Vehicle Insurance Plans

In today's world, vehicle ownership is a common necessity and a symbol of independence and mobility. Whether it's a car, motorcycle, or any other motorized vehicle, having the right insurance plan is crucial to protect yourself, your assets, and others on the road. Vehicle insurance provides financial coverage in the event of accidents, theft, or other unforeseen circumstances, offering peace of mind and ensuring that drivers are prepared for the unexpected.

This comprehensive guide aims to delve into the world of vehicle insurance plans, providing an in-depth analysis of the various aspects and considerations involved. From understanding the different types of coverage to exploring the factors that influence insurance rates, we will cover it all, empowering you to make informed decisions when choosing the right insurance plan for your vehicle.

Understanding Vehicle Insurance: Types and Coverage

Vehicle insurance is a complex field, offering a range of coverage options to cater to different needs and requirements. Understanding the types of insurance available is the first step in navigating this landscape effectively.

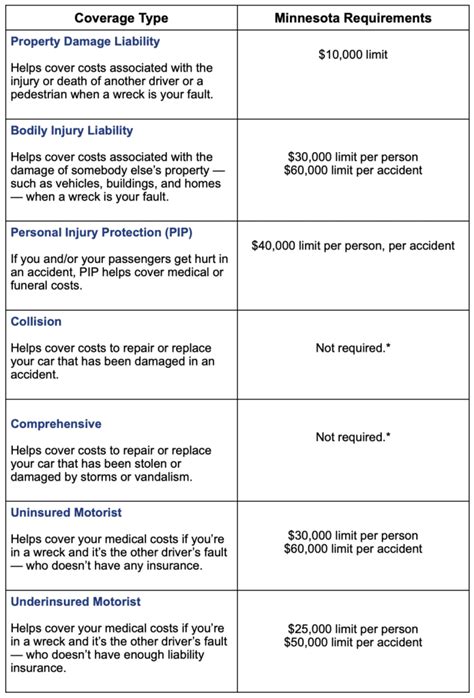

Liability Insurance

Liability insurance is a fundamental component of vehicle insurance, providing coverage for bodily injury and property damage caused to others in an accident for which you are at fault. This type of insurance is legally required in most regions and serves as a financial safeguard, ensuring that you can meet the costs associated with such incidents.

Liability coverage typically includes two main components:

- Bodily Injury Liability: Covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: Pays for the repair or replacement of property damaged in an accident for which you are responsible.

Collision and Comprehensive Coverage

Collision and comprehensive coverage offer protection for your own vehicle, providing a safety net in case of accidents, vandalism, theft, or natural disasters. These types of insurance are not legally required but are often recommended to ensure comprehensive protection.

- Collision Coverage: Covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: Provides financial protection for non-collision incidents, such as theft, vandalism, natural disasters, or damage caused by animals.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments Coverage focus on the medical and rehabilitation costs associated with injuries sustained in a vehicle accident. These types of insurance are crucial for ensuring that you and your passengers receive the necessary medical attention without bearing the full financial burden.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Medical Payments Coverage: Provides more limited coverage for medical expenses, often with a lower limit than PIP.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage is designed to protect you in the event of an accident with a driver who either lacks insurance or has insufficient coverage to meet the costs of the incident. This type of insurance is essential for ensuring that you are not left financially vulnerable in such situations.

- Uninsured Motorist Coverage: Covers bodily injury and property damage caused by a driver who does not have insurance.

- Underinsured Motorist Coverage: Provides additional coverage when the at-fault driver's insurance is insufficient to cover the full extent of the damages.

Other Coverage Options

Beyond the aforementioned types, there are additional coverage options available, tailored to specific needs and situations. These include:

- Rental Car Reimbursement: Provides coverage for rental car expenses when your vehicle is being repaired or replaced.

- Roadside Assistance: Offers assistance for emergencies such as flat tires, dead batteries, or running out of fuel.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you still owe on your loan or lease.

Factors Influencing Vehicle Insurance Rates

Vehicle insurance rates are determined by a complex interplay of factors, each playing a significant role in the overall cost of coverage. Understanding these factors is crucial for predicting and managing insurance expenses effectively.

Vehicle Type and Make

The type and make of your vehicle are key determinants of insurance rates. Certain vehicles, particularly those known for their performance and luxury, often command higher insurance premiums due to their increased repair and replacement costs.

| Vehicle Type | Average Insurance Premium |

|---|---|

| Sports Car | $2,500 - $3,500 |

| Sedan | $1,200 - $1,800 |

| SUV | $1,500 - $2,200 |

| Electric Vehicle | $1,300 - $2,000 |

Driver Profile and History

Your driving history and personal profile are significant factors in insurance rate calculations. Insurance providers consider your age, gender, driving record, and credit score when determining rates. Young drivers, for instance, often face higher premiums due to their perceived higher risk on the road.

Location and Usage

The location where you reside and use your vehicle can greatly impact insurance rates. Urban areas often have higher premiums due to increased traffic and the higher likelihood of accidents. Additionally, the purpose for which you use your vehicle, whether for personal or commercial use, can also affect insurance costs.

Coverage Level and Deductibles

The level of coverage you choose and the deductibles you select can significantly influence your insurance rates. Higher coverage levels and lower deductibles generally result in higher premiums, as they provide more extensive protection and reduce the out-of-pocket costs in the event of a claim.

Discounts and Bundling

Insurance providers offer a range of discounts and incentives to attract and retain customers. These can include discounts for safe driving records, multi-policy bundling (e.g., combining auto and home insurance), and loyalty rewards for long-term customers. Exploring these options can help reduce insurance costs.

Choosing the Right Vehicle Insurance Plan

Selecting the appropriate vehicle insurance plan requires careful consideration of your specific needs and circumstances. While it may be tempting to opt for the lowest premium, it’s essential to strike a balance between cost and coverage to ensure you’re adequately protected.

Assessing Your Needs

Begin by evaluating your unique situation. Consider the value of your vehicle, the risks you face on the road, and the financial impact an accident or other incident could have on your life. This self-assessment will guide you in determining the types and levels of coverage you require.

Comparing Insurance Providers

Once you have a clear understanding of your needs, it’s time to explore the market and compare insurance providers. Different companies offer varying levels of coverage, service, and pricing. Utilize online tools and resources to obtain quotes from multiple providers, ensuring you’re getting the best value for your insurance dollar.

Reading the Fine Print

When reviewing insurance policies, pay close attention to the fine print. Understand the specific terms, conditions, and exclusions of each policy. This ensures that you’re fully aware of what is and isn’t covered, preventing any unpleasant surprises in the event of a claim.

Seeking Professional Advice

If you’re uncertain about the best insurance plan for your needs, consider seeking advice from an insurance broker or agent. These professionals can provide personalized guidance based on your circumstances, helping you navigate the complexities of vehicle insurance and make informed decisions.

Frequently Asked Questions

How much does vehicle insurance typically cost?

+The cost of vehicle insurance varies widely based on factors such as the type of vehicle, driving history, location, and coverage level. On average, liability-only insurance can cost around 500 to 1,500 per year, while comprehensive coverage can range from 1,000 to 3,000 annually.

What happens if I get into an accident and I don’t have insurance?

+Driving without insurance is illegal in most places and can result in severe penalties, including fines, license suspension, and even jail time. Additionally, you would be financially responsible for all damages and injuries caused in the accident.

Can I customize my insurance plan to fit my specific needs?

+Absolutely! Most insurance providers offer customizable plans, allowing you to choose the types and levels of coverage that best suit your needs and budget. This ensures you’re not paying for coverage you don’t need while still maintaining adequate protection.

Are there any discounts available for vehicle insurance?

+Yes, insurance providers offer a variety of discounts to attract and retain customers. These can include safe driver discounts, multi-policy discounts, loyalty discounts, and even discounts for certain occupations or educational achievements. It’s worth exploring these options to reduce your insurance costs.

How often should I review and update my insurance plan?

+It’s a good practice to review your insurance plan annually or whenever there’s a significant change in your life, such as a move to a new location, a new vehicle purchase, or a change in marital status. Regular reviews ensure that your coverage remains up-to-date and appropriately tailored to your needs.