natural Disaster Damage

In the event of a natural disaster, such as a hurricane or flood, your vehicle may sustain significant damage. With comprehensive coverage as part of your full coverage policy, you can receive financial assistance for repairs or even the replacement of your vehicle if it’s deemed a total loss.

Scenario 3: Roadside Assistance

You’re stranded on the side of the road due to a flat tire or a dead battery. With roadside assistance included in your full coverage insurance, you can call for help, and the insurance provider will arrange for a service vehicle to assist you.

Comparative Analysis: Full Coverage vs. Liability-Only Insurance

To further emphasize the advantages of full coverage insurance, let’s compare it to liability-only insurance, which is the minimum coverage required by law in many regions.

| Coverage Type | Full Coverage | Liability-Only |

|---|---|---|

| Collision Coverage | ✔️ | ✖️ |

| Comprehensive Coverage | ✔️ | ✖️ |

| Liability Coverage | ✔️ | ✔️ (Minimum Requirement) |

| Uninsured/Underinsured Motorist Coverage | ✔️ | ✖️ |

| Medical Payments Coverage | ✔️ | ✖️ |

| Rental Car Reimbursement | ✔️ | ✖️ |

| Roadside Assistance | ✔️ | ✖️ |

As evident from the table, full coverage insurance provides a much broader range of protection compared to liability-only insurance. While liability-only insurance is legally mandated and covers damages caused to others, it offers limited protection for your own vehicle and personal well-being.

Future Implications and Trends in Vehicle Insurance

The vehicle insurance landscape is evolving, and several trends are shaping the future of this industry. Here are some key developments to consider:

Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and vehicle usage, is gaining traction. Insurance providers are offering usage-based insurance policies that adjust premiums based on driving habits and miles driven. This trend promotes safer driving and personalized insurance rates.

Connected Vehicles and Data Analytics

The integration of advanced technology in vehicles, such as connected car systems and sensors, generates vast amounts of data. Insurance providers are leveraging this data to analyze driving patterns, vehicle performance, and risk factors, enabling more accurate risk assessments and personalized insurance offerings.

Autonomous Vehicles and Insurance Challenges

The rise of autonomous vehicles presents unique challenges for the insurance industry. As self-driving cars become more prevalent, liability issues and insurance coverage for these vehicles will require careful consideration and adaptation of existing insurance models.

Digitalization and Online Insurance Platforms

The insurance industry is embracing digitalization, with online platforms and apps making it easier for customers to compare policies, purchase insurance, and manage their coverage. This trend enhances convenience and provides more transparent and accessible insurance options.

Sustainable Insurance Practices

As environmental concerns grow, insurance providers are exploring sustainable practices. This includes offering incentives for eco-friendly vehicles and promoting green initiatives to reduce the environmental impact of the insurance industry.

Conclusion

Vehicle insurance full coverage is a comprehensive solution that provides peace of mind and financial protection for vehicle owners. By combining various coverage types, it ensures that you are prepared for a wide range of potential risks and liabilities. From collision and comprehensive coverage to liability protection and additional benefits like roadside assistance, full coverage insurance offers a robust safety net.

As the vehicle insurance landscape continues to evolve, staying informed about the latest trends and developments is crucial. By understanding the factors influencing insurance rates and exploring the benefits of full coverage, you can make informed decisions to protect your vehicle and financial well-being.

How do I choose the right full coverage insurance policy for my vehicle?

+Choosing the right full coverage policy involves considering your specific needs and budget. Assess the value of your vehicle, your driving habits, and the level of coverage you desire. Compare quotes from multiple insurance providers and tailor your policy to include the coverage options that align with your priorities. Don’t hesitate to seek advice from insurance experts to ensure you make an informed decision.

What happens if I have an accident with a driver who has no insurance coverage?

+If you’re involved in an accident with an uninsured driver, your uninsured motorist coverage will come into play. This coverage ensures that you are protected and can receive compensation for damages and injuries caused by the uninsured driver. It provides a financial safety net, allowing you to focus on recovery without worrying about financial burdens.

Are there any disadvantages to full coverage insurance?

+While full coverage insurance offers extensive protection, it typically comes with higher premiums compared to basic liability-only insurance. The increased cost may not be feasible for all vehicle owners, especially those on a tight budget. However, it’s essential to weigh the benefits against the costs and consider your specific needs and circumstances.