Verizon Phone Insurance Cost

In today's world, smartphones have become an integral part of our lives, serving as our primary communication devices, personal assistants, and entertainment hubs. With the constant evolution of technology, new smartphone models with advanced features are released frequently, making it crucial to protect these valuable investments. One popular way to safeguard your device is through phone insurance, and Verizon, a leading telecommunications company, offers comprehensive coverage options for its customers. This article aims to provide an in-depth analysis of Verizon Phone Insurance, exploring its costs, coverage details, and benefits, to help you make an informed decision about protecting your smartphone.

Understanding Verizon Phone Insurance

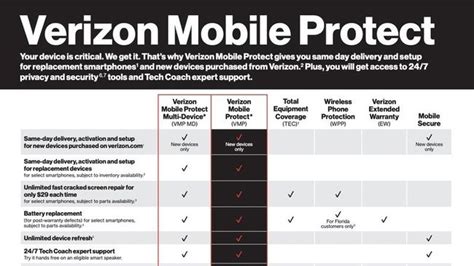

Verizon Phone Insurance, also known as Verizon Device Protection, is a comprehensive plan designed to cover your smartphone against a range of potential mishaps. It offers financial protection in case your device is lost, stolen, damaged, or experiences mechanical or electrical failures.

The Cost of Verizon Phone Insurance

The cost of Verizon Phone Insurance can vary depending on several factors, including the type of device you own, your specific plan, and any additional coverage options you choose to add. Generally, the insurance plan is billed monthly and is included as a line item on your Verizon bill.

For example, the standard insurance plan for a high-end smartphone like the iPhone 13 Pro Max may cost around $13 to $15 per month. This cost can increase or decrease based on the make and model of your device. It's essential to note that the insurance cost is separate from your regular monthly plan charges and is an optional add-on.

| Device Model | Monthly Insurance Cost |

|---|---|

| iPhone 13 Pro Max | $13.99 |

| Samsung Galaxy S21 Ultra | $14.99 |

| Google Pixel 6 Pro | $12.99 |

Coverage Details and Benefits

Verizon Phone Insurance offers a comprehensive range of benefits to protect your device. Here are some key coverage details:

- Loss and Theft Protection: In the unfortunate event that your device is lost or stolen, Verizon Phone Insurance provides coverage to replace it. You'll typically need to file a police report and meet certain conditions to be eligible for a replacement.

- Accidental Damage Protection: This coverage ensures that if your device suffers accidental damage, such as a cracked screen or water damage, you can have it repaired or replaced. The insurance plan covers a set number of claims per year, with a deductible applied to each claim.

- Mechanical and Electrical Failures: If your device experiences internal issues like a malfunctioning camera, microphone, or charging port, the insurance plan covers the cost of repairs or replacement.

- Battery Coverage: Some plans include coverage for battery replacement if your device's battery performance deteriorates over time.

- Priority Repair Service: With Verizon Phone Insurance, you may gain access to priority repair services, ensuring your device is fixed promptly.

Comparative Analysis

When comparing Verizon Phone Insurance to other insurance providers, it’s essential to consider the coverage limits, deductibles, and additional benefits offered. While Verizon’s insurance plans are comprehensive, other providers may offer similar or even more extensive coverage at different price points.

For instance, AppleCare+ for iPhone offers similar coverage to Verizon Phone Insurance but with different pricing and coverage limits. AppleCare+ provides up to two incidents of accidental damage coverage, each with a service fee, and also covers battery replacements during the coverage period. On the other hand, Verizon's insurance plans may offer more flexibility in terms of coverage limits and deductibles, allowing you to customize your plan based on your needs.

Evaluating the Benefits of Verizon Phone Insurance

Verizon Phone Insurance offers several advantages to smartphone users, providing peace of mind and financial protection in the event of unexpected situations.

Financial Protection

One of the primary benefits of Verizon Phone Insurance is the financial protection it offers. Smartphones, especially high-end models, can be expensive to repair or replace. With insurance coverage, you can minimize the financial burden associated with unexpected damages or losses. The insurance plan ensures that you won’t have to pay the full cost of a new device or extensive repairs out of pocket.

Peace of Mind

Knowing that your device is protected against a wide range of potential issues can provide significant peace of mind. Whether you’re concerned about accidental drops, liquid damage, or the risk of theft, Verizon Phone Insurance offers comprehensive coverage to ease your worries.

Convenience and Accessibility

Verizon Phone Insurance is convenient and accessible. You can easily add insurance coverage to your existing Verizon plan, and the monthly cost is included on your bill. Additionally, Verizon has a vast network of authorized repair centers and retail stores, making it convenient to file a claim and get your device repaired or replaced promptly.

Additional Benefits and Discounts

Verizon often offers additional benefits and discounts to its insurance customers. These may include access to exclusive promotions, priority customer support, and even discounts on accessories and additional services.

Performance Analysis and Customer Experience

Verizon Phone Insurance has received generally positive reviews from customers. Many users appreciate the comprehensive coverage and the convenience of having insurance directly through their wireless carrier. The ability to add insurance to an existing plan and the accessibility of Verizon’s repair network are often cited as significant advantages.

However, some customers have expressed concerns about the specific coverage limits and deductibles, as well as the process of filing claims. It's essential to carefully review the terms and conditions of your insurance plan and understand the claim process to ensure a smooth experience.

Future Implications and Considerations

As technology advances and smartphones become more integral to our daily lives, the demand for comprehensive phone insurance is likely to increase. Verizon, recognizing this trend, continues to enhance its insurance offerings to meet the evolving needs of its customers.

One potential future development could be the integration of advanced technologies into insurance plans. For instance, Verizon may explore partnerships with smartphone manufacturers to leverage built-in diagnostics and repair capabilities, streamlining the insurance claim process. Additionally, with the increasing popularity of wearable devices and smart home ecosystems, Verizon may expand its insurance coverage to include these connected devices.

Furthermore, as sustainability and environmental concerns become more prominent, Verizon could explore eco-friendly initiatives within its insurance plans. This could involve encouraging device repairs over replacements or offering incentives for customers to recycle their old devices responsibly.

How do I add Verizon Phone Insurance to my plan?

+Adding Verizon Phone Insurance to your plan is straightforward. You can do so by logging into your Verizon account online or through the My Verizon app. Navigate to the Device Protection section and select the device you want to insure. Follow the prompts to choose your desired plan and coverage options. You can also add insurance by calling Verizon customer support or visiting a Verizon retail store.

What is the process for filing a claim with Verizon Phone Insurance?

+To file a claim with Verizon Phone Insurance, you’ll need to contact Verizon’s customer support or use the My Verizon app. Provide details about the incident and any relevant documentation, such as a police report for theft or loss. Verizon will assess your claim and guide you through the next steps, which may involve sending your device for inspection or repair or receiving a replacement device.

Can I cancel Verizon Phone Insurance if I change my mind?

+Yes, you can cancel Verizon Phone Insurance within 30 days of purchase if you change your mind. However, once you’ve filed a claim, you won’t be able to cancel the insurance until the claim process is complete. It’s essential to review the terms and conditions carefully before canceling to avoid any unexpected fees or penalties.

Are there any exclusions or limitations to Verizon Phone Insurance coverage?

+Yes, Verizon Phone Insurance coverage has certain exclusions and limitations. These may include damage caused by intentional acts, normal wear and tear, cosmetic damage, and damage resulting from unauthorized modifications or misuse. It’s crucial to read the policy terms carefully to understand what is and isn’t covered.